Today I unpacked my bags. In the last six months, in my travels, I have presented to supply chain teams in China, Belgium, France, Germany, Peru, Mexico, Netherlands, South Africa, Singapore, Spain and the United Kingdom. To streamline my efforts, I just kept a packed bag in the closet. I strongly feel that if I am going to cover the global supply chain that I need to experience it.

Connectivity enabled the growth of the global supply chain, opening up markets driving opportunity. The combination of technology, along with the advancements in transportation, made it possible. However, globalization comes with responsibility. The traditional manufacturing job defined the middle class. As we have driven improvements in globalization, jobs shifted as companies chased lower costs of labor. Today’s populist movement is about new winners and losers. It is about jobs and new business models.

As I travel, CNN is on my TV around the world. In the words of the South African driver in Sun City, “We eat your chicken, listen to your music, and watch your TV.” Entertainment and fast food globalized quickly. Supply chain process development is slower. Border crossing(s), port unloading, and global visibility are barriers. The nitty-gritty of shipments –reliability becomes the lifeblood– is the lifeblood of the global supply chain. Driving progress in this world of uncertainty and high risk is the job of the global supply chain leader.

Each time I turn on the channel, manufacturing jobs frame the global debate. Ironically, as global manufacturing jobs decrease, there is a need for talent in the global supply chain. Today’s global supply chain has positions open they cannot fill. The skill requirements for the next generation supply chain are quite different. The greatest gaps are at the intersection of business process and analytics. As we define next-generation capabilities for the global supply chain, we must own building talent, and defining the ethical supply chain. The effective supply chain builds global economies and has the potential to save the planet. This is easier when there is growth and profitability. In today’s economy, where both are under attack, it requires a different level of leadership. In this post I take a hard look at the global supply chain.

A Personal Reflection

As I travel the world, many companies struggle to understand what I do. For many who I meet in my global travels, the industry analyst role is a new concept. It is not a globally recognized role. As a result, at conferences I am often introduced as a consultant. When this happens I quickly dismiss the categorization. I explain that a consultant is sure that they know what drives supply chain excellence while I, on the other hand, am not so sure. I explain that I am researching the trends, and trying to discover/figure out what drives balance sheet results. I also explain that we, as supply chain professionals, have not held ourselves accountable enough to the delivery of value. While we are quick to use the term “best practices,” I don’t think that we have done the hard work to figure out what drives competitive advantage.

A Closer Look at the Global Supply Chain’s Balance Sheet

This is our third year of analyzing balance sheets to understand which companies outperform. In my work tonight, I carefully studied 2006-2015 financial results to select the Supply Chains to Admire winners. The winners drive improvement while posting financial results in the Supply Chain Metrics That Matter ahead of the peer group. In the analysis we study 33 industry peer groups across more than 300 public companies. The performance factors evaluated in the analysis are:

- Growth. Higher percentage of growth than the industry average for the period of 2006-2015

- Operating Margin. Greater margin performance than the industry average for the peer group for the period of 2006-2015

- Inventory Turns. Better performance in inventory turns than the peer group average for the period of 2006-2015

- Return on Invested Capital (ROIC). Higher performance on ROIC than the average for their peer group for the period of 2006-2015

- Price to Tangible Book Value. (PTBV). Better performance than the industry average on driving market price of the public stock as a ratio to tangible assets for the period of 2006-2015

We take the long view believing it takes more than three years to evaluate the effectiveness of supply chain strategy. Corporate report data is not readily available before 2006.

I start the research by studying the performance factors: I build a short list of companies within a peer group. After building this list I then ask, “Did the supply chain drive improvement higher than the peer group average for the period of 2006-2015?” To calculate improvement, we use The Supply Chain Index as a measurement of supply chain improvement. Each of the factors—balance, strength and resiliency— comprises 1/3 of the total score.

The methodology is not limited to a best company in the peer group. Each industry segment can have multiple winners. Listed in the runners-up category are companies which met the improvement ranking, but are performing slightly below the industry average for ONE of the performance factors.

