It was not my goal; but by accident, it became my mission.

It was not my goal; but by accident, it became my mission.

At Supply Chain Insights, as we combed through over 9000 quantitative responses on supply chain management from business leaders to understand what drives supply chain excellence in preparation for the Supply Chain Insights Global Summit. In the process, we proved Hau Lee’s theorem in the Famous Harvard Business Review Article, “Triple A Supply Chains.”

Here is an excerpt from the article:

“…it isn’t by becoming more efficient that the supply chains of Wal-Mart, Dell, and Amazon have given those companies an edge over their competitors. According to my research, top-performing supply chains possess three very different qualities. First, great supply chains are agile. They react speedily to sudden changes in demand or supply. Second, they adapt over time as market structures and strategies evolve. Third, they align the interests of all the firms in the supply network so that companies optimize the chain’s performance when they maximize their interests. Only supply chains that are agile, adaptable, and aligned provide companies with sustainable competitive advantage.”

Hau Lee, October 2014

Harvard Business Review

Over the last six years, we studied the connection between business results (growth, operating margin, inventory turns and Return on Invested Capital (ROIC)) and the link to company characteristics. What did we find? We consistently see that companies focused on functional excellence–a focus within a functional silo like manufacturing, transportation or distribution– or singular metrics– like inventory or costs– underperform against their peer groups.

In our monthly webinar last Wednesday, I presented these results. During the webinar, a respondent asked me to not present just the facts, but to give advice. The question was “how to improve performance.” When I got this response, I sucked in deep. He was right. “The how” needs to be the focus

Let’s Start with Definitions:

One of the difficulties in supply chain is the lack of common definitions. To help the reader, let’s start with definitions used in our research:

- Efficiency. Delivering products at the lowest possible cost.

- Agility. A supply chain that produces products at the same cost, quality and customer service given the level of demand and supply volatility.

- Responsive. Delivery at the shortest cycle time. Note that this is not the same as agile, adaptive or aligned.

- Adaptive: The time to sense and respond to market changes.

- Alignment: We assess alignment by asking companies to rate their organization. It is an easy test. We ask how important is alignment between function and divisions? And, then assess the gap. We are assessing both importance and performance. The focus is to understand how companies gain agreement on future direction.

Today, a supply chain cannot be agile, responsive and efficient at the same time. It requires a choice.

Most companies want to be agile, but they drive an agenda focused on efficiency. By definition, an efficient supply chain is not adaptive, agile or aligned. Our data also shows that it underperforms the peer group. For a financial team, this will seem illogical. Leaders must explain that the the supply chain strategy needs to be about more than cost mitigation.

In the future, with the evolution of cognitive computing, these objective functions will be able to adapt. Today, they cannot.

The delivery against goals starts with leadership and a clear strategy. Many try to start with technology. Let me give you example. Recently, I was presenting to a supply chain team in Europe. The technology group wanted to implement SAP IBP, and the business leaders were resistant. The team lacked alignment between commercial and operational teams. The gap was large. It could not be closed through technology. So I asked, “Why would you want to automate a process when the groups are not aligned?” We continued, “Wouldn’t it be better to drive alignment through use of the current S&OP technologies and implementing a cost-to-serve approach?” I am not sure that I convinced the group, but I got them to think.

