The 2016 US presidential political contest was brutal. Emotions are still quite raw. I hated it. When emotions run high, everyone loses.

Unfortunately, I think the concept of “Demand Driven” is headed down the same path. I feel the discussions are becoming religious arguments about right and wrong instead of healthy discovery (much like this picture of Tibetan monks debating). Let’s face it, the definition of demand-driven is evolving. There is no single definition. Today’s processes are largely supply driven. The base definitions of the SCOR model are inside-out, and supply-centric. They do not work as well as we would like. The 1990’s technologies of Advanced Planning (APS) along with Distribution Requirements Planning (DRP) and Material Requirements Planning (MRP) amplify the bullwhip effect within the supply chain resulting in the loss of agility and an inflexible response for the long tail. Figure 1 depicts the long tail.

Unfortunately, I think the concept of “Demand Driven” is headed down the same path. I feel the discussions are becoming religious arguments about right and wrong instead of healthy discovery (much like this picture of Tibetan monks debating). Let’s face it, the definition of demand-driven is evolving. There is no single definition. Today’s processes are largely supply driven. The base definitions of the SCOR model are inside-out, and supply-centric. They do not work as well as we would like. The 1990’s technologies of Advanced Planning (APS) along with Distribution Requirements Planning (DRP) and Material Requirements Planning (MRP) amplify the bullwhip effect within the supply chain resulting in the loss of agility and an inflexible response for the long tail. Figure 1 depicts the long tail.

Figure 1. The Definition of the Supply Chain Long Tail

Why is this important? As companies personalize product offerings, the tail grows. For example, over the last five years, in consumer products the average company increased items by 38%. As a result of growing item complexity, the demand profiles become lumpier with increased demand latency. (Demand latency is the time that it takes from shelf take-away to order processing. In the 1990’s demand latency in a regional supply chain was weeks. In consumer products today, based on item proliferation, demand latency for many products is now months, making the order a poorer representation of true demand. It is often out of sync with the market.) Today, based on the use of traditional processes, companies cannot sense market shifts quickly and align their supply chain response.

Reflections

In the period of 2005-2010 I created research on the topic of demand-driven value networks as an analyst at AMR Research. This ended when Gartner purchased AMR Research in 2010. Since I do not believe in the Gartner business model, I left. After reflection, I broadened the demand-driven concepts and started writing about Market-Driven Value Networks in 2012. Listed in Figure 2 is the Market-Driven Value Network definition along with the prior definitions from the work at AMR Research.

Figure 2. Demand-Driven Definitions

Definitions Matter

Over the last decade many technology providers co-opted the term without understanding the concepts. Sitting in a SAP presentation, using the term demand-driven at the recent SAP Insider conference, without grounding in the definition is painful for me. In the SAP presentation, I saw traditional supply-centric concepts rebranded as demand driven.

In 2013 the Demand-Driven Institute redefined the term “demand-driven,” giving it a very different meaning than the Demand-Driven Value Network concept defined by AMR Research in 1996. (The Demand-Driven Value Network model is now owned by Gartner Group.) Their definition is “Demand Driven Material Requirements Planning is a formal multi-echelon planning and execution method to protect and promote the flow of relevant information through the establishment and management of strategically placed decoupling point stock buffers.”

The Founder is Carol Ptak. I love Carol on stage. She is bombastic and compelling. I violently shake my head in agreement with her concepts of flow and buffers. However, we disagree on the principles of forecasting and the use of demand sensing technologies. I believe that demand-driven processes start from the channel back, flowing to the enterprise, and that buffers are only a piece of the answer. I also believe that forecasting plays a vital role in determining the rules for inventory buffers, driving market-to-market orchestration, and defining the principles for network design. The disconnects grow with Carol’s recent work on Sales and Operations Planning (S&OP). (I will stop here. I am going to try to avoid a religious argument.)

Kudos to Carol and her partner Chad for gaining market attention. The concepts of DDMRP are growing in popularity. However, despite the excitement, the current implementations are largely small and regional projects. The software approaches and project implementations are not enterprise class. The current focus is on inside-out enterprise processes, not outside-in value networks. In addition, the branding of how Demand-Driven Institute certifies software is confusing. Many of the websites for the certified software, carry similar branding to the DDMRP group leading to market misunderstandings.

Does this mean I think we should throw out the baby with the bath water? Absolutely not. Carol’s work on Demand-Driven MRP is solid. The Demand-Driven Institute’s concepts on material planning are important to the demand-driven road map. It is just not the end state. Alone, it is not sufficient to build a demand-driven road map. I believe that the work done at AMR Research on the design of outside-in processes, along with the recent work from Supply Chain Insights, needs molding with the demand-driven MRP concepts. I also believe that with recent technology innovation the vision is much, much more. We need a definition of demand-driven manufacturing and transportation, and the building of multi-tier canonicals in the network of networks.This is something I have tried to accomplish with the Demand-Driven Institute, but failed.

Moving Forward

So, if you are a leader of supply chain processes trying to build a market-driven or demand-driven roadmap, what do you do? The first thing to do is to question traditional supply chain planning concepts and platforms. I recommend five steps:

1) Define the process from the customer back, mapping all the demand signals (social sentiment, weather, ratings and reviews, channel inventories, and point of sale) and define how to use new forms of demand data. Measure and understand the impact on demand latency.

