I watch news channels on mute. The reason? I hate political pundit debates. When the nonsensical banter reaches a crescendo, I shake my head and ask myself the question of “Why?” I wonder why people are listening.

Fondly I remember the days of Walter Cronkite and Dan Rather with eye-witness accounts and on-the-ground reporting. Phenomenal photography brought the stories to life. In my lifetime, the 24-hour news cycle eroded the essence of TV news.

News is the first write of history. I feel that topic of supply chain management is analogous to the downward cycle of the news channels. There are many pundits and too few facts. (I shake my head, and watch the twitter and LinkedIn streams. I see much opinion, but seldom find factual information.)

Writing the News. What Drives Supply Chain Excellence?

I analyze supply chain management. In the research, I’m trying to understand the impact of choices—technology, process innovation, and leadership– on balance sheet performance. No one pays me for my ink. The research is independent and data-driven.

I analyze supply chain management. In the research, I’m trying to understand the impact of choices—technology, process innovation, and leadership– on balance sheet performance. No one pays me for my ink. The research is independent and data-driven.

For the past six years, I have analyzed public reporting and triangulated the results to the quantitative research. What have I found? I think that history will write many stories. There is the story of aggressive sales teams over-hyping the promise of technology to drive balance sheet improvement. There is no correlation between technology selection and balance sheet performance. History will also include case studies of mergers and acquisitions. No company in the past decade achieved the promised economy of scale. Most degraded value. Financial re-engineering–outsourcing, elongation of payables, chasing the lower costs of labor–made companies less resilient. Best performing companies have three characteristics:

- Drive Business Model Innovation. Smaller, more agile companies outperform the larger and well-known brands in the retail, beverages, food, and pharmaceutical industry sectors. Companies with traditional definitions of marketing and sales struggle to beat the competition. The more significant the gap between commercial and operations teams, the lower the performance.

- Consistent and Enlightened Leadership. A clear definition of purpose and alignment of business process to corporate strategy is an apparent characteristic of companies that outperform. Maturity in horizontal process development– Sales and Operations Planning (S&OP) and new product launch—also drives value.

- Building Outside-in Processes. The broader the definition of end-to-end strategy and the alignment of supply chain processes drives value. When the process focus is from the channel to the supplier’s supplier there is greater value. In contrast, the focus on functional silo excellence and transactional processing reduces value.

Discovery

Over the last month, I have been working on the 2019 Supply Chains to Admire™ analysis. Industry-by-industry, I compiled data for the period of 2010-2018. (Click the link to see the detail.) The study of improvement and performance for the 535 companies in 26 industries took two months. (The source data for the analysis comes from Ycharts.)

While social media is full of opinions on supply chain excellence and techniques to drive balance sheet improvement, I find most of this commentary noise. The dialogue lacks a standard definition for supply chain excellence and most of the posts are self-serving. This adds to the confusion.

Summary

Leadership teams want easy answers. They want to know, “What drives supply chain improvement? Where should they invest?” It is not an easy journey. The starting point is the definition of the supply chain. The narrower the description, the more difficult it is to drive balance sheet improvement.

