It has been awhile. After the Supply Chain Insights Global Summit, I took the time to recharge and took a month off from writing. The presentations from the Summit are posted now on the Supply Chain Insights You Tube Channel. Next year’s conference will be on September 8th-11th in Franklin, TN, south of Nashville, TN. The design of the conference includes tours of several modern warehouses and centers of excellence.

It has been awhile. After the Supply Chain Insights Global Summit, I took the time to recharge and took a month off from writing. The presentations from the Summit are posted now on the Supply Chain Insights You Tube Channel. Next year’s conference will be on September 8th-11th in Franklin, TN, south of Nashville, TN. The design of the conference includes tours of several modern warehouses and centers of excellence.

During the month, this blog post formed in my head. I worked on several drafts mulling it over day after day as I worked with clients. The focus is on the role of supply chain finance in driving supply chain excellence.

————————-

As the leaves fall from the trees outside my windows, the financial planning cycle is in full swing. Employees at my clients are busy with strategic planning and annual budget reviews. It is all-consuming.

The fall ritual precedes the dropping of the ball on Times Square to ring in 2020. For the past ten years, I have written about the redefinition of the supply chain to embrace new business models. In this writing, 2020 was a target and a marker as a transformational year.

2020 is a non-event. Unfortunately, not much has changed in the supply chain over the past decade despite an unprecedented influx of new technologies, business models, and process redefinitions. Most become fads. Why? The focus of the supply chain leader is supplying products forward to the channel while the executive team is trying to drive change in business models and product portfolios from the market back. The dilemma? Most supply chains need a fundamental redesign. They are not fit for purpose. Fixing this is not easy, and is the genesis for this article.

As we move into the New Year, and a new decade, I wanted to reflect. What we can learn from the past decade to apply to the current financial planning processes in full swing?

The Preamble

Over the course of the last two weeks, I find myself sitting in CFO offices attempting to explain how financial leadership can drive supply chain improvement. The discussions are with groups of executives—often ex-management consultants. They are attempting to learn the supply chain; but to most, it is an enigma. The discussions focus on shifts in the channel and the required impact on the supply chain and the unwillingness of supply chain leaders to change. Absent from the table is the supply chain leader.

Most of the discussions are circular. I find senior executives love to throw around superlatives like customer-centric, agile, efficient and responsive but lack the understanding of how the words translate to supply chain strategy in the real world.

Managing a supply chain requires big feet—grounding in real-world experience—coupled with big wings—conceptualization of strategy. I find that supply chain leaders have the big feet but struggle to connect with the wings of the organization (strategy leaders sitting at these round tables in the CFO offices.) I also find too few leaders with the ability to connect the real-world with the swirl of strategic concepts (shifts in the channel and the consumer, the emergence of the circular economy, shortening of product lifecycles, and global shifts in the world economy) driving the need for a supply chain redesign. To power growth and unleash new potential, the feet must be connected to the wings in new and meaningful ways.

Background

The number one question that I am asked today by manufacturers across all industries is “How can I improve customer service?” Nine times out of ten improving customer service requires different management of the budget cycle and a rethinking of financial planning. Companies confuse the processes of from 2010 through 2018 and supply chain planning. They are complementary, but not inter-changeable processes.

The supply chain is a complex non-linear system. The budget is not sufficient and is often a detrimental input for supply chain forecasting. The popular concept of the “connected supply chain is flawed”.

Why Is the Financial Forecast Not a Good Proxy for a Supply Chain Forecast?

The financial budget is a cost-control mechanism. There are many reasons why the budget cannot be used as a supply chain forecast. The issues include:

- Level of granularity. Supply chain management requires good data at the mix level of an item/location. Granular data by volume is a must to be able to manage replenishment, network design, and inventory targets. Most budgets are completed in currency at a brand level. It is not sufficient.

- Time horizon. The budget is for a fiscal year with quarter reporting and updates. The supply chain forecast is a rolling forecast usually over a longer duration.

- Bias and error. Financial forecasts tend to have a negative bias (forecasts less than market potential) to ensure that employees have a better probability of meeting their bonuses. The processes for financial budgeting are usually convoluted and political.

