Today I am facilitating a share group. The dream is to build a Network of Networks. The goal is to close current gaps, to build inter-enterprise visibility, and improve interoperability between businesses. Today the gaps are large. The solutions to close the gaps are not easy.

In attendance are manufacturing representatives from BASF, BerryGlobal, Corning, Covestro, Grace, Evonik, Intel, Monsanto, and Smith’s Detection. Prior attendance included Adama, Dow, J&J, Nestle, P&G, Siemens, and Schneider Electric. It is a meeting of equals. Technologists and manufacturers working together to try to define multi-tier processes to redefine B2B.

There are no sponsorships. The meetings are open. Technologists in attendance for recent sessions include Boardwalktech, Centrifuge, Crosslinx, Elemica, ECCMA, GS1, GSQA, and Infor/GT Nexus. Prior technologists included Cloudera, Enterra Solutions, IBM, and Microsoft. The group meets quarterly with monthly conference calls in between the quarterly meetings. There is an active group in Europe and North America.

We are attempting to separate hype from reality and to test new technologies to try to redefine B2B processes. The reason? Frustration abounds. Traditional thinking on linear optimization and enterprise automation is not equal to the challenge. Stuck, only 10% of manufacturers are driving improvement (90% of companies are unable to drive improvement at the intersection of inventory management, operating margin and customer service).

Transactional and linear thinking defined traditional thinking. The focus on enterprise efficiency is limiting. We are attempting to define outside-in processes. The group is working on case studies to test new technologies like blockchain, cognitive computing, supply chain operating networks, and open source analytics.

Figure 1. Shifts from Traditional Thinking to Drive the Digital Transformation

Why Should You Care?

Companies are busy. Information Technology teams focus is on long and drawn-out ERP deployments. It is hard to shift gears to drive a digital transformation and build value networks. So, the first question is “Why should I care?” Let me start by giving three reasons–brand protection, business continuity, and growth. These three drivers are why supply chain leaders should work together to build the Network of Networks:

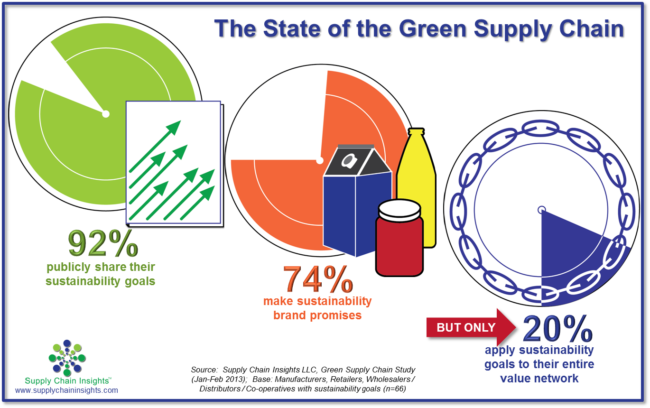

- Brand Protection. On November 2012, the executives of Walmart awoke to find that they were front page news. Fires in a Bangladesh sewing factory resulted in 112 deaths. The factory was a second-tier supplier to a primary Walmart supplier. Factory conditions did not meet Walmart’s standards, but the garments were outsourced to a substandard factory by a contract manufacturer. Today, over 90% of companies have corporate social responsibility statements, but 70% of nonrenewable resources are in value networks. Only 20% of companies are taking ownership of their networks.

Figure 2. The Gap in Value Networks in Driving Social Responsibility

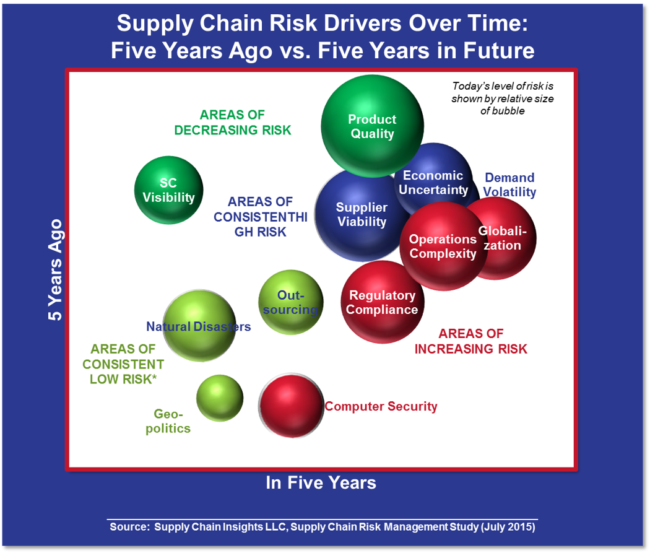

2. Business Continuity. In 2017, supplier performance issues resulted in the bankruptcy of Aerosoles. The company could not recover and restore customer service. Demand error is increasing and supplier viability is a growing risk. Port infrastructure and logistics capacity are growing issues. The average company has two to three material events due to supply chain issues.

