It is fall. The hot and humid days are giving way to cool and crisp weather. Today, as I type this blog post, the rain is softly falling on my windowsill. The wet streets below signal a shift in seasons. The seasonal rhythms link the threads of our life. As fall becomes winter, supply chain leaders are planning their budgets and building strategies for 2017. With this in mind, in this blog post I make an argument that we, as supply chain leaders, have screwed up direct material procurement. My goal is to have supply chain leaders consider a procurement redesign for 2017. Let me start with the argument, and then conclude with some thoughts on steps to improve results.

It is fall. The hot and humid days are giving way to cool and crisp weather. Today, as I type this blog post, the rain is softly falling on my windowsill. The wet streets below signal a shift in seasons. The seasonal rhythms link the threads of our life. As fall becomes winter, supply chain leaders are planning their budgets and building strategies for 2017. With this in mind, in this blog post I make an argument that we, as supply chain leaders, have screwed up direct material procurement. My goal is to have supply chain leaders consider a procurement redesign for 2017. Let me start with the argument, and then conclude with some thoughts on steps to improve results.

The Argument

As shown in Figure 1, roughly one in two supply chain organizations have responsibility for procurement. Most of the focus in the last decade was on indirect procurement. The opportunity is in the management of direct procurement. The difference? Direct procurement ties directly to manufacturing conversion processes through a bill of materials, while indirect procurement is not an input to the manufacturing processes. Indirect procurement includes office supplies, professional services and temporary labor.

In the last decade the use of new technologies drove significant improvement in indirect procurement. Examples include control of maverick spend, qualified vendors, electronic bidding and price comparisons. This is not the case with the purchase of direct materials. Direct material purchases are still controlled by Material Requirements Planning (MRP) and traditional buying processes. The focus is primarily about the reduction of purchase costs. The issue is that the MRP signal, while precise, is inherently inaccurate. As demand latency and error increased, MRP is a less dependable signal. This is more true in 2016 than it was in 1996 when the traditional ERP/APS systems were designed.

The second issue is that companies need to focus on value while balancing costs. The systems deployed through conventional MRP systems in ERP enable buying, but do not enable visibility of supplier viability, reward innovation/contribution of new ideas, and drive improvements in corporate social responsibility. (This is important since approximately 65% of nonrenewable resources are in the extended value network.)

Figure 1. Supply Chain Reporting Structures

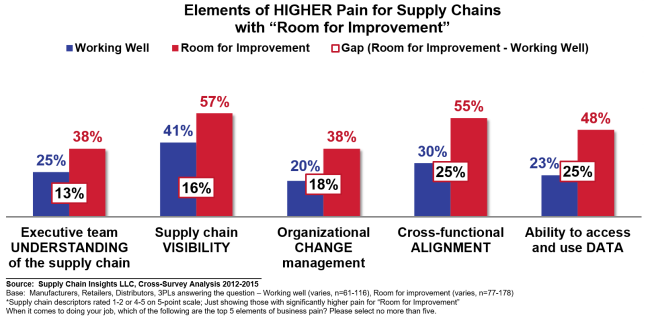

Companies that believe their supply chains are working well have better alignment between manufacturing and procurement, and visibility of the extended supply chain relationships of not only first tier suppliers, but also first and second tier relationships. Progressive companies are actively working supplier development programs, risk management plans and corporate social responsibility programs in unison. There is congruence. These factors have significance at a 90% confidence level; however, only one in three companies feel that their supply chain is working well.

Figure 2. Characteristics of Companies that Feel Their Supply Chains are “Working Well”

Today the average company uses 5 technology applications to manage direct procurement. The most frequently used are office productivity and ERP solutions. When we contrast what companies feel is the most important in selecting a direct materials supplier versus the current state of technology, as shown in Figure 4, the greatest gaps are in the areas of financial viability, driving innovation, measuring and nurturing the relationship, and corporate social responsibility. These risks in supply chain are growing unchecked.

While technology vendors were quick to put the term “relationship” into the naming conventions of transactional “Supplier Relationship Management Systems,” it is clear transactional systems do not improve relationships. In the past decade, as companies rolled out single instances of ERP, most manufacturing became more difficult to do business with. Those with Business Process Outsourcing (BPO) are significantly worse than those who have focused on building procurement as a core competency within the organization.

