Over the Memorial Day weekend, I stumbled on an old article that I wrote in 2001. At the time, I was a junior Gartner analyst. The piece, “CPG/Retail E-Marketplaces: The Emperor’s New Clothes?” was controversial. At a time that marketplace offerings were super-hyped, I forecasted the doom of ten e-marketplace providers. I was dubbed by my boss as the ultimate-contrarian. This was to such a degree that one of the e-marketplace providers, Transora, called me to task and launched an investigation. This landed me in front of the Vendor Review Board at Gartner to defend my research. <This is an experience that I would never care to repeat.> I reminisced about the experience over a glass of wine with some friends and we laughed. Sometimes being an analyst, and pushing an unpopular view, is no fun. I could not laugh about it then….

Today, the Dust has Cleared

Today, nine of these ten providers, including Transora, are history. The stories border on the ridiculous. Transora was an extreme. It was funded by 50 large consumer products manufacturing companies (CPG). In the dawn of e-commerce, conservative manufacturers, anteed up $240 million in four months. The high-flying company had no clarity of purpose or clear governance, but the funds kept coming. Transora had a short history. It ceased to exist in 2005 when it merged with 1Sync.

In the Gartner article, I cautioned companies to invest only if three conditions were met:

- A well-defined scope.

- The solution solved a relevant industry issue.

- Clear governance.

Today, I feel that this advice is still relevant. I asked companies to “Navigate through the hype focusing on the feasibility of scope and technology.” Today, while the hype has dissipated, some data exchanges remain, and a few are starting to thrive again.

In the height of the e-commerce craze, the marketplace offerings started with a focus on e-procurement. I clearly remember the weekly calls where over 30 Gartner analysts would feverishly discuss the future of marketplace offerings. The debates were heated. At the time, the popular belief was that Enterprise Resource Planning (ERP) technologies would build multi-tier capabilities. The thought was that the ERP infrastructure would build adapters to marketplace offerings. The widely-held view was that the e-procurement market would fuel the next generation of marketplace applications. Today, we know that these assumptions were incorrect.

Today, the multi-tier capabilities for supply chain management are coming from the born-again marketplaces. They are industry-specific niche offerings. While there is work within SAP to rethink SNC and use the assets purchased with Ariba to build multi-tier capabilities, the progress is not encouraging.

Marketplace Rebirth

The rebirth of marketplace offerings is not on the back of e-procurement or ERP. Instead, they are standalone marketplace offerings solving one of four business problems: supply chain multi-tier visibility, inter-enterprise systems of record, benchmark analytics, and delivering collaborative workflows. We missed the understanding and future vision for these solutions in our early calls at the genesis of these solutions when I was at Gartner. I will be publishing a comprehensive summary of these solutions in October; but until then, I would like to share my insights on three announcements that happened in May. I am favorably impressed by the changes that GHX, E2open, and Elemica have made in this area. This has made me believe, what is old is new again.

