As a mom, I loved to read to my daughter. One of our favorites was the book Where the Wild Things Are. I loved the imagery in this short story of 338 words.

I loved the imagery in this short story of 338 words.

You have probably also read it many times; but, just in case you are not familiar, let me briefly summarize the plot. The story is about a young boy, Max, who after dressing himself in his wolf costume, wreaks havoc in his house. As a result, Max is put to bed without his supper. The story unfolds as Max’s bedroom undergoes a mysterious transformation into a jungle environment, and he sails to an island inhabited by malicious beasts known as the “Wild Things.” After successfully intimidating the creatures, the Wild Things crown him KING. He throws a wild party with his new friends, but must return home. A hot dinner awaits.

My Adult Version of the Beasts

It is Sunday morning in Palo Alto, CA. The sun is rising. Again, I find myself having had a sleepless night, tossing and turning. So, I thought that I would grab a cup of coffee and pen a short blog post before I take off for Phoenix to work with clients and attend the Manhattan Software event. (Then it is off to Dallas to speak on Supply Chain Metrics That Matter at the Dallas CSCMP roundtable and complete some more client work.) Life is busy on the road, but I am deep in thought about the wild things, the beasts at work that are undermining supply chain progress. Let me share my story:

My briefcase is heavy. I am deep in research analysis of a couple of efforts (wrapping up our first year of supply chain planning benchmarking for ten clients, writing reports for the Supply Chain Insights newsletter and finishing some work with a couple of manufacturing clients) which are all telling me the same thing: companies are feeling supply chain pain. Looking back at history, they made more progress in supply chain management during the period of 1995-2005 than today. Companies are feeling the pain of process complexity, globalization, and product life cycles. The business requirements have outpaced the first- and second-generation capabilities of Advanced Planning Systems (APS).

Feeding the Beast or Improving the Business? When I heard a comment by a supply chain leader in a qualitative interview last week, who was participating in the Supply Chain Insights supply chain planning benchmarking work, I winced. When I asked him, “How would you rate yourself in your capabilities to deliver supply chain excellence through supply chain planning?” his response was fascinating. He answered, “We are doing a better job of feeding the beast than driving insights.” When I asked for clarity, he responded, “So many of our processes focus on feeding our ERP systems, that we don’t see the patterns of our business.” The dialogue was rich. In short, this major manufacturer, and a well-respected supply chain leader, lamented the lack of good decision-support tools and the singular focus of his IT team on ERP implementation.

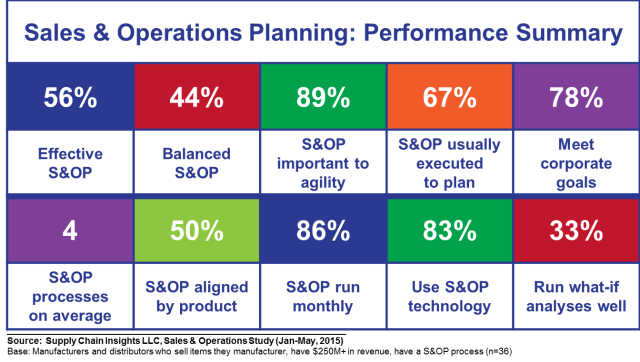

Figure 1. Current State of Sales and Operations Planning

My next call was with a group of leaders working on supply chain planning in Sales and Operations Planning (S&OP) processes. The slide in Figure 1 stimulated great discussion. The group of 12 manufacturing planning leaders working on S&OP had a great discussion on the “&” in S&OP. The discussion went like this… “We have made some progress on the processes of supply and forecasting, but not in the translation of information into better plans. The issues of changing product mix, demand translation, revenue management, and new product launch abound. Balance is desirable, but not reality.” (44% of the S&OP processes balance the “S” and the “OP”, and only 33% can successfully do “what-if” analysis.) We know from our correlations to supply chain financial metrics that when companies have balance between the “S” and the “OP” they have organizational alignment, and progress is faster on the Supply Chain Effective Frontier in balancing growth, costs, cycles, and complexity.

