When I was six, my mother volunteered me for a new polio vaccine trial. It was risky, but my determined mother took a chance. She believed in science and patted my shoulder reassuringly as I rolled up my sleeve.

During my toddler years, polio fear gripped the nation. Mothers, anxious that children would catch the disease swimming, kept families secluded indoors in the sweltering heat in the days before air conditioning. As a result, I never experienced the joy of jumping into a swimming pool until I was six.

The first major polio epidemic in the United States occurred in Vermont in the summer of 1894. The majority of infected people showed no signs of the disease, but the impact for many, like Franklin Delano Roosevelt, was paralysis. The last case of polio in the United States was 1979. A vaccine, focus, and hygiene eradicated polio.

This type of success gave my generation a false sense of security. The thought of a pandemic killing over 350,000 people globally and over 100,000 in the United States in just three months is mind-numbing. The World Health Organization cautions that we are at the beginning of this COVID-19 risk cycles. While my town in Pennsylvania is releasing restrictions, and people are starting to gather again in large groups, I say, “We cannot be too careful.”

A Long Road Ahead

Supply chains were ill-prepared for the pandemic. The Global Risk Report published in January 2020 highlights the issue. As shown in Figure 1, based on data collected in the period of September-October 2019 from over 600 business leaders, at the start of the year, the likelihood of a pandemic was low risk. Let’s face it. COVID-19 took us by surprise. The risk management concern of business leaders in January 2020 was climate action failure. The design of the global supply chain at the start of the pandemic assumed frictionless borders, availability of transportation resources, and supply with few constraints.

Figure 1. Global Risk Management Report Study of Risks Published in January 2020

Navigating the World of Gray. There Will Not Be A New Normal.

Why do I tell this story? Supply chain management as a discipline—a set of flows combining the processes of source, make and deliver together to drive value– is relatively new. The processes were first defined in 1982. As supply chain professionals, we have never managed the supply chain through a pandemic. Instead, all of the disruptions to date had a predictable pattern: a devastating blow, a set of shock waves, and the re-establishment of a new normal. The new normal pattern appeared in months, and the supply chain adjusted. What is different in this pandemic is that we will not see a new normal until we get a vaccine or effective treatment (like we have seen with AIDS). Instead, we will ride wave-after-wave of disruption.

Through the pandemic, we will experience the hammer and the dance. The sledgehammer will fall as infection rates rise. (The second wave of the Spanish Flu was worse than the first.) As crisis ensues, and emergency measures will drive communities to retreat to their homes. As the hospital admission rates subside, the dance begins again. We will experience this cycle over and over until we have a vaccine.

The answer? The supply chain response will need to be a locally-focused program using analytics to sense shifts market-by-market based on consumption data. Scrap traditional demand shaping programs. (The pre-COVID-19 programs for advertising, trade promotions, and price management based on history are ineffective.) The virus drives the tempo of the dance, continually changing demand. For supply chain leaders, the key to moving with the changing rhythm is to remove data latency (improve sensing) and build capabilities to translate baseline demand seamlessly. All of the business goals and budgets in the world will be immaterial as we try to piece together plans to maximize opportunity and mitigate risk through this pandemic.

Demand shifts through the pandemic are surprising. Readers of this blog are reporting demand shifts around the world. As we entered the last wave of shutdowns sales of toilet paper, guns, flour, luxury bed linens, and baking yeast surged. Automotive sales slumped by 65%. In Scandanavia consumers switched from rice to potatoes. In the Americas, consumers purchased smaller packages of paint: no longer purchasing gallons of paint consumers reached for pints. With the shutdown of dentist services for teeth cleaning, mouth wash sales grew over 50%.

In this process of navigating the dance, through the pandemic, supply chain process effectiveness hinges on navigating the world of gray. Let me explain what I mean. Transactional systems are very black and white. Supply chain processes depend on navigating the world o f gray. In this pandemic, the shades of gray multiply. The answer is advanced analytics using market data.

f gray. In this pandemic, the shades of gray multiply. The answer is advanced analytics using market data.

Here is an example.

A black and white question is, “What did we sell last week?”

In the supply chain world, to understand requirements, there are many follow-on questions. All rapidly descend into the world of gray (the attempt to drive insights through the use of analytics to understand market drivers.) Here are some examples:

- What was the product mix of the shipments? When compared to the S&OP plan, how did the mix change?

- What is the impact on the baseline lift? How is the baseline for demand shifting with the spread of the virus?