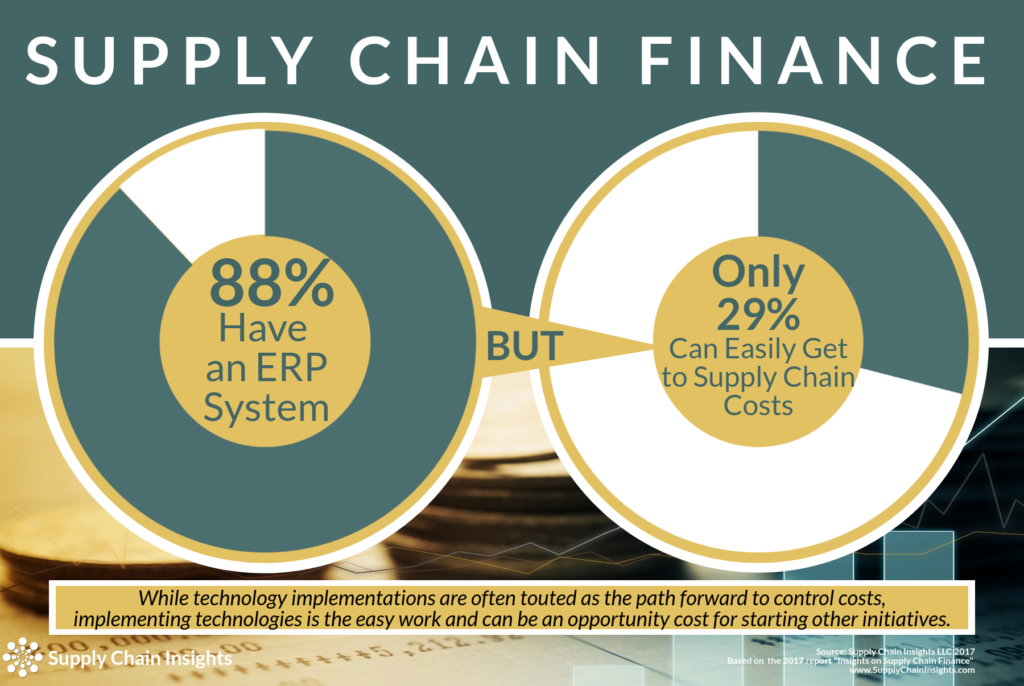

Reactive, knee-jerk decisions often stem from transactional mindsets focused on cost. Companies that are better at planning are more agile and adaptive. Cost decisions are the most effective when set in motion in the tactical and strategic planning horizons. (The time horizons past the order duration and crossing the planning horizon.) In planning, the management of cost is easier said that done. Why? Only 29% of companies can easily view total supply chain costs. Despite having robust ERP and APS solutions, most can only access costs within functions and regions. This is largely due to how companies implemented technologies and not with the systems themselves. Using these limited views of costs will drive the supply chain out of balance. Achieving and obtaining total cost information to drive decision-making is difficult for most companies.

Figure 1: Managing Supply Chain Costs

Driving Change:

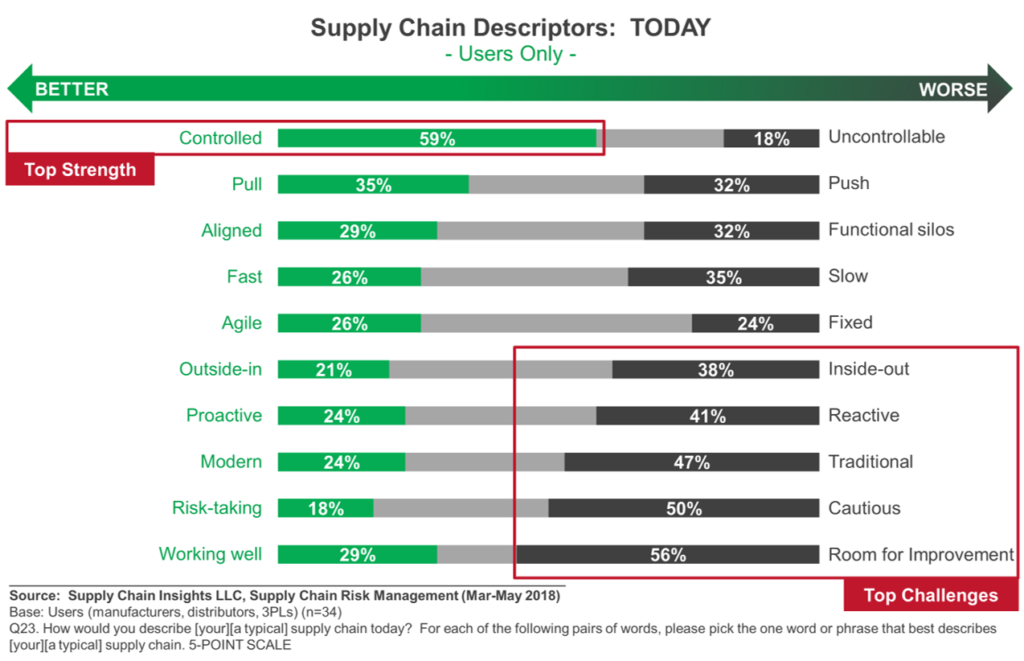

While companies desire agility, today’s supply chains are largely reactive. Contrast the current state in Figure 2 to the desired state in Figure 3. Today, only 1/3 of business leaders feel that supply chains are working well. The focus of today’s processes as controlled, inside-out and largely reactive do not drive alignment, agility, and adaptability.

Figure 2. Current State of Supply Chains Through the Lens of Business Leaders

In the future, the desired state is a supply chain that is aligned, agile and proactive. For most, this requires a supply chain redesign.

Figure 3. Desired Future State of Supply Chains

How do I Drive Greater Change Against the Goals?

