Today I attended the SAPinsider Conference. The theme? Digital transformation. The storyline of the event goes like this:

Today I attended the SAPinsider Conference. The theme? Digital transformation. The storyline of the event goes like this:

- Do you have the business problem of complexity, personalization, and globalization requiring faster time to market? (Complete with nice videos and Shutterstock pictures.)

- The answer? Digital transformation.

- How? SAP S4/HANA delivers on the goal of digital transformation.

On stage there is inordinate hand-waving, but few details. The storyline bothers me. Here I share why.

Background.

For the last fifteen years I have attended this conference. It has always been more valuable to me than Sapphire.

I yearn for the years when the SAP Insider conference was larger and full of energy. Then, the packed halls had a lot of business user case study presentations. Today fewer and fewer supply chain professionals make the event. Consultant presentations dominate.

To make the event profitable, SAP Insider now combines supply chain, customer relationship management, human resource management, and product life cycle management. The program now has four focus areas and the attendance is 1,500 people. I remember attendance for the supply chain event was 5,000. The attendees are hardcore SAP teams trying to figure out the new architecture. While these teams try to piece together the picture, which is difficult in rooms with few details, overall excitement for supply chain technology advancement is waning. This should worry SAP. It worries me. At a fundamental level I feel we have not delivered on the promises of the last two decades of supply chain transformation; and as a result, the market interest is declining. This is unfortunate.

Digital Transformation

As a conference attendee the discussions of digital transformation for me stretches over the period of 1988-2017. It is not new. Initially the goal was paperless processes through the use of personal computers. In 1998 the shift was to e-commerce and the use of the Internet for B2B. Today the term lacks a common meaning. When I ask a speaker to define digital transformation from a conference stage it is often used interchangeably with the terms:

- Autonomous Supply Chain: automation of supply chain processes through cognitive learning and artificial intelligence eliminating labor and reducing the need for people to touch data.

- Value Chain Uberization: a platform to enable shared resources across a community.

- 3D Printing: localization of manufacturing through the sharing of digital images using additive manufacturing.

- Internet of Things: the use of machine-to-machine streaming data to improve supply chain outcomes.

- Multi-Tier Networks and Redefinition of B2B: the building and execution of multi-tier networks for data sharing, collaborative workflows, and improved decision making. This includes a discussion of blockchain, network canonicals, and interoperability.

- Cloud-Based Computing. The promise of cloud is federation and democratization of data, in both private and public clouds, with the promise of lower cost of ownership.

- Listening: The use of unstructured data–social sentiment, warranty, and quality data–to improve organizational productivity and align processes outside-in to be market-driven. Market-driven is a more mature definition of demand-driven.

For me, it is not one concept, but a convergence.

A Closer Look at SAPinsider

At SAPinsider the digital transformation message was never defined, but the use cases focused on the Internet of Things, delivered through a Leonardo architecture, and the strategic advantage of S4/Hana for real-time analytics.

I am encouraged by the investment in IoT. Let me be clear. No one makes better software than SAP when they are clear on the business problem. The opportunity is to use IoT to redefine business processes.

The focus of the discussions is on real-time. This is when my forehead starts to furrow. Not all supply chain processes need to be or should be real-time processes.

What is S4/HANA? SAP defines it as:

SAP S/4HANA is SAP’s next generation business suite designed to help you run simple in a digital and networked world. This new suite is built on our advanced in-memory platform, SAP HANA, and offers a personalized user experience with SAP Fiori and collaboration using SAP Jam.

The 1610 SAP S/4 HANA release includes advancements in response management (allocation, ATP and order management) and procurement tracking and collaboration of purchase order workflows. The original HANA supply chain applications, introduced in 2013, were SAP IBP and Demand Integrated Signal Management (DiSM).