Only 5% of public companies meet the definition for the Supply Chains To Admire for 2016. Another 5% of companies are runners-up. In completing the analysis, one of the things which strikes me is that regional supply chains are making more progress than global or multinational companies.

The Challenge of Being Global

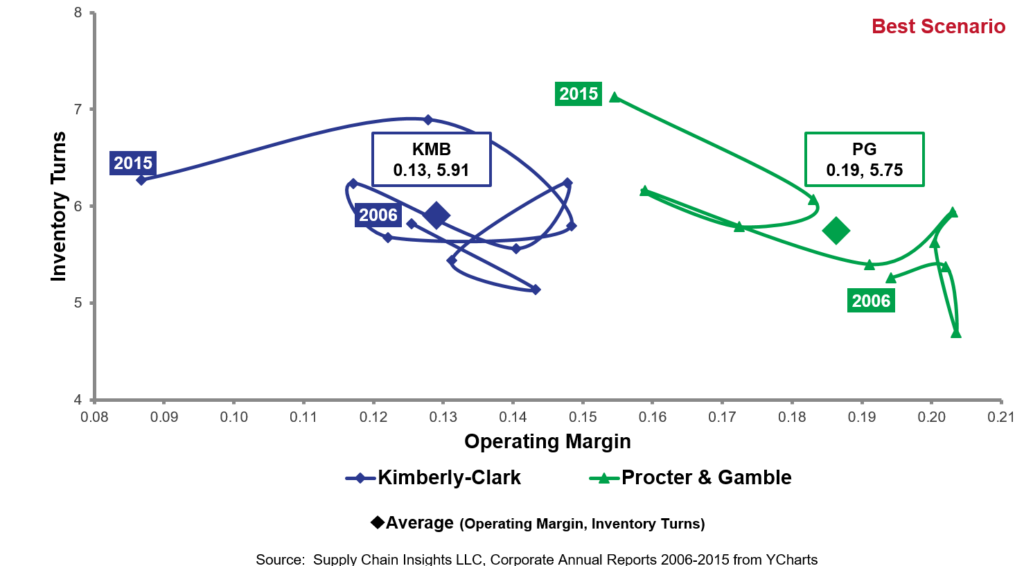

For example, P&G is often touted as a supply chain leader. The Gartner Group lists P&G in a special category in the Gartner Top 25. Listed in the Masters Category is P&G. However, let’s examine Figure 1, an orbit chart for the period of 2006-2015 for Kimberly-Clark and P&G. Like 90% of supply chains, these two supply chain leaders are going backwards in the management of margins. (If you trace the year-over-year pattern, you can see that P&G made progress on inventory turns and operating margin 2006-2007, 2009-2010. In the other years, P&G improves inventory turns but regresses on operating margin performance.) While P&G operates at a 19% average operating margin, as compared to 13% for Kimberly- Clark, the story is in the pattern. A Supply Chain Leader will make progress on both of these key metrics with a very tight and controlled pattern.