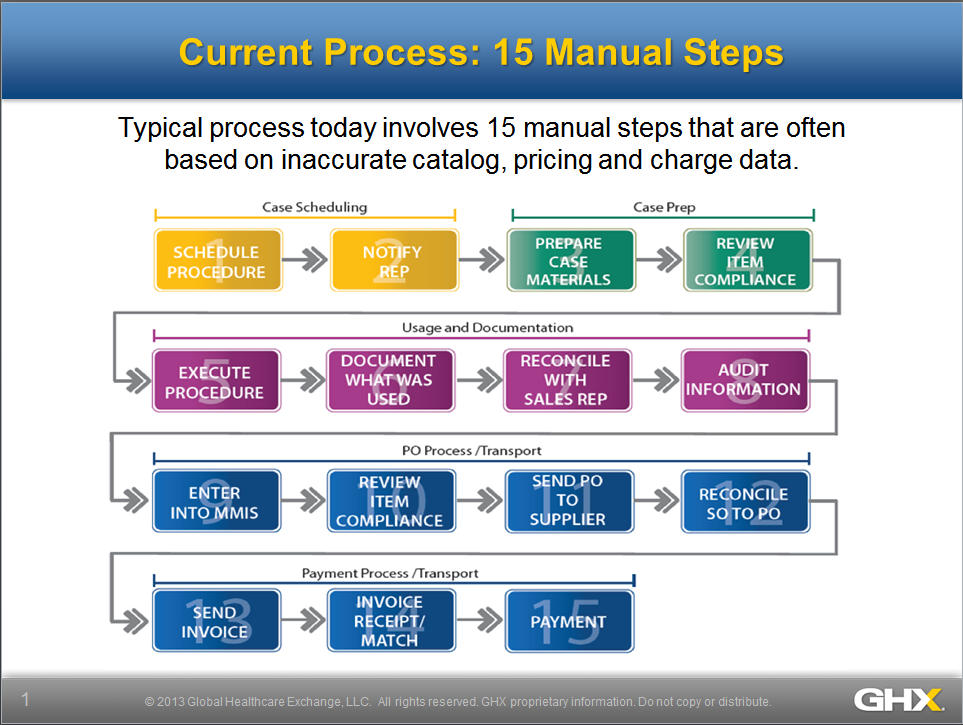

GHX. Founded as the Global Healthcare Exchange in 2000 by five of the world’s largest medical product manufacturers—Johnson & Johnson, GE Healthcare, Baxter International Inc., Abbott Laboratories and Medtronic, Inc.—the company is owned today by 20 organizations representing manufacturers, distributors, hospitals and group purchasing organizations (GPOs). This month, the company introduced a multi-party solution for hospitals, physicians, payers, and medical device manufacturers for the scheduling and billing of implantable devices. This is both an inter-enterprise system of record and a multi-tier visibility system to enable translation of sixteen steps for case requirements and planning into downstream visibility. While early in launch and execution, the solution received good reviews at the GHX Summit in Las Vegas last week. It has been designed by the parties in the healthcare supply chain over the past year, and is extremely promising. An overview of the solution is shown in Figures 1 and 2.

E2open. This month, E2open launched a new product Rapid Resolutions. This multi-tier solution is designed to reduce the bullwhip effect by improving demand and supply translation through multi-tier concurrency. It is a more mature version of Supply Chain Visibility, enabling multi-tier orchestration of demand and supply matching. E2open was founded in 2000 by eight high-tech companies. It went public last year in one of the few successful IPOs in the supply chain software space. The company serves 32,000 enterprise trading partners and has successfully diversified to other industries. Companies looking to translate supply and demand across complex networks should consider the new E2open solution.

Elemica. Formed in 1999 to serve the process chemical industry, Elemica is moving from a singular vision of e-procurement to multi-tier visibility and collaborative workflow. The solution has been rebuilt from the ground-up to be a multi-tier data model and is named the Supply Chain Operating Network. The first year is a foundational connectivity play with future plans to enable partners to write software on top of the platform. Today, Elemica processes nearly $200 billion in annual transactions across more than 5,000 process industry trading partners. The user interface of the solution is very promising. I will be speaking at the Elemica customer conference Insights and will share my reviews with the Shaman’s readership from Philadelphia on June 11th.

I am often asked about the differences between these and the conventional supply chain visibility solutions. In short, it is the evolution of a multi-tier data model and new forms of collaborative workflows for supply chain visibility. The conventional supply chain planning systems are designed for the enterprise. They are not designed for multi-tier functionality. For example, an application like SAP SNC, while functioning across supply chain tiers, is an enterprise data model that is inside-out, not outside-in.

Supply chain management (SCM) is now in its fourth decade. While we have talked about the evolution of multi-tier functionality, we may actually see it become a reality in this decade.

What do you think? Is there a multi-tier exchange that I should include in my October report? Let me know. I look forward to hearing your comments.

Until then, I am traveling to South Africa to speak at SAPICS 2013 on the book Bricks Matter. On the trip to and from South Africa (16 hours door-to-door), I started writing the new book that I will be publishing in 2014. Termed Metrics That Matter, it is based on our work on the Supply Chain Index, and the industry studies that we have completed in the Supply Chain Metrics That Matter series. I have never been in Africa. I am looking forward to sharing my insights about the supply chain leaders there.

I am also busy lining up great speakers for the Supply Chain Insights Global Summit at the Phoenician on September 11th-12th. This event is limited to 150 supply chain leaders and only 35% of the attendees can be technology providers. There are only five seats left for technology providers, so if you want to attend, send in your registration soon.