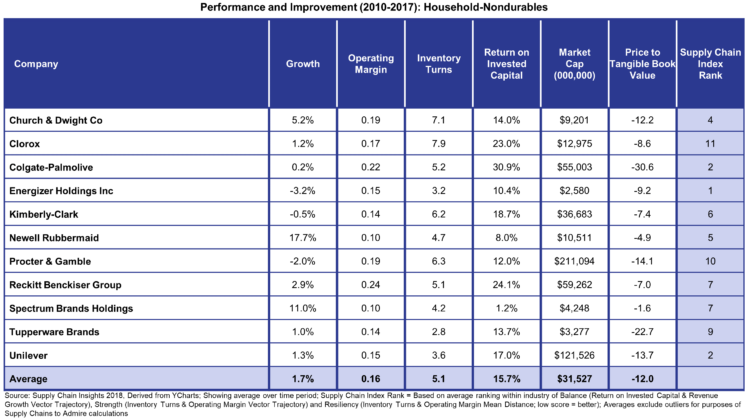

Global growth is slowing to levels of GDP. Notice that the average growth for consumer nondurables (often termed household products) is 1.7%, as shown in Table 1. This is a far cry from the pre-recessionary growth rate of 6%.

Global growth is slowing to levels of GDP. Notice that the average growth for consumer nondurables (often termed household products) is 1.7%, as shown in Table 1. This is a far cry from the pre-recessionary growth rate of 6%.

Public markets reward growth. As the rate of year-over-year revenues slows, companies attempt to grow through tactics. In consumer good supply chains, this includes new product launch, price incentives, and trade promotion management. In the digital world, traditional broad-brush marketing programs become less effective. Yet, they are still widely deployed. The residual effects drive higher demand error and increased complexity.

When it comes to risk, this impact is not trivial. In this blog post, I explore the impact on fast-moving consumer goods companies. Table 1 is sourced from our Supply Chains to Admire analysis, and the Index represents improvement. Companies with a lower rank on the Index are driving faster rates of metrics improvement. Energizer and Unilever are driving the fastest rates of improvement, and Clorox and P&G improvement rates are the slowest on the Supply Chain Metrics That Matter of Growth, Operating Margin, Inventory Turns, and Return on Invested Capital (ROIC)).

Table 1. Average Performance Metrics for Consumer Nondurable Industry for the Period of 2010-2017

What Is Risk?

In the current quantitative study that we are completing on risk, we define risk management processes as the “proactive identification and assessment of potential risks to the supply chain – as well as the development of strategies to avoid these risks.” It can include uncertainty, disruption or volatility.

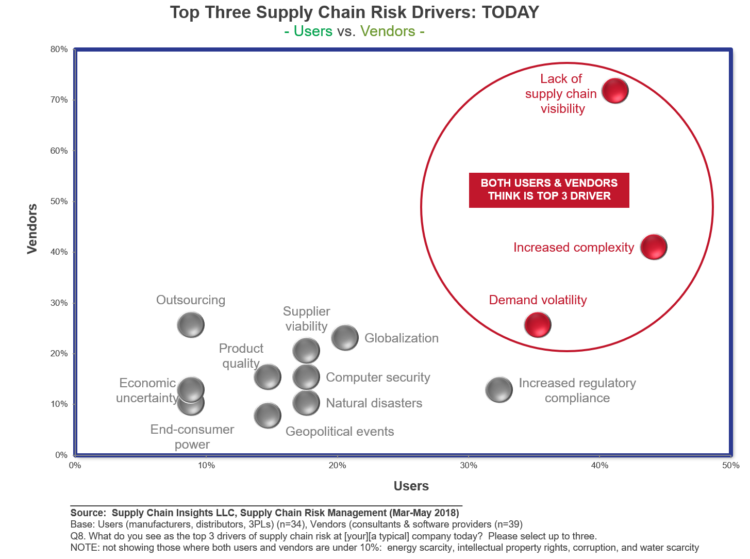

While most leaders, early to the subject, think of risk as mitigation of events (in Figure 1 we share the most disruptive events from the period of 2013-2018), event mitigation is the easy part of risk management. The tougher issues lie with the management of complexity and volatility.

Figure 1. Top Events Leading to a Supply Chain Disruption

The increase in risk due to cyber hacking is a change versus prior studies, with cyber threat increasing in the supply chain.

What Are the Risk Drivers?

While technologists and consultants hawk wares for supply chain visibility, the larger issues are in demand volatility and operations complexity. Recently, I have been working closely with customers to measure inconsistent and intermittent demand. Sadly, I am finding that the combination of poorly implemented deterministic optimization technologies is creating a negative Forecast Value Add (FVA) and increasing demand error by 2-30%. The saddest part is that most of these customers believed they were doing the right thing by deploying forecasting technology but did not know how to measure/determine a good plan.

With consumer goods companies increasing item complexity on the item master by 30-40%, this is a never-ending cycle. Another sad story is while companies believe that item complexity is tied to driving a growth agenda, in many categories it has added brand confusion, not personalization.