- What was the case fill rate? What were the drivers of the order shortages? How did the new product launch product line perform in the market?

- What was the cost of sales for the products shipped? How does this compare to the S&OP plan?

- With the changing product mix, what was the cost to serve at each customer? What drove the cost outliers?

- How did the changing mix of the orders shipped change inventory buffers at suppliers?

- What could we have sold with greater supply chain agility? What were the missed opportunities?

The list could go on and on, but I am sure that you get the point. Getting data in today’s organization is difficult. To make the point, let me use an analogy. While nearly 70 percent of the world is covered by water, only 2.5 percent of it is drinkable. The rest is saline and ocean-based. Even then, just 1 percent of our freshwater is easily accessible, with much of it trapped in glaciers and snowfields. Similarly, companies are drowning in data and low on insights. Business leaders cannot use the data they have. The reasons are many:

- Design. Organizations have many black holes. A black hole happens when data to answer a question is just not available. Most organizations have not designed their systems for data mining and discovery. Clouds, lakes, and streams need a well-defined architecture to enable discovery.

- Latency. Businesses also struggle with data availability at the speed of business. Data latency is a barrier to driving data discovery and building organizational alignment. Traditional technology architectures are batch.

- Simulation. The use of “what-if analysis,” discrete event simulation, and digital twin modeling allows organizations to see the impact of potential decisions. The supply chain is a complex non-linear system. The future impact of choices is not apparent without visualization. Only one in three companies have this capability, and only one in two companies feel that they can tie S&OP planning to execution.

- Traditional Thinking. Historically, the supply chain professional focused on stuffing transactional data into relational databases. Traditional processes use structured data but lack clarity on how to mine and use unstructured data. The focus is on answering known questions with known solutions, but much of the opportunity is learning to use data to answer the questions that we do not know to ask, and mining data for unique insights.

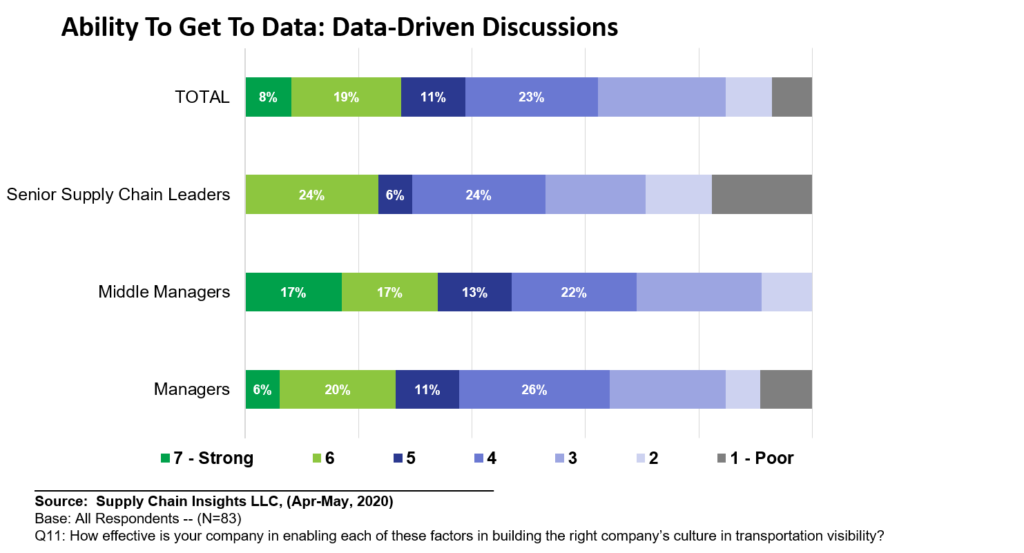

As shown in Figure 2, using a rating of 1-7, when it comes to getting to data to make decisions, middle managers rate organizational capabilities higher than Senior Directors at an 80% confidence level. Only 26% of companies feel that they can use streaming data. (Today’s architectures are just not designed to handle streaming data.)

Figure 2. Ability to Get Data

Streaming data is a golden opportunity to build outside-in processes. (Outside-in processes use market data—consumption data, market signal sensing, weather, unstructured text mining of rating and review data—to drive market insights at the speed of business to align the supply chain.)

The supply chain, as designed, is data-rich, but lacking insights. As the pandemic continues, and the world of gray unfolds, pattern recognition and the translation of data to improve decisions grows in importance, becoming more critical.

