The Supply Chain Insights Global Summit is over, but we hope the energy to define Supply Chain 2030 is just beginning. Our goal is to build a guiding coalition to think differently to improve outcomes. Today only 12% of supply chain teams are driving improvement, performing better than their competitors and driving value (as determined by Price to Tangible Book Value). As companies prepare for Supply Chain 2030, we think that it is time to rethink the basics. It cannot be about incremental improvement. What does it take? The consensus is process innovation.

The Supply Chain Insights Global Summit is over, but we hope the energy to define Supply Chain 2030 is just beginning. Our goal is to build a guiding coalition to think differently to improve outcomes. Today only 12% of supply chain teams are driving improvement, performing better than their competitors and driving value (as determined by Price to Tangible Book Value). As companies prepare for Supply Chain 2030, we think that it is time to rethink the basics. It cannot be about incremental improvement. What does it take? The consensus is process innovation.

2030 is 14 years in the future. Each decade is a mile marker for change. The journey for starts with a focus on business outcomes. At the Global Summit, supply chain leader after leader shared insights. It is clear that new outcomes cannot happen through a focus on traditional continuous improvement programs. Advancements will not happen by doing more of the same with greater efficiency. It requires rethinking business outcomes using advances in technologies through a redesign of supply chain processes. In the words of one of the speakers, “We must get uncomfortable and not sleep at night. We must disrupt the status quo.”

I am disrupting the traditional analyst model to fuel the disruption. By sharing content openly and connecting supply chain leaders, I want to catalyze a change. Here I share insights from the 2016 Supply Chain Insights Global Summit.

Getting Started

Leaders will take a different path. They will challenge commonly accepted best practices and test new technologies. The days of the big projects, mapping “as is” and “to be” processes and hiring large teams of system integrators, are gone. The value in Business Process Outsourcing (BPO) is in decline. Why? The level of technology disruption is now so great that it is about test-and-learn with small, scrappy teams focused on innovation projects. The transformation starts with a clear focus on the business problem. The program is built with the goal in mind. Driving new levels of value will be a fight. Tradition is deeply rooted. The change in front of us will transform the base-level definitions of source, make and deliver.

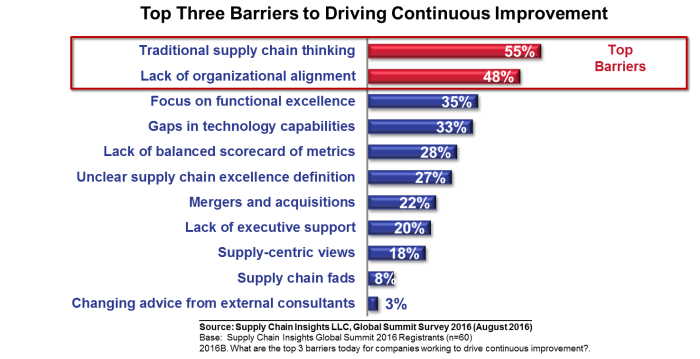

As shown in Figure 1, the biggest obstacles to powering improvement/performance are traditional supply chain thinking, the lack of organizational alignment and a focus on functional excellence. These are tough to overcome.

Figure 1. Barriers

Seven Predictions for Supply Chain 2030

It is hard to predict the future; and when you do, you know that you will be wrong, but please lean in with me and Imagine Supply Chain 2030. Here are my seven predictions. Let me know if you have any questions.

1) Outside-In Processes.

One of the current issues for the supply chain leader is the unchecked rise in item complexity. This coupled with the lack of customer-centric supply chain processes makes it difficult to serve customer needs. While many companies have customer-centric and demand-driven projects, they are not connected in a meaningful way. Most companies are treading water because they are not rethinking the basics of demand. It is time to get clear.

The traditional focus on Enterprise Resource Planning (ERP) and Advanced Planning Solutions (APS) does not bridge the gap. Independent demand, or channel consumption, is the basis of demand-driven value networks, while MRP and DRP translate orders and shipments. As a result, MRP and DRP are precise, but wrong.

As item complexity increased over the last decade, demand latency increased in the average company 5-6X. In the next 15 years, it will only get worse. As a result, to fulfill customer-centric and demand-driven strategies, companies need to build outside-in processes using market and channel data to sense, shape and drive a more intelligent response. These architectures are evolving and will be deeply rooted in the evolution of prescriptive and cognitive analytics.

Action Item: Get clear on the definitions of these three interrelated strategies and define the processes with a focus on the intersections of the strategies.

Figure 2. Development of Outside-In Processes

2) Learning Supply Chains.

At the 2016 Supply Chain Insights Global Summit, there were two announcements on the evolution of the learning supply chain. (Enterra Solutions announced a partnership with Cap Gemini and ToolsGroup announced the release of a software solution for the self-correcting supply chain with a focus on cleaning data and detecting anomalies.) I think that we are five years away from supply chains that learn as we sleep.

