dig·it·al ˈdijitl/adjective

digital (of signals or data) expressed as series of the digits 0 and 1, typically represented by values of a physical quantity such as voltage or magnetic polarization. Relating to, using, or storing data or information in the form of digital signals.

Growth has slowed. Complexity has increased. At least this is the story for consumer packaged goods (CPG) companies in North America. The complexity of changing product portfolios and the increase in demand-shaping programs (price and promotion) have distorted demand signals and made supply chain planning more complex.

As outlined in my recent Forbes article, the cost to bring a new product to market has increased four-fold in the last five years. The supply chain capabilities to sense market requirements and support new product launch successfully is a gap. There is just too much latency in the traditional order signal to effectively respond at the market cadence. What to do?

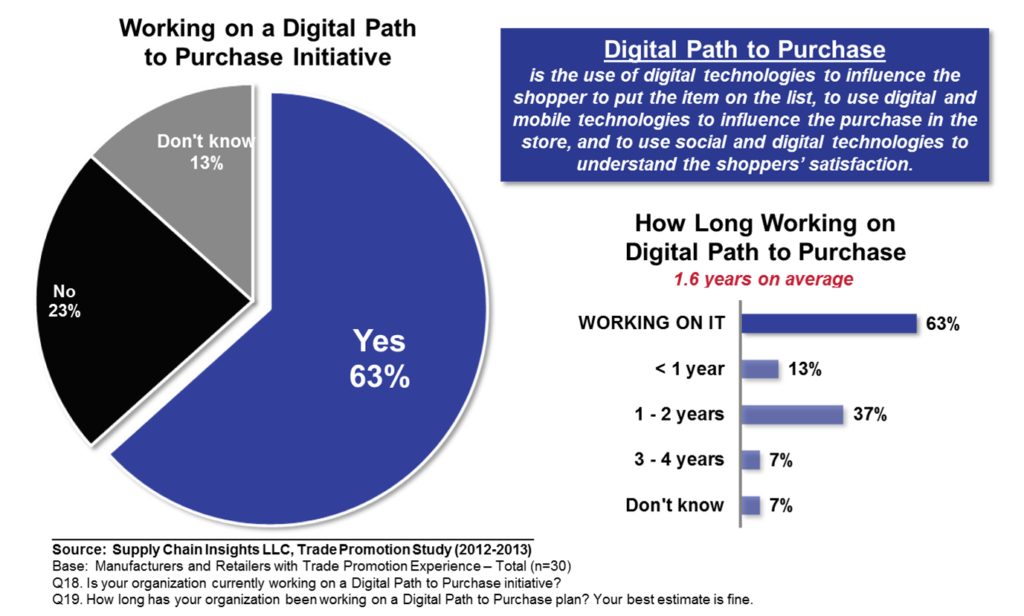

Today, 63% of consumer manufacturing organizations have a digital path to purchase initiative. This is a wonderful opportunity to design outside-in processes. Here are three steps to take:

1) Read Promotion and Price Effectiveness with Minimal Latency. Today, it takes 30 days for the consumer products organization to read the impact of a promotion. This might be sufficient for sales and marketing processes, but for the activities of replenishment, 30 days is too long. Use downstream data (retailer Point of Sale and warehouse withdrawal data) to build outside-in processes to sense short-term demand requirements and translate them to the supply chain. This is the combination of demand sensing technologies in combination with channel data. Build these processes outside-in. Focus on data synchronization and harmonization.

2) Use New Forms of Analytics to Uncover Unlikely Inferences. Answer the questions that you do not know to ask. Text mining and sentiment analysis can be used to build listening posts to help companies listen to the voice of supply chain. Likewise, cognitive learning engines that use unstructured and structured data can listen and learn from multiple data types to better understand the right assortment in each market, and the reasons driving customer acceptance. (Many of which can be changed with the product launch.) Information from ratings-and-review data can help align the organization to better serve the shopper. Actively work on these initiatives to use the power of analytics to serve the shopper.

3) Test and Learn. Today, consumer products companies can sell in e-commerce channels directly to the shopper. Use these emerging channels to test and learn about the relationship of product attributes to customer attributes. Use test-and-learn strategies (either cross-channel or in vitro market testing) to better serve the shopper. The days of spray and pray are gone. The secret is to carefully design the test-and-learn strategies and to be careful in the execution to accurately read the market.

To do this, companies cannot operate in functions and the processes need to be designed outside-in. Supply chain leaders need to partner with commercial teams to drive a market-driven, not a marketing-driven, response. The key is listening, sensing and adapting to market signals with little latency. This cannot happen with the old inside-out processes. Use these new initiatives to build innovation at the edge and test new forms of analytics and use new forms of data.

For me, this is exciting. It is a wonderful opportunity to build outside-in processes to serve the shopper. What do you think? What do you see as the barriers?

All the best in your journey! Let me know your thoughts.