Warning! A holy war is raging. It is a religious war. …one of holy factions.

It cannot be won, and it is not worth trying. When you peel back the heat of the battle, you find that it is the battle of acronyms: Integrated Business Planning (IBP) versus Sales and Operations Planning (S&OP). It is fueled by analyst pundits, and driven largely by software vendors trying to hawk their wares into a mature market. At the center of the battle — as the fury rages over who is right and who is wrong— companies are losing perspective.

What Matters….

Remember Shakespeare’s wisdom? “What’s in a name? A rose by any other name would smell as sweet….”

I feel that when the focus is on the NAME–versus the OUTCOME– we all lose. No matter what we call it, cross-functional tactical planning matters; and this is at the center of the discussion. However, many are unable to take advantage of the benefits, because they are stuck in the holy war. As a result, I see companies losing perspective on what tactical planning is, what it needs to be, and why it matters.

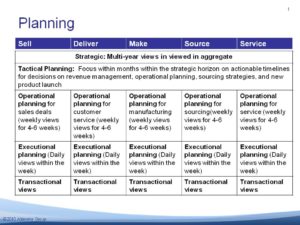

Tactical planning is very different than strategic, operational or executional planning. (See figure 1). While strategic planning is focused on long term outcomes and viewed in aggregate, tactical planning is focused on a more actionable period ( period of 6-18 months (the duration is driven by the time frame of actionable decisions)). It crosses multiple vertical silos. The most mature crosses the end-to-end value network and the least mature deal with the issues silo by silo.

The next layer of planning—operational planning –is within the silo. So if you do not get tactical planning right, you cannot align cross-functionally. Strategic planning is at too high of a level and the levels of planning below it do not cross the functions. Getting it right is paramount to drive alignment and organizational balance. To be successful, tactical planning needs to have four attributes:

Assess. A successful tactical planning process drives balance and aligns the organization cross-functionally with market drivers. In the best processes, tactical planning aligns functions beyond the Enterprise using outside-in thinking through the evaluation of options and deriving the best answers based on market (sell-side) to market (buy-side) insights.

Actionable. An equal focus on risk and opportunity. To make this happen, the team needs to be knowledgeable and have access to the pulse of the organization. The planning group MUST report to the P&L center. A cultural pitfall can happen when the tactical planning is relegated to a single group like finance that is not directly tied to line management. When this happens, companies over-state opportunities and hide risks. Over and over again, I see that when planning is not directly tied to responsibility for the plan, people tend to shoot the bearer of bad news.

Accurate. Getting the model right. To do this, companies need to have the right data model, the right time horizons and the right level of granularity to drive accurate and actionable insights. To get this right, there needs to be a recognition of different value networks and the inter-dependencies between them that drive value. One model does not fit all supply chains….

To do this, understand that enterprise data models do not cut the mustard. Modeling the enterprise is not sufficient. The real risks and opportunities are ONLY exposed when we evaluate tactical options for the strategy against MARKET drivers. Additionally, with the swirl of IT options, many companies have forgotten that the data models are very industry specific, and granular. As a result, general ERP solution vendors do not understand or deliver well against tactical planning needs. The greatest success in tactical planning is happening with industry-specific best of breed providers.

Timely. To be successful, the analysis needs to happen within a finite window of actionability. Who cares if it is accurate, but too late? Or too quick, but not accurate?

The Definitions:

To demonstrate my point, I share the definitions currently in Wikipedia below. While I would argue that neither of these definitions is appropriate. Compare them to the points above. I want to demonstrate is the closeness of the definitions, and why there is confusion.

- Integrated business planning (IBP) refers to the technologies, applications and processes of connecting the planning function across the enterprise to improve organizational alignment and financial performance. IBP accurately represents a holistic model of the company in order to link strategic planning, and operational planning, with financial planning. By deploying a single model across the enterprise and leveraging the organization’s information assets, corporate executives, business unit heads and planning managers use IBP to evaluate plans and activities based on the true economic impact of each consideration.

- Sales and operations planning (S&OP) is an integrated business management process through which the executive/leadership team continually achieves focus, alignment and synchronization among all functions of the organization. The S&OP plan includes an updated sales plan, production plan, inventory plan, customer lead time (backlog) plan, new product development plan, strategic initiative plan and resulting financial plan. Plan frequency and planning horizon depend on the specifics of the industry. Short product life cycles and high demand volatility require a tighter S&OP planning as steadily consumed products. Done well, the S&OP process also enables effective supply chain management.

See the gaps?

<Pitfall! Avoid a Stumble.>

The integration of the financial plan into the tactical operational plan is the number one change management issue for companies in tactical planning processes. The term “budget” is a loaded term. For this reason, tight integration between financial and operational processes is NEVER recommended. It can be an input, but not a constraint.

What Makes Success?

To drive success, side-step the holy wars and answer these three questions:

- What is the goal? Fundamentally, companies are not aligned on the strategy cross-functionally. It is impossible to drive great tactical outcomes if you are unclear on the goal. Of the over 200 companies that I have interviewed on this topic, most give me an answer of dead silence when I ask the question of “what is the goal of tactical planning?” The reason? They don’t know. And, when they do know, less than 1% of companies understand how to align tactical planning to the strategy. And, if the goal is to meet the budget objectives, the organization will never maximize the opportunity within the value chain.

- What does good look like? After getting clarity on the goal, the next step is how to align incentives cross-functionally to achieve the goal. It is myopic to think that companies can be successful rewarding manufacturing for asset utilization, R&D for growth, marketing for market share and sales for volume. The incentives need to align cross-functionally to support the strategy.

- Where are our risks and opportunities? This can be achieved through sensitivity analysis, but only by having an understanding of the pulse of the organization and by using a data model that enables the modeling of both the risks and the opportunities. <see above>

What do you think? I look forward to getting your thoughts.

This week, I will be sharing this perspective with the attendees at the S&OP IE Event in Las Vegas (reference http://www.theiegroup.com/SOP/Register.html) look for more follow-up as I publish my first report on the technologies. I look forward to the discussion with the group there. Until then, I am off to Vegas. For me, what happens in Vegas will not stay in Vegas…look for more on this topic later in the week.