Supply chain resilience is “the capacity of a supply chain to persist, adapt, or transform in the face of change”.

Wikipedia

Revlon bankruptcy. McCormick stock falls on Q2 earnings miss. CEO of Bed Bath and Beyond out as sales tumble. Target earnings disappointment and restatement. Daily, we see business continuity case studies as headline news in the Wall Street Journal. I am thinking a lot this month about business resilience and the role of supply chain leaders.

The future is uncertain. Inflation is today’s reality. Will it be a double-dip recession in the future? Green stagnation? Material shortages continue. Food instability looms in Africa. Greater political unrest? Continued port issues haunt us. Looming transportation shortages in the United States with the adoption of AB5 and the redefinition of the owner-operator are risks. Unresolved labor issues in the Leathermen Terminal in Charleston South Carolina and contract negotiations for 22,000 dock workers in the ports of LA and Long Beach hang heavy. The list goes on and on. The answer is not doing more of the same.

This is not a risk management issue of yesterday with the answer of quickly implemented control towers for better visibility. …or long laborious discussions of the differences between Integrated Business Planning (IBP) and Sales & Operations Planning (S&OP). Our days of chasing shiny objects and making supply chains more efficient, but more brittle need to be behind us. In the last decade, supply chain performance regressed. Conventional and historic practices were not equal to the challenge. Traditional technology approaches failed. We need to have a mea culpa moment to move forward.

The issue is business continuity. Inflation increases the need for cash. Growth agendas with the spiraling demand require cash, supplier shortages necessitate the shortening of payables, and the longer/more variable transport lead times decrease inventory turns increasing the need for cash. The answer? We need to aggressively move to outside-in processes. The how is tricky. We need to redefine work to be less siloed and focused on internal outcomes. Today’s processes are inside-out not outside-in. Market changes need to quickly translate into process reality. They cannot today.

A Stark Reality in Market Data

Companies were unequal to the challenges of the past three years. Let’s examine the market reality by looking at a peer group. While there is much market hype around projects, implementations, and digital transformation, the companies that are driving business continuity actively design their supply chains, manage complexity, and align cross-functional teams. There is less focus on cost, IT standardization, and outsourcing.

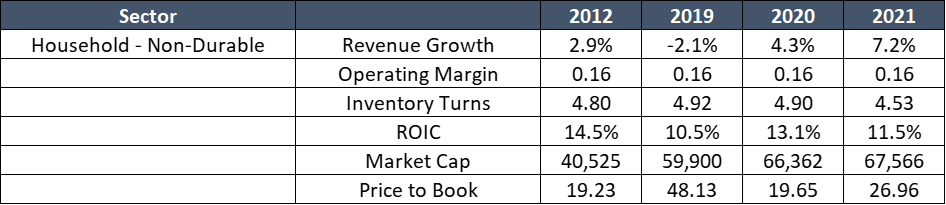

As I write the report, I am reflecting on how can companies be resilient in a market that is volatile? To make the point, let us start with a discussion on Consumer Products manufacturing. In Table 1, we share the overall industry trend.

Table 1. Industry Trend by Year

Let’s admit that the shift from a historic growth of positive growth of 2-3% to a -2.1% contraction in 2019 to positive growth of 7.2% in 2021 was a rough ride. While fortuitous at present, it is a good time to reflect on lessons learned.

Wowza! Let’s start with celebrating the supply chain teams that drove these results. These types of shifts are unprecedented.

This work was tougher if the company measured demand based on pattern recognition of historic orders. Or if the Company lacked alignment between commercial and operations teams.