Figure 1. Orbit Chart of P&G and Kimberly Clark for the Period of 2006-2015

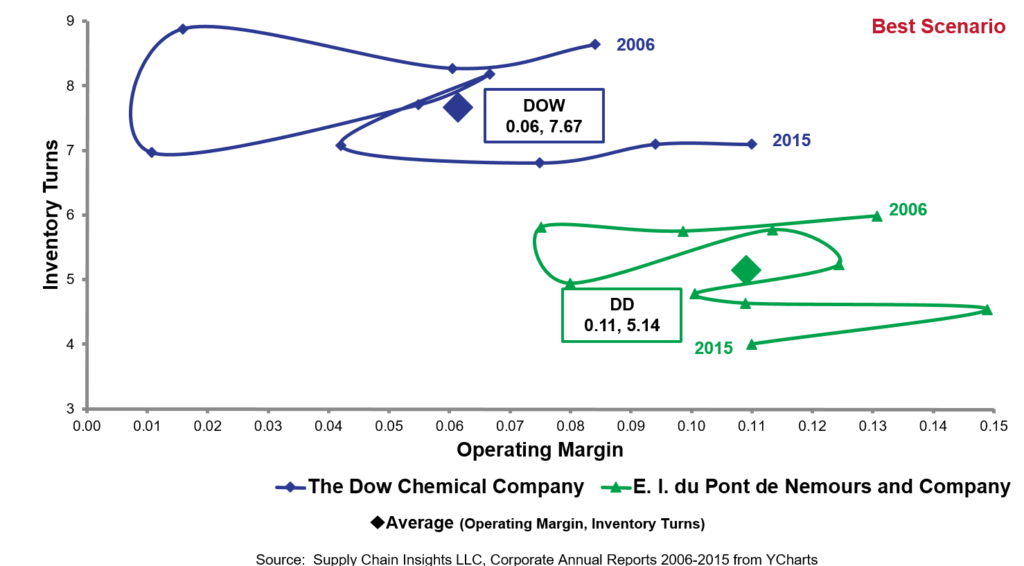

The pattern I see in the Kimberly-Clark/P&G results are the same I see in the annual reports of other global companies. Note the pattern in Figure 2 of Dow and DuPont. Global expansion increased complexity. Global leaders are seeking new answers to build the next-generation global supply chain. Regional supply chain process thinking is not sufficient.

Figure 2. Dow and DuPont Orbit Chart for the Period of 2006-2015

To be sure that we’re accountable to ourselves as supply chain practitioners, I think we need to hold ourselves accountable to balance sheet results. Before we label supply chain processes as “best practices,” don’t we need to validate that we are driving balance sheet improvements?

As I study supply chain practices, I feel that we are guilty of adopting supply chain fads. I find that well-intended supply chain consultants often tout it as the “fix” for supply chain ills. Let’s me start with two fallacies and then share insights on five actions which I think global Supply Chain Leaders should consider.

Lean

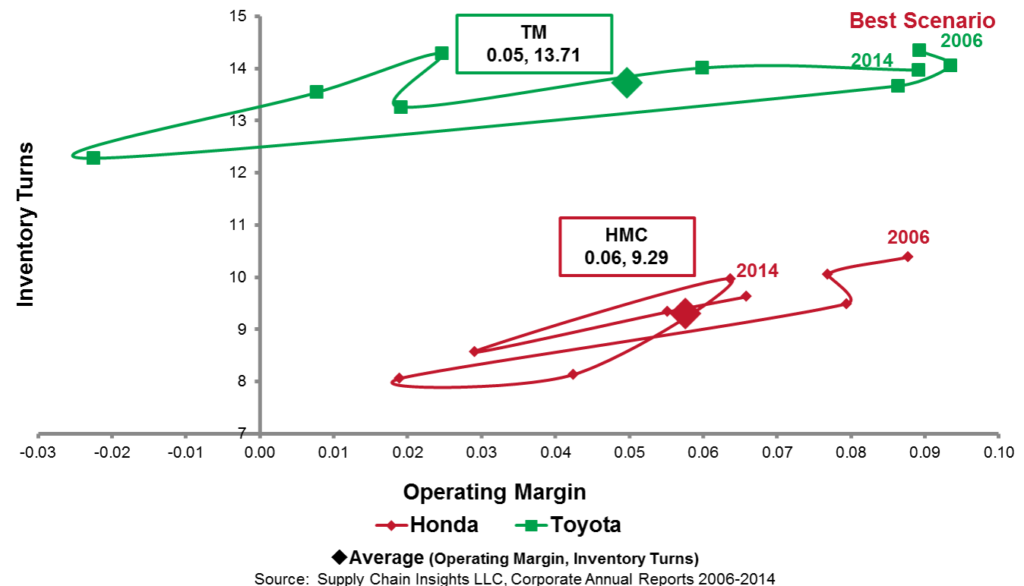

While I believe Lean is a useful concept, I think it is not the only tool within the Supply Chain Toolbox. I often seen Lean too widely applied as the fix of the day for supply chain maladies. I think it is overused and misapplied. There are many companies on a Lean journey without rationalizing if it is the appropriate supply chain technique for the strategy. To illustrate the point, let me ask, “If lean is the answer, why are Toyota’s and Honda’s results (Honda and Toyota are strong proponents of Lean) at the same levels of operating margin and inventory turns in 2014 as they were in 2006?”

