Let me start this blog post with a story.

Let me start this blog post with a story.

I believe that supply chains build economies and save the planet. It is about value creation. I also believe that finance is the art of money changing hands until there is nothing left. Supply chain processes and financial flows often run in counter currents.

Two years ago I completed a research study on supply chain visibility. When the report published it stimulated many conversations. The reason is simple. The term “visibility” lacks a common definition within the industry. Supply chain leaders inherently know that they need greater visibility, but the conversations between buyers and sellers spin due to a lack of definitional alignment.

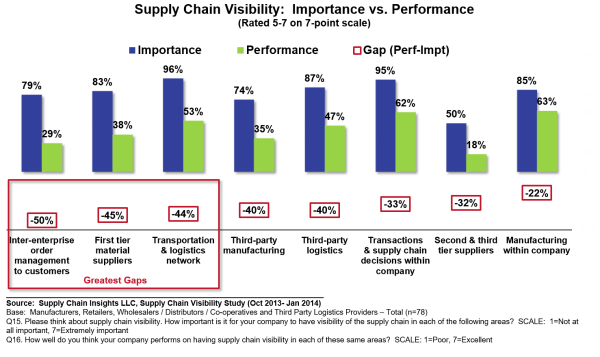

Visibility as a topic is confusing. Technology vendors have conflicting definitions. The current state is pretty powerpoints with hollow words bandied about in sales cycles. It is messy. As shown in Figure 1, currently there are large gaps for the line-of-business user. Despite the advancements in B:C processes, we have made little progress in the advancement of B:B processes. Most hang on the back of 40-year old Electronic Data Interchange (EDI) processes.

Figure 1. Supply Chain Visibility Gaps

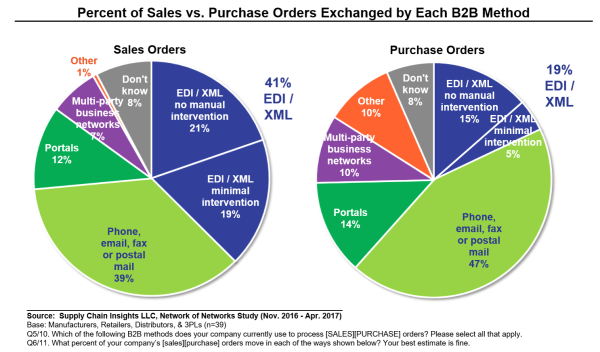

At the time, I was working with two large manufacturing companies that were not clear on the definition of supply chain visibility. Each had invested in multiple forms of supply chain operating networks (many-to-many business networks are often termed ‘supply chain operating networks’.) Examples include E2open, Elemica, GT Nexus (now owned by INFOR), and SAP Ariba. As shown in Figure 2, few orders and purchase orders flow hands-free. There is friction in the process of data exchange. Investments in ERP are not the answer.

Figure 2. Current State of Hands-Free Orders

The elephant in the room is interoperability. The two manufacturing companies struggled to connect their multiple systems and combine them with private networks (from the transportation vendors), while coupling them with Value Added Networks (VANs) (primarily from IBM and Open Text). Stuck, they asked for help. They requested an intervention. By the end of the lunch meeting, we agreed that it would be a good idea to start a facilitated workgroup to design and test new approaches. This included the testing of new technologies like cognitive computing, blockchain, open source analytics, and the Internet of Things (IOT).

For the industry, the larger elephant is “What is the Return on Investment?” While companies know that they need to conquer this hurdle, they are hamstrung. Process innovation with new technologies is hamstrung by the need to show a definitive ROI.

To get started, I invited the smartest technologists, and the most innovative business users to try to challenge convention. Our goal was to define and test/design a new approach. We named the working group the Network of Networks. We started with group ideation and the sharing of case studies. We then narrowed down use cases to test. The first use case is supplier onboarding. The goal is to write once and use company data multiple times across networks. The average time for company onboarding today is four months, and the business pain is high. Onboarding is a barrier to greater market penetration by the ‘supply chain operating networks’.

After 18 months of group facilitation, the network of networks group made progress (through quarterly, face-to-face sessions and monthly phone calls. Admittedly, it is slow). There is much left to accomplish. Here I share my learning:

1) Hard to Get the Right People to the Table. This is bloody difficult: and time-consuming. When the group started, technology/software providers wanted to send salespeople. This required some very heavy-handed facilitation and boundary management. In the industry, we have a practice of technology vendors sponsoring this type of group under the guise of lead management. I tried to break this model. I did not make many friends in the process. Business leaders also struggled. The challenge was to find people who had a wider purview of the business problem. Onboarding the group required a lot of education. (The teams within manufacturers that focus on B2B technology protocols and standards, and business processes to improve visibility, are often worlds apart. The language is different. The topic is complex. As a result, there are few companies that have business leaders who are knowledgeable about both technology, and the use cases. Organizational turnover compounds the issues.)

