At what point does erosion cause the side of a mountain to give way? It is usually the small shifts….over time, there is degradation. And, then suddenly, the mountain gives way collapsing to the land below.

At what point does erosion cause the side of a mountain to give way? It is usually the small shifts….over time, there is degradation. And, then suddenly, the mountain gives way collapsing to the land below.

S&OP Slip Slidin’ Away

…the same is happening in supply chain processes. This week, as I worked on my Sales and Operations Planning (S&OP) report, I found myself tapping my foot to the same music in my head, as I asked myself the question, “Why are companies getting worse, not better in managing their S&OP processes?”

Let me take you back in time. The year was 1977. I was graduating with my first college degree. (Yes, I am that old.) At the time, I was an optimistic teenager thinking I could change the world. I vividly remember the Paul Simon Song, Slip Slidin’ Away. The song never topped the charts, but it was a catchy tune. As I worked my summer job as a lifeguard, my well-tanned legs in fringed jeans shorts tapped my Earth Shoes to the beat of the song. Here are some of the lyrics:

Slip slidin’ away

You know the nearer your destination

The more you’re slip slidin’ away

To the mortal man

We work our jobs

Collect our pay

Believe we’re gliding down the highway

When in fact we’re slip slidin’ away

Erosion and degradation happens slowly. In Figure 1, note the slippage in S&OP over the past three years.

Figure 1. Satisfaction with Sales and Operations Planning

Why is success elusive? Why is progress in S&OP slip slidin’ away? My conclusion? We are chasing fads and missing the basics. As I track the process evolution through research, I find that every three years there was a trend introduced that moved us backward, not forward. Here I share these insights.

A Focus on the Basics:

Let’s start with the basics. These are not sexy and often misunderstood. Getting good at the basics requires hard and dodged work over many years.

Clarity of Strategy. Great S&OP processes start with clarity of strategy. Companies that do S&OP do it well can quickly answer the question of, “What is the role of S&OP? What defines success?” Sadly, most companies cannot answer these questions. When I ask them, they look at me like I am the dumbest analyst in the world. The answer is not easy, but needs to be defined for each organization.To move forward quickly, there needs to be clarity of the role of the supply chain in driving growth.

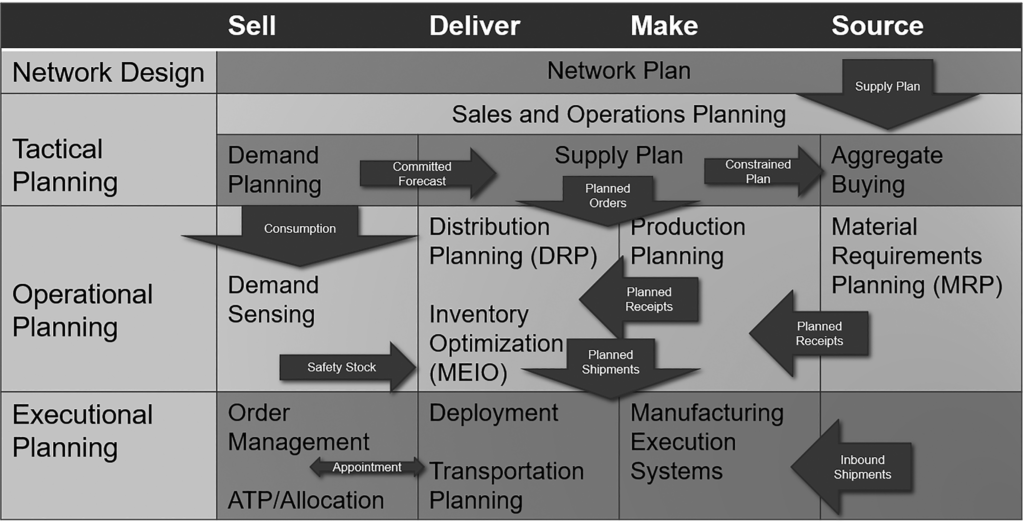

Discipline. S&OP, when done right, is a tactical process. The focus is to help companies to make trade-offs in the period in the longer time duration (past the order and operational horizons). S&OP execution should not be confused with S&OP planning. S&OP execution is an operational process of organizational alignment of S&OP plans.

