Usually in a fairy tale there is a big, bad wolf… or a hairy monster. One that is going to eat you up!

In part one of this blog series, I started the saga of the supply chain fairy tale. It was a story where people believed that functional excellence leads to supply chain superiority. Year after year, well intentioned people toiled against improving metrics that reduced, not improved, the effectiveness of the supply chain. The example that I give in the first post is the focus of manufacturing strategies to drive strong results to improve Return on Assets (ROA) that have actually caused a deterioration in operating margin. For the supply chain traditionalist this may seem counterintuitive, but I make the argument that three primary factors have changed– go-to-market strategies, cost inputs and the basic rhythms and cycles of the supply chain –and, that there is a need to manage the supply chain cross-functionally to drive end-to-end progress. I strongly feel that a blind focus on functional excellence will cause the supply chain to become out of balance.

Here I want to make the argument that the big bad wolf that is swallowing up the supply chain is investment in traditional technologies that were primarily designed to improve manufacturing decision making processes by reducing only manufacturing constraints. I feel that there is an opportunity cost to the organization to work on their third or fourth ERP upgrade and look blindly, and only, at analytics from the ERP vendor. Instead, I would like to see companies invest in new forms of analytics to better use existing data. The argument that I want to make here is that the supply chain problem has changed, but we are implementing the same old technologies without stopping to realign against new goals. Here is my argument.

Based on recent research, today, over 90% of companies have an Enterprise Resource Planning (ERP) system and an Advanced Planning System. These technologies are mature. We are in the evolution phase of user-based enhancements. The consolidation of this industry has served the technology providers well, but has largely stymied innovation. Yet companies are still investing millions of dollars in these upgrades. I feel that many of these technologies are now legacy.

I feel that continued investment in multi-year ERP systems is the big, bad wolf. The opportunity cost to an organization is huge. Based on the analysis of financial ratios, I can clearly see that companies with the best results on revenue-per-employee have strong ERP systems, but they have implemented once and have avoided multi-year evolution projects. ERP is valuable to improve transactional accuracy, but I can find no evidence that investments in ERP have reduced inventory or improved cash-to-cash cycles. I believe that the ERP and APS systems that were developed in the 1990s are now largely legacy applications. I also believe that companies should stabilize their investments in these technology areas and begin to push the acquisition of technologies that can better align with the organization’s need to reduce operating margins, absorb volatility and drive agility.

While some would point to companies like Amazon and Apple as examples of how to solve this dilemma, I think not. Don’t get me wrong. I like Amazon and Apple, and I admire the leadership within each of these companies that had the courage to redefine business models. For most companies, the use of supply chains to redefine business models is not a current reality. They see supply chain as a function within the organization not supply chain as a way of doing business. They do not have the power to redefine business systems to be an Apple or an Amazon. So, to hold up Apple and Amazon as points of light to help companies go forward is a bit like saying that Lora Cecere will be the February Cover Girl model on Vogue magazine. You got it! It is a low probability that this will ever happen.

Table 1. Ten-year averages – food manufacturing companies

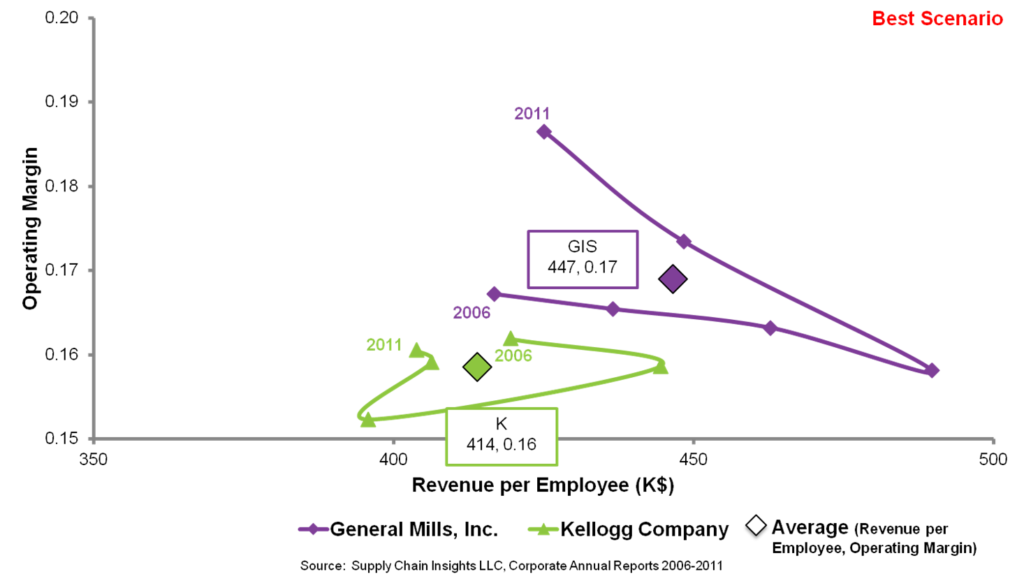

Figure 1. Metrics comparison of Kellogg Co. vs. General Mills, Inc.

A Case Study

As a researcher, due to merger and acquisition activity, it is getting harder and harder to compare companies. The peer groups are growing more and more complex. It is tough to compare conglomerates, and I do not believe that you can put companies from all industries in a spreadsheet and shake them up. Instead, I think that the best insights come from comparing peer groups. In table 1, I compare ten-year averages (2001-2011) for food manufacturing companies. In this industry, operating margin has decreased by 1%, Return on Assets has decreased by 2%, SG&A margin has increased by 1%, and days of inventory has increased by 3%. The only good news is that revenue/employee has improved by 29%.

The answer is not to be like Amazon or Apple. I think that the answer is to be more like General Mills. Note in the figure above how General Mills has improved operating margin for the past three years. I compare General Mills to Kellogg to give some contrast. Over this period, the cereal business has been hard hit by commodity price increases and private label. Corn and oil have tripled in cost. Both are more volatile.

So why has General Mills been able to increase operating margin, and the peer group has not? The reasons are many; but, I think one of the core reasons is General Mills is good at supply chain planning. They are not only near the top of their peer group in forecasting, but they use their forecasting analytics to drive better plans. They have become best-in-class at network design and they are very active in the use of advanced technologies for inventory optimization. Unlike many companies that buy technologies for a project and then do not use them, General Mills has built the teams to actively model demand and supply and drive better results. They have had the courage to give up ROA to drive better operating margin.

Where to Invest?

So, if you are a supply chain leader, what do you do? Where do you invest? I feel strongly that the answer lies in the use of new forms of analytics for network design, demand and supply sensing, supply chain visualization, demand orchestration (horizontal orchestration of demand and supply variability for price, material substitution, and alternate sourcing), and the use of listening posts to better understand unstructured data from the channel.

It cannot be a fad, it needs to be part of the DNA. Multi-tier inventory optimization was a fad in the last decade. It was overhyped and largely underdelivered. Unfortunately, I see that many companies have invested in inventory optimization and have not reduced inventories. The answer is a lot like why people do not lose weight on diets. It takes commitment, hard work, and discipline. These are three characteristics that elude many organizations.

In closing, I want to leave you with a couple of thoughts. There are many technology vendors that will knock at your door, and your day will be packed with meetings, but stay focused on what matters. Our goal in the supply chain was to reduce costs, improve customer service, reduce inventories and drive growth. Over the course of the last decade, we have gone backwards not forwards. I think that we need to hold ourselves accountable to financial results. I think that it takes new forms of analytics to push us off of this supply chain plateau. However, it has to be part of the DNA: it cannot be a fad diet. Let me know what you think.