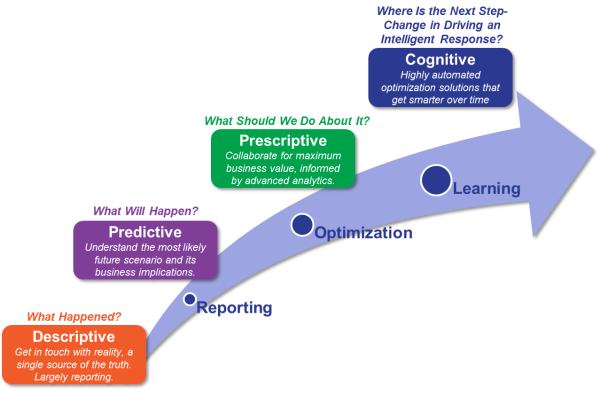

As I sit in the audience I squirm. SAP S/4 HANA is all about real-time analytics. By definition, decision support processes–supply chain planning and price optimization–are not, and should never be, managed in real-time. When they are it introduces nervousness into an already complex system. The SAP S/4 HANA architecture, in my opinion, offers promise in operational planning (often termed supply chain execution and now termed response management by SAP), but to make this robust, I think SAP needs to get serious about the use of cognitive learning to manage large rule sets. We know from history that simple one-to-many rule sets are insufficient. Response management needs cognitive computing to sort through the logic of ‘many ifs to many thens’ which is the reality of real-world supply chains. It is too complex for manual touches. Instead, the solutions need to learn and drive new insights. Most of the discussions in the presentations focused on descriptive analytics while I wanted to see prescriptive analytics and cognitive learning. (SAP made promises to deliver on AI in a recent press release. I did not see this at the conference.) To understand this transition, reference Figure 1. The most advanced work on AI is at IBM, SAS labs, and pilot work by Enterra Solutions, and FusionOps.

Figure 1. The Evolution of Engines in Decision Support Software

Cost is the elephant in the room. SAP S/4 HANA is a new platform and migration to SAP S/4 HANA is expensive. (Because HANA is a change at a database level the costs spiral quickly.)

The second elephant in the room is migration. SAP R/3 released in 1992 and SAP Netweaver in 2004. SAP Netweaver was the foundational architecture for the introduction of My Business Suite of PLM, SCM, HRM, and SRM. My Business Suite was a group of decision support tools that included SAP APO. At SAP Insider, there was no discussion of migration or inclusion of SAP APO in the discussion of SAP S/4 HANA. In essence, in my simple world (and I am no SAP expert), SAP APO DP and SAP APO SNP functionality is being consumed into the SAP S/4 HANA architecture for SAP IBP while SAP APO PPDS and SAP APO GATP are moving into the SAP HANA ERP architecture. The picture for SAP SCM support of APO is not clear. Will it be supported through 2025? And, what will this mean? At the conference, there is no explanation. It is a muddle.

Migrations are expensive. Sitting in the audience at the SAP Insider conference are the same teams forced to pay for the Netweaver upgrade. My struggle is that open source software–Apache Foundation’s work with HADOOP and Spark–is moving quickly. The market adoption of HADOOP as the foundation architecture for cognitive learning to redefine decision support software is also gaining steam with the introduction of Kudu. My POV? I think that SAP is defining an expensive, inferior and insular path for supply chain planning. Consultants that have a lot to gain–pockets to line–through expensive migration to SAP HANA.

I want to separate the discussions of ERP and supply chain planning. While I think SAP S/4HANA for ERP and transactional processing may make sense for large company ERP upgrades to improve scalability and descriptive analytics, SAP has not sufficiently made their case for me, or most of my clients, on the migration of supply chain planning to HANA.

The Digital Transformation Drinking Game

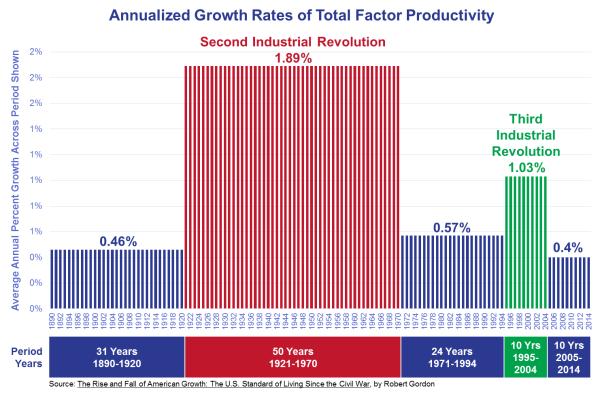

I think that there is a reason that American productivity in the third industrial evolution stalled in 2004. Why? The costs exceeded the value. For this, we need to all accept responsibility. As analysts, we over-hyped the technologies. Concepts like extended ERP II were flawed. Technology vendors, like SAP, drove up costs without holding themselves accountable to balance sheet fundamentals. Today, as a result, the CIO, strapped with high maintenance costs, is looking for budget relief. Business leader dissatisfaction with IT is growing. It is the Digital Transformation drinking game.