Figure 3. Orbit Chart of Toyota and Honda for Operating Margin and Inventory Turns for the Period of 2006-2014

IT Standardization

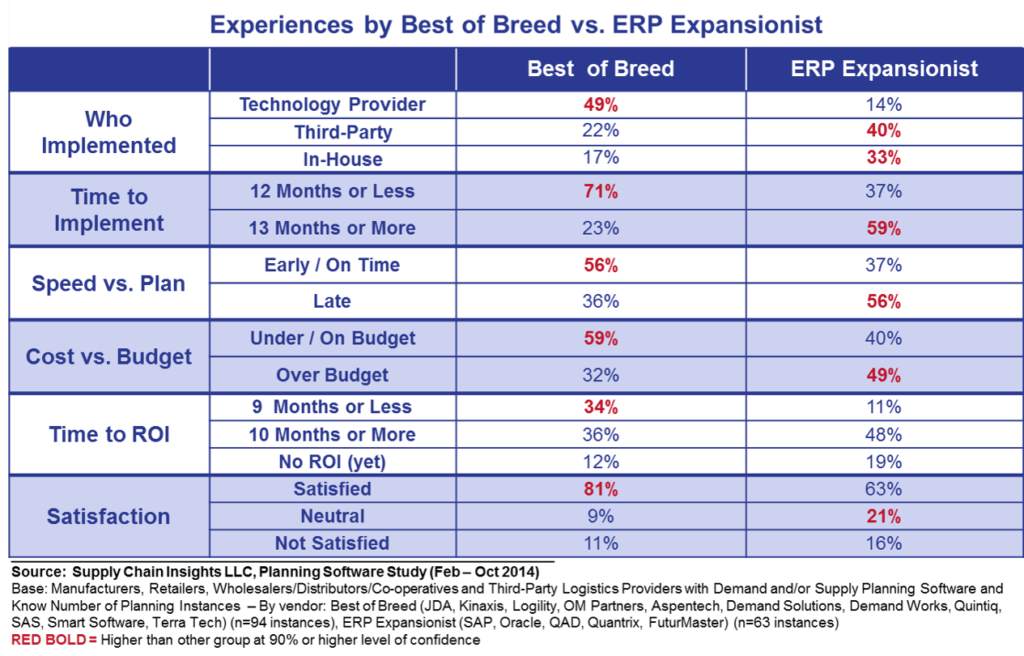

Likewise, many consultants advocate IT standardization as a way to control costs. For most organizations this becomes a political battle between best-of-breed technology selection versus ERP standardization. Best-of-breed solutions offer deeper optimization, but most consultants advocate a single instance ERP and IT standardization. (Buyer beware. This discussion is in the consultant’s best interest. Consultants make money on IT ERP single-instance deployments and they make more money on the implementation of SAP APO versus best-of-breed advanced planning deployments. The reason? They are longer and more complex.)