What will it look like? As shown in Figure 3, in the evolution of future architectures. ontologies will define supply chain rules. The use of cognitive learning, coupled with ontologies, will drive new outcomes. The architectures for the rules that we have today–Available to Promise, Allocation, Inventory Matching, Deductions, Hands-Free Orders– are inadequate. Why? Today’s rules are simple–single if(s) to single then scenarios. They are not adaptive. In the learning supply chain, the rules will be more flexible, changing with business (enabling the matching of multiple if statements to many thens).

The supporting data will be self-correcting. I believe that we will have no master data managers in the age of Supply Chain 2030 and that the systems will be self-correcting with continual learning. It will be easier. The supply chain planner’s role today is too hard. Here is the scenario in my mind: I think that the supply chain planner in 2030 will come in to work, get a cup of coffee, and talk to his mobile device like I currently talk to Siri on my iPhone. Then over a cup of coffee the learning system will tell the planner the evening corrections and where to focus. The planning system will adapt and learn autonomously. Companies using traditional technologies coupled with Excel spreadsheet ghettos will be at a disadvantage.

The implications of this are tremendous. I think the current solutions for planning will become obsolete within ten years. Some will make the pivot, and others will not. I believe that SAP will miss the mark and fail, and then quickly recover. (No company builds better software than SAP when they are clear on the future outcome, but the current focus on SAP HANA and transactional processing is not sufficient.) I believe that Oracle’s redefinition of planning in the cloud-based architecture is promising, but the proof will be in the pudding. I think that small scrappy best-of-breed companies like E2open, Enterra Solutions, Kinaxis, Opalytics and ToolsGroup will get there first, and sales-driven companies that are slow to adapt –like JDA and Logility– will lose market share. Capgemini, IBM and Infosys will drive leadership in the consulting market.

Figure 3. The Depiction of Supply Chain Learning Systems and Rules-Based Ontologies

Action Item: Charter a team and test and learn to understand the potential for cognitive and prescriptive analytics.

3) Rethinking Manufacturing.

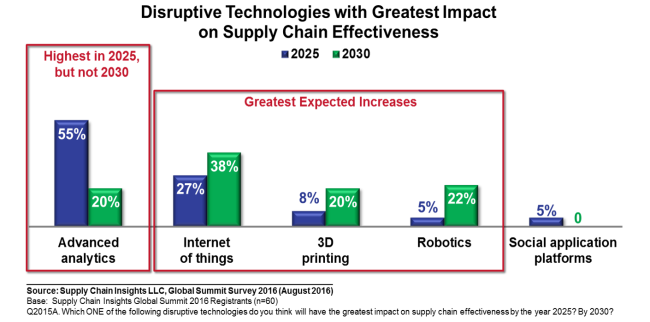

When we ask companies to Imagine Supply Chain 2030, the first response is a focus on analytics. We agree that analytics are important, but we also believe that source, make and deliver will be redefined. It will be about the confluence of technologies. Digital manufacturing–3D printing, M2M interface through the Internet of Things, Robotics and Biomolecular re-engineering–will enable new capabilities in manufacturing. The factories of the future will be more agile and autonomous.

To help your team, do not think about the digital pivot in hollow words and aimless, but well-intended strategies. Make it concrete. Embrace the confluence. Imagine what the processes of manufacturing, transportation and procurement can be in Supply Chain 2030. The options are endless.

Figure 4. Attendees’ Views of Disruptive Technologies on the Future of Supply Chain

Action Item: Ideate on what the future of your manufacturing processes could look like. And begin a path to test new technologies with R&D. Don’t focus on one technology in isolation. Instead, charter a team to start with a business goal in mind and work backwards, while embracing the confluence of all technologies.

4) Network of Networks.

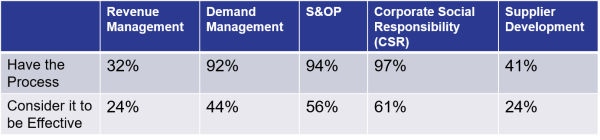

While we talk of value networks, and connecting trading partners through business networks, the reality of the world of supply chain is that 27% of orders and purchase orders move hands-free, and only 7% of flows are automated through business networks. The adoption of Supplier Relationship Management technologies increased the time to onboard a supplier by 30-60 days, and most companies feel like they are portaled to death. While 40% of companies have supplier development programs, only 24% believe they are effective.

Table 1. Current State of Cross-Functional Processes

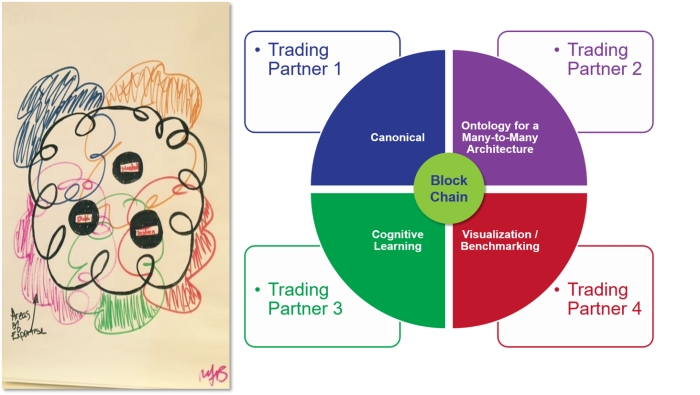

We are actively working with a cross-functional group of technologists and business leaders to design the future of B2B networks. What will it look like? We are not sure, but we are actively trying to ideate together. In the last session, I asked participants to draw a future vision of a network of networks which enabled interoperability between networks like CH Robinson, GT Nexus, E2open, Elemica, GHX, OpenText, SAP/Ariba and SupplyOn, and one drew the picture on the left of Figure 5. My picture, not much better, is on the right. Together, as a group, we agree that what we have today cannot work effectively.