Figure 3. Risk Drivers and Business Continuity

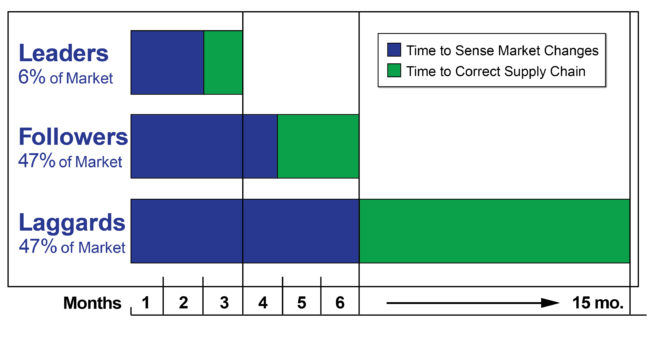

3. Market Opportunity. Growth. Market growth is now 1% versus the 2.5-3% of the last decade. Growth opportunities are increasingly intertwined with the redesign of new business models. Most companies operate blind. In 2007, it took six months for companies to sense the downturn in markets and align supply chains. Today, we have not fixed this problem. Companies cannot sense and adapt. The focus on functional excellence–sales and marketing through technologies like CRM– puts a company on the back foot. The company cannot adapt and change as markets shift.

Figure 4. Managing Demand Across Value Network

Building Blocks

As a part of the Network of Networks, the group initiates pilots to test and learn using new technologies. The hype about Blockchain and cognitive computing is rampant, giving great fodder to Dilbert cartoons. Through work with leading technologists, the group better understands both the current limitations and opportunities of Blockchain.

Together, the group is attempting to understand the future of these technologies and the potential to redefine multi-tier processes. An example is the European pilot outlined in Figure 5. Since Blockchain technologies are currently limited in scalability, and the ability to connect many parties to many parties, the group is using Blockchain to connect existing supply chain operating networks. (Most Blockchain deployments are one-company to one-company, or one-company to many-companies. The technology is not scalable to support a many-to-many architecture.)

This pilot uses Elemica and Crossinx as nodes on a public Blockchain. Through this pilot, we are trying to connect structured data (transactions) and unstructured data (contracts and documents) to enable multi-tier payment. Long-term, the flows of this pilot could automate multi-tier many-to-many matching processes of invoices, deductions, and returns, to automate payment and streamline processes.

Figure 5. European Blockchain Pilot

As we think about multi-tier process evolution in the future, we cannot be limited by current thinking. We need to challenge supply chain fundamentals. For example:

- Orders? If companies use streaming data through the Internet of Things to drive replenishment, do we need customer orders?

- Contracts? We have a lot of lawyers that negotiate a lot of contracts that are never used in supply chain processes. How do we connect transactional flows to enable contract compliance?

- Risk? How do we drive multi-tier visibility of brand risk? Better manage supplier development?

- Asset Utilization? Is there a possibility to drive better asset utilization of trucks and vehicles? (40% of trucks move empty on roads today.)

- Waste? In 2050, we will struggle to feed the world. The world will need to produce 69% more calories by 2050, given a global population of 9.6 billion people. Yet today, we throw away 1.3 billion tons of food a year.

- Onboarding? Today, it takes an average of three months to onboard suppliers into enterprise systems. Onboarding is a barrier to driving network effectiveness.

A Set of Truths

At the end of the meeting, we put a list of truths from our session on the board. This is the set of belief statements from the work that we have done together:

- Connectivity. Blockchain technology is new and evolving. It is over-hyped. There is more unknown than known. We cannot find any use cases that demonstrate the use of blockchain for many-to-many networks. As a result, to build many-to-many capabilities, we are testing the use of blockchain to link Supply Chain Operating Networks (Elemica, E2Open, GtNexus/Infor, SupplyOn and Ariba).

- Current State of Supply Chain Operating Networks. Interoperability between existing Supply Chain Operating Networks today is very limited. There is more connectivity between GTNexus/Infor and Elemica than other nodes. This is an area of opportunity.

- Return on Investment of the Work. While the group believes that there is great value for growth, improving business continuity and driving revenue through new business models in the building of network of networks. Today, there is no definitive ROI. We have five active case studies. We will use the insights from these case studies to define the potential ROI.

- Use of Standards. Data definition is important. The group’s understanding of industry standards has evolved. The greater use of GS1 and ISO standards is an opportunity for all.

Next Steps

It is clear. The current focus on improving vertical silo efficiency through investment in ERP has diminishing returns. The opportunity lies in building better networks. We hope to see you at the next meetings:

- June 25th-26th at Evonik in Hanau, Germany

- July 16th in North America (current thinking is Charlotte or Chicago)