As a result, connecting the financial forecast to supply chain forecasts is fraught with issues. The direct connection between the two processes increases costs and increases error. Instead, it should be mapped as an input to track supply chain forecasting to financial budgets for reporting and insights. Supply chain forecasting should be held accountable to Forecast Value Add (FVA) analysis. (For more gauging improvement, check out a past article on Supply Chain Diagnosis.) Unfortunately, over the last decade, misguided attempts to implement Integrated Business Planning (IBP) took us backward not forward on delivering balance sheet improvement.

The direct connection of the sales forecast is also flawed, but for different reasons. The sales forecast tends to have an even greater bias than the financial forecast due to sales incentives. Additionally, many sales and marketing forecasts due not reflect total volume. Why? Special programs—new product launch, promotional packaging, and samples—are often managed as marketing programs using offline processes (usually spreadsheets). The management of the supply chain requires visibility of all volumes.

The bias and error in sales and finance data is a barrier. Without measurement and accountability, the popular concept of connecting sales and financial data to supply chain data is detrimental to customer service.

Looking Forward: What Can We Learn From The Last Decade to Drive Improvement?

What can we learn from the past decade to apply to this budget cycle? Here are nine considerations:

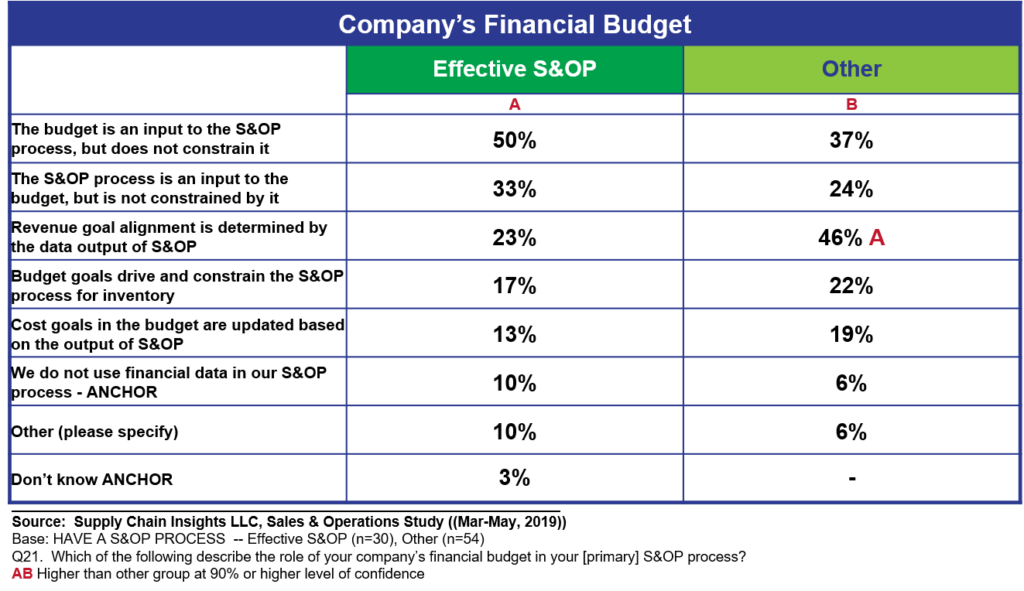

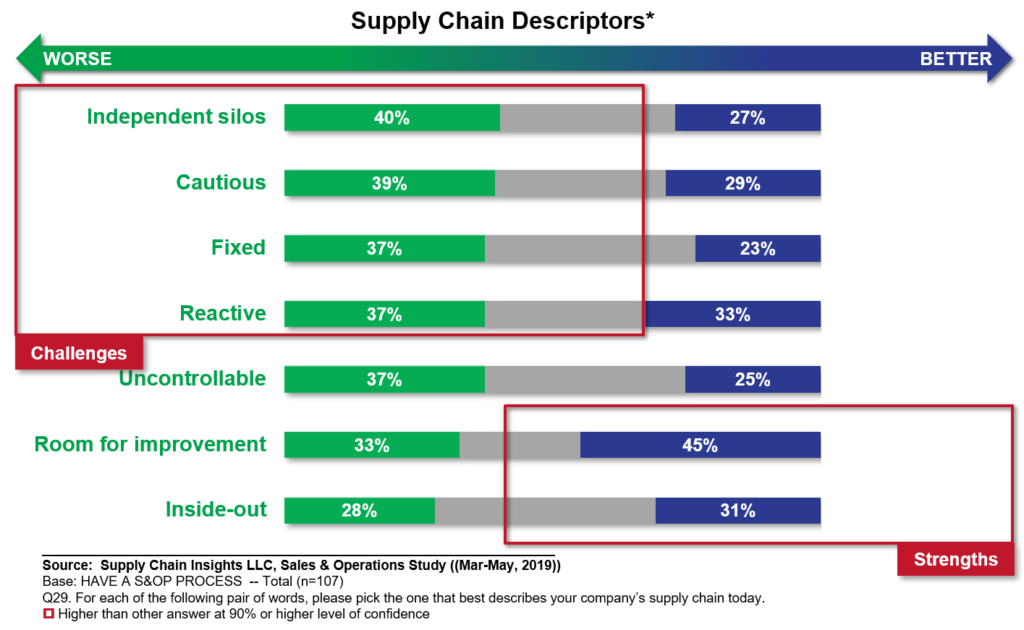

#1 S&OP Budget Constraints. Sales and operations planning (S&OP) is a horizontal process to drive organizational plan alignment. Companies that directly connect financial data to supply chain data without creating a feasible plan at an item/location level rate themselves significantly lower on S&OP effectiveness creating higher costs, levels of inventory and order short shipments. The data in Table 1 is from a recent research study.

Table 1. The Role of the Budget in S&OP