Figure 2. Role of S&OP in Planning

There are processes above the line and below the line in planning. I use the concept of the “line” to define the differences between S&OP leadership meetings and the work that happens before and after the meeting. Below the line is the work of model building, maintenance and what-if analysis. Above the line are the discussions with the leadership teams to determine trade-offs.

There are processes above the line and below the line in planning. I use the concept of the “line” to define the differences between S&OP leadership meetings and the work that happens before and after the meeting. Below the line is the work of model building, maintenance and what-if analysis. Above the line are the discussions with the leadership teams to determine trade-offs.

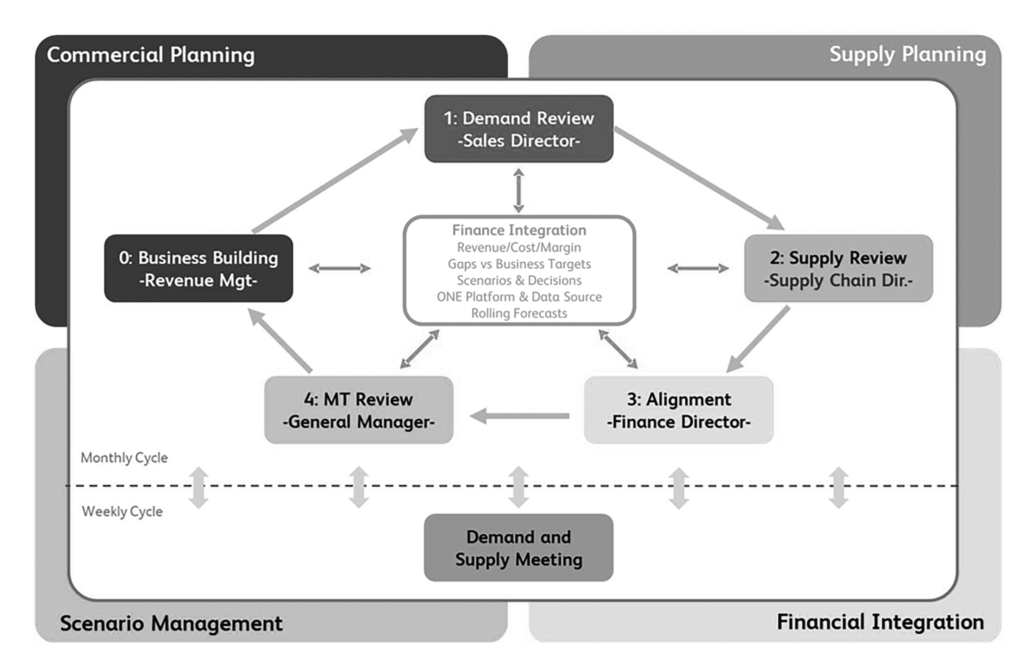

Today, there is more emphasis above the line, but in companies that do S&OP well, there is focus both above and below the line. The meeting processes are not the main focus. I share a client example in Figure 3.