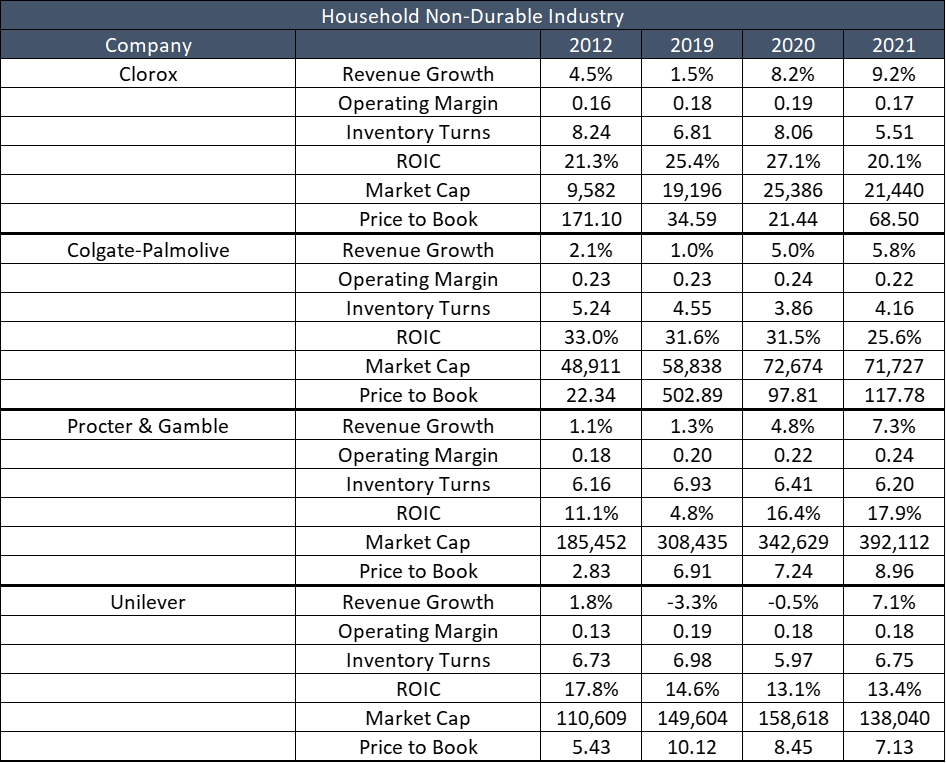

Who is the most resilient? Clorox is more resilient than Colgate, P&G, or Unilever. Smaller companies have greater clarity of strategy and less process latency in decision-making. Clorox based on their supply chain segmentation work is also clearer on strategy helping the company to be more balanced cross-functionally as they face the headwinds of market turmoil. In contrast, Colgate sweats their assets and focuses myopically on cost. Point of sale data and market signals are buried in sales and marketing. P&G lacks a tactical supply plan to manage load across factories and contract manufacturing to effectively communicate to suppliers and underperforms on ROIC. Unilever is very decentralized and subject to localized decisions and regional gaming. The constant reorganization and leadership changes within Unilever create ongoing turbulence not seen in their peer group. Companies without clear governance on decision-making like J&J and Unilever struggle the most in the face of turbulent headwinds.

Table 2. Comparison of Industry Players Within Consumer Goods for the Period of 2012-2021

The three most dreaded words in the English language are ‘negative cash flow‘.