The takeaway? The financial budget should be input into the S&OP plan, but it should not constrain the process. Companies need to rethink the misguided thinking on one-number forecasting. In addition, IBP implementations reduced the effectiveness of many companies’ S&OP processes due to the lack of discipline and measurement.

The takeaway? The financial budget should be input into the S&OP plan, but it should not constrain the process. Companies need to rethink the misguided thinking on one-number forecasting. In addition, IBP implementations reduced the effectiveness of many companies’ S&OP processes due to the lack of discipline and measurement.

#2 Demand Is A River. One of my favorite activities, in my work with clients, is to help them draw their river of demand. Visualization of demand flows challenge current organizational paradigms. Thinking of demand as a flow from the customer’s customer challenges functional paradigms. It also challenges mental models as demand as a spreadsheet of time-phased data within a time horizon. Only a mature company realizes that demand is a river with the need to manage the flows at strategic, tactical based on and operational time horizons.

The goal should be a common plan, not one number. Let me explain. There are many numbers in a hierarchical demand management supply chain model and financial teams usually want to focus only on the top-line sales numbers. This creates many issues. Supply chain excellence requires discipline at the mix and item/location data. Details matter.

Let’s take an example. As shown in Figure 1, at a recent client engagement, there is a strong and clear process definition of the budget process and the lack of clarity and discipline in the demand flows for the supply chain. As a result, this team introduced a 22% error into the demand stream because of the lack of discipline and clarity. The S&OP plan, termed S&OP+, tightly coupled the budget to the supply chain supply plan introducing additional error. As a result, the organization, tightly capacity-constrained failed to forecast and build capacity ahead of market demand. Currently, the lack of capacity and S&OP capabilities are a barrier to growth.

Figure 1. The River of Demand.

