Self-congratulations notes abounded this week as vendor-after-vendor shared their rankings on the Gartner Magic Quadrant for Supply Chain Planning. For me, it was a big sigh. I believe that the Gartner Magic Quadrant is a barrier to progress in supply chain planning, and that vendors that rally in support have a false sense of superiority.

Reflection

Let me start with some history. The first Gartner Magic Quadrant for Supply Chain Planning that I participated in as a technology vendor was in 1995. In 2000-2003, I worked on teams as a Gartner analyst developing Magic Quadrants. Twenty-five years ago, there were more players, and the solutions were more comparable.

Not much has changed in the methodology, but a lot has changed in the market–consolidation, technology advancements, and the growth of the global multinational. Today’s planning market is muddy: the methodology is inadequate to compare entities that are not alike.

I liken today’s selection process to making a bowl of minestrone soup. How so, you might ask? In the soup, there are beans, carrots, tomatoes, macaroni, peas, spices. Each is very different, but together, the flavors combine to make a delicious dish. I especially, like a hot bowl with homemade bread on a cold evening.

I find this an apt analogy for the Gartner Supply Chain Magic Quadrant. Let’s play out the analogy. Anyone short listing John Galt, Kinaxis, o9 Solutions, OMP, or Retek in the same search does not understand supply chain planning. The reason? They are too different.

However, if the buyer wants to buy complimentary solutions, buying and combining solutions might make sense. The days of selections where there is one throat to choke selections are long gone.

There Is No Leader

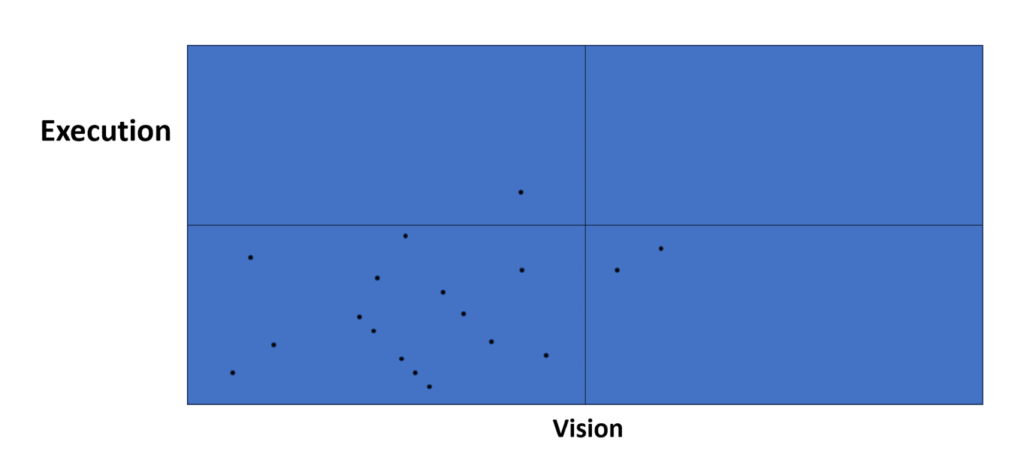

If I was drawing the magic quadrant today, it would look like Figure 1. There would be no leaders.

Figure 1. A Representation of the Current State of Supply Chain Planning

Over the last decade, I watched vision vaporize, and execution issues become more acute. So, have I convinced you yet that there is no magic in the Gartner Magic Quadrant for supply chain planning? In this blog, I also make the argument that if you follow the Gartner Magic Quadrant direction, you may decrease the value of the firm.

The True Winners are the Technology Sales Reps

When the Gartner Magic Quadrant was announced this year, Philip Vervloesem, now the Chief Commercial & Markets Officer for Global Expansion for OMP, taped a video in Florida announcing the win for OMP. Note the opulence. The video is captured in front of beautiful yachts and homes on the Florida canal. Philip, and other supply chain planning sales teams, have profited over the decades on the back of the historic definition of supply chain planning. He believes that achieving a leadership position on the Gartner Magic Quadrant is a good thing. I do not.

