Last week Walmart announced the closing of 269 stores and the layoffs of 10,000 employees. In addition, Macy’s announced the closure of 36 stores and K-Mart followed suit with announcements of 27 store closings. For December 2015 retail sales were the lowest since 2009. What does this mean?

Last week Walmart announced the closing of 269 stores and the layoffs of 10,000 employees. In addition, Macy’s announced the closure of 36 stores and K-Mart followed suit with announcements of 27 store closings. For December 2015 retail sales were the lowest since 2009. What does this mean?

I think three things:

- Decline in Customer Sentiment. The turbulence in the January stock market has an impact on customer sentiment. Customers are buying less.

- Success of New Business Models. The Amazon Impact is having an effect on Wal-Mart Stores, Inc. and retail in general. Amazon’s innovation is redefining e-commerce faster than Walmart can keep up.

- Disintermediation. Manufacturers are Now Selling Directly to Consumers. The days of going to a brick and mortar store to buy product is only one of the ways that people want to buy.

This week many of my friends will gather in New York for NRF. I expect a somber mood at the National Retail show. I stopped going to NRF three years ago. I hate traditional trade shows. NRF is a world of large booths, traditional press releases, and dinners with glitz and glamour.

In the last decade power shifted to the shopper. As a result, both retail and consumer products processes are being redefined. Consider the recent news.

Why the closure of retail stores? Retail was slow to adopt supply chain processes to drive new business models; and as a result, traditional retail redefinition of supply chain processes got caught in the omni-channel hype while Amazon worked its magic to become a market leader. The results last week tell this tale. Retailers can no longer have their heads in the sand, but neither can consumer products manufacturers.

Overall Trends in Consumer Value Networks

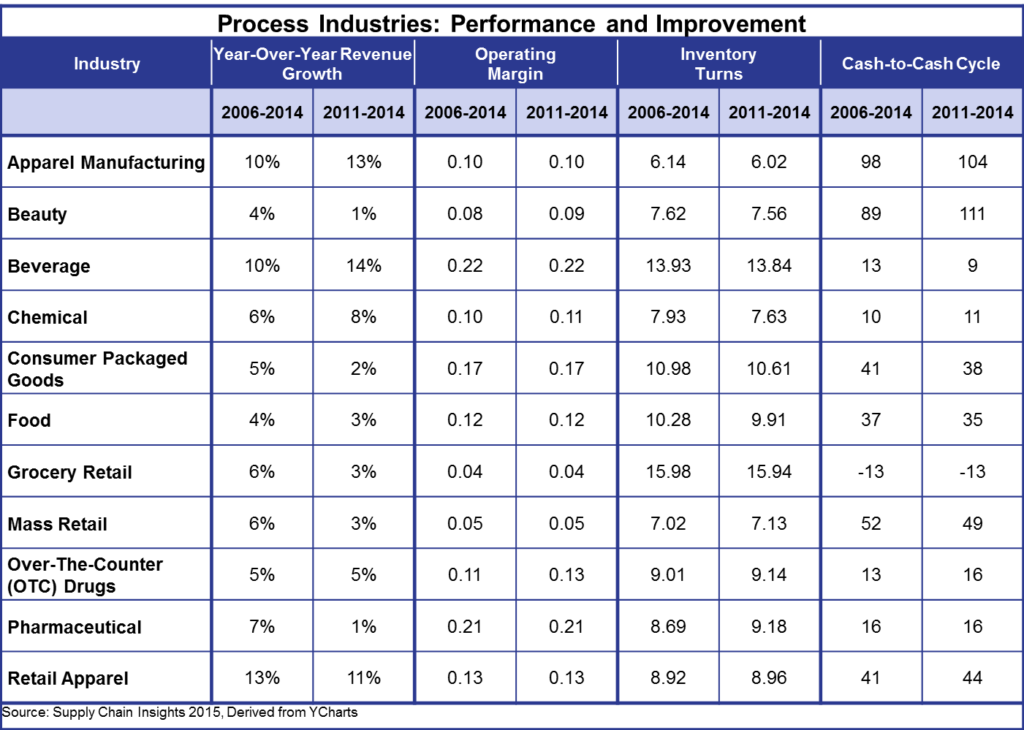

As shown in Table 1, the growth of traditional retail industries is declining. (This is an analysis of traditional retail minus e-commerce pure plays.) When we do this type of analysis we look back at the data as far as we can reach (Y chart data is available only back to 2006 in a reliable form), then we look at the period of 2006-2014, and the more recent period of 2011-2014. Note that apparel manufacturing is growing and apparel retail is declining. The difference? E-commerce. Also note that beauty, consumer packaged goods, and food growth is also declining. The difference? Retail generic products sold through new channels.

Table 1. Contrast of Growth, Operating Margin, Inventory Turns and Cash-To-Cash for Consumer-Facing Industries

Also note the sluggish trends in operating margins. Only beauty, chemical, and Over-the-Counter (OTC) Drugs made progress in operating margins. In parallel, take a closer look at inventory turns where only pharmaceutical companies made slight progress. What can we learn? For today’s supply chain leader the pressures on both operating margin and inventory turns are great. Standing still in the face of shifting business models is often a feat calling for a celebration.