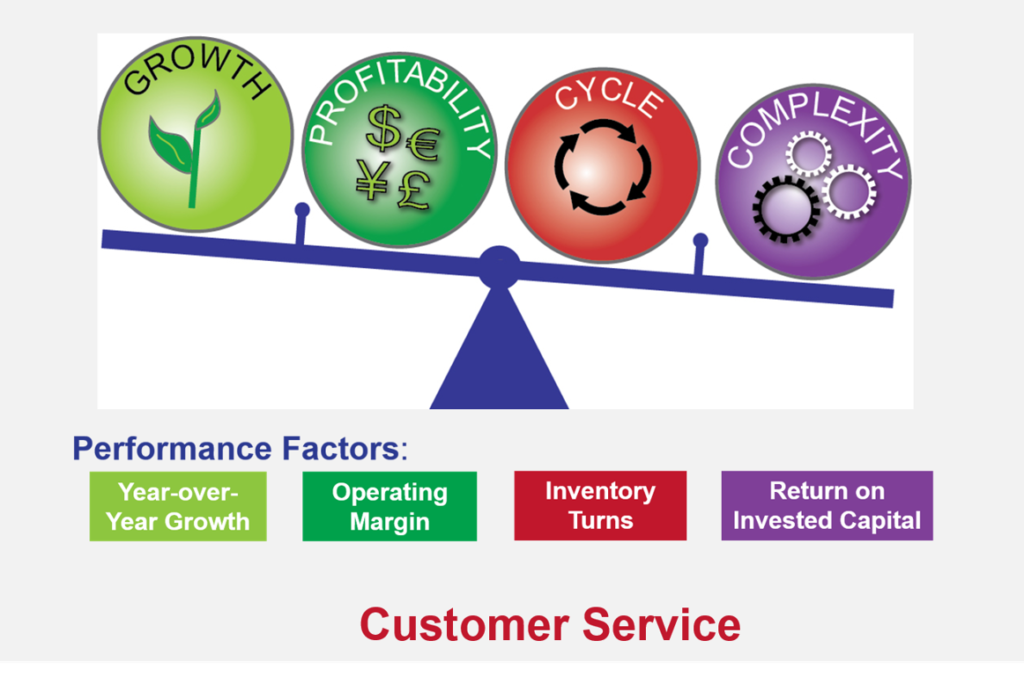

#3 More Than a Simple Triangle. A simplistic view is that supply chain excellence is the trade-off of cost, inventory and customer service. In the real world, the intricacies are much greater. Growth, asset utilization, and item complexity play equal roles.

For the global supply chain, it is a constant juggling act. A common issue in financially-driven companies is the heavy utilization of manufacturing assets past reasonable limits throwing the supply chain out of balance. No metric should be measured in isolation, and functional metrics should be replaced with the balanced scorecard metrics shown in Figures 2A and 2B. To maximize value—price to tangible book, functional metrics need to be reset to focus on reliability. Examples include first pass yield, schedule adherence, hands-free orders, orders shipped complete, and minimization of waste.

