Currently, LinkedIn is flooded with smiling pictures of supply chain business leaders attending conferences. The good news is that we can attend conferences again. The bad news is that most discussions are based on opinions, not facts. As a contrarian voice in the industry, I want to share some research to steer the conversations towards a more fact-based dialogue. (I know. The industry is full of strong opinions. I can only try.) My goal is to help.

In this post, I want to focus on tactics that work and don’t drive success based on recent research of 107 business respondents. (The panel group is sourced from my group of LinkedIn followers. I openly conduct and share research in front of the firewall.)

Supply Chain Center of Excellence

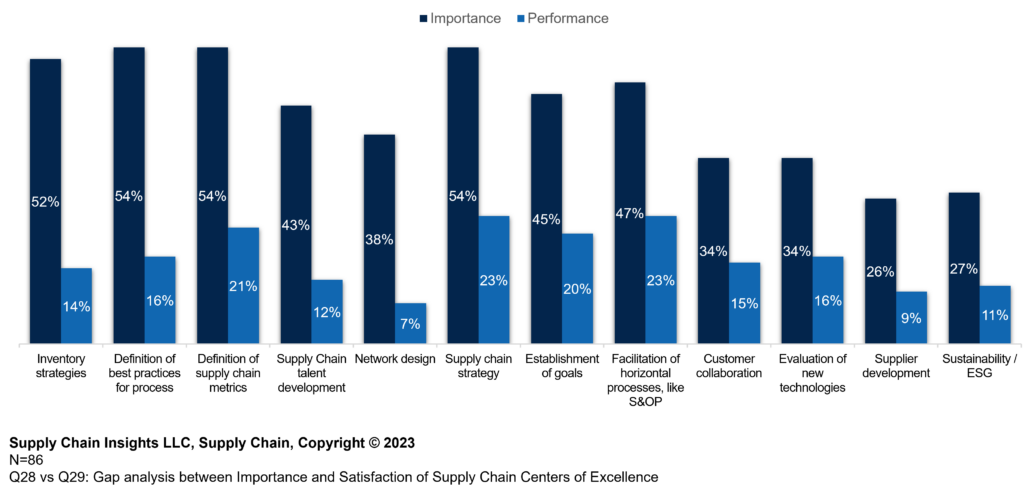

Let’s start with a discussion on Supply Chain Centers of Excellence. I know, a Supply Chain Center of Excellence sounds like a good idea. Right? I used to think so as well. The problem is that few companies have a clear definition of excellence compounded by the lack of clear definition of a business strategy. As a result, with the lack of clarity on supply chain excellence, the group flounders. In Figure 1, we share the gap analysis.

Figure 1: Supply Chain Center of Excellence Gap Analysis

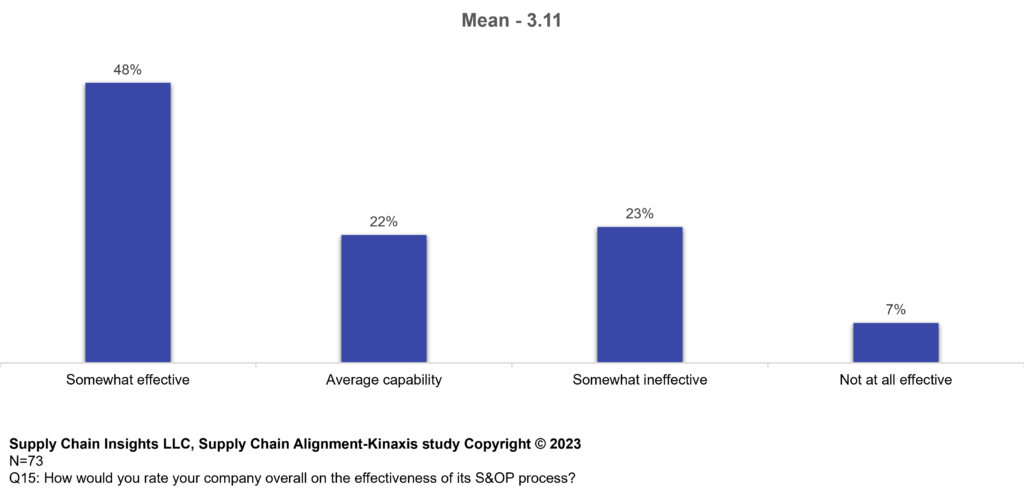

To understand the root issue, we analyzed the impact of different factors on Sales and Operations effectiveness (S&OP). In the survey, companies rated their S&OP process on a scale 1-5 with a score of five representing capabilities in five areas: the ability to sense and respond to demand and supply volatility, organizational alignment to the plan, the connection of planning to execution, the ability to balance demand and supply to develop a feasible plan, and the organization’s ability to maximize opportunity and minimize risk.