The Losers Are the Global Multi-National Supply Chain Teams

As I work on the Supply Chains to Admire report, that will publish soon, I wince at the performance of large strategic customers of the supply chain planning vendors when compared to their peer groups. Eastman Chemical (A longtime customer of OMP– and one of the most strategic– underperforms against the chemical peer group). Similarly, Schneider Electric, a strategic customer of Kinaxis underperforms as does Anheuser Busch, a strategic customer of o9 Solutions.

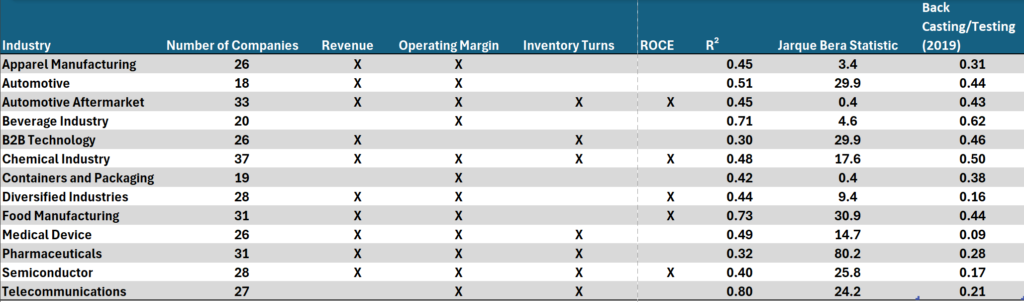

The Supply Chains to Admire report measures progress of a company within an industry peer group for the past decade. The research methodology for the Supply Chains to Admire compares the performance of a company against its industry peer group for the metrics of Year-over-Year Revenue Growth, Inventory Turns, Operating Margin, and Return on Capital Employed (ROCE).

The patterns in the research over the period of 2015-2024 support:

- Supply Chain Organizations Are Not Achieving an Economy of Scale. In our analysis, small and regional players outperform larger multi-nationals

- Does End-to-End Supply Chain Planning Drive Value? I am not sure. The supply chain planning technology providers’ most strategic companies are underperforming. Companies that are outperforming either use multiple solutions or have built their own. Traditional supply chain planning architectures introduce variability and increase the bullwhip. The focus on control towers and visibility drives reactionary behaviors. The value of supply chain planning is cross-functional visibility to improve alignment on a plan.

- The Wisdom of the Supply Chain Crowd is Flawed. Most of the companies that supply chain leaders believe are outperforming are actually underperforming. You will not find the top performers on stage at the many supply chain conference bragging about their performance. Yet, they outperform year-over-year.

- The Gartner Top 25 Underperforms. The Gap is Growing. There are only three companies in common with the Supply Chains to Admire methodology and the Gartner Top 25. In the Gartner Top 25 methodology, we find that 59% of the Top 25 winners score below their peer group on average revenue growth, 41% below inventory turns, and 41% below Returned on Capital Employed (ROCE).

The methodology is now 20 years old. The gap in value delivered for shareholders between the two lists has grown over the past decade. The Gartner Top 25 is a poor measurement of supply chain value.

Why It Matters

For the past two years, I have been working with statisticians at Georgia Tech to analyze public reporting of manufacturing, retail and distribution companies to understand the relationship between metrics, and market capitalization/employee. For 80% of industries, the supply chain metrics represent more than 40% impact on value.

Today, companies measure too many metrics without a clear definition of value. At a recent seminar, when I asked how many metrics companies measured in S&OP, all of the manufacturers in the room hands were raised when I said over fifty. Let’s have an honest discussion. How can you drive improvements in value if you don’t understand the inter-relationships of the metrics measured?

The supply chain is a complex, non-linear system. When companies attempt to save costs within a function, often total costs rise. Savings in one function can potentially throw the supply chain out of balance increasing total costs and reducing customer service. The larger the company, the greater the impact on value. The reason? There is a lack of understanding of trade-offs.

The traditional supply chain planning architectures at the center of the Gartner Magic Quadrant focus on functional optimization. There is a need to actively make trade-offs across source, make, and deliver while aligning to a balanced scorecard. No planning technology today can do this. As a result, the Gartner Magic Quadrant is a barrier for industry progress: companies that espouse the methodology will fail to innovate.