Figure 2A. Supply Chain Trade-offs

Figure 2B: A Focus on Reliability

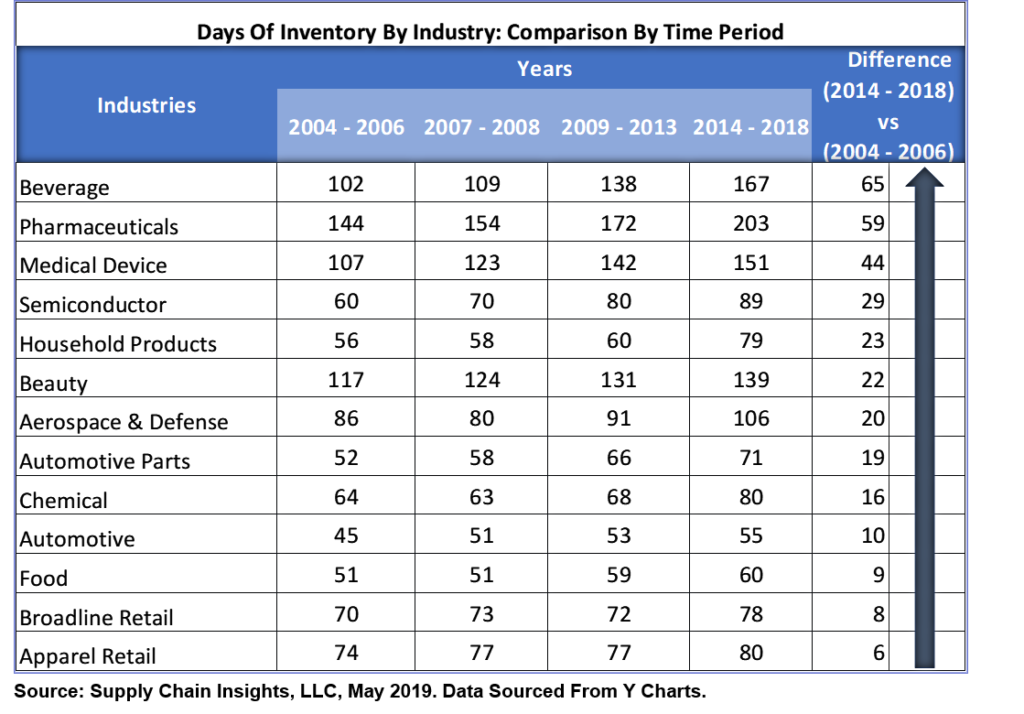

#4 Maximize Buffers. With the increase in demand and supply volatility, buffers grow in importance. These are natural shock absorbers. The two primary buffers in the supply chain are manufacturing capacity and inventory.

With higher levels of asset utilization, inventory management becomes more important. Ironically, inventory levels today are higher than they were in 2007; yet customer service levels issues abound. The reason why? The answer is simple. Few companies are managing inventory holistically—cycle, in-transit, seasonal, promotional, and safety stock levels. The lack of holistic management is compounded by decisions to make broad-brush cuts in inventory to meet a quarter-end target.

Table 2. Average Inventory Levels by Industry throughout 2010-2018

The issue? In financially-driven organizations, inventory is managed as a liability, not as an asset. Also, there is a lack of understanding that inventory must be managed at an item/location level. This requires a focus on the form and function of inventory as a part of network design, but only 7% of companies actively design their networks.

The issue? In financially-driven organizations, inventory is managed as a liability, not as an asset. Also, there is a lack of understanding that inventory must be managed at an item/location level. This requires a focus on the form and function of inventory as a part of network design, but only 7% of companies actively design their networks.

When inventories are managed with end-of-the-quarter cuts to make working capital targets, and if the company has high asset utilization, customer-service recovery is almost impossible. With higher compliance costs and the growth in customer fines, companies are learning this lesson a million dollars at a time.