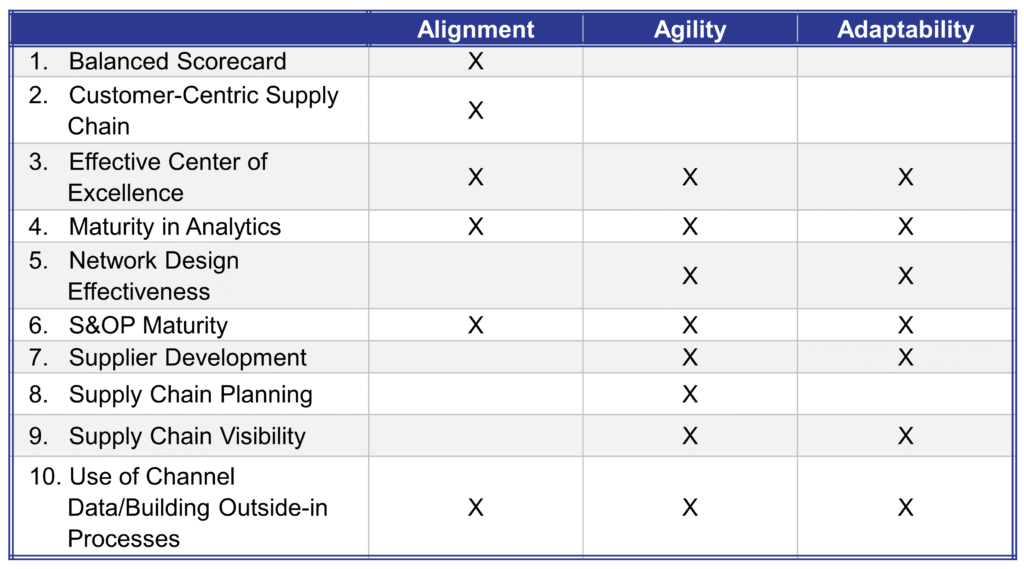

To change course, learn from history, to unlearn to rethink outcomes. In Table 1, from our research, I share ten tactics to consider. To drive alignment, adaptability, and agility, avoid hype and focus outside-in.

Table 1: Ten Tactics to Consider

To take action focus on these ten processes:

- Balanced Scorecard. Reward teams for cross-functional metrics. We like the metrics of growth, on-time and in-full orders, operating margin, inventory turns, and Return on Invested Capital (ROIC). Select 7-9 and hold all functions equally accountable. Focus functional metrics to improving reliability. For more on this topic, read the book Supply Chain Metrics That Matter.

- Customer-Centric Supply Chain. Understand what your customers value and deliver. Do this through assessment, top-to-top meetings, and ongoing feedback. Tie policy to action. Don’t make the mistake of only valuing net-promoter scores. (for more on this topic, check out the report on Customer-Centric Supply Chains.)

- Cost-to-Serve Analysis. In the supply chain, many organize the response by function. What seems like a low-cost option in one function is not always the lowest total cost alternative. For more on cost-to-serve analysis check out our recent report on supply chain finance.

- Maturity in S&OP. Seems like everyone in supply chain has an opinion on S&OP. Many renaming it and white-washing the basics. The best S&OP processes balance the “S” and the “OP”. The focus is on the ampersand. Aligned across the organization, the process focus is on executing the supply chain strategy. For more on S&OP and building a resilient process check out our report, Why is S&OP So Hard?

- Maturity in Analytics. The advancements in analytics–open-source, cloud, internet-of-things (IOT), and cognitive computing–are very promising. It requires the building of an analytics framework. For more information on advanced analytics, check out this report.

- Network Design Analysis. Supply chain excellence starts with design. Buffer strategies. Push/pull decoupling points. The design of transportation and supplier networks. It is about conscious choice in aligning assets and building cross-functional processes. In our data when the network design tools are used within a function, and only for that function, there is a negative correlation to value. When it is used holistically across make, source and deliver to design a network, there is a positive correlation to price to tangible book. Successful network design strategies are holistic crossing the boundaries of source, make and deliver.

- Supply Chain Center of Excellence. Thirty percent of supply chain leaders have a Supply Chain Center of Excellence but only 50% are successful. However, when the center of excellence is driving thought leadership against a strategy there is a statistically significant relationship to agility and alignment.

- Supplier Development. The management of supplier relationships is dependent on successful supplier development processes. Companies that outsource procurement and focus on transactional supplier management are less agile and struggle to be adaptable.

- Supply Chain Planning. The most advanced companies are good at supply chain planning. They use the technologies, have less dependency on excel spreadsheets and understand the need for “what-if analysis.” The focus is on the important not the urgent. For more insights, here is a recent report.

- Supply Chain Visibility. Supply chain visibility means different things to different people, but in our research it is the ability to understand the state of transactions between first and second tier trading partners and the sharing of planning data. For more reading check out our report.

This week, we will be hosting our sixth Supply Chain Insights Global Summit. Our goal is to build a guiding coalition to drive change. There will be no videos, but we will be writing up the case studies for our September newsletter. Let us know your thoughts.