It was November. I was speaking at a client site. The topic was customer-centric supply chains. We started the morning by asking attendees to share their definition of a customer-centric supply chain. I slowly wrote the definitions on the whiteboard. At the end of the sharing I had as many definitions on the board as people in the room. The only thing that was clear was the lack of definition clarity.

It was November. I was speaking at a client site. The topic was customer-centric supply chains. We started the morning by asking attendees to share their definition of a customer-centric supply chain. I slowly wrote the definitions on the whiteboard. At the end of the sharing I had as many definitions on the board as people in the room. The only thing that was clear was the lack of definition clarity.

Then the leader of the team crossed his arms and sighed. He said, “I am not sure if this exercise makes sense. The definition of customer-centric is perfectly clear to me. It is doing whatever the customer wants.” He then went on a rant. Quickly an atmosphere of quiet uneasiness settled over the room. The team shifted uncomfortably in their chairs.

Reflections

I cleared my throat and told a story of two clients in Houston. The companies were competitors. Each distributor delivered oil and gas products to refineries. The companies were commodity-based businesses and operated on razor-thin margins. One company defined the customer-centric strategy as, “Do whatever the customer wants.” Their costs were higher and their reliability to the customer was lower. The organization was always jumping through hoops. The second organization had a very different definition of customer-centric. Their vision was to manage distribution policies based on customer segmentation with a focus on reliability. At the second company, policies were clear and the focus was on reliable delivery. At the end of the year I watched both companies gather in a room for the most valued supplier award. The company that jumped through hoops constantly did not win the award, while the second company won the supplier of the year. What can we learn? Reliability matters. Failed promises, no matter how well intended, have long-term consequences.

What Does Customer-Centric Mean?

As I work with clients to help them refine supply chain strategies I often find many companies will use words like customer-centric, but will fail to define the term to make it actionable. On this fall day, at this strategy workshop, this was the case.

Since many confuse demand-driven, customer-centric, and outside-in processes, during the session I shared the image in Figure 1 to jumpstart the conversation.

Figure 1. Customer-Centric Supply Chain Definition

The image helped. For an hour we discussed definitions and process maturity.

Flashback During Writing

This week I am reflecting on that session as I work on the correlations and patterns in the recent research on customer-centric supply chains. In the study, 60% of companies state there is great room for improvement in their supply chains; yet, 75% of responding companies are bullish about their capabilities on being customer-centric. The average respondent had a customer-centric supply chain strategy for over five years, and 60% feel they are successful in the execution of their customer-centric strategy. My takeaway? Should they be so confident in their capabilities? I think not. Success is easier said than done.

Figure 2 shows the gaps in the execution of customer-centric policies and strategies. The top three gaps are visibility of channel inventories and orders, management of complexity, and the alignment between commercial and operations teams. These three characteristics often go hand-in-hand. When there is close alignment there is usually better management of complexity and the sharing of channel data.

Figure 2. Gaps in Customer-Centric Strategies

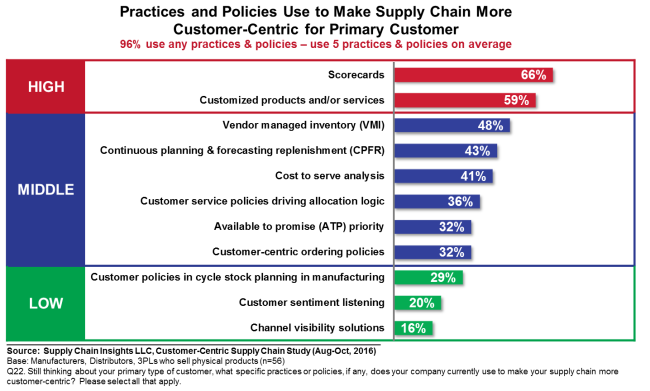

The average company uses five practices to execute a customer-centric supply chain. We share these details in Figure 3.

Figure 3. Strategies Deployed

Ironically, while the biggest gap in the execution of customer-centric strategies, the implementation of channel visibility solutions is very low (16%). Is the use of channel data and customer sentiment data one of the reasons why most companies feel their supply chains are underperforming despite the belief that companies have more than five years of history in managing customer-centric policies? I am not sure because I am not done with the data analysis, but I think it is likely. As complexity increased, companies dependent only on the order signal struggle to respond at the cadence of business. What do you think?

We will publish the full report next week in our monthly newsletter. Sign up to get our regular updates on research findings, webinars and podcasts. We help supply chain leaders find answers.

Digital Transformation: Where Was the Beef?

Where is the Beef? is now a colloquialism. The phrase started as a line in an advertisement in 1984 for Wendy’s hamburgers. I remember sitting