2) Detours/Potholes and Spiraled Learning. It is easy for groups to get caught up in discussions of technology for the sake of technology. Chasing pretty objects is alluring. The group’s foray into blockchain discovery was a detour with fruitful insights. While blockchain as a technology is very promising, the definition of network governance is a strong precursor–the number of nodes, what gets written into the blockchain infrastructure, and security/authentication. This world is in flux, and we are not ready to have this discussion. There are many startups, but finding a blockchain expert who is knowledgeable about supply chain is a formidable task. (As my mother would say, “It’s like finding hen’s teeth.”) In our discovery, we find that the focus of today’s blockchain deployments are on one-to-many business use cases (e.g., Maersk to their network, or Walmart to their network). The world of many-to-many network enablement is a blank canvas for supply chain. While there are some use cases in banking, the deployments building on data and process standardization? That does not exist in the world of supply chain.

3) Trust Coupled with Big and Hairy Data. Companies do not naturally work together in the supply chain. While we talk about collaboration, it seldom happens. There are few use cases of collaborative success. I define collaboration as a sustainable win/win value proposition across trading partners. Today, it is largely a win/lose value proposition. Over the last decade, despite lots of fanfare, we have pushed cost and waste backwards in the supply chain. Unlike banking, there is no common definition of data, other than EDI documents, for sharing. Companies have customized ERP implementations and business process flows. As growth slowed, and merger mania reigned, data sharing has progressively gotten more complex. The lack of trust, and the big and hairy datasets, are barriers. We need to get the hair out of the system.

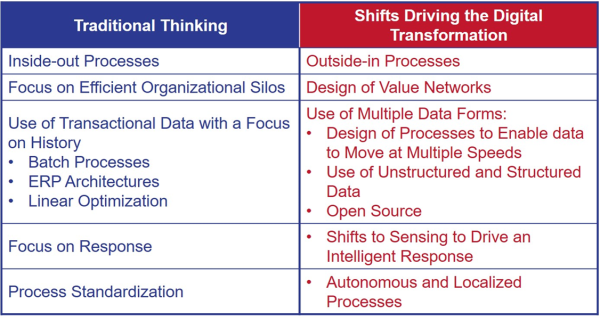

4) Need for Ongoing Education. One of the biggest benefits for the members of this group is learning and ideation on next-generation supply chain processes. It has been fun to facilitate this learning. To spice up the discussion, I brought the smartest technologists to the table to share insights on Open Source analytics, blockchain, IOT and cognitive computing. All of these technologies are moving at fast speeds with overhyped promises. To grasp the potential impact requires a paradigm shift in thinking. Supply chain teams used to thinking in batch processes, with fixed hierarchical representations using relational database models, need to change. The world of schema on read, blockchain, cryptocurrency, rules-based ontologies, streaming data architectures and cognitive computing is all new.

Figure 3. Shift in Paradigms

Does this mean we will abandon the effort? No. As the group coalesced and reviewed next steps, we gained agreement on action items:

- Finish the Current Pilot. The blockchain pilot for supplier onboarding between Elemica and GT Nexus helped us to better understand blockchain. We will continue to test the technologies in a BASF/Corning deployment. We will share these insights at the Supply Chain Insights Global Summit.

- Document the Use Cases and Define the Larger Market Value. A major barrier is the lack of alignment on use cases and potential business value. This paradigm shift from transactional thinking and relational database technologies is a gulf to close. In October I will be writing the case studies and sizing the market opportunity. We will use this in our December meeting to define a mission/charter and governance model.

- Improve the Possible. Use the technology sub-team within the group to look at what is possible today for flows between the existing networks of E2open, Elemica, GT Nexus, and SAP Ariba (this is a win if nothing else happens out of this group).

The next meeting of the Network of Networks group will be in December. We will continue the monthly calls to share updates from the sub-groups within the initiative. We will also have a short meeting on the topic at the Global Summit.

What are the first steps for the user who is not a part of this group to take? When choosing a visibility technology, focus on definition clarity. The term ‘visibility’ lacks a universal meaning. Get clear on the definitions. Sidestep the hype (it is pervasive). And build with the end in mind.