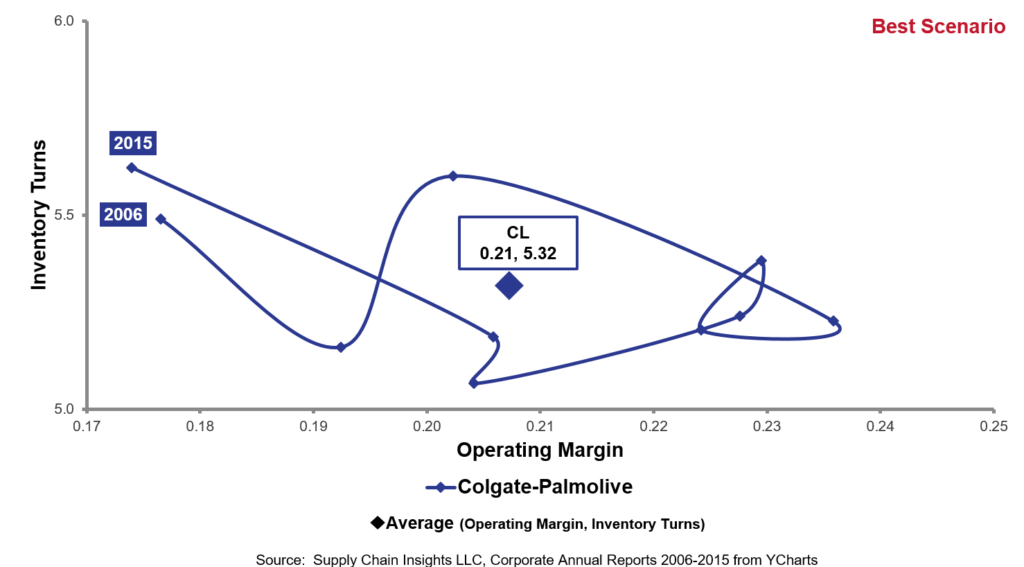

In my research, Colgate is the consummate example of adherence to IT standardization on SAP. However, as we look at Colgate’s orbit chart, it should spark a question of “If IT standardization is the answer for managing costs and inventory, why is Colgate at the same level in 2015 that they were in 2006?”

Figure 4. Orbit Chart of Colgate at the Intersection of Operating Margin and Inventory Turns

Insights on Defining Global Planning Processes

My observation is that as the global supply chain became more complex, supply chain planning is more important. Companies that are better at planning and sharing data are more likely to make the Supply Chains to Admire list.

1) A Focus on Quick Deployment Versus Building Human Capabilities. The supply chain is a complex system with nonlinear relationships. It requires more than simplistic linear optimization. While over 80% of companies deployed supply chain planning, companies are more satisfied with supply chain execution systems than supply chain planning. For most, while planning solution deployments, are underutilized.

One of the reasons is that many companies focused on speed of deployment versus building the organizational muscle to plan. As shown in Table 1, companies that adopted best-of-breed solutions–versus those available in ERP solutions– made more progress at the intersection of inventory turns and operating margin.

While a new generation of cloud-based solutions is evolving, (Today Microsoft and Oracle are redefining planning in the cloud while companies like Anaplan, Demand Solutions, o9, Kinaxis, and Steelwedge are building cloud-based planning.) companies will drive higher value if they DO NOT treat planning as a technology project. Instead, use it to build organizational capabilities. When given a choice between quick and effective, focus on making planning a core part of the global supply chain.

