I help business leaders transform supply chains. Fiercely independent, I triangulate the market and share insights. While companies like research, they love stories. For me, this poses a dilemma. How so? No one wants their story told, yet they want to know stories of other companies. I sign a Non-Disclosure (NDA) everywhere I go.

Stories from Tom, Dick, and Harry

For a gal that writes for an audience of over 400,000 readers, this poses a problem. How do I share the experiences while preserving anonymity? The term “every Tom, Dick, and Harry,” means everyone and anyone. In short, he is the quintessential guy. Today, in this blog, while the tales from the road are real, I will share stories using Tom, Dick, and Harry pseudonyms.

Driving Value. As a part of my annual Supply Chain Academy class, I offer office hours. A recent call was with Tom. I have known Tom for five years. His first call was on Sales & Operations Planning, and his new inquiry was on S&OP. He is frustrated that he is not making progress. On the first call, he introduced me to his new boss, Jim. Tom wanted help to take his S&OP processes to a new level, but his boss was dismissive. Jim did not think that he needed help.

On the recent call, Tom shared the story of S&OP evolution through two bosses. In short, it was a zig-zag pattern based on the beliefs of his previous bosses. Progress stalled, and Tom questioned what to do. Here is a synopsis of our discussion.

Tom’s questions:

My organization does not value the role of forecasting. The group doing the planning feels disenfranchised. How do I show value?

I shared that Tom’s organization is not alone. As I talked, We laughed. I asked if he had read my article, Have You Given Your Demand Planner Some Love Today? Planning organizations around the world struggle for acceptance in a supply chain world that is mainly reactive.

Most business leaders do not understand the value of planning. The struggle for Tom’s team is real. Supply chain planning organizations do not measure and communicate value propositions in business terms. What to do? I asked Tom to measure Forecast Value-Added (FVA), and inform the organization on the progress of the planning group in forecasting. I shared some examples of how others shared data in a fun way. We discussed a marketing campaign to give the demand planners some love.

The answer? Show them the money. I asked him to translate the improvement in FVA into value by calculating the safety stock required using the naive forecast and the levels using the forecast from the team. The secret is to dollarize the difference in safety stock needed to support replenishment based on FVA. When Tom and I connected later, he shared how practical the approach was to give the demand planning group an anchor to deliver business value.

The organization focuses on operations. How do I drive value and encourage organizational alignment?

We discussed the different paradigms of Tom’s three managers over the past five years. His new boss is named Jim. Each leader had a very different definition of S&OP. Jim is bullish that he knows the answers. However, the most successful S&OP processes report to a profit center manager; yet Jim’s focus is operations. Tom and I discussed how to elevate the discussion and gain the approval of the process at the P&L leadership level.

First step? The key is to focus on growth and customer fulfillment. When the P&L owner believes in S&OP, magic happens. Tom and I discussed how to make this happen. The process evolution is still a work in process. What I see over and over is a litany of supply chain leaders each believing they have the answer. However, organizations churn. They are unable to move forward because the focus is on the supply chain as a function within the organization versus delivering a process to serve the business better.

In the words of Tom’s boss, “Jim is failing to design ‘a better path’ forward. He claims to know the answer already, so there you have it. He will get improvement (so I’m not going to try and intervene), but they won’t deliver excellence or drive excitement or competitive advantage. This is my dilemma.”

As a result, processes circle the drain. Most Jim’s fail to question prior experiences and the need for organizational alignment to drive business value.

Focus on Inputs. A week later, I got a call from Dick. He is an active leader in defining/driving the autonomous supply chain at a major pharmaceutical company. As part of the 7% of manufacturers attempting to use cognitive computing for demand planning, he shared, “Lora, the magic is not in the new technology. I found that we, as an organization, are too focused on the outputs, and have forgotten the importance of the inputs. We have gone through a myriad of acquisitions, and in the process, we have forgotten the basics of demand planning. Our data is just bad.” Dick continued, “I have improved the demand plan by 21%, and it sounds good; but only a quarter of the improvement was due to the switch of technology. The majority of the error reduction came from attention to detail on inputs and alignment of the engines to drive better outputs. The improvement sounds good on stage, but I know that the majority of the savings came from a focus on the basics not from the new technology.”

I laughed. Then sighed. Dick’s story is too real. Most clients lack an understanding of demand planning. While they have implemented a demand planning technology, they lack the knowledge of how to measure and drive improvement. On average, companies that I work with have degraded the forecast 16% due to the lack of understanding of planning. Imagine how devastating it is for a hard-working team to learn that the technology implemented is making the forecast worse, not better, and then to accept the fact that their well-intended efforts and hard work drives deleterious results. What goes wrong? Many have wrongly implemented demand planning as technology versus opening a pathway to drive continuous improvement.

