Supply chain excellence. It is easier to say than define. Getting it clear is important. Why? The answer makes or breaks a supply chain leader’s career and defines corporate value.

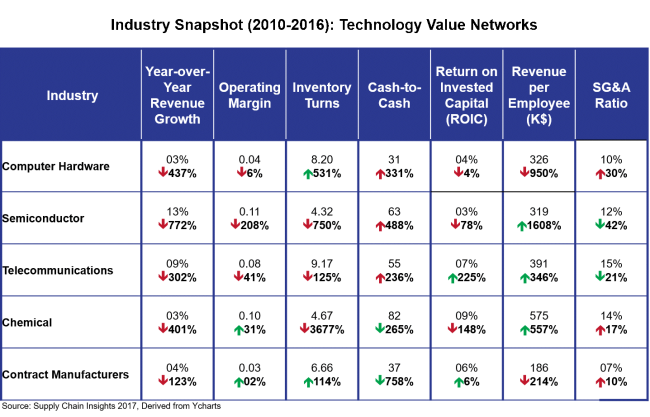

Let’s take an example. When we look at the relative progress of industries within the Technology Value Networks in Table 1, you see a lot of red. The first number in a cell represents the average value for a specific industry for 2010-2016, and the percentage on the second line is a comparison of the average for 2010 when compared to 2016. If the arrow is red, the industry is moving backwards on a metric. If the arrow is green, progress was made. The industry made progress on revenue/employee, but struggled on growth, margin, inventory turns. Is this because this value chain is a laggard? Hardly. Some of the strongest case studies of supply chain leadership are in this value chain. These are shifts in business fundamentals.

Table 1. A Closer Look at Technology Value Networks for the Period of 2010-2016

No doubt about it, today the world of supply chain is an order of magnitude more complex than a decade ago. In the technology value chain it is a case of “when the going gets tough, the tough get going.”

In the court of public opinion there is a worldview of ‘who does supply chain best’. Executives usually have a short list of companies they admire. When we ask supply chain business teams to name the best performing companies in supply chain management, the most frequent responses are Amazon, P&G, and Walmart. While we agree that each of these companies are leaders with significant contributions to the industry, we do not find these companies outperforming when compared against their peer groups on a balanced portfolio of metrics. We often find that the court of public opinion is out of sync with balance sheet performance.

To analyze supply chain excellence more holistically, four years ago we started work on the Supply Chains to Admire methodology. The goal of this work is threefold: to help supply chain leaders set realistic supply chain goals; to provide industry benchmarks to gauge progress; and to recognize companies achieving higher levels of supply chain excellence. We started the analysis to guide our own research and started sharing it with the industry in 2013.

We start the process in March when full year reporting is available from the prior year. This analysis is a study of improvement, value and performance of companies against an industry peer group. This year, we analyzed 495 companies in 31 industries.

Today we’re announcing the 24 winners of the 2017 methodology as shown in Figure 1.

Figure 1. The 2017 Supply Chains to Admire Award Winners

What can we learn from the analysis? (Click here for the full report and here for the Winners Summary Slide Deck)

- Industry Performance Varies Greatly by Peer Group. Note in the charts in the report show the stark differences between peer groups. It is for this reason that it is fool’s play to put companies in a spreadsheet and shake them up, then declaring a winner. BASF cannot be compared to P&G. Instead, it needs to be compared within its industry peer group.

- Sustaining Performance Year-Over-Year Is Difficult. This list is different than last year, and the year before. A test of a true leader is the ability to not only drive higher levels of performance, but to sustain competitive advantage over time. Using the Supply Chains to Admire analysis, three companies—Apple, Cummins and TSMC—are winners for two consecutive years. Dollar Tree and L’Oréal are winners for the past three years. And Cisco, a consistent top performer, has made the winners list for the past four years.

- Most Industries, and Most Companies Are Stuck. There are no companies outperforming their peer group in 16 of the 31 industries studied. Likewise, there are 24 companies outperforming out of 495.

- Driving Improvement Is Slow Going in High-Performing Companies. The greater the performance level, the harder it is to drive improvement. Improvement is much slower for high performers.

- Balanced Portfolios Drive Higher Levels of Value. Companies, based on culture, tend to focus on singular metrics. When companies focus on managing the portfolio, the organization creates higher levels of value.

- Efficient Silos Do Not Create Effective Supply Chains. While the traditional focus is on creating efficient silos within the organization, Supply Chains to Admire winners focus is on alignment and strong horizontal processes.

- Discrete Companies Are Making More Progress than Process-Based Companies. Process companies are stuck to a larger degree than discrete companies. We are not sure why. Is it because they are larger? More global? More traditional? This is part of our future research. Stay tuned.

The Supply Chains to Admire analysis is part of a larger study to understand how the choices companies make impact balance sheet and income statement performance. Using big data mining techniques, this larger study will include the Supply Chains to Admire analysis, over 7000 quantitative survey responses collected over the past five years from supply chain leaders, and relevant market indices. The focus is to understand what choices companies made over the last decade that improved corporate value through improvements in supply chain excellence. The full results of this study, along with presentations from the Supply Chains to Admire winners, will be presented at the Supply Chain Insights Global Summit on September 5-8, 2017 in Greensboro, GA.