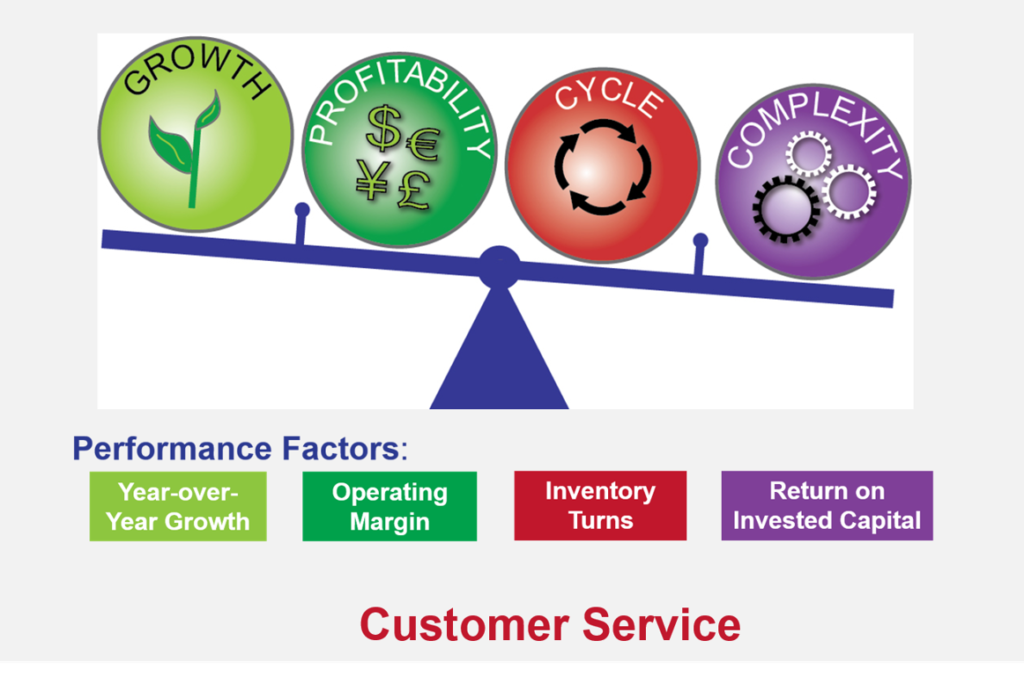

Let’s explore why. The supply chain is a complex nonlinear system. Each company operates on its Effective Frontier™. It is not as simple as trading-off inventory, cost, and customer service. There are many trade-offs: asset strategies, product complexity, growth plans, demand flows, and price volatility. In the Supply Chains to Admire™ analysis, the focus is to understand the relative performance of a company within a peer group of growth, operating margin, inventory turns, and Return on Invested Capital (ROIC). (We selected these metrics based on correlation work with Arizona State University in 2012. The portfolio shown in Figure 1 had the highest correlation to market capitalization.)

Figure 1. Building a Balance Scorecard to Focus on Value

The long-term view of eight years in the analysis allows the tracking of year-over-year patterns through orbit charts. The Supply Chains to Admire is a study of pattern recognition: performance and improvement at each of the balanced scorecard intersections.

The long-term view of eight years in the analysis allows the tracking of year-over-year patterns through orbit charts. The Supply Chains to Admire is a study of pattern recognition: performance and improvement at each of the balanced scorecard intersections.

Celebrating Success

Please join me in celebrating the success of 23 companies. The winners drove long-term value (measured by market capitalization) while outperforming on the portfolio of metrics shown in Figure 1. They also drove improvement faster than their peer group. The top-performing supply chains include Apple, Ahold, Abbvie, Broadcom, Borgwarner, Capri Holdings (previously Michael Kors), Continental AG, Dollar General, Eastman Chemical, Ecolabs, Herman Miller, Intuitive Surgical, Lululemon, Leggett & Platt, Lockheed Margin, L’Oreal, Monster Beverages, Paccar, Packaging Corporation of America (PCA), Ross Stores, Sleep Number, TJX, and Ubiquiti Networks. L’Oreal places as a top performer for four consecutive years. Apple, Broadcom, Dollar General, TJX and Ubiquiti Networks earn placement in the Winner’s Circle for three successive years. Capri Holdings (previously Michael Kors), Eastman Chemical, Monster Beverages, Herman Miller, Leggett & Platt, and PCA are also award winners for multiple years.

Please join me in congratulating the winners of the Supply Chains to Admire for 2019. Shown in Figure 2 are the logos of the winners.

Figure 2. Supply Chains to Admire 2019 Top-Performing Supply Chains

Comparison To The Gartner Top 25

The Supply Chains to Admire analysis is six-years-old. When I present the results, one of the first questions asked is, “How does this compare to the Gartner Top 25?”

There is no industry definition of supply chain excellence, nor is there a perfect measurement system. The Supply Chains to Admire analysis is a data-driven discovery by peer group. Shown in Figure 3 is the comparison of the two approaches. Only Apple and L’Oreal make both the Gartner Top 25 and the Supply Chains to Admire lists.