2) Build an outside-in demand planning model to use channel data. Experiment with attribute-based planning and probabilistic forecasting to better predict the long tail.

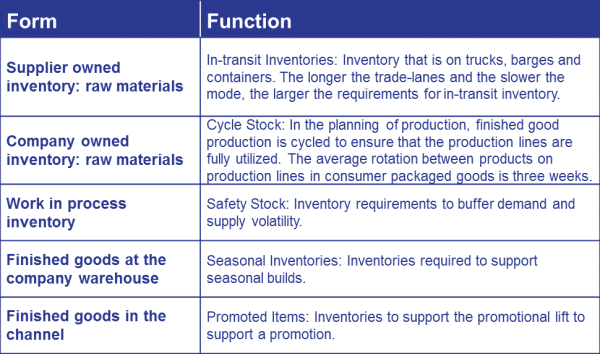

3) Use the probability of demand (not the fixed numbers) to drive the flows and buffer strategies for inventory and material planning. Focus on managing form and function of inventory. I define it in Figure 3

Figure 3. Form and Function of Inventory

4) Implement demand sensing technologies to improve the short-term demand signal to improve replenishment and supply chain execution. There are three solutions in the market–E2open (acquired Terra Technology), SAP, and ToolsGroup. In discussions with clients, the strongest references and results are with the Terra Technology implementations/companies (now E2open). However, realize that most of these projects are evolving.

5) Experiment with new technologies to drive improvements in traditional approaches. I list some that I think are promising in the next section.

New Technology to Consider

If you look at my historic blog posts, you will see that I have written positive reviews about Terra Technology’s Demand Sensing (now a part of E2open), Logility’s new Product Profile Planning, and Adexa’s Attribute-Based Planning. I still like these concepts.

Avoid doing development with traditional supply chain leaders on demand driven. Most of these efforts circle the drain. These companies are fighting for deals in traditionally supply-centric models. Here are some promising opportunities:

1) Use of Machine Learning to Improve Planning Master Data and Improve Sensing in Supply Chain. I like the work that Rulex Analytics and Elemica are doing on mapping the context of data to improve supply chain planning master data. As we all know, a lead-time is not constant, and supply chain master data for planning–locations, capabilities, and routes–are ever-changing. This is a great area for machine learning to drive improvements.

2) Demand-Driven Manufacturing. Of all of the technologies evaluated by the Demand-Driven Institute, I am the most bullish about Orchestr8. After watching the organization evolve for the past five years, I am excited to see and follow their go-lives. I hope to have one of their demand-driven manufacturing implementation leaders present at the Supply Chain Insights Global Summit. I am also featuring a paperless manufacturing case study from Agco using Proceedix at the Summit. The translation of demand into manufacturing and to the shop floor is still an uncharted frontier, but these two technologies are promising.

3) Redefine Forecasting. I am also featuring a presentation using Lokad and the techniques in probabilistic forecasting at the conference. I think we have made a mistake in trying to make demand planning precise when the numbers really represent the probability of demand. As we get into the long tail of the supply chain, I think we have to radically rethink demand planning.

4) Cognitive Computing. I am also working to get two case studies for cognitive computing at the conference. The difficulty is that the speakers are struggling to get approval. The results are just too compelling. I think that Cognitive Computing redefines decision support. For more on this topic, contact Enterra Solutions and FusionOps.

5) Streaming Data Architectures. In the area of the Internet of Things, the discussion is on how to best use the data. Streaming data architectures are evolving, and there are few sources of definitive data. I like the work that Savi is doing on sensor data using Apache Spark, and SAS’s work on predictive analytics in asset-intensive industries, but this work is quite new and evolving.

6) Market-to-Market Orchestration. Yesterday I reconnected with a market-orchestration company, SCA Technologies out of Pittsburgh. I like the work they are doing with food service companies on menus and raw material buying. The concept is simple. A reverse bill of material optimization in sourcing based on market cost. Most companies cannot connect what is happening in real-world sourcing to execution. This is one of the few companies that I find that is working in this area.

7) Cost-to-Serve. Recently, we published a report on Supply Chain Finance and the issues with managing costs. One of the techniques that I am bullish on in demand-driven processes is cost-to-serve. Unfortunately, there are few enterprise-class data models to enable this process. I really like Halo’s new release for cost-to-serve. Simple to use and cost competitive, it fills an unmet need in the market.

In summary, I think advances on the demand-driven concepts happen when supply chain leaders redefine their processes, outside-in, using market data and orchestrating from market-to-market. These are very different concepts that are pushed by supply chain traditionalists. As a result, the fastest progress happens through work with best-of-breed providers.

If interested in more insights, here is a past blog post:

What Happened to the Concept of Demand Driven?

Author’s note: When this article was published on 5/7/2017, the initial article inaccurately reported that the Demand-Driven Institute sells and certifies software. After further review and research, the blog has been modified. The issues of branding and messaging of the certification adds to the murkiness. The author apologizes for inaccurate reporting.

Failure: a Building Block for Success

As I enter my fifteenth year of trying to help supply chain leaders improve value through supply chain planning software, I answer a challenge by a reader on what is the value of an industry analyst. My reply centers on how I think we can help, and that it takes a village and I hope that he will help as well.