My thoughts? Here is my magic wand answer: I believe that the future architectures will be many trading partners connected to many trading partners, and that they are connected through a process, canonical and a rules-based ontology, to support the many-to-many architecture. (Today’s structures are one-to-one or one-to-many.) I also believe that the network of networks will be powered by prescriptive and cognitive analytics with new forms of visualization and benchmarking. Business will change as contracts and funds flow through blockchain technologies. I also think there will be a community registry through collaborative work with someone like Dunn & Bradstreet. I think this could be a new business model powered by Hadoop and managed by a new entity.

Figure 5. Envisioning the Network of Networks

Action Item: Actively push technology providers to redefine B2B to power value networks.

5) The Socially Conscious Supply Chain

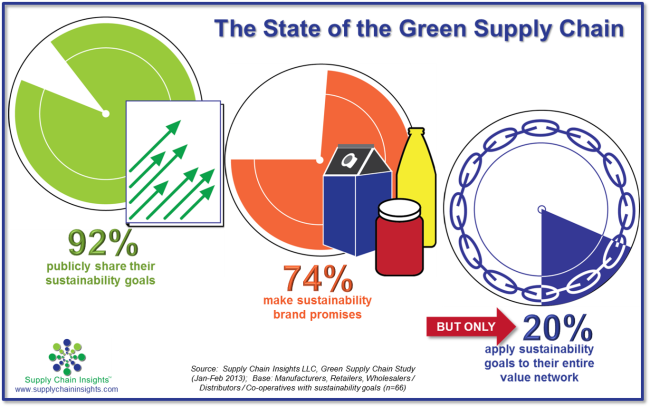

Today, while we talk about social responsibility, the focus is on the four walls of the corporation. Today companies have a risk that they have committed to be socially responsible to the market and over 70% have made claims in marketing communication. However, only 20% of companies are aggressively addressing the issues of managing the extended network. The major opportunity to deliver a socially responsible value network lies outside the four walls. Today 65% of nonrenewable resources are in value networks. As water supplies tighten, and the consumer becomes more aware, companies will be forced to actively manage value networks to ensure fair labor, build the ethical supply chain, and manage nonrenewable resources. I think the evolution of these strategies will lead to the building of the network of networks.

Figure 6. Current State of Corporate Social Responsibility

Action Item: Companies that are not working on socially-responsible networks will be at a disadvantage. Actively work to drive CSR programs through supplier development efforts and network interoperability.

6) Supply Chain: The New Engine of Growth

Today, the supply chain operates on a cost agenda. The focus is inside-out and dependent on the current horizontal processes of revenue management, Sales and Operations Planning, New Product Launch, Corporate Social Responsibility and Supplier Development. In the future, we believe the supply chain will become the engine of growth through active listening posts, market sensing, and management of the network of networks. While the supply chains of the past were dependent on test markets and limited tests, we believe the supply chains of the future will be actively adapting based on markets.

Figure 7. Building of Horizontal Processes to Fuel the Engine of Growth

Action Item: Commit to a top-line revenue goal and align the supply chain to deliver on business results. Create the culture of “Yes” and kill the culture of “No.” Seize new business opportunities.

7) New Business Models.

Finally, I welcome the infusion of new business models. In my lifetime I’ve witnessed the birth of Airbnb, Amazon, Facebook, Lyft, and Uber. I also watched the decline of packaged food and the obsolescence of many consumer technologies. I think that the market is ripe for the creation of new business models. I want to fuel that Guiding Coalition to think about new possibilities.

We welcome you to join the Guiding Coalition to question the status quo. If you missed the Supply Chain Insights Global Summit, please join us in watching the videos and gaining from the insights.

We appreciate all of our speakers sharing and speaking openly. Here are a few of the videos (we’re uploading more):

We appreciate all of our speakers sharing and speaking openly. Here are a few of the videos (we’re uploading more):

Global Talent Panel: Mourad Tamoud, SVP of China, Schneider Electric; Jose Luis Deya, Director of Supply Chain Center of Excellence – Latin America for Syngenta: and Walaa Maher, Director of Gulf Cooperative Council and Arab Peninsula for Kimberly-Clark.

Rethinking Processes: Driving Continuous Improvement at Schneider Electric, Mourad Tamoud

Using Analytics: Building a Data-Driven Culture, Mani Janakiram, Intel

Show Opening: Building a Guiding Coalition

The Tale of the Gartner Supply Chain Planning Magic Quadrant and Minestrone Soup

Self-congratulations notes abounded this week as vendor-after-vendor shared their rankings on the Gartner Magic Quadrant for Supply Chain Planning. For me, it was a big