Figure 3. Comparison of the Supply Chains to Admire and the Gartner Top 25 Methodologies

The list in the Supply Chains to Admire does not reflect public opinion. There is popular belief that brand owners like Boeing, Colgate, Intel, Nike, P&G, Schneider Electric or Unilever define supply chain excellence. Most of these companies market their supply chain capabilities by speaking or sharing case studies. When I was at Gartner, the presentations by PepsiCo to capture our hearts and minds on their prowess was over the top. (It included a beverage cabinet with our favorite beverage.)

The list in the Supply Chains to Admire does not reflect public opinion. There is popular belief that brand owners like Boeing, Colgate, Intel, Nike, P&G, Schneider Electric or Unilever define supply chain excellence. Most of these companies market their supply chain capabilities by speaking or sharing case studies. When I was at Gartner, the presentations by PepsiCo to capture our hearts and minds on their prowess was over the top. (It included a beverage cabinet with our favorite beverage.)

I have a lot of respect for each of these companies and have worked side-by-side with their teams. However, the data does not support public opinion. Each company scores below peer group on the metrics in Figure 1 and/or is struggling to drive improvement. The Supply Chains to Admire Analysis is a data-driven analysis. We score each company on the creation of value (comparison of price-to-tangible book or market capitalization to peer group), rate of improvement (a vector analysis of the orbit charts) and performance (scores above the mean in each factor with consideration for outliers).

Driving Long-Term Results

Based on observation, I know that it takes three-to-four years to drive balance sheet improvement. On the journey, companies typically make three mistakes: starting with technology, a focus on performance within functional silos, and the lack of alignment of measurement systems to strategy. When companies focus on silo’d excellence, they throw the supply chain out of balance.

Long-term balance sheet improvement requires a focus on a balanced scorecard and the alignment of sell, deliver, make, and source to drive value. It is not easy, and most pundits over-simplify the journey. Fads drape the historical landscape. Tactics come and go, but when deployed within a function in the absence of balanced scorecard, they reduce value. Functional excellence, when taken to an extreme sub-optimizes the supply chain. (The complete report will publish by the end of the week.)

Why Does It Matter?

My friends ask me why I sat hunched over my PC for a month calculating these results. The answer is simple. I want to help. My goal is to break through the noise to change the current dynamics. Isn’t it sad that only twenty-three companies made the list? Lets face it. We don’t have best practices. Supply chain processes are emerging and they are important. I firmly believe that supply chain leadership builds economies and could save the planet.

I want teams to think harder. Here is why:

- Automation. If we are going to automate supply chain planning don’t we need a clear goal? Automation against the wrong goals drives us faster down the wrong path.

- Target Setting. The companies I work with struggle to set metrics targets. They are not clear on what is a reasonable target or the performance of their peer group. My goal is to help drive alignment.

- Debate Stirs Better Results. I know that the analysis is not perfect. (However, in the toes of my shoes, I am firmly convinced that it is a better methodology than the Gartner Top 25.) My goal is to provoke thought and open debate. My goal is to force leaders to think harder. 95% of companies are not improving results. I want to drive change.

Thanks for your support. I welcome your thoughts.

Look for the full report by the end of the week. I am inviting all of the winners to my September event to receive their award. I hope to see you there. My goal is to build a guiding coalition to drive change. Together, we need to ask better questions and push for new answers.

Struggling to Stay Current?

Technology change is moving faster than process innovation. Many companies struggle to keep pace. If this is you, I welcome you to join our upcoming events. Our goal is simple: to build a guiding coalition to drive value in supply chain processes.

Imagine Supply Chain 2030. Supply Chain Insights Global Summit, September 3rd-6th, 2019, at UI Labs, Chicago, IL. The focus is on Imagining Supply Chain 2030. What is different? The format is unique. The event has no sponsorships, paid speaking sessions or lofty analyst discussions. Designed for extreme networking, I dub this event the unconference. At the event, technologists and business leaders work shoulder-to-shoulder to Imagine Supply Chain 2030. To ensure balance of business and technology leaders, I closed the conference this week to technologists/consultants to ensure the right balance of business and technology leaders. This week, I have added speakers from Dell, Dow, Intel, and Simple Tire. I hope to see you there.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

To register for these events, please contact Regina.denman@supplychaininsights.com.