I have been an analyst for over a decade. Two years at Gartner, six years at AMR Research (now Gartner), two years at Altimeter Group, and three years as the founder of Supply Chain Insights. During this period I have watched the acceptance of cloud-based supply chain solutions evolve. In 2002 there was no interest. In studies from the period of 2006-2008, there was slow adoption of 15-20%; and today, the supply chain leader prefers a cloud-based solution. The reason? I hear three primary reasons in my qualitative interviews:

1) IT Avoidance. As organizations have become larger through Merger and Acquisition (M&A) activities, many organizations have made IT a profit center. In these organizations, it is very difficult to get day-to-day support, and the supply chain leader wants control of their destiny.

2) Value Network Connectivity. The cloud—through web-based interfaces—makes it easier to connect through cloud-based solutions to customers and suppliers. Whereas the traditional license models with client-server architectures are not very extensible, the newer cloud-based solutions make this easier.

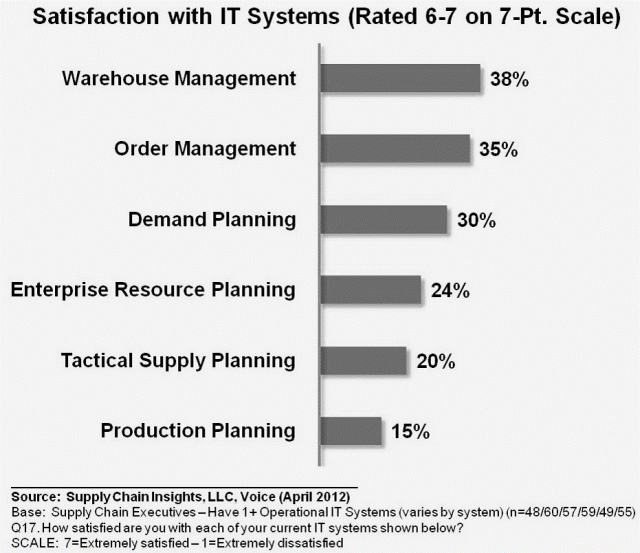

3) Higher User Satisfaction. Each year we do a study on user satisfaction with today’s systems. Figure 1 came from the 2012 study. As noted on the figure, currently people are not happy with any of their supply chain systems. The first and second acts of the supply chain planning and execution software market are slowly giving sway to what I term the third act. Users of Software-as-a-Service solutions have higher satisfaction rates. Why? The bar of performance is higher for the provider of the software. If the user does not like the software, they will turn it off. Secondly, in a true Software as a Service model, there are no maintenance upgrades, and third it enables the deployment of easier to use software models.

Figure 1. Satisfaction with IT Systems

It is important to note that Software as a Service and hosting are very different models. While the more traditional vendors have repackaged their software into hosted solutions, this is not a true Software as a Service deployment. The difference? The primary difference is in the definition of the word ‘service’. In an SaaS model you use the software; whereas, in a hosting agreement you own the software. In a hosted model there is very little difference than on-premise with the exception of where it is physically located and who maintains it. There is still a need for maintenance outages and software upgrades and it is not as easy to deploy to third-party participants on the value network.

What Can We Learn? A Look at History

In the last three months, the vendor market in supply chain has shifted significantly to the SaaS model. Kinaxis, an early pioneer in the evolution of SaaS solutions, committed to the model in 2005, and went public on the Toronto Stock Exchange in 2013. The company is now profitably operating at a run rate of $70 million in annual revenues.

Steelwedge, a Software as a Service solution of S&OP, just announced a new round of financing by Camden partners. The company secured $22.5 million in fresh capital to invest in R&D to build a technology services hub in Austin, Texas. With new capital, and new CEO Pervinder Johar from HP, their goal is to become the “Salesforce.com” of the supply chain industry.

E2open went public in July 2012 and in February 2015 participated in a private buyout for $273 million by Insight Venture Partners. Prior to the buyout, E2open’s stock price was battered with a 74% decline in the company’s shares over the last year. The initial public offering of 4,687,500 shares of its common stock was at $15 per share.

New Entrants. The predominate model of new entrants in the market is a Software-as-a-Service model. This includes Enterra Solutions, Exceedra, Orchestra8, O9 and Solvoyo.

Market Insights

The last decade was a tough sled for Software-as-a-Service providers. However, it was a battle worth fighting. Kinaxis is well-positioned at a good time in the market.

Cash is king. Steelwedge has gone through multiple rounds of financing and repositioning as it progressed in the market. The going was tough. The concept of Software as a Service S&OP was introduced by Steelwedge before the market was ready. In addition, technology today enables more capabilities than Steelwedge could offer in its earlier solutions. As a result, Steelwedge looks very different today than when I first met them in 2002.

Public markets are not patient with vendors on an aggressive growth plan. E2open learned the hard way that the markets want profitable growth, not just growth. Companies should not go public until they are ready to demonstrate reliable, and profitable growth.

Not a place for consultants. While many consulting partners are dabbling with the introduction of Software-as-a-Service models to augment gaps in current software, buyers beware. I have never seen a consulting partner successful in selling supply chain software.

Conclusion

I like the clouds. In my opinion, they offer real promise for the supply chain. What do you think? I would love to hear and learn from your experiences.

____________________________________________________________________

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, quilting for her new granddaughter, and actively taking ballet.

Thirteen Years a Blogger

Thirteen years. 600 posts. Where does time go? For over a decade, since founding Supply Chain Insights in 2012, I have pounded the keyboard, asking