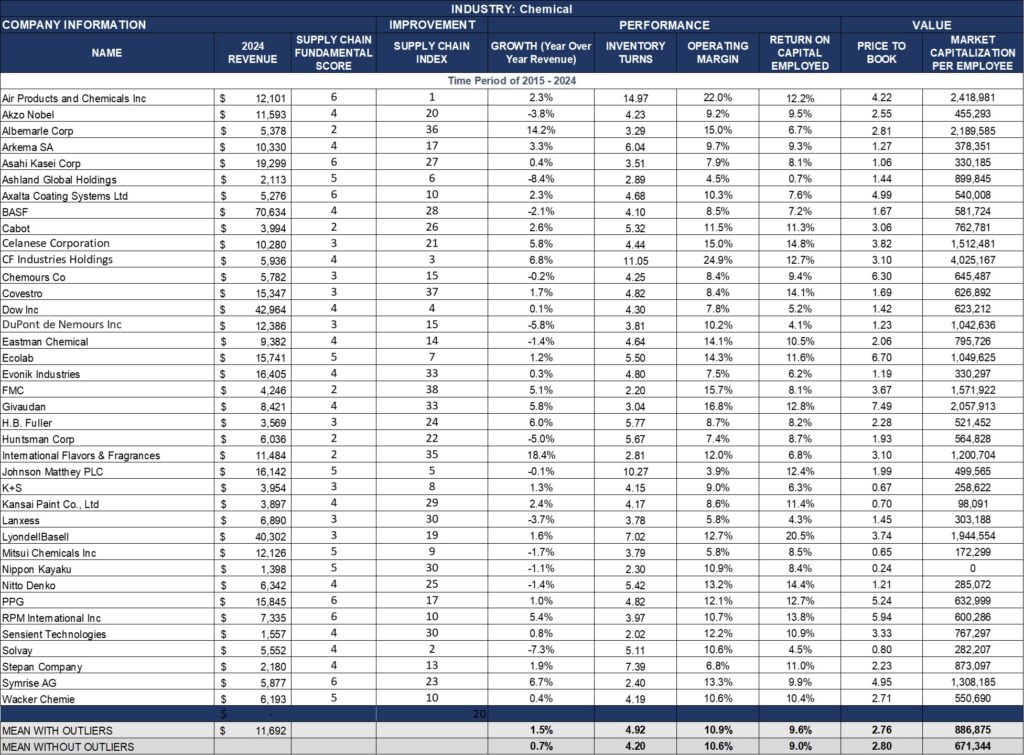

Let’s go back to OMP. The company is known for deep industry expertise. The chemical sector is a sweet spot for the company. The Gartner Magic Quadrant ranks them at the top of the leader’s quadrant. If OMP is truly a leader in supply chain management, why are their strategic customers–Axalta, BASF, Dow, Eastman Chemical, Evonik, Solvay–underperforming their peer group for the last decade? Of the group, Axalta is doing the best but note the relatively small size of the company when compared to the chemical peer group.

Figure 2. Supply Chains to Admire Chemical Industry Analysis for the Time Period of 2015-2024

Note: The Supply Chain Fundamental score is a measurement of controlled progress while the Supply Chain Index measures business resilience against the peer group. Both will be explained in the upcoming Supply Chains to Admire report.

So, What Do You Do About It?

If you are a supply chain planning operational leader recognize that there is no ONE solution to meet your needs. The market lacks a leader. Get clear on your objectives, train your team, align your metrics, and test the solutions before deploying. Buy for short-term results as the market reshapes based on technology advancements of machine learning, unstructured text mining, vector DB, graph databases, and artificial intelligence.

In the process, serve up some minestrone soup. Think about how multiple solutions could work together to meet your needs.

What do you think? I look forward to your comments.

Time to Think About Outside-in Planning?

In the process, consider enrolling your team in our upcoming outside-in planning class. In the six-week class, gain an understanding of how the supply chain planning taxonomies change with the use of channel and market data and explore the use of new forms of technologies to reduce data latency, the bullwhip effect, and variability. (Follow the link to check out the curriculum.)

The class is only open to business leaders (no consultants or technologists). If interested shoot me an email at lora.cecere@supplychaininsights.com.