Figure 2: Supply Chain Effective Frontier

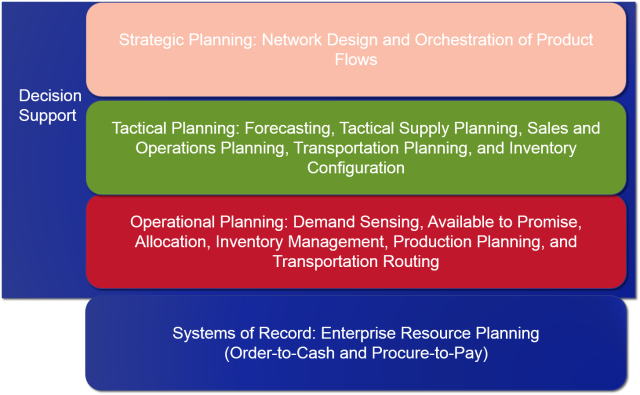

The supply chain is a complex system and these metrics are tightly linked in non-linear relationships. Managing growth and driving improvement requires an investment in decision support technologies. The companies using technologies from JDA, Kinaxis, Logility or OM Partners rate themselves better on the ability to perform “what-if analysis” to build playbooks to execute business plans. Companies with tightly coupled ERP planning tools–those from SAP and Oracle– feel stuck. The ERP beast is labor-intensive and a barrier to driving insights and getting good planning. While ERP is effective, and needed as a system of record, the SAP APO and HANA technologies and the Oracle SCM tools do not support good planning processes. (The SAP tool is the best system of record, and the Oracle technology struggles to deliver either.) The tight coupling of planning to ERP has taken us backwards, not forwards. There is a need to plan for the future when there is a lack of definition in items, markets and policies. ERP, by definition, does not support planning where uncertainty and volatility is high. As a result, most companies today find themselves in the unfortunate position of feeding the beast, not seeing the insights that are critical to manage the business. To reverse, this trend, companies need to define their supply chain planning, and decision support architectures. It requires work. The average business leader understands transactions more readily than planning architectures. The tendency is to react not to plan. There are as many cultural barriers as there are technology ones.

Spend time, as a group, to define requirements at each level of the planning architecture as shown in Figure 3.

Figure 3. Defining Planning Architectures

Inventory Is a Hot Potato That No One Wants, but Everyone Needs To Own

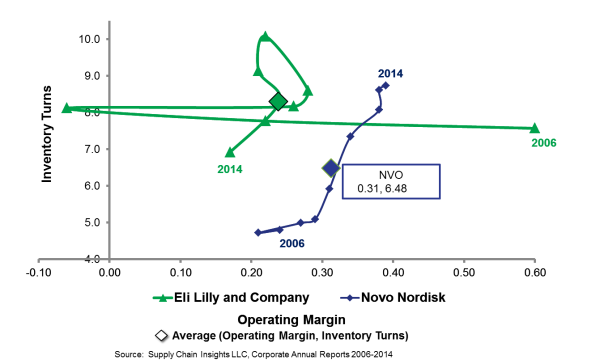

In the process of feeding the beast, inventory is a hot potato that no one wants but everyone needs to own. In my work on Supply Chain Metrics That Matter, I realize how little real progress the average company has made in improving operating margin and inventory turns. Nine out of ten are stuck. Despite all the rhetoric in the press currently on “Supply Chain Leaders,” I struggle with why there isn’t more attention paid to companies like Novo Nordisk, and Ecolab which are making progress at the intersection of inventory turns and operating margin.