Figure 2. Risk Drivers

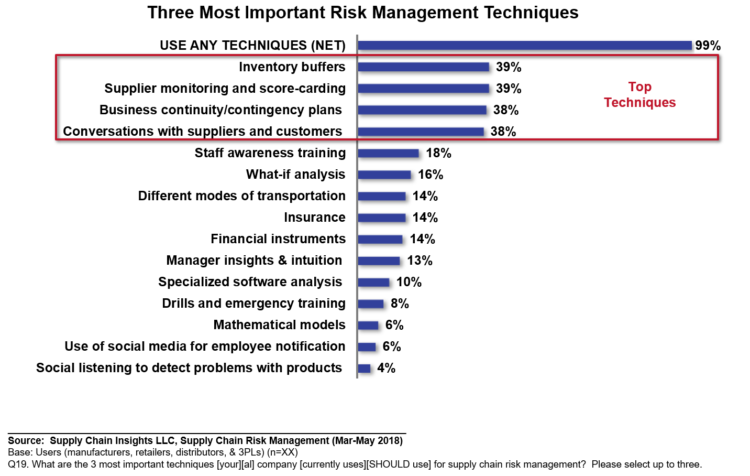

How Do You Mitigate Risk?

Consultants and technologists are selling risk management solutions, however, the answer is a focus on supply chain basics. Designing the supply chain with a focus on the form and function of inventory, flexibility, supplier score-carding processes along with monitoring, business continuity planning and “What-if” analysis. Unfortunately, most companies are not good at these basics. Only 1/3 have supplier development programs, and 12% design/modify the supply chain with a focus on form & function of inventory. The traditional supply chain process only focused on the management of safety stock. For more on the form and function of inventory and inventory strategies, please reference the earlier blog post. A focus on safety stock is not sufficient.

Let’s learn from the story of Baxter International and the production of small IV bags in Puerto Rico. The product was sole-sourced from Puerto Rico in a heavily regulated industry. So when hurricane Maria decimated the island, and power became an issue, Baxter could not manufacture the product at their three sites all in Puerto Rico. The design of the supply chain did not allow for alternative production sites. Designing the supply chain for alternate sourcing is critical. Business continuity needs to be the focus.

In addition, item complexity is a silent killer of supply chain performance. It increases volatility, operational complexity, and supplier risk. Unfortunately, less than 5% of companies actively manage item complexity.

Figure 3. Most Important Techniques for Risk Mitigation

Summary

To wrap up, before I turn out the light and get some badly needed sleep, most companies believe that risk management centers on event management or a shiny new tool. In reality, risk management it is about getting good at supply chain process basics with a focus on business continuity. This includes the design of inventory buffers, alternate sourcing, common platforms, management of item complexity, better management of demand, effective supplier development programs and “what-if” analysis. So the next time that you see a presentation on delivering an integrated end-to-end supply chain, ask, “How are you managing the risk?” The sad reality is that in the majority of the integrated supply chain strategies that I see, we are not. Instead, they center on the implementation/justification of a new technology. Few teams understand the basics of demand management, the reduction of complexity, the design of inventory buffers, robust supplier development programs or the inclusion of “what-if” analysis. I strongly believe that to drive opportunity, you must manage risk through a focus on fundamentals and business continuity.

Let me know what you think. I am going to turn out the lights now in Frankfurt and hopefully have a good night’s rest.

Help Us with Research?

If you like our research, please consider helping us finish some of our studies. We currently have a quantitative project in the field on Satisfaction with Supply Chain Planning. Our philosophy is, “You give to us, and we give to you.” When business leaders take our surveys we share the responses openly. Our research is independent and open. So, if you are a business user and have knowledge of supply chain planning, we would love to have you participate in our study. We are closing this study next week.

Join Our Event to Act Differently and Drive New Outcomes

This week, I sent personal invites to business leaders and Supply Chains to Admire Award Winners to attend the Supply Chain Insights Global Summit on September 4-7, 2018 in Philadelphia, PA. The registrations are rolling in. We expect it to sell out.

This week, I sent personal invites to business leaders and Supply Chains to Admire Award Winners to attend the Supply Chain Insights Global Summit on September 4-7, 2018 in Philadelphia, PA. The registrations are rolling in. We expect it to sell out.

Designed to help supply chain leaders think differently and to drive new outcomes, the agenda is unique. Designed for extreme networking, the conference is small and intimate. Where else can you attend a conference with no sponsors, a 60/40 ratio of business users to technologists, and hand-picked presentations with a focus on driving change? There are thirty seats left. Don’t let this opportunity slip you by.

To learn more about the Risk Management, check out these past posts:

Supply Chain: The True Game of Risk

Can You Take the Risk?

Digital Transformation: Where Was the Beef?

Where is the Beef? is now a colloquialism. The phrase started as a line in an advertisement in 1984 for Wendy’s hamburgers. I remember sitting