Flow. Then there is the story of Harry. In my travels at two organizations, I have spoken to two Harry’s in the last month. Both have a similar goal: it is a story of flow. The aspiration is to use channel data and build outside-in processes to minimize the bullwhip effect and improve replenishment. Flow-based replenishment is a corollary to lean theory. The first question Harry asks is, “What happened to flowcasting?”

I start with a discussion of flow. It sounds a bit academic, and many will roll their eyes, but mapping flow is essential to understanding the answer to Harry’s question. Flowcasting defines replenishment as pull from the market. In most supply chains, this is not possible. Let me explain. Most supply chains are a combination of push and pull. Seasonal demand, by definition is a push signal to a distribution center. Also, demand shaping activities–price, promotion, new product launch–redefine the demand signal making it more of a push-based process.

Channel demand can transform both push and pull replenishment, but the order definition is different. Each also has a very different meaning of the role of inventory. In a push-based supply chain, the focus of order management is compliance (order fulfillment). In contrast, in a pull-based supply chain, the focus of the order is to minimize waste with shorter cycle time to market. In pull-based replenishment the order is an output from the production schedule.

Let me share a story. In the 1990’s I worked for Clorox. My role was to start-up Vendor Managed Inventory (VMI) processes for Clorox to replenish Wal-Mart more effectively. I believed, at that time, that VMI could transform organizations. I believed that companies could become more outside-in. I was wrong. In my research of over sixty organizations in consumer manufacturing, no company connects the VMI signal to the demand planning processes. Instead, demand, managed in isolation, is only a signal to order management.

Over the last two decades, as companies struggle to grow, there are fewer opportunities to deploy pull-based processes. As a result, push-based models are the prevalent signal in today’s supply chains. While channel data is increasing in availability, channel demand seldom drives replenishment. As a consequence, the Harry’s of the organization act as mavericks. They continually push to find a better way. The answer? Plot the push-and-pull boundaries of the organization and design the decoupling points. When possible, maximize flow based on channel data, but understand that it is one of many options.

Some Hope

As I travel, consultants and technologists flood my inbox. I welcome new ideas, but I am usually disappointed with what they believe is breakthrough thinking. Their goal? They want my ink. My goal? I want to help Tom, Dick and Harry.

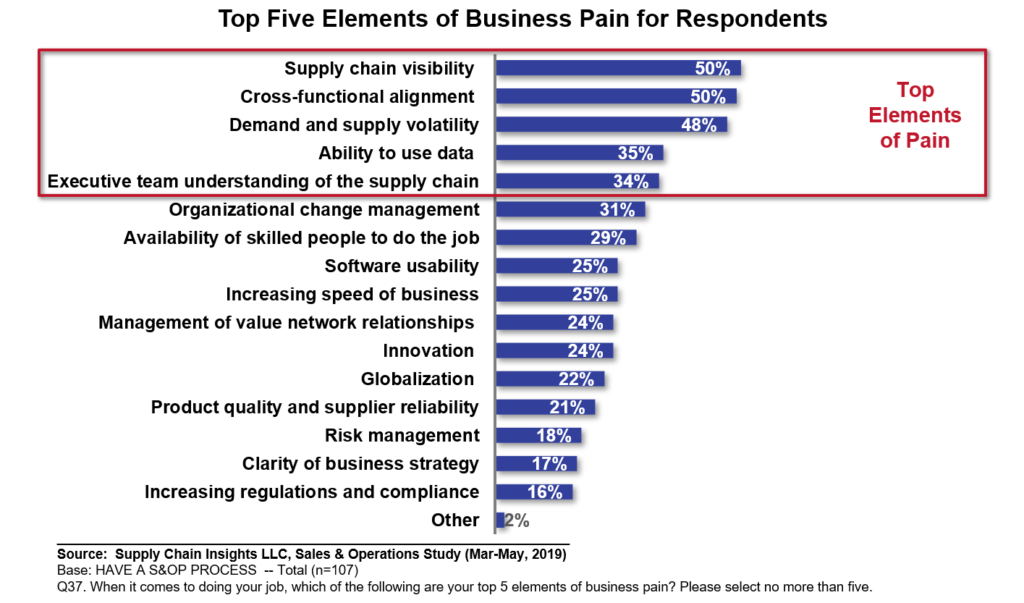

My recent research is discouraging. Companies rate themselves worse on S&OP process effectiveness in 2019 than 2016, and satisfaction of supply chain planners is low. Despite investment in technology and processes, companies struggle with the same issues. Over the past five years, the problems remain, and there is no improvement. Shown in Figure 1 are the ongoing issues in S&OP.

