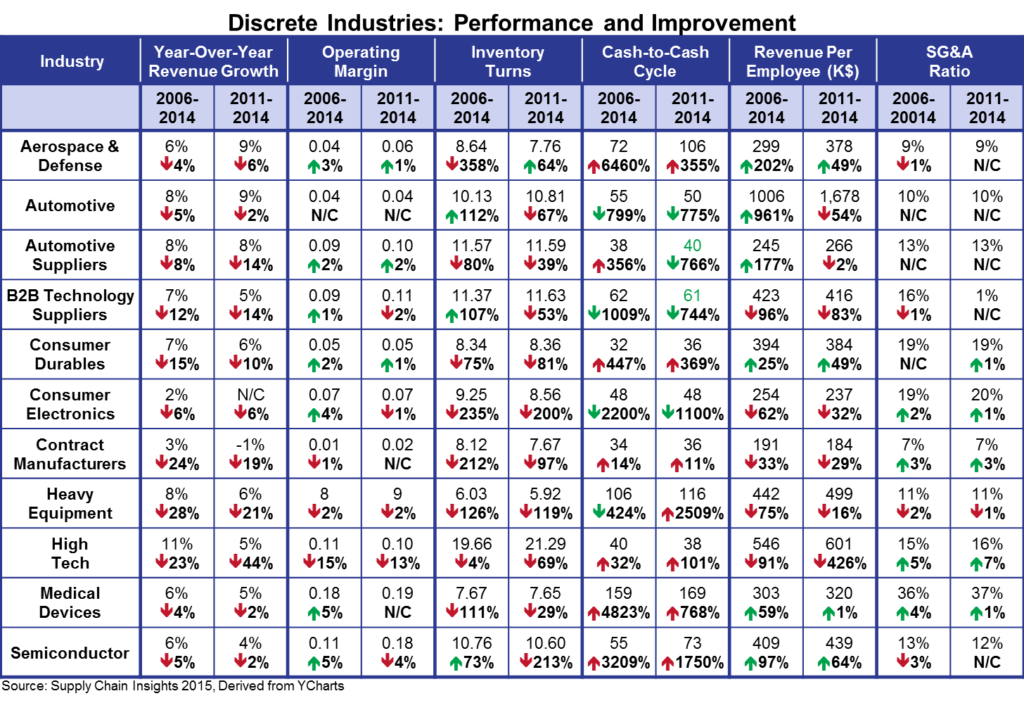

2016 is around the corner. For the supply chain leader it is time to reflect and build budget targets. To help, in this blog post I share industry trends. For the discrete industries we contrast the industry averages for growth, operating margins, inventory turns, cash-to-cash cycle, revenue per employee, and SG&A ratio for the periods of 2006-2014 and 2011-2014. For each metric we show the averages and the percent change from the beginning and end of the period. What can we learn?

- Growth Is Slowing. All industries are in decline. With the headwinds of a recession gathering, companies are battening down the hatches.

- Operating Margin. Operating margin improvement was easier at the start of the last decade. It is more difficult now.

- Inventory Turns. Progress on inventory turns is declining due to business complexity. Inventory tactics to right-size buffers and manage the form and function of inventory matter more than ever.

- Cash-To-Cash. While progress on inventory turns is declining, reductions in payables are driving cash-to-cash improvements. This, over time, erodes costs. To drive value companies with a lower cost of capital should fund investment for their suppliers that have a higher cost of capital.

- Revenue-Per-Employee. Outsourcing and labor reduction projects were easier at the start of the last decade. They are more complex now.

Table 1. Metric Performance for Discrete Industries

So, what can we learn?

1) Each industry has a different potential. Set your targets based on industry performance.

2) Driving progress is more difficult. This is a case where complexity management and a focus on year-over-year improvement is paramount. Set realistic expectations.

3) There is no magic bullet. Supply chain leadership requires focus and leadership.

4) Faster success happens when there is organizational alignment. Build a bridge to your commercial teams and work to close the gap between commercial teams and operations. Define customer-centric supply chains that provide value to your customers in a meaningful way. Work with your commercial teams to accomplish this task.

5) Educate the executive team. This is the purpose of this post.

Good luck on your journey! Tonight I am writing the Supply Chain Metrics That Matter report on the High-Tech Industry, and the Research in Review for 2015. We are heads-down on reports for our last newsletter for 2015. This will be our 87th report. Over the course of the last four years at Supply Chain Insights we have built over 3,000 pages of content which we have now archived in our new community, Beet Fusion. Over the holidays we will be posting more financial analysis on industries into Beet Fusion. Let us know if you have any questions. We want to help companies set the right targets. Metrics cannot be managed in isolation and realistic targets drive career success. We hope that this helps.

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for excellence.