Figure 3. Client Example of Process Flow

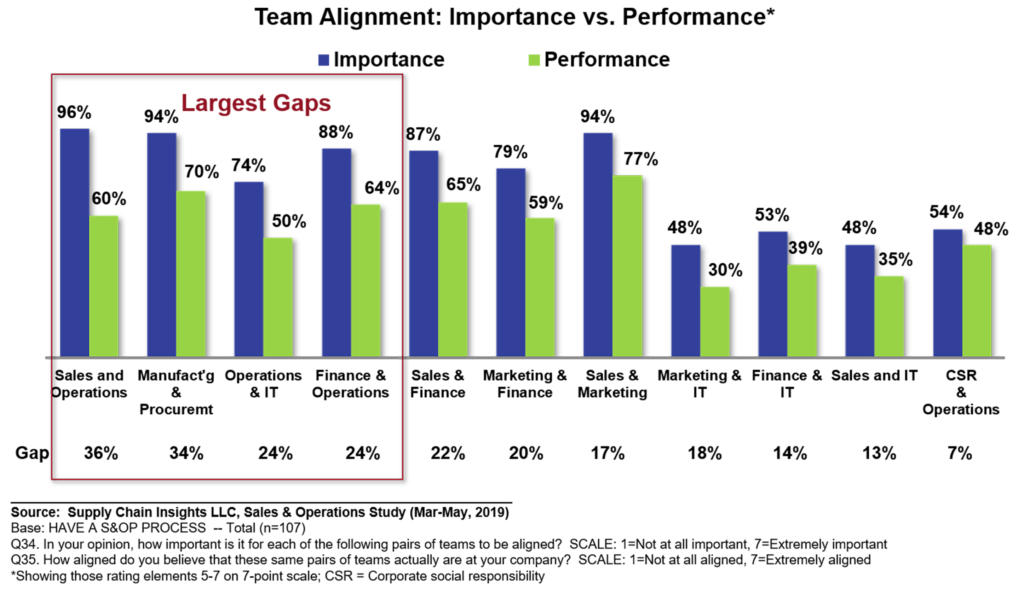

The Right Stuff in Organizations. The road map for a successful S&OP process is 60% change management, 30% process definition and 10% technology. Most people, enamored with technology, find it difficult to drive governance (who should make decisions and how should decisions be made). build alignment (driving goal congruence), building reward systems (defining a cross-functional set of metrics to align to the strategy) and defining the right reporting relationships (the S&OP process needs to report to the profit center manager). The S&OP process should never report to a function. Reporting relationships to sales, finance, or supply chain are equally bad.

In successful S&OP processes, leaders work to improve alignment between functions. I ask this question in surveys once a year. These gaps have widened over the last decade of doing research in the space. I show them in Figure 4.

Figure 4. Alignment Gaps

Strength in Planning. Companies that perform S&OP well are good at planning. There is strength in “what-if analysis.” (Only 1/3 of companies today have “what-if analysis capabilities.) Modeling is effective with an improvement in Forecast Value Added (FVA) (the average company that I work with has FVA degradation of 18%).

Strength in Planning. Companies that perform S&OP well are good at planning. There is strength in “what-if analysis.” (Only 1/3 of companies today have “what-if analysis capabilities.) Modeling is effective with an improvement in Forecast Value Added (FVA) (the average company that I work with has FVA degradation of 18%).

Effective modeling and network design and planning by design are key factors. Over the last decade, we have improved the scalability of planning, but the research shows backward movement in the ability to model a feasible plan and drive actionable insights.

Figure 6. Planning Gaps

A pitfall is a hidden or danger that is not easily recognized by the team. In contrast, a pothole is an issue or a series of events that drive a gradual process degradation. Both are challenges for leadership teams.

Table 1. Potholes and Pitfalls of S&OP Deployment

| Potholes | Pitfalls |

| Degradation of Planning Engine Effectiveness Post Implementation | Strategy Alignment |

| Training and Skill Dilution from the Initial Implementation | The Role of the Budget |

| Management of Planning Master Data | Governance |

| Clarity of Definitions | Process Discipline and Clarity of Roles |

| Shifts in Leadership | Measurement Systems |

Degradation: Chasing Fads

So, you might ask, why are we slip, slidin’ away? I believe that it is deeply rooted in the organization’s orientation to want to chase fads and not be grounded in building the foundational elements listed above.

Was it CPFR? In the period of 1998-2005, there was an infatuation with the CPFR process. Companies wanted to be more customer-centric so VMI processes were broadened to include forecasting and replenishment processes. Many of these became S&OP processes with customers. The problem? Most retail forecasts were just not good enough to drive success. People accepted that the forecast of their partner would yield a good planning output. However, the error in customer forecasts coupled with the lack of accountability made this an S&OP rat hole.

