Last week, I spoke at the CPHA supply chain conference in Philadelphia, Pennsylvania. (This was the inaugural supply chain event for the Consumer Healthcare Products Association. Checkout the presentation posted on slideshare.)

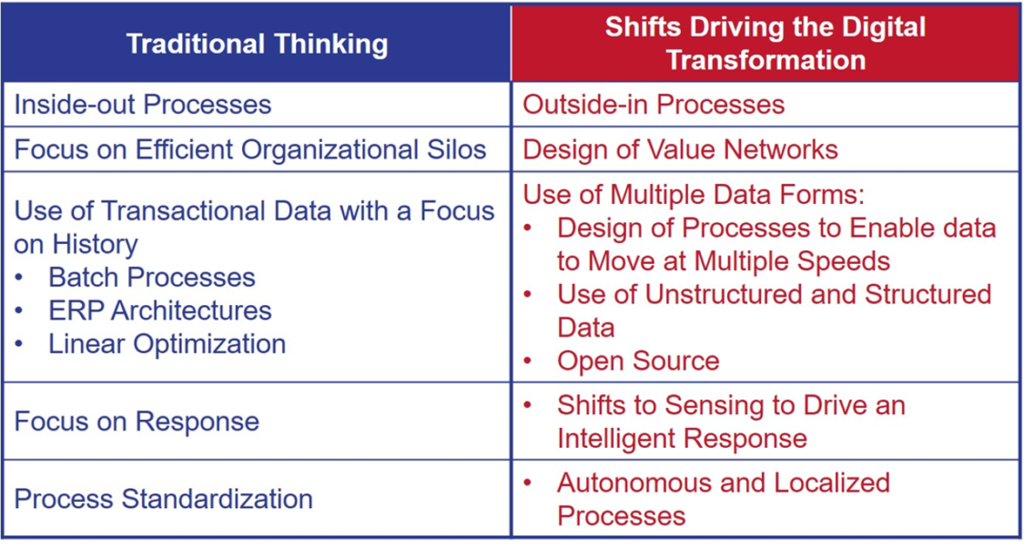

During the presentation, I spoke about the future of supply chain management, and the building of outside-in processes. In my discussion, I used the chart in Figure 1.

Figure 1. Shifts in Traditional Supply Chain Processes in the Building of Capabilities for Supply Chain 2030

To make my point, I stressed that:

- New Forms of Data. Becoming outside in requires the use of new forms of data– sensor data, unstructured sentiment, rating/review data, return data, point of sale data, weather. These new data types do not fit neatly into old and traditional architectures or existing processes.

- Rethink Demand. Demand is a river, or stream. The stream rises from the customer’s customer and flows to and through the enterprise to suppliers. In all relationships, there are rocks in the river. It is never smooth. Companies that are good at demand management understand the need for design–form & function of inventory and push/pull decoupling points –and the orchestration of demand to make better decisions in sourcing, transportation and delivery.

- Redefine the Role of Orders. Orders are not a good representation of demand. In process-based industries, the order changes 2-3X and 25-30% of orders at any point of time are incorrect.

- Trust but Verify. Retail forecasts are never a good source of data for the manufacturer. Before using, test the forecasts to understand the bias and error. Trust, but verify.

- Focus on Probability. Demand data is not a finite set of well-defined time-phased numbers. How so, you might say. Each demand number carries a probability of demand.

- Move Past Buy/Sell to Sense Purchase. While we have spoken of retail/consumer products collaboration in value chains for the past three decades, the industry still operates in a buy/sell relationship with consumer sales teams working hand-in-hand with buyers at retail. The more holistic development of programs–CPFR, VMI, data sharing–is at a standstill.