It is no longer about industries. I think that the energy needs to be on redefining value chains to embrace the consumer and the shift to the shopper. For many it starts with embracing the EACH.

A Closer Look at Consumer Value Chains and the Value of the EACH

Traditional supply chains ship cases, pallets and trucks; but not the EACH. With the dawn of e-commerce, companies must now ship the EACH.

What is the EACH? Open a case and you will see individual units. This is the selling unit for e-commerce. Buyers don’t want a case or a pallet. A case is too much product. A shopper wants an each or an individual item. In the past, in the consumer value chain, retailers merchandised the shelf and removed units from the case and placed it on the shelf. E-commerce has changed the definition. We how have the endless aisle with the need to ship the EACH. Manufacturers that want to have e-commerce capabilities are scrambling to catch up. Their processes cannot ship and track the EACH, and the outsourcing to third-party logistics is too expensive.

As a result, unit picking, shipping, and returns is redefining warehouse management and transportation processes. Voice picking, piece-pick walls, and pushing the goods to the packer are new processes; but, underlying these process redefinitions is the need for investment in warehouse management. As a result, the average company is increasing investment in supply chain management technologies by 6% and rethinking architectures. In Figure 1 we share insights from a recent study on the overall focus of 2016 spending. Note the increase in investment in supply chain execution. Most of this spend is targeted at the redefinition of warehouse management to make e-commerce a reality.

Figure 1. Expected Changes in IT Spending in 2016

The shipping of the EACH is not, and cannot be, an evolution of existing systems and processes. It cannot be an evolution. Instead, it is a redefinition. Expect a redesign that requires a new process, and an investment in automation. For most companies serious about e-commerce the move to the EACH requires a warehouse management replacement strategy, which is boosting the sales of Manhattan and JDA software, and driving innovation in new contenders using Software as a Service (SaaS) like Logfire.

Five years ago e-commerce channel opportunities for manufacturers were less than 1% of revenue. Today, in my work with clients, I find that it is 5%-7 % and growing. Manufacturers now have the freedom to build e-commerce capabilities and not be seen as a competitor to their retailers. E-commerce in manufacturing is accepted as a way of doing business for manufacturers. (This was not true in 2000-2005 where e-commerce capabilities by a manufacturer were seen as too competitive to retailers. It is now accepted that manufacturers will have retail capabilities.)

For a manufacturer, e-commerce allows companies to better manage assortment of unique items to specialized markets and better know their customers. What is not to like about a customer-centric supply chain? The concept is rich, and attractive, but requires work.

The EACH also requires additional tracking. Traceability in pharmaceuticals with unique identification, cold chain tracking in temperature controlled supply chains, gray good/counterfeit procedures for luxury goods. The list goes on and on. Traditional supply chain processes have not been good at tracking the chain of custody and the challenges are even greater with tracking chain of custody with the each versus the pallet. To accomplish these processes companies need to embrace big data architectures for streaming data. The data sets are larger and more complex. As a result, the architecture for the EACH and chain of custody of products for e-commerce requires HADOOP and non-relational Open Source technologies like Apache Spark. For the supply chain leader used to investment in Enterprise Resource Planning (ERP), this is a brave new world. When supply chain leaders were asked about the importance of data variety and data volume to process capabilities, and shown in Figure 2, product traceability tops the list.

Figure 2. Big Data and Process Capabilities

It also requires the definition of listening posts to understand product feedback, and ratings and reviews. Only 3%t of manufacturing companies have tackled the issues to build listening posts and share rating-and-review data cross-functionally; and at our recent Supply Chain Insights Global Summit, no one in the audience other than Lenovo was tackling the use of sentiment data in the supply chain. We need to move digital marketing processes across the functional silos and make consumer data usable by supply chain process. This is a change management issue at its finest.

Is it worth it? I think yes.

At the beginning of the decade only 5% of companies rated their capabilities to ship the EACH as satisfactory, resulting in the use of many third-party logistics solutions to fill the gap. However, as e-commerce strategies grow in importance, more and more companies are beginning to bring these capabilities inside the company and are working on the redesign of warehouse management and logistics systems. Why? A shopping cart and a basket is not sufficient. Companies need to be successful in delivery and returns. With rating and reviews, and an increased cadence of business, this matters more than ever. Supply chain leaders need to embrace the EACH. Why? It is a necessary capability for e-commerce and new business models. Growth lies in redefining the consumer value chain to embrace the shopper.

The “So What?”

As I end this blog post let me leave you with three thoughts.

- Supply chains need to morph to embrace new business models to drive growth. It needs to be a value-chain driven process, thinking outside of the traditional industry norms.

- Growth is difficult and implementing new business models is even harder. For the supply chain leader this is an opportunity. The ability to influence the organization is growing. Seize it!

- Traditional processes will change based on the business model. Today I am speaking of embracing the EACH. Tomorrow it could be a discussion on 3D Printing, non-relational databases, robotics, or drones. The key is to start with the buyer and map the processes back while considering how process capabilities can change/be improved using new technologies.

These are my thoughts. I look forward to hearing from you!

We will be covering these topics at the Supply Chain Insights Global Summit. We hope to see you there!

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for excellence.