What was the role of collaborative sales forecasting? The CPFR process then morphed to collaborative sales forecasting. The concept was simple. Want to know what we are going to sell? Ask sales. The problem? The sales organization is biased based on incentive structures. While the sales organization’s input on trends is useful, having the sales organization forecast without the discipline of FVA logic is largely a waste of time. Most companies through collaborative sales forecasting unknowingly introduced large bias and error into the forecast.

Shifts from regional to global supply chains? Governance clarity is paramount in the definition of a global supply chain. In the evolution of markets, companies need to be clear on what is the role of the region, and what is the role of a division? And what is the role of the global teams? How should companies make decisions? And, how do these decisions role up to the larger corporation for visibility and alignment to management processes? In the evolution of the global supply chain, I have seen many, many mistakes in this area.

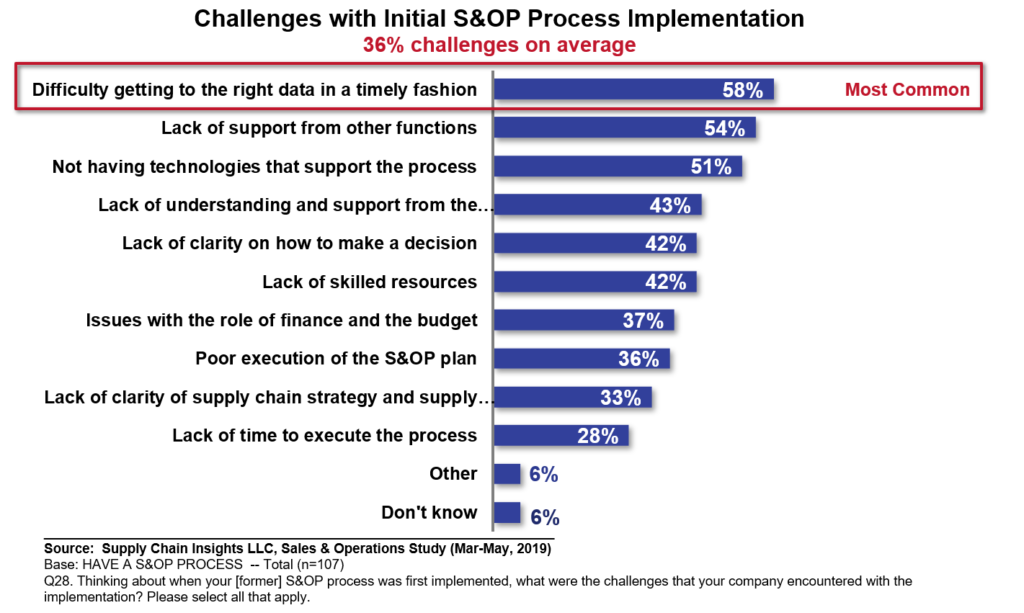

Impact of IBP? In the last decade, the focus has shifted to Integrated Business Planning. Companies that are not clear on the role of the financial budget rate their processes much lower than companies with clarity in the role of the forecast. The difference is significant at a 90% confidence level.

A common mistake is to manage S&OP to the budget commitments. In mature process, the budget is an input, but not the constraint. The reason? A budget is out of date when published and does not keep pace with the market. To drive growth, corporations need to balance opportunity and risk while updating the budget.

In parallel, it is not sufficient to connect financial data. The only thing that sales, financial and supply chain forecasts have in common is the word forecast. The data models, processes and definitions are different. As a result, connecting data without context leads to confusion. I believe that many well-intentioned IBP process implementations drove S&OP degradation in the past five years.

Figure 5. Current S&OP Challenges

Shifts with DDMRP? This is a new threat to the S&OP process evolution. Demand-driven MRP is a functional process to translate demand into material requirements. A singular functional focus of any type is death to S&OP process evolution.

In short, why is S&OP effectiveness slip slidin’ away? I believe that it is easier to chase fads than work on the basics. What do you think? These are my thoughts. I look forward to hearing from you.