Steps to Take

The world of gray is uncomfortable. Companies dislike uncertainty. Today, companies try to get precise on imprecise numbers. We have many political arguments about data.

The desire for precision s a hard habit to break. In this new environment, techniques like attribute-based forecasting, sentiment mining, probabilistic modeling, what-if analysis, streaming data from IOT (Internet of Things), S&OP execution, and digital twin visualization rise in importance. Designing capabilities to use data is job one for the recovery team.

In this world of gray, as we try to navigate and understand the right go-forward position, the question is what to do.

Step 1. Stabilize Existing Systems. Build Recovery Teams. Now is not the time to deploy traditional APS and ERP. Focus on the redesign of the supply chain to build better. Deploy agility tactics.

Step 2. Define An Outside-in Strategy. To understand market-to-market variability, build planning master data systems, and demand lakes.

- Planning master data includes lead times, conversion rates, cycle times, and variance by mode. Track the shifts in the market and use these for planning.

- Demand Lakes enable the mining of market data (consumption, weather, and rating/review data) by market channel.

Step 3. Build Strong Relationships. Build strong supplier development programs (only 30% of companies operate supplier development programs) and improve trading partner capabilities with logistics providers. Recognize that both logistics and supply will be a constraint. Plan for disruption.

Step 4. Drive Insights. Use new forms of open-source analytics to continually mine the market data to answer the questions in the face of uncertainty. Invest in capabilities to make trade-offs between the source/make and deliver processes. Use these capabilities to improve S&OP execution, continually assess inventory health and routes to market.

Step 5. Invest in Sensing Capabilities. Identify and test market data, and validate the trends through testing. Build effective networks to enable flows. Avoid portals that lack the system of record for tracking business shifts. Sidestep networks that just share data and lack process enablement (canonicals) between companies. (The word network is overused and lacks clarity in most conversations.) Based on our survey data, today, only 16% of supply chain flows are enabled by Supply Chain Operating Networks.

Table 1. Navigating Network Strategies

Get Clear. Embrace New Opportunities.

Get Clear. Embrace New Opportunities.

In my work, I continually view new approaches in supply chain planning and test innovation. I like modernization and hate the ‘yadda, yadda, yadda’ (using a lot of words and saying little) approaches to supply chain management.

What do I mean? Let me share a story. I placed the phone on mute last week and laughed at two companies when they explained that they invested in o9 Technologies and were not clear on what they bought. They asked, “How should we use o9?” Let me caution, this was not o9’s fault, just an extension of companies unclear on how to buy planning systems and trying to grab bright and shiny objects. My caution? Don’t buy just because you think technology is cool. Get clear on the value proposition and clearly state goals to employees. Avoid bright and shiny objects. Test, learn and verify. Now is a time where there are many advances in new technologies that enable great opportunities for innovators to test.

In this world of stay-at-home orders, political unrest, and ever-changing supply chain requirements, I find some good news.

- Data-Driven Testing to Fill the Conference Void? The supply chain has too many bad conferences. Propped-up by paid speaking slots and over-priced booth presence, the only people gaining value are the conference organizers. These conferences contribute to the yadda, yadda, yadda mindset. Hopefully, with the COVID-19 precautions and the cancellation of these events, there will be more focus on driving real results. The conference booths and the over-hyped presentations are primarily a waste of time and an opportunity cost to drive actual results.

- New Approaches. I am enjoying the evolution of supply chain technologies from innovators like Enterra Solutions, Expero, and Kroynos. If you are having a bad day, check out their websites. Consider pilots to overlay on top of your systems of record.

- New Solutions. LLamasoft and Halo (a division of Logility) launched cost-to-serve models while Bluecrux accelerated work on the Digital Twin to model S&OP. LLamasoft also is focused on a new approach focused on schema-on-read demand planning targeted at the eCommerce market.

- New Licensing Approaches. Kinaxis has redefined its user licensing model, and Gains Systems shifted its business model to pay only after delivered value.

- The Building of Outside-in Processes? This week marks the second decade of writing about market-driven supply chain transformations. I think that the concepts are finally starting to stick. The pandemic demonstrates the differences between sales-driven, marketing-driven, and financially-driven processes (functional automation of the enterprise) and market-driven ( data sensing from the channel back).

Good luck navigating the world of gray. Let me know how I can help, and good luck in using analytics to buffer disruption. Prepare for the long haul. While the curtain is lifting slowly, it will have many ups and downs. For more insights, check out our YouTube channel.