“If the only tool you have is a hammer, it is tempting to treat everything as if it were a nail.”

Abraham Maslow, 1966

In Figure 2, we share the relative maturity value of the respondents. A score of 5 was very effective, while a score of 4 is somewhat effective, and a score of 3 represented average capabilities, and a score of 2 was somewhat ineffective and 7% represented a process that was not effective. The average score was 3.11 and there were no respondents that rated their process effective on this definition.

Figure 2: S&OP Maturity

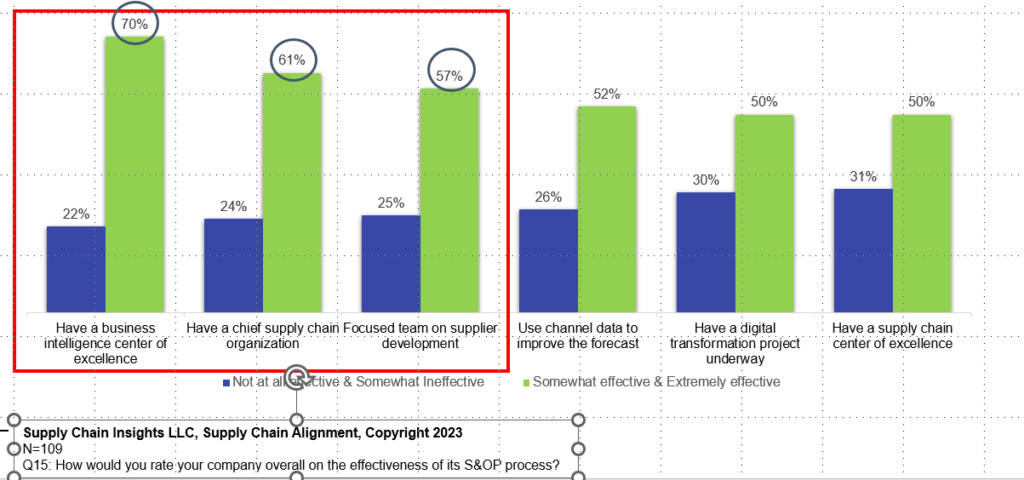

The exciting trend I observe in many industry white papers is the overuse of the S&OP to solve all supply chain maladies. It reminds me of the hammer and nail quote. As a result, I find the concept of S&OP over-used. It is not a panacea. I find that S&OP does not drive organizational alignment, nor is it a replacement for a clear supply chain strategy. However, the research does support that companies with a strong business intelligence center of excellence, a chief supply chain officer, and a clear supplier development program tend to perform better on S&OP. (The correlations at an 80% confidence level are circled in Figure 3.) It also supports that companies with strong manufacturing scheduling capabilities in process-based companies score better on S&OP. (There is no similar correlation for the other elements of planning.)

Figure 3: Gap Analysis of S&OP Maturity Factors Along with Significance Testing

- Why does a Business Intelligence Center of Excellence score higher on driving effectiveness than a Supply Chain Center of Excellence? The Supply Chain Centers of Excellence struggle to define excellence in organizations with increasing alignment issues. (Alignment gaps grew three-fold over the past decade.) This group struggles if companies cannot clearly define an operating strategy and a supply chain excellence definition. In contrast, a Business Intelligence Center of Excellence has a clear, non-controversial agenda to help the organization use data better.

- And why does a Digital Supply Chain Transformation Effort not score higher? The answer lies in the lack of clear definitions to drive outcomes. Most are engaged in digital supply chain transformations without clear grounding on “the what” and “so what” of the initiative. Digital supply chain transformation is a fad. Hollow words thrown around a stage without clear meaning. What does it mean? I don’t know. There is no standard definition.

- Or the use of Channel Forecast Data? I also think that the industry is not clear on how to transform demand processes based on channel data.

Summary

So, if you are at a conference hearing a presentation on S&OP imagine where the presenting company is on maturity and ask for feedback on this research. Let’s make supply chain a fact-based discussion. The reason? Too much is dependent on not getting caught up in industry groupthink.