- Use Point-of-Sale Data. Point-of-sale data, testing first conducted in 1968 at Marsh Supermarkets (see picture), is still not used by consumer products companies to determine demand. (

There are a few deployments of Multi-Enterprise Demand Sensing (MDS) by E2open clients (four), however, for most companies the data sits in the sales account teams.) Most companies do not understand the value proposition of POS data usage . The value proposition is three-fold:

There are a few deployments of Multi-Enterprise Demand Sensing (MDS) by E2open clients (four), however, for most companies the data sits in the sales account teams.) Most companies do not understand the value proposition of POS data usage . The value proposition is three-fold:

a) decreasing demand latency to sense the effectiveness of trade promotions, and new product launch sooner(four-to-six weeks earlier) to improve out-of-stocks, b) ability to manage localized assortment, and the c) facilitation/management of test and learn programs.

At the end of the speech, I looked down at the timer on the floor and saw, much to my dismay, that there were only 5 minutes left for questions. While I normally finish early on presentations, on this day, I had almost run over reducing the time for questions. I shrugged my shoulders and sighed. I value dialogue with audiences, and hate to cut it short.

Answering the Question from The Hand In the Audience

When the facilitator for the event asked for questions, I looked back and saw Pat’s raised hand. Sitting on the back row of the event was Pat Bower from Combe, INC. Pat is a frequent speaker at APICS (now the Association for Supply Chain Management (ASCM) and IBF (Institute of Business Forecasting) events. I respect him as a supply chain thought leader. I knew that any question from Pat would take more than two-three minutes. Pat started by stating that “He believed in the power of point of sale data.” His question was, “Is there a maturity model for the use of market data to improve demand management?” In essence, Pat was asking, “What are the steps to maximize value?” We spoke for a while, and after the session, I wrote the steps on the back of a napkin for Pat.

I started by sharing the model in Figure 2. Outside-in processes recognize that the order is not the best signal for demand. The focus is on improving demand sensing, demand translation (into manufacturing, transportation and material processes) and the execution of demand orchestration strategies.

Fig ure 2. Demand-Driven Model

ure 2. Demand-Driven Model

He then asked for a maturity model. I scribbled the model in Figure 3 quickly. Traditional supply chain processes are very supply focused. The concepts of managing demand data outside-in with a focus on minimizing demand latency is often a tough concept for teams.

Figure 3. Maturity Model for the Management of Demand Signals

This is the model that I shared with Pat. It has changed in the last year with the evolution of analytics and demand sensing capabilities.

Let me close with three case studies experienced in working with clients.

The first is a story of a sinus products. The demand latency for this product is 120 days. (Demand latency is the time for the translation of shelf take-away to order visibility.) Demand drivers include pollen counts, pollution and allergen triggers. As a result, distribution shifts are swift and volatile; and the company struggled to reduce shelf out-of-stocks. To maximize out-of-stock issues, the company built outside-in processes with a focus on the seasonal triggers. The focus on localized assortment increased sales by 5.8%.

Figure 4. Allergy Case Study

A second case study is the use of sentiment data and the building of listening posts by Lenovo. In this work, the company is looking for supplier issues and consumer satisfaction of new product launch by mining unstructured data for review in weekly meetings. This practice improves customer satisfaction and mitigates potential recalls.

Figure 5. Listening Post Example

The third case study when summoned to a major chemical company during the Great Recession of 2007. When I arrived, I faced a panel of economists that wanted to know if the rebound would be a “U”, a “V”, or a “W”. I laughed considering it ironic that these economists were asking me. (I sat on the back row of my Wharton MBA classes.) The demand latency for their products was 180 days. The company manufactured paint pigments. The products were a part of the automotive and building supply chains. For both value chains consumer purchase data was readily available, but not used. The company made decisions based on orders, and were unaware that there was an extreme market bullwhip effect in the signal. I worked with the company to implement a process for market-driven forecasting. This worked well through the recession, but was not maintained when the company upgraded to the next version of SAP and adopted conventional demand-planning forecasting practices available in the SAP APO modules.

How about you? What would you add?

I would love your thoughts.

For more on my thoughts on demand management and becoming demand-driven check out these blogs.

The Lenovo Way

Demand Driven: Can We Sidestep Religious Arguments?

Is a Customer-Centric Strategy the Same as Demand-Driven? Outside-In?

What Happened to the Concept of Demand-Driven?