What is the Digital Transformation Drinking Game? It is a definitionless discussion of future promises that never materialize. We all get drunk on the promise, and struggle with the outcomes. I saw it SAPinsider. We should not let it continue.

Figure 2. Annualized Growth Rates of Total Factor Productivity

Considerations. As companies build the future of Supply Chain and look forward to the future, we must learn from the past. Accountability for technology vendors–value statements and clear definitions– is paramount. The fourth industrial revolution lies in front of us, but it will be the convergence of many, not singular, technologies and the reshaping of today’s ecosystem. As companies sort through the options in the market be wary of:

1) A Discussion on Technology for the Sake of Technology. We all lose when the discussion is on technology for the sake of technology. Instead, it needs to drive business process improvement at a balance sheet and income statement level. The discussions at SAPinsider centered mainly on the use of SAP S/4 HANA, not on the value proposition. The world is about more than ERP. SAP has more work to do to make me a believer in this vision.

My advice: Do not got caught in this trap. Define the business value for SAP S/4 HANA before migration. The SAPinsider discussion was largely ERP for the sake of ERP.

2) Confusing Evolution Roadmaps. Technology evolution is difficult. However, when the technology providers obfuscate the migration path it borders on the ridiculous. SAP APO became the market share leader for supply chain decision support in 2002. SAP IBP is immature. Connecting the dots is difficult for everyone.

My advice: Press SAP hard on the evolution roadmap.

3) Falling Behind on the Redefinition of Decision Support. The majority of today’s processes are batch. They are not real-time. However, not all processes need and should be real-time. The supply chain is a complex, nonlinear system. Successful supply chain processes require reliability. Too much touching of the system drives instability. In the next five years, pattern recognition and cognitive computing will redefine decision support. SAP will not lead this evolution. Instead, if history is our guide, I predict that SAP will fail and then copy a technology to catch-up.

My advice: Augment SAP APO functionality with decision support from third-party solutions. Wait for SAP IBP to mature.

4) Benefit? Relative Cost. I think that we need to be honest with ourselves. Cloud-based computing through a solution like Anaplan is 10-20X cheaper than SAP IBP with similar functionality. The average company has a complex ERP landscape with 5 to 7 instances. There is a need for core planning and modeling functionality. (Core modeling requires the use of technologies like Arkieva, Infor SCM, Kinaxis, LLamasoft, Logility, OM Partners, Oracle SCM, and SAP APO.) This capability is currently not in SAP IBP. Global companies need to build architectures that span the roles in Figure 3. SAP APO is a planner’s tool. SAP IBP is a visualization technology for business analysts. This recognition is not shared by SAP.

Figure 3. Spanning the Decision Support Requirements by Business Role

My advice: Define the business architecture in planning for all users.

5) Inside-Out versus Outside-In Processes. The future of business processes are outside-in. It is about the use of channel data and customer sensing. While SAPinsider paid lip-service to the concepts of Demand-Driven DRP, SAP still lacks a fundamental understanding of demand-driven or market-driven processes.

ERP will never support demand-driven processes. By definition, ERP uses order and shipment data in DRP and MRP processes which accelerates the bullwhip effect. The bullwhip effect is less severe in a regional supply chain, but has greater implications for the global model. Demand-driven MRP logic is the most advanced in best-of-breed solutions like Orchestrat8 for demand-driven MRP and Terra Technology (now E2open) for demand sensing.

While some might argue that this could be the promise of the new Internet of Things architecture termed Leonardo by SAP, in the demo area I did not see a definition of outside-in processes. Consider that today, two decades after the evolution of VMI, less than 1% of companies integrate and synchronize this valuable source of channel data into order management policies and supply chain planning. VMI largely operates in isolation. This will also be the case for SAP’s Leonardo vision unless there is a definition of outside-in processes.

My advice: Force all technologists to define outside-in processes. IoT for the sake of IoT is nice, but not sufficient. In defining next generation supply chain processes start with the market and work backwards.

