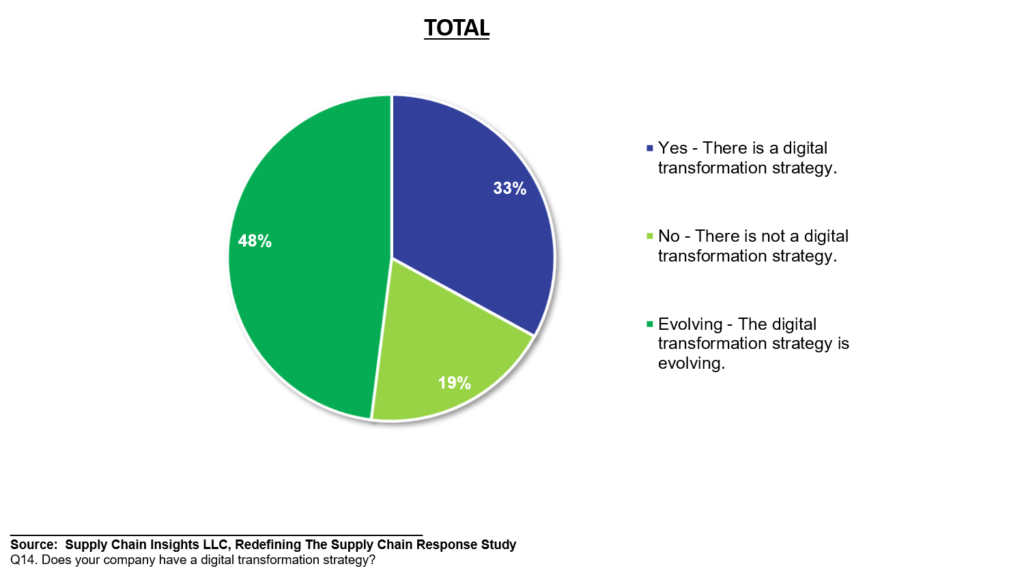

In a recent research project, we found that 2/3 of companies had a digital supply chain transformation strategy; however, those that were evolving their strategy performed better during the early months of the pandemic than those that were “clear” on the project plan for a digital transformation. I know, a head-scratcher.

My conclusion? Sometimes organizations are too sure and chase shiny objects, push a fad, or fall prey under the spell of a Supply Chain Conquistador. Let me explain.

The Quest for a Digital Supply Chain.

The Spanish Conquistadors sought God, glory, and gold. The supply chain warrior selling digital supply chain concepts has similar goals.

To maintain the support of the Spanish crown and the Catholic Church, the cunning Cortés always gave an expedition a religious angle. For many tech providers, the message often becomes a religious argument. Who has the best approach? In the process, there is a fine line between marketing hype and overpromising, making buying difficult.

The race started in 2016 as a foggy definition of digital appeared in supply chain marketing from technology providers. Today, there is no standard definition of digital. The numerous definitions across the supply chain technology and consulting providers are very different and often confusing. Let’s take a look:

- Digital Brain. For o9 Solutions, the marketing message is the “Digital Brain.” What is a digital brain? I have no idea. On the website, there is no definition, but the implementations focus on a deeper optimization using traditional APS taxonomies in a Graph database. The graph approach enables taxonomy flexibility, but I find clients confused about defining a digital strategy for planning.

- Supply Chain 4.0. For McKinsey, the moniker is synonymous with supply chain 4.0. What is supply chain 4.0? It combines robotics, analytics, and the Internet of Things (IoT). (McKinsey promises improved agility (not defined) with up to a 30% reduction in operational cost and a decrease in inventory of 75%. (I am not sure this is possible or desirable in this world of heightened variability.)

- Digital Supply Networks. At Deloitte, the focus is on digital supply networks for a digital thread that connects the physical to digital, digital to digital, and digital to physical. In theory, digital Supply Networks establish a “digital thread” through physical and digital channels, connecting information, goods, and services in powerful ways. Yet, the models depict traditional supply chain software deployments. There is no network provider in the market that is equal to the delivery of Deloitte’s vision. Companies are stuck having to deploy multiple networks that do not interoperate. (For example, I am working with a client that has deployed Ariba from SAP, GT Nexus from Infor, Everstream, and Project 44. When asked how to drive interoperability, I replied, “There is no good template. Companies operate these networks in isolation as functional deployments.”

- Integrated Cloud-Ready Portfolio. In contrast, SAP touts an integrated cloud-ready portfolio that includes predictive analytics, automation, and IoT capabilities. Looks similar to McKinsey, right? The difference is the technology mix and the focus.

- Digitalization. For the Association for Supply Chain Management (ASCM), the definition is digital transformation or digitalization, which is the process of developing digitized data, integrating communications, and automating processes to improve performance. The assumption is that digitizing current processes will drive value. I am not so sure.