In business there is always the carrot and the stick. In the past decade the stick got bigger with suppliers seeing the carrot seen less and less. As growth slowed, and the focus increased on costs, manufacturing procurement organizations became very functionally oriented; and as a result, the procurement function focused on squeezing suppliers for lower costs, and enforcing longer terms for payment. Vendor setup times in procurement increased (setup times take an average of 48 days), and most suppliers feel “portaled to death.” While being pushed on costs, they are not getting good information or aligned to drive value. Why? Few manufacturers have taken ownership of their demand signal, built effective visibility networks, or driven incentives for sharing innovation. Today 40% of companies have a supplier development program, but only 21% of companies surveyed feel that they are successful.

Figure 3. Contrast of Company Performance on Supplier Management of Direct Materials Versus Performance of Current Technologies

Why It Matters

The prescription? The answer lies in cross-functional process redefinition. Companies need to focus on the redesign of procurement in context to the effective implementation of horizontal processes. When we tested 65 characteristics of supply chains against improvement in Price to Tangible Book Value, we found four factors correlated. This includes an effective center of excellence, robust Sales and Operations Planning processes, supply chain viability, and supplier reliability. Shown in Figure 4 are these correlations.

Figure 4. Analysis of Factors that Drive Value

Seven Strategies To Consider:

Driving value and improving risk is important because we have never had a less viable, and more fragile supply base. Demand volatility and supplier viability are increasing risks today for the supply chain leader. The management of the supply base is a requirement to improve product quality. The focus over the last decade on transactional systems, auctions, and portals has not been equal to the challenge of today’s supply chain.

Figure 5. Supply Chain Risk Factors

- Align. Design and Build Collaborative Workflows. Two out of three companies have aggregated procurement. While procurement is global, innovation centers are regional, and manufacturing is more local. In the development of commodity strategies, there is a need to focus at the intersection of new product launch and sourcing, manufacturing and procurement to drive manufacturing reliability. One of the large gaps with today’s technologies is the sharing and review of design documents. In discrete manufacturing, collaborative workflows between suppliers and globally dispersed parties within a large organization are critical. These workflows are not present in ERP. Use an augmentation strategy. Consider using a combination of Product Lifecycle Management solutions like Oracle/Agile, Enovia, Siemens Team Center in combination with direct material technologies like Directworks, Pool4Tools, and SupplyOn to view and collaborate on design specifications and requirements.

- Be Easy to Do Business With. Today less than one in four purchase orders are processed hands-free. Minimize the time for vendor setup and ensure that vendors can get the data they need. At one A&D manufacturer that I work with, they staff a hotline with an experienced engineer to answer quality of design questions from suppliers directly with experts. The focus is on making it easy for the supplier to get the right answers. Analyze your current processes.

- Tie Manufacturing Planning to Direct Material Sourcing Strategies. Less than 5% of companies have successfully connected supply planning processes to direct material requirements planning. Consider the use of technologies like E2open and Kinaxis to translate manufacturing requirements into sourcing requirements. Transmit manufacturing schedule changes through networks to ensure a system of record.

- Take Ownership of Data. For most suppliers the translation of demand into requirements is problematic. In the last decade demand accuracy has decreased, and despite the investment in many technologies, the improvement of the demand signal to the supplier has not improved. Hold yourself accountable. Consider tying incentives to better demand signals. If you can give the supplier a better demand signal can they give you a better discount?

- Use Market Data. Drive Purchases from Independent Demand. The work that Carol Ptak and the Demand-driven Institute is doing on the redefinition of MRP to be driven from an independent demand signal is very promising. Where possible, use channel demand in determining requirements and push for technology vendors to adopt the DDMRP principles. Consider a DDMRP pilot with your strategic technology vendors.

- Drive and Align Reward Systems. Get the carrots out of your desk. Reward suppliers to share innovation through open innovation networks. Build systems to enable visibility between new product launch requirements and the qualification of new suppliers. For most this is the major gap. Flowchart the flows between new product launch supplier identification and the time to onboard a new supplier and review/refine specifications for qualification. Work to shorten the times and make the processes more effective.

- Invest in New Technologies and Approaches for Direct Material Procurement. Recognize that SRM systems are a fit for indirect procurement, but the building of effective processes for direct procurement requires a redesign, outside-in, and the partnering with best-of-breed solutions. Don’t confuse indirect technologies with the needs of direct procurement. They are distinctly different.

I look forward to getting your thoughts on this topic. Ideas to share? All the best in your building of 2017 strategies. Let us know if you have any questions.