Figure 1. Challenges and Business Pain for Companies Deploying S&OP

Tom, Dick, and Harry struggle. Each, in their way, feels that their company is not making progress. They are right. Despite the adversity, they remain champions for change. The opportunity lies in attacking the compendium of issues outlined in Figure 1 head-on. Traditional thinking is not sufficient.

The answer? We must challenge traditional paradigms. Let’s start by questioning the role of ERP. Undermined by Mergers & Acquisition (M&A), integration of Advanced Planning (APS) to Enterprise Resource Planning (ERP) is too inflexible. It cannot adapt.

M&A slows supply chain progress. Since 2000, in manufacturing industries, there were more than 200,000 M&A transactions. Each M&A activity is a restart for the supply chain team. A merger scrambles IT systems, destroys master data and redefines supply chain organizations. As a result, the simple concepts of tight integration of advanced planning to a single instance of Enterprise Resource Planning is a pipe dream. The average company has ten ERP systems. Today’s reality? Companies have tens and hundreds of disparate systems. (For example, Corning has thirty-nine ERP systems while Schneider Electric has over 100.) IT complexity grows each year. As complexity increases, it becomes harder and harder to get to data and improve supply chain visibility. The answer lies in defining flexible technology. Let me give you some examples. There are some bright spots. For Tom, Dick, and Harry, I find several current technological trends encouraging:

- Thoughtspot. Founded by ex-Google executives, Toughtspot enables relational search over disparate back-office systems. Imagine descriptive analytics similar to Power BI initiated by a search (like a Google search bar). The solution then uses the questions asked by role to drive insights using prescriptive analytics. So, for example, if you asked about on-time deliveries at customer x, the system will follow results and then push insights based on pattern recognition to give you ideas on the questions that you do not know to ask. I like this approach for three reasons. The first is the price point. The second is time for the deployment, and the third is ease of use. Given that the only constant in our IT architectures is change, solutions like Thoughtspot that work over disparate technologies offer promise.

- LLamasoft Demand Guru and Digital Twin. With the shifts in leadership at Llamasoft, the organization is embarking in some new directions. Two that are early, but promising, is the focus on Demand Guru and the Digital Twin. Demand Guru is a schema-on-read demand planning technology that enables the synchronization of market signals with orders and shipments. The Digital Twin offers the capability to model the potential of the supply chain system in a virtual environment. In a couple of years, I believe that we will have a digital twin sitting on top of all S&OP processes. The simulation will evolve, starting with machine learning and changing into cognitive modeling. The use of the digital twin will help business leaders to understand that the supply chain is a complex and non-linear system with limitations. For example, I recently worked with a company CEO that dictated 100% order compliance with no inventory. (Are you laughing yet?) The team struggled to convince him that this was not a feasible request. The use of a digital twin would allow the leadership team to see the constraints themselves.

- Cloud-based Planning Solutions. I like the flood cloud-based planning solutions into the market to tie production planning to production scheduling and transportation routing for process-based industries. Much easier to deploy than competitors like JDA, Logility, Oracle or SAP, these cloud-based solutions are lower price point and easier to use. They are ideal for smaller, regional deployments. Examples are I-Plan and Optimity. While DDMRP is over-hyped today–it is not a panacea. The process of DDMRP is a best fit for material-centric supply chains. If this is you, I like the simplicity and customer commitment of Orchestr8.

I look forward to hearing from you. Let me know your thoughts.

Struggling to Stay Current?

Technology change is moving faster than process innovation. Many companies struggle to keep pace. If this is you, I welcome you to join our upcoming events. Our goal is simple: to build a guiding coalition to drive value in supply chain processes.

Imagine Supply Chain 2030. Supply Chain Insights Global Summit, September 3rd-6th, 2019, at UI Labs, Chicago, IL. The focus is on Imagining Supply Chain 2030. What is different? The format is unique. The event has no sponsorships, paid speaking sessions or lofty analyst discussions. Designed for extreme networking, I dub this event the unconference. At the event, technologists and business leaders work shoulder-to-shoulder to Imagine Supply Chain 2030. To ensure balance of business and technology leaders, I closed the conference this week to technologists/consultants to ensure the right balance of business and technology leaders. This week, I have added speakers from Dell, Dow, Intel, and Simple Tire. I hope to see you there.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

To register for these events, please contact Regina.denman@supplychaininsights.com.