David Tang

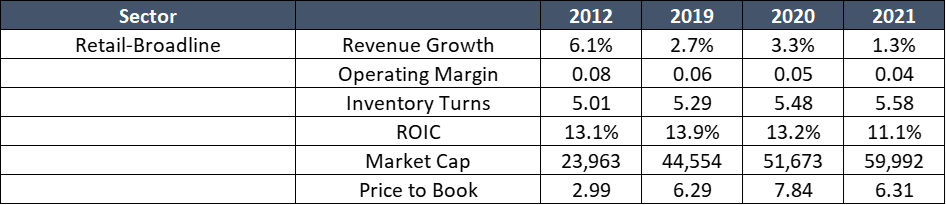

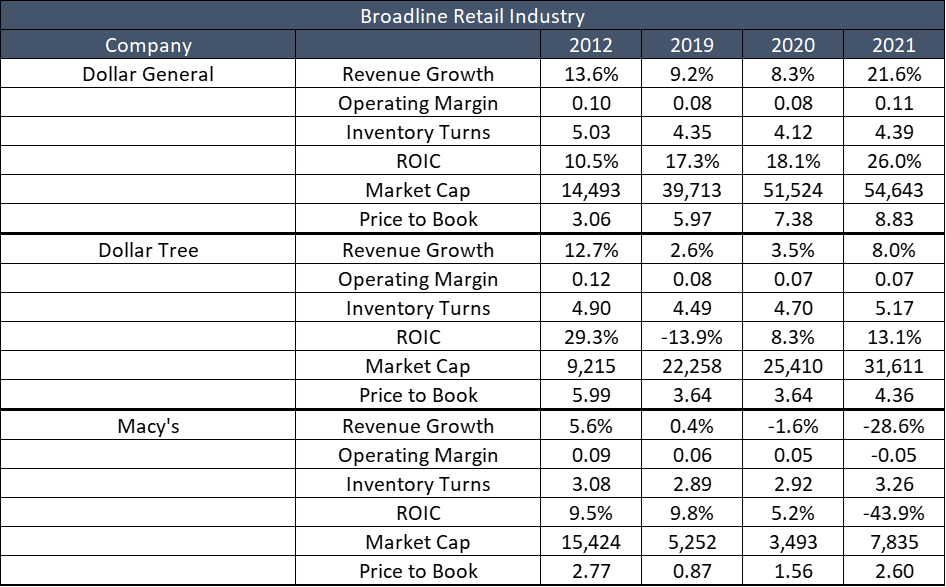

As I worked on the Supply Chains to Admire report (to publish this week), I thought a lot about cash flow and business continuity. For many industries, the results are much worse than consumer goods. Imagine the downturn in growth in broad line retail and the pressure on margins.

Table 3. Broadline Retail Changes Over the Decade

Table 4. Company Performance in Broadline Retail.

Reflection

As you reflect on these market swings, think about organizations’ ability to do work. Step back and reflect on my five unlearnings as I think about planning and the shifts in outside-in process development:

- Taxonomy. Conventional planning evolved around siloed planning taxonomies focused on localized optima with a bias of plan, do, act. The evolving framework is centered on a unifying data model based on the flow of sense, design, plan, orchestrate, learn, and adapt. The focus needs to move from functional metrics to balanced scorecard outcomes. Functional metrics insulate organizations and throw the supply chain out of balance.

- Inventory. Currently, the focus of planning is on inventory levels and the calculation of safety stock, and in more advanced applications multi-tier inventory optimization. The new focus needs to be on inventory quality of decisions with a focus on the form and function of inventory. For example, a “buy plan” for procurement.

- Demand. Traditionally, demand planning was chopped up into many applications—demand planning, forecasting by finance, revenue management, and sales account planning. The focus of an outside-in process is to manage demand as a flow outside in with role-based views and optimization in a connected system that measures sensing, shaping, and shifting at the speed of business.

- Variability. Market variability is real and decision support systems must first sense all forms of market variability before running a plan. Hence the need for a planning master data system.

- Democratization of Work. The historic focus of planning was on the planner as the user. In an outside-in process, the focus is on the democratization of planning with the business leader as the user and the planner as the orchestrator.

Join the Discussion Tomorrow?

Tomorrow, we share the results of the ninth analysis of the Supply Chains to Admire work. Twenty-five companies (4%) outperform their industries in these turbulent times. We will continue the discussion of business continuity in this webinar. Progress continues to decline in the retail and process sectors over the decade.

Wednesday, July 13 at 12:00 PM

https://lnkd.in/ey2Ujre7

See You At the Supply Chain Insights Global Summit?

Registrations are pouring in for the Supply Chain Insights Global Summit on September 6th-8th in Washington, DC. The focus of the conference is on Supply Chain 2030. This conference has a physical presence for 90-100 business leaders at the Westin near Dulles Airport and a virtual component that will be facilitated on a collaborative platform with guest speakers by Sarah Barnes Humphrey. I encourage all to sign up.

The conference is designed for extreme networking. Our goal is to build a guiding coalition of industry leaders to drive change. We need to redefine supply chain planning architectures, but it needs to start with redesigning work. To do this, we must have a different discussion and free ourselves from convention.