Yesterday morning, I woke to learn the news. H.J. Heinz Company and Kraft Foods Group were merging. The press release, sprayed with superlatives of goodness, promises great things; but as I read it, I smiled. This, I believe, is a sign of a new wave of merger mania.

Let’s start with the facts. The merged company will be the third largest food and beverage company in North America and the fifth in the world. The new company will have revenues of $28 billion with eight $1 billion brands. Berkshire Hathaway and 3G Capital are driving the merger. The goal is to drive organic growth in North American and global expansion by combining Kraft’s brands with Heinz’s international platform.

Now, let me give you my take. Battered food and beverage companies struggle today. With intense merger and acquisition activity, rising commodity prices and the slowing of global growth, food companies are reorganizing to try to gain competitive advantage. The movement to health and wellness with fresher foods creates a more complex, and costly supply chain.

Neither Heinz or Kraft are supply chain leaders. There is opportunity for synergy for these underperforming brands, but it will require the alignment of very different cultures—with stark differences in what they value in supply chain excellence—quickly. All eyes will be on this transformation, as the strong hand of Berkshire Hathaway tries to boost the value of underperforming assets. This is a bellwether move for redefining traditional processes to be outside-in, focused on the shopper, and the alignment of assets and supply chain processes to drive new levels of value.

For the larger supply chain (the larger freight infrastructure of the North American market), I worry. As I drink my coffee this morning, many thoughts swirl in my head. In this blog post, I share my stream of consciousness:

Bigger Is Not Always Better. Larger company performance is not always better. While both Kraft and Heinz are underperforming (Kraft has a low ROIC and Heinz is below the industry average in both operating margin and inventory turns), there is M&A risk.

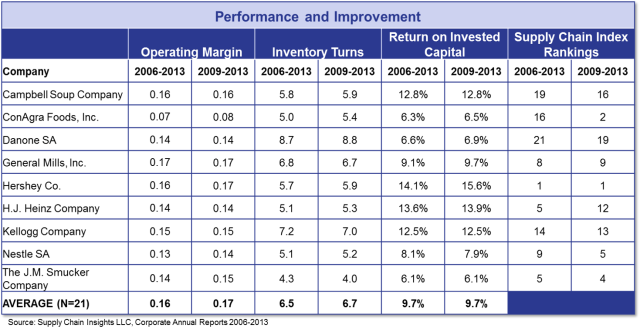

In the food industry, synergies and economies of scale are growing tougher and tougher, and as shown in Table 1, and are not guaranteed.

Table 1. Food Company Performance and Improvement

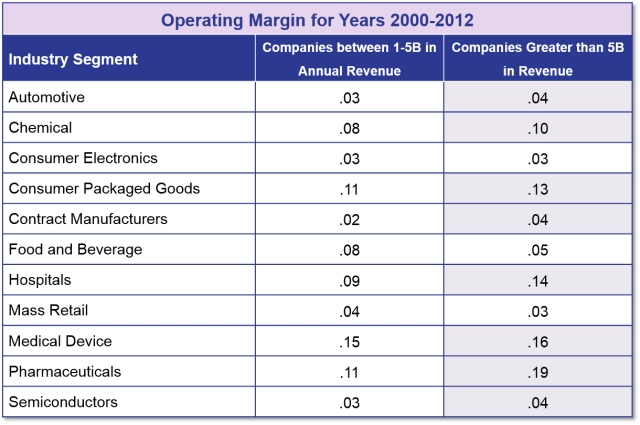

We find that many large organizations lose their way—becoming absorbed in functional excellence and losing their ability to drive cross-functional synergy. As a result, operating margin averages are less profitable for larger companies in the food industry (see Table 2). While this may be an anomaly of the recession, we know that there are unique issues—regional taste preferences, short code dates, volatile commodity prices, expensive temperature controlled warehousing, pressure from retail grocer house brands—within the food industry which puts pressure on scalability. The food and beverage industry has a very different dynamic than the consumer product company.

Table 2. Operating Margin Comparison by Industry

Expect Major Shifts in the North American Transportation Market. Kraft is a major shipper in North America and is very mature at the management of freight. To drive synergy they must redesign and adapt their transportation network. This transition will happen at the same time that Procter & Gamble is redefining their North American network to build “mixing centers.” As a result, the loading of freight lanes will change. What to do? North America shippers need open dialogue with their major carriers to understand the impacts on costs and availability.

Human Resource Churn. This move is happening at a time when supply chain talent that is knowledgeable in building value networks is at an industry low. Supply chain management is 30-years old, and many of the first and second generation of supply chain pioneers have left the industry. This is particularly true at Kraft where employee churn due to early retirement packages has been high. My concern is that the redesign of networks that are feasible requires knowledge which I feel is scarce today. What looks good on paper, based on average rates, is often very different in reality. Companies need to ensure that the redesign of these large supply networks is based on both optimization and simulation to test feasibility.

Supply Chain as it Ties to Market Positioning. Iconic brands need strong supply chains. The definitions of supply chain excellence today are very different at both Kraft and Heinz, and in North America and Europe. Neither organization has a strong supply chain leadership team. A key element of this transition will be the quick building of a clear definition on operating strategy and then using a steady hand on the rudder to drive change. I project that it will not be easy or fast. Kraft is still in the transition from the Cadbury acquisition and the Mondelez spin-off, and Heinz is less mature in driving organizational change transformations. The question of the day is, “Will Warren Buffet have the patience?” And, if not, what then? I still remember the impact of the RJR takeover and Kraft’s failure to build mixing centers with the General Foods acquisition in the 1990’s. Both of these had major impacts on the larger ecosystem and value chain. The customer service outages were opportunities for their competitors.

I think that this could be the tipping point of a another round of merger mania. Investor unrest with traditional food companies is high. Growth has slowed and many of the product portfolios are not meeting expectations. If this happens, just beware. The North American transportation network is fragile, and the implications for the networks of supply chains to have adverse affects from a poorly executed M&A deal is high. Let me close by saying, “Good luck Warren Buffet. I think you have a tiger by the tail.”

These are my thoughts. I would love to hear yours.

The Tale of the Gartner Supply Chain Planning Magic Quadrant and Minestrone Soup

Self-congratulations notes abounded this week as vendor-after-vendor shared their rankings on the Gartner Magic Quadrant for Supply Chain Planning. For me, it was a big