In this high-stakes play, with a myriad of definitions, is there any wonder that confusion reigns? And, shouldn’t the discussion be about improved supply chain capabilities, not the selling of technology for technology’s sake? Or the pushing of religious arguments to satisfy egos?

Shifting From a Focus on Technology Feeds and Speeds to Building Business Capabilities

My question is simple. Where are the business models that help buyers to rethink processes to gain insights on how to drive value based on these technological advancements? My answer? They do not exist.

Most deployments I see only focus on driving yesterday’s processes faster: which I believe is a recipe for disaster. For example, deeper analytics into poorly implemented planning systems makes terrible decisions faster. I see this every day. Dramatic improvement only happens when planning models use market data and the focus changes to evaluate an outside-in model to reduce latency. (For reference, check out the testing on outside-in processes that will publish in Journal of Logistics in January.)

Rethinking Processes Based on Technology Advancements To Drive Improved Business Capabilities

The business goals vary. It may be the delivery of a seamless experience for the consumer across channels. Or increased visibility of orders and shipments to improve order delivery reliability. The key is that an excellent digital supply chain strategy starts with a clear goal rather than a list of technologies.

For example, using NoSQL unified data models can reduce the latency of collecting perpetual inventory data from multiple integration points (warehouses, third-party logistics providers, and service providers) by 70-80%, improving the accuracy and responsiveness of Available to Promise (ATP). The technology is the easy part, but making a conscious choice on inventory deployment is challenging for companies. No salesperson wants to deliberately choose which of their customers to short when dealing with real-time data.

Here are some additional examples:

- Hands-free processes? Paperless and touchless transactions? Is the goal to improve employee retention? Or the quality of conformance? And how will it be measured? I have seen several successful projects focused on hands-free processes to improve order management and plant floor performance. The win occurs when the focus is on reducing redundant work and streamlining flow.

- Artificial intelligence? It should never be AI for the sake of AI. Is the goal to mine patterns from channel data to improve sensing or map data based on pattern recognition? The most successful AI projects I see the focus on mining data insights from disparate data—trends for listening posts, customer sentiment, and improving inbound delivery through root cause analysis.

- Machines talking to machines? The evolution of intelligent agents and software bots? Is the goal better process control? Or improvement of supply chain visibility or repair automation and an improvement in machine parts? The deployments need a clear goal with a learning engine based on a rules-based ontology. The success I encountered in this area is in cold chain lifecycle management and improving the uptime of heavy equipment.

- 3-D printing based on digital images? Is the goal to improve the uptime of a heavy asset and prevent downtime? Or to redefine service? If so, how will the company transition from 2-D to 3-D documentation and drawings and redefine tolerances for additive manufacturing?

- Semantically structured knowledge? Proactive insights? Companies struggle to use data. The important question is, if companies build new and better insights, how will the team redefine work to decrease process latency (the time to make decisions based on better insights)? The average process latency of market demand data is 4-6 weeks.

- Digital twin? I love the concepts of the digital twin and network design. But, as companies deploy these models, how will they define the governance to use the models? Within a company, manufacturing plants compete for volume, and sales teams challenge order management for their share of inventory. It is not enough to produce the models. The focus needs to be on how to build governance processes to use the models.

- Robotics? Self-driving cars? Automation requires the redefinition of work. How will jobs change with this evolution?

- Real-time? What does real-time mean? And, why does it matter? We are not clear on how to use real-time data without creating noise. My advice? Focus on defining data and process flows with minimal latency at the speed of business while recognizing that the cadence of business varies by process, product, and time horizon.

Web 2.0, the interactive web, and Web 3.0 technologies powered significant change in social media and e-commerce, but the supply chain is playing catch-up. The most significant barrier is not technology: it is the redefinition of work to improve business capabilities.

While the Supply Chain Conquistadors push the digital message, don’t fall prey to shiny objects or engage in religious arguments. Instead, do digital your way. First, clarify definitions and educate your teams to gain a base-level understanding of new technology capabilities. Then focus on how to use these insights to improve business capabilities. Never go down a rat hole of digital deployment without testing and learning. The last thing you should do is spin a meaningless RFP into the market or try to automate yesterday’s processes with a new optimizer.

Conclusion

The supply chain industry is ripe for rethinking outcomes based on new technology capabilities. When you use the term digital, stop and define it with a focus on business outcomes. The industry is currently at a stalemate. The Supply Chain Conquistadors spin powerful stories while selling expensive software primarily for personal gain. Business leaders want a well-defined ROI and low-risk project, yet the industry is unclear on how to use digital technology capabilities to improve outcomes. Answering this question requires a new form of business collaboration for technology and business leaders to innovate together.

What are your thoughts? I would love to hear your stories.