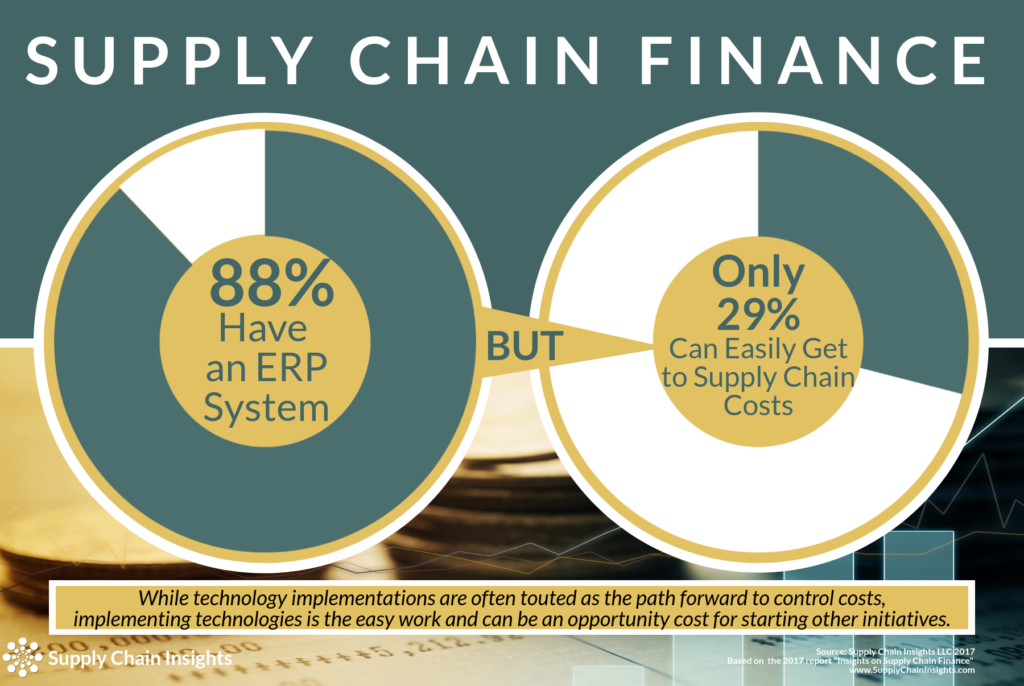

#5 A Focus on Functional Metrics Throws the Supply Chain Out of Balance. Only 29% of companies make decisions on the basis of total costs. Most can only measure functional costs—transportation, manufacturing, and procurement. A focus on functional costs will throw the supply chain out of balance.

Figure 3. The Companies’ Ability to See Total Costs

#6 The Only Constant Is Change. Tax and tariffs. Commodity shortages. Shifts in demand. The looming recession. When companies focus on internal processes and build inside-out practices, the supply chain will be less agile and will take longer to adjust to market signals. It is for this reason that one out of two supply chain leaders feel that their supply chain processes are adequate.

We do not have “best practices.” Instead, we have historical concepts that are outdated.

Figure 4. Current Satisfaction with Today’s Supply Chain Processes

#7 Financial Reengineering Projects Do More Harm Than Good. Over the last decade, financial reengineering projects reigned. Few created long-lasting value. Popular techniques included business process outsourcing, contract manufacturing to reduce the cost of labor, low-cost country sourcing, tax efficiency projects, and the elongation of payables to improve cash-to-cash. The focus is on saving costs within the organization, but most financial re-engineering projects throw the supply chain out of balance.

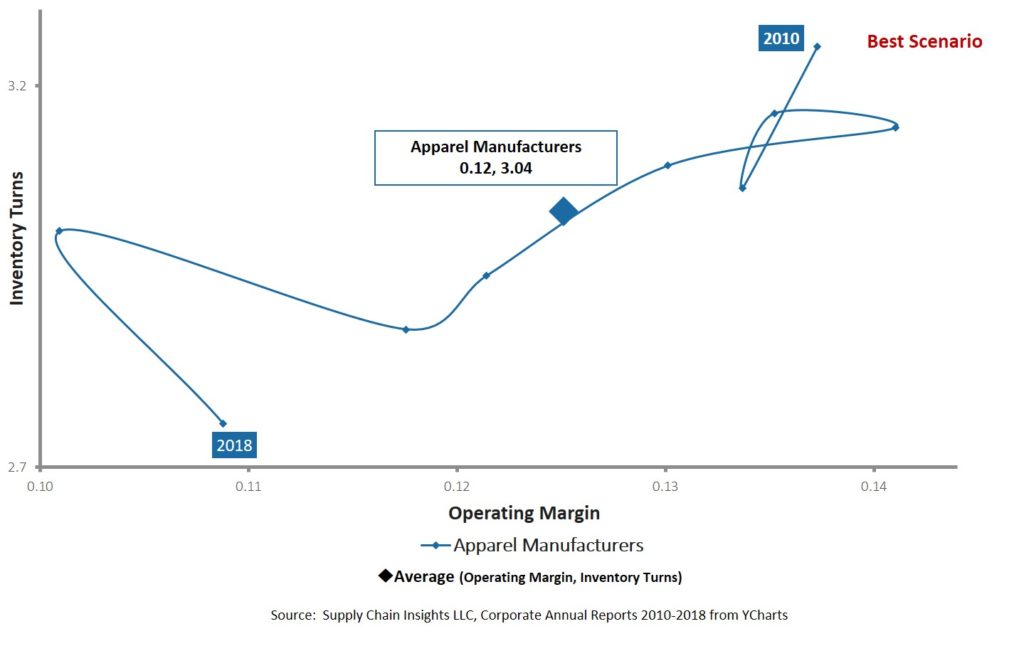

Industry patterns show a steep decline in supply chain metrics in 60% of manufacturing industries since 2010. To understand the point, let’s look more closely at an industry peer group. Apparel is an example. Note in Figure 5 that throughout 2010-2018, while the industry chased lower labor costs, apparel manufacturers lost margin and decreased inventory turns. Companies struggled to balance inventory and customer service with higher levels of volatility.