Figure 4a. Orbit Chart of Chemical Companies

Figure 4b. Orbit Chart of Pharma Companies

At conferences, I hear from many supposed “supply chain leaders”; however, to me a supply chain leader drives progress at the intersection of these two important metrics of operating margin and inventory turns. Few conference speakers meet this criteria. In fact, in my research, I find only 10% of companies have this characteristic. As we published in our recent Supply Chain Metrics That Matter Report on the Pharmaceutical Industry, I learned that AstraZenca has better performance and Novo Nordisk is driving a faster rate of improvement than their peer group. I want to hear from them. In parallel, in the chemical industry, Eastman Chemical has a better overall performance than their peers, and Ecolab is driving greater progress on improvement. I want to tell their stories. I do not think we hold “supply chain leaders” accountable enough to talk about their real impact on the business. My goal is to bridge the gap between supply chain processes and balance sheet results.

While many companies are quick to turn to technology to solve the inventory problem, my caution is to rethink your organizational and cultural dynamics before you start to consider technology. While you cannot make this type of improvement without technology, you cannot make the improvement with the technology unless you address the cultural issues. The first challenge, is to define a job position and process for inventory management. Recognize that the design and execution of inventory strategies is about far more than technology. It requires adopting a new lexicon to manage the form and function of inventory, and rethinking business policies. Many companies have a number of misconceptions on inventory management. Try to address these in advance.

The second barrier is accountability. One of the characteristics I see in companies making progress on this critical issue is the ownership of inventory.

Figure 5. Inventory Ownership

In Figure 5, I share recent information on inventory management. In companies with more advanced inventory technologies, i.e. multi-tier inventory management and inventory configuration technologies, notice the lack of cross-functional ownership for inventory management. Organizations without cross-functional ownership for inventory will struggle to make progress. No matter how much companies spend on technologies, in this environment progress will not happen. Instead of holding the hot potato, supply chain leaders need to fight for cross-functional ownership and understanding of inventory. Start with the finance team. Use your supply chain design technologies and “what-if” analysis (if you have it) in tactical planning to help finance see that inventory is a needed buffer, not a cost to cut, and shine a light on the business policies (e. g., supply chain design, customer fulfillment policies, and relationships with suppliers) that are undermining progress in inventory management.

Return Home. Craft Your Five Stage Plan.

So like Max, when the dust settles, and the ERP implementation is complete, and you have danced with the Wild Things and fed the beast, it is time to get back to business and drive supply chain improvement. Where to start?

1) Define where you are. Plot your progress against competitors on the intersection of inventory turns and operating margin, and assess the current state. Ask yourself the question, “Am I dancing with the beasts like Max? Is the team focused on feeding the beast versus driving business insights?” If so, realign.

2) Analyze your team’s impact on performance last year. Carefully look at the events on the timeline as they unfolded. As the team analyzes last year’s successes and wins, define what you need for decision support technologies. Have the courage to test new forms of analytics and be clear on the definitions.

3) Socialize the concepts and build a guiding coalition. Start with the finance group.

4) Build a road map. Drive results.

5) Call me and let me write the story! Good luck in your journey.

Life is busy at Supply Chain Insights. Our newsletter, with three new reports, releases at the end of the month, and we are working on the completion of our new game–SCI Impact– for the public training in Philadelphia in June and August and the content for the Supply Chain Insights Global Summit in September. Our goal is to help supply chain visionaries, around the world, break the mold and drive higher levels of improvement.

Life is busy at Supply Chain Insights. Our newsletter, with three new reports, releases at the end of the month, and we are working on the completion of our new game–SCI Impact– for the public training in Philadelphia in June and August and the content for the Supply Chain Insights Global Summit in September. Our goal is to help supply chain visionaries, around the world, break the mold and drive higher levels of improvement.

____________________

About the Author:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push the organization harder to drive excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push the organization harder to drive excellence.

Please Don’t AI Stupid

Drip. Drip. Drip. Industry 4.0. DripBig Data. Drip.The Connected Supply Chain. DripDigital Supply Chain. Drip.Autonomous Supply Chain Planning. Drip. Self-Healing Supply Chains. Drip. Touchless Supply