6) ERP for the Sake of ERP. I would like to see a focus on the simplification of ERP, and movement of ERP into a less costly model. We need to break the discussions of tightly-coupled decision support solutions to ERP. Supply chain management is about MUCH more than ERP data. I estimate ERP only contributes 45% of the data used by supply chain planning processes. As companies mature their supply chain processes the focus needs to be on market data, not ERP integration.

My advice: Build supply chain planning outside-in with a focus on market data for a heterogeneous IT environment. The advantages of tight-integration for Supply Chain Planning with ERP are over-hyped.

7) It Takes a Village. At the SAP Insider conference there were many small consultants. Each one is attempting to drive revenue on the back of SAP S/4 HANA. SAP partnerships with Microsoft, SAS, and Teradata have come and gone with little to no market value. The partnership ecosystem for SAP continues to be self-serving with little to no value for the greater ecosystem.

My advice: Be wary of press releases and any company who declares an advantage because of a SAP partnership.

These are my thoughts. I welcome yours. I love active dialogues, but I don’t want to get lulled to sleep by a nice conference with wine and beer. I am too old for the digital transformation drinking game.

Use caution as you read this blog post. I do not claim to be a SAP expert. My focus is on supply chain management and the evolution of business value. I write for the business leader, not for the IT team. In this role SAP refuses to brief me directly. My sources of insight come from personal investment in attending conferences, interviews with business teams, and consultants implementing the technologies.

I know the discussions within manufacturing organizations are political. Many IT teams are vested in the evolution of SAP architectures. (Many IT leaders have tied their career path to SAP evolution and expertise.) I cannot make the decisions for you; but hopefully, through reading this post, you will ask better questions.

Join Us to Redefine Supply Chain Processes to Drive Value

Our goal is to help companies take supply chains to the next level. We write for the business visionary. To maximize your learning we offer a number of opportunities.

Research on Supply Chain Finance. Want to know how others are progressing on cost-to-serve and building supply chain finance organizations? Take our survey, and join a virtual roundtable to discuss the results with others.

Research on Supply Chain Finance. Want to know how others are progressing on cost-to-serve and building supply chain finance organizations? Take our survey, and join a virtual roundtable to discuss the results with others.

Next-Generation Supply Chain Training. Have a number of  high-potential employees you would like to give a leg up on next-generation thinking? The Cross-Company Cohort in May will take a group of leaders through the seven supply chain online learning modules that we built with help from CorpU. There will be European, Asian, and North American cohorts of 30-40 people. Each company can place 1-3 people in a cohort that will run during the period of May-December 2017. If interested, please send an email to Regina Denman at Regina.Denman@supplychaininsights.com.

high-potential employees you would like to give a leg up on next-generation thinking? The Cross-Company Cohort in May will take a group of leaders through the seven supply chain online learning modules that we built with help from CorpU. There will be European, Asian, and North American cohorts of 30-40 people. Each company can place 1-3 people in a cohort that will run during the period of May-December 2017. If interested, please send an email to Regina Denman at Regina.Denman@supplychaininsights.com.

Network of Networks. Next week several companies will discuss the planned pilots to test blockchain and cognitive learning to improve interoperability across networks. The sessions are open to all innovators. The next formal face-to-face session to discuss the pilots is on April 13 in North America and April 28th in Europe. For an overview of the work, check out this call to action.

Network of Networks. Next week several companies will discuss the planned pilots to test blockchain and cognitive learning to improve interoperability across networks. The sessions are open to all innovators. The next formal face-to-face session to discuss the pilots is on April 13 in North America and April 28th in Europe. For an overview of the work, check out this call to action.

Imagine. We are finalizing the agenda for the Supply Chain Insights Global Summit. The conference is designed to challenge teams to think different and drive better outcomes. The Summit on September 5-8, 2017 will challenge teams to think out of the box, and is designed to build a guiding coalition between business innovators and technology visionaries.

Imagine. We are finalizing the agenda for the Supply Chain Insights Global Summit. The conference is designed to challenge teams to think different and drive better outcomes. The Summit on September 5-8, 2017 will challenge teams to think out of the box, and is designed to build a guiding coalition between business innovators and technology visionaries.

To register for the events, contact Regina Denman at regina.denman@supplychaininsights.com.