Table 1. ROI and Time to Deploy Different Types of Planning

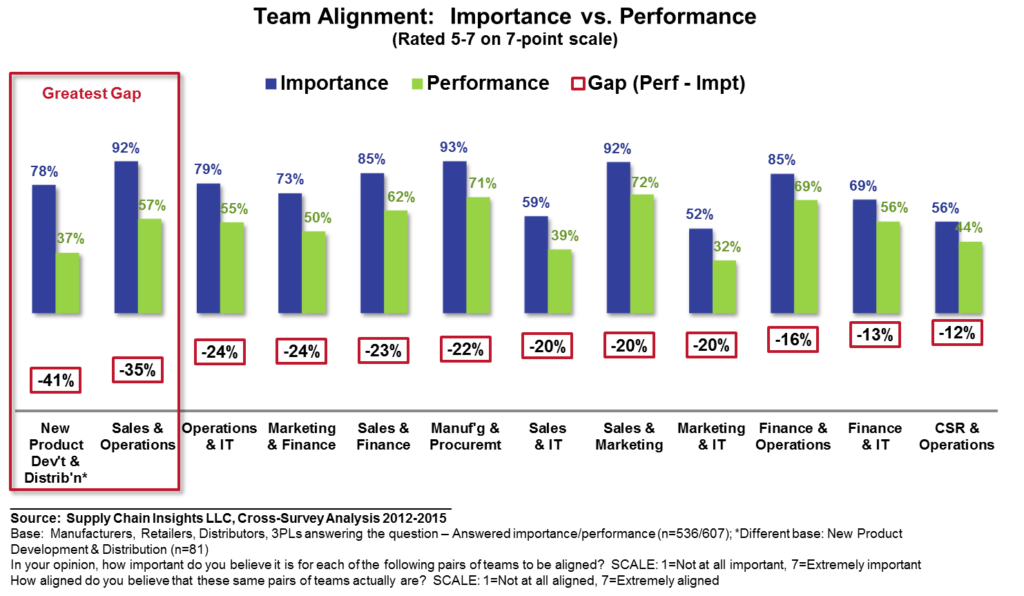

2) Alignment. In the evolution of the global supply chain we have made a number of bad decisions. We have often deployed collaborative sales planning assuming that the commercial teams know the market. The gaps between operations and commercial teams are large, and even larger in global supply chains.

Collaborative sales forecasting input leads to increased bias and error. My advice for the global supply chain leader is not waste your time asking the sales team to forecast. Instead, focus on market drivers. Use market signals to drive forecasting and demand sensing capabilities. Align with the commercial teams and earn credibility through process reliability. Don’t waste the sales department’s time by asking them to forecast. Instead, let sales sell.

Figure 5. Team Alignment

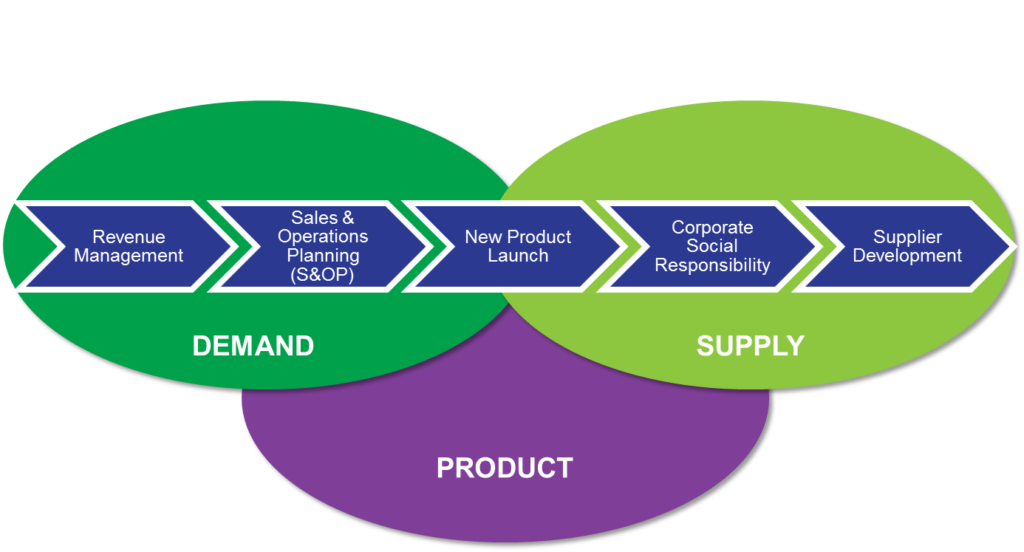

A focus on horizontal processes closes the gaps. To reduce the gap between new product launch and sales, focus on the design of the supply chain at the intersection of S&OP and new product launch. Design planning processes to enable product life cycle sensing. Use techniques like demand sensing, attribute-based forecasting, attach-rate modeling, and network design techniques to define inventory buffers to enhance cross-functional processes. Make new product launch and life cycle planning a part of all the horizontal processes.

