On Wednesday, Supply Chain Insights will host our first conference. It is designed as an annual event for supply chain leaders. We are proud of the line-up of speakers.

The event will open with the sharing of research of how supply chain leaders have made trade-offs on Conquering the Supply Chain Effective Frontier. (We have been analyzing balance sheets and studying the financial performance of companies for the last sixteen months. We wanted to understand how companies have made the trade-offs of growth, profitability, cycles and complexity.) In the morning session, leaders from P&G, Intel and Merck will be sharing their insights behind their numbers. We look forward to hearing their perspectives.

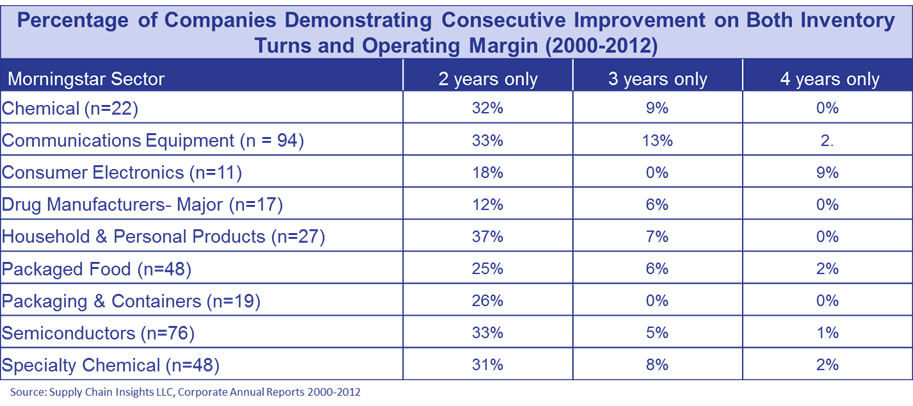

We find that nine out of ten companies are stuck.. Complexity has risen and progress on margin and inventory is stalled. While 1/3 of companies have been able to drive progress for two consecutive years over the last decade, no company has been able to sustain this for more than four years. In Table 1, we share these results. Attending the conference, and making improvement in both inventory cycles and operating margin for two consecutive years, are Colgate, Dow Chemical, and General Mills.

Table 1.

As shown in figure 1, ironically, the greatest improvement, and the toughest work, was at the end of the last two recessions. We believe that it is a case of when the going gets tough that the tough get going.

Figure 1.

Today, many companies are stuck. We believe that to improve supply chain potential, companies need to adopt new technologies and processes and build supply chains outside-in. When we asked the attendees to imagine their supply chains of the future, and to rank the supply chain trends that they were the most excited about in the race for Supply Chain 2020, their answers are shown in figure 2. It will be interesting to see how their perspectives change, with the sharing of insights from global leaders, over the course of the conference. We will be sharing these insights on our upcoming webinar that will happen post-conference. Register for the webiner at our Upcoming Events page.

Figure 2.

If you are not able to make the conference, tune in to see their response live. You can follow the conference on our USTREAM channel at http://www.ustream.tv/scisummit13 and follow the action on Twitter via the hashtag #SCIsummit. Once the Summit has ended we’ll be archiving the presentations and the video for six months.

Also, just because you will not be there in person does not mean that you will miss out on the action. If you have a question for our speakers just send it to us on twitter using the #scisummit hashtag and we will ask it to the speakers during the Q&A sessions. So, join in the conversation and share the presentation with your team. We are convinced that it will be unlike any other supply chain conference.

Beyond Rabbit Ears on a Black & White TV

When I was a young girl, we got one television channel. Rabbit ears on the TV helped us get channels. We loved the new world