The root of the problem is that supply chain metrics cannot be modeled effectively in a spreadsheet. Spreadsheet-based modeling fails to adequately reflect the impact of cycles, variability, and constraints. As a result, the organization reduces functional costs, but increases cost in other functions.

Companies struggle to have the right discussions. Most are abstract discussions around a circular table in a CFO’s office with well-intended leaders that lack real-world experience.

Figure 5. Results of Financial Reengineering Fails the Apparel Manufacturing Industry

The action item? Understand the aggregate trends for your industry. Ask yourself questions to understand the drivers. Challenge the effectiveness of financial reengineering efforts. Over 60% of industries have negative trends like apparel manufacturing.

#8 IT Standardization: Only the Path for Laggards.

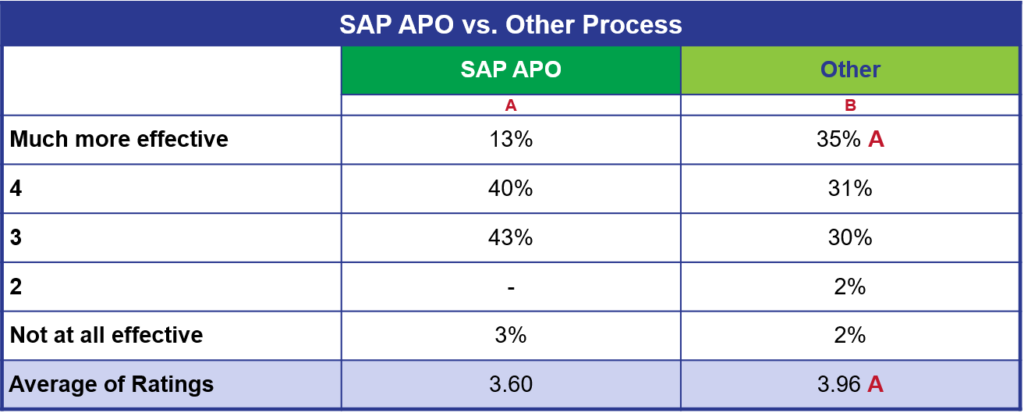

Companies following the path of ERP standardization in supply chain projects (purchase of transactional and decision support software) from the same vendor rate themselves at a significant disadvantage in modeling and S&OP effectiveness. There is a gap in “what-if modeling” and “creation of a feasible plan.” Over the decade, in the four studies completed in S&OP, this gap shown in Table 4, grew.

Table 4. Comparison of S&OP Effectiveness for SAP Users Versus the Rest of the Population

#9 Earning a Seat at the Table. Traditional supply chains are insular and inside-out. Today’s supply chain design started with the supplier. Tomorrow’s supply chain needs to be mapped and orchestrated from the customer back. As a result, functional techniques like the SCOR model are obsolete.

As we move to circular economies that maximize the use of resources and improve sustainability, supply chain leaders have the opportunity to make the supply chain discussion more strategic. However, to do this, the team needs to have both the real-world understanding (the feet) and a working knowledge of strategic concepts (the wings).

Conclusion

To earn a seat at the table, the supply chain teams need to challenge convention. The process definitions that got us to 2020 will not drive leadership in the next decade. Those that can connect the wings and feet—reality and opportunity– will have a strategic advantage in their careers.

We must learn from the past to unlearn to rethink the supply chain. The process is largely a change management journey. A rule of thumb is 60% change management, 30% process design, and 10% technology. Unfortunately, most discussions start with technology, and supply chain leaders are not holding themselves accountable to rise above fads and hype to drive sustainable balance sheet performance.

Your thoughts? I would love to hear from readers. I am working on a more complete analysis of this data for a series of reports on S&OP and your feedback would be appreciated.

Struggling to Stay Current?

Technology change is moving faster than process innovation. Many companies struggle to keep pace. If this is you, I welcome you to join our upcoming events. Our goal is simple: to build a guiding coalition to drive value in supply chain processes.

The Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), the definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

The Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), the definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

To register, please send a note to Regina.denman@supplychaininsights.com.