Figure 6. Horizontal Processes

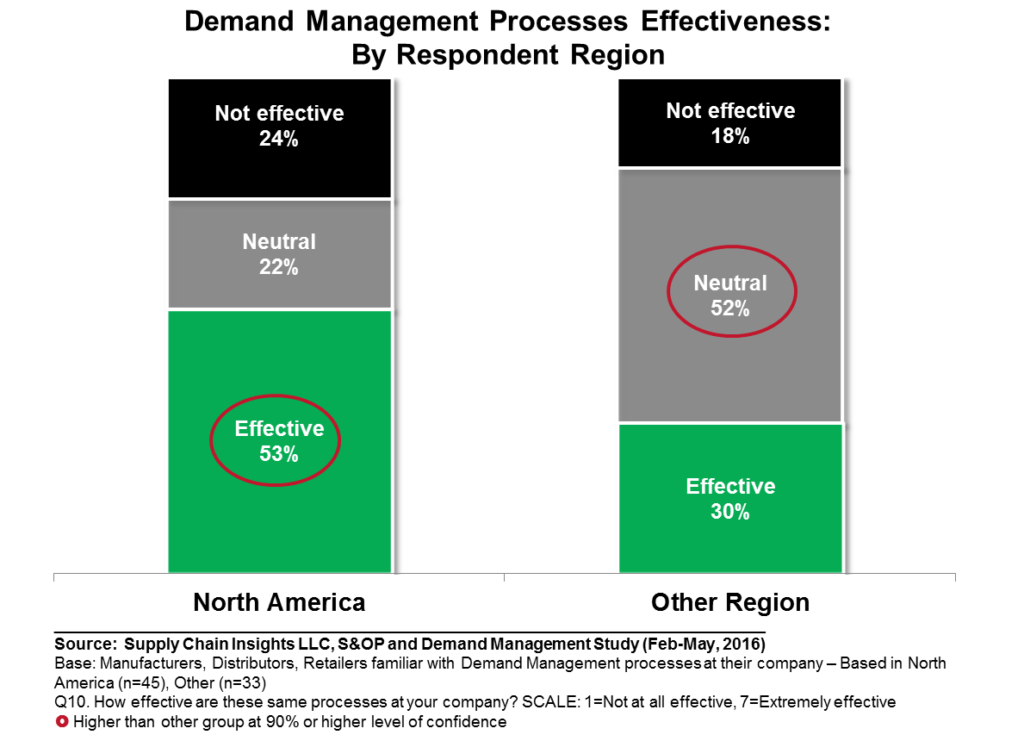

3) Deploying Advanced Planning in Emerging Economies. The horizontal processes depend on supply chain excellence. Capabilities for planning in North America and Europe, as shown in Figure 7, are greater than the growth economies. Acknowledge this and invest in training, skills development, and career paths for planners. Excellence will not automatically happen by having young, energetic, cheap labor in Excel ghettos around the world. It requires discipline and knowledge.

Figure 7. Global Satisfaction with Demand Planning

4) Governance. Supply chain planning processes enable greater access to data. As more and more people can more easily access and use data, the question becomes, “How should we make decisions?” Spend time answering this question. It is not easy. Define the roles and hand-offs. Political issues become barriers if this is not addressed early.

Planning governance is different within each organization, and it varies by sell, deliver, make and source. While sourcing roles are more aggregated, channel support is usually regional. Decide where you should make the pivot in planning and build clear work processes.

Figure 8. Governance in Supply Chain Processes

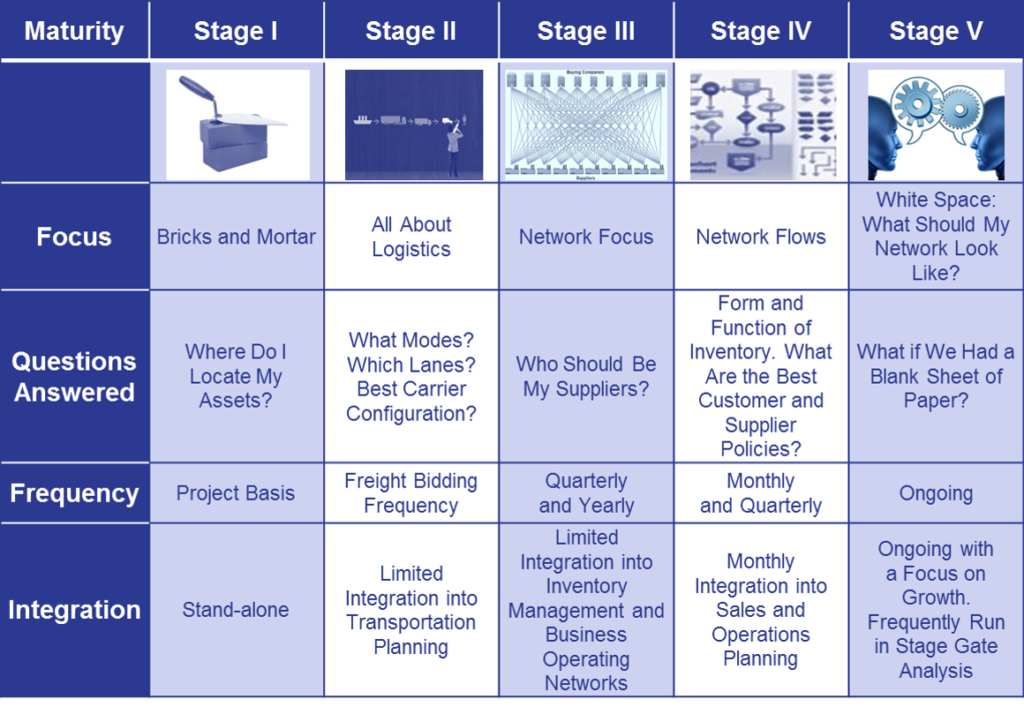

5) Design. The best global supply chains design flows. As the supply chain matures, the term flow matures. The focus moves from just a sole view on supply flows to also include demand, cash, and information flows, along with those of supply processes.

Companies with mature network design capabilities improve alignment and horizontal supply chain process capabilities. Today, 53% of companies design the supply chain, but only 6% are at a mature level of network design capabilities (where the processes are at a regular cadence supporting cross-functional processes). Build network design capabilities. Recognize that the greatest results occur when simulation, combined with network optimization design technologies, defines the plan. (Network design tools will typically give the best result based on optimization of averages, while discrete-event simulation tools like Arena and Anylogic enables the assessment of network design feasibility.)

Figure 9. Network Design Capabilities

I would love to hear from you. What do you think? Why do you think the progress on results in global supply chains is not moving faster? Do you think the definition of next-generation supply chain planning offers promise? What insights do you have to share with the global supply chain leader?

It is time to curtail my travel. I have two months to write and prepare for the Supply Chain Insights Global Summit. There is a lot to do. I am very excited about the program and the content we are developing.

This week we published our new Shaman’s Journal. Order your copy today to learn more about our research on building the global supply chain. We will continue this discussion on this blog in our countdown to the Supply Chain Insights Global Summit.

This week we published our new Shaman’s Journal. Order your copy today to learn more about our research on building the global supply chain. We will continue this discussion on this blog in our countdown to the Supply Chain Insights Global Summit.

(Registration is open for the first 125 participants. We limit the number of technology providers to 25% of the audience.) The conference will be live-streamed. We will be discussing five themes:

- Supply Chains to Admire. Financial Results. A critical look at supply chain processes impacting financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models like Alibaba, Amazon, and Uber.

- Supply Chain 2030. Building Outside-In Processes. Experience the difference between traditional inside-out and new outside-in processes through the use of new forms of analytics.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement and talent development for emerging markets.

We hope to see you there!

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn.

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn.