Definition: “Customer–centric is an approach to doing business that focuses on providing a positive customer experience both at the point of sale and after the sale in order to drive profit and gain competitive advantage.”

Today I am flying to see the leadership team at Cummins Inc. (Included in this post is Cummins’ digital award for the 2016 Supply Chains to Admire.  All winners received their digital images this week.) I am on a mission. My goal? I want to understand why some companies outperform on the Supply Chain Metrics That Matter while others do not. I am enlisting their support to share their stories in podcasts, blog posts and at the Supply Chain Insights Global Summit on September 6-9.

All winners received their digital images this week.) I am on a mission. My goal? I want to understand why some companies outperform on the Supply Chain Metrics That Matter while others do not. I am enlisting their support to share their stories in podcasts, blog posts and at the Supply Chain Insights Global Summit on September 6-9.

Sleep deprived, this morning I am stumbling through the airport in an Olympic coma. It is a condition of too little sleep due to fabulous late night coverage of the 2016 Olympic Games in Rio. I love the Olympics. I am sure the words “true Olympics junky” will be on my tombstone.

For my readers that fly Delta, you know that this was a tough week to travel. My plane was five hours late on Monday and the scenes at the airport were chaotic and brutal. The Delta Medallion customer service agent told me that she had never seen anything quite like it. A tough time for all.

For my readers that fly Delta, you know that this was a tough week to travel. My plane was five hours late on Monday and the scenes at the airport were chaotic and brutal. The Delta Medallion customer service agent told me that she had never seen anything quite like it. A tough time for all.

For five hours on Monday I sat in the airport watching the monitors. They were never updated with the correct information. I followed the angry herds at the gate. (People shuttled from one gate to another based on random and usually incorrect information.) I finally gave up and aborted my plans and went home. I was one of the lucky ones. An IT power outage stranded travelers around the world. #Deltafail trended all day on twitter.

As I sat at the airport waiting on my flight, I worked on my presentation for the Supply Chain Insights’ webinar on building a customer-centric supply chain on August 17. Dutifully I plugged in my laptop with each gate change, and keep working as the irate crowd ebbed and flowed with six gate changes on bad information over the course of five hours. I know. An ironic, and unfortunate, set of events. However, it gave me some great time to think. Here I share my thoughts on building a customer-centric supply chain strategy.

What Is a Customer-Centric Strategy? How Does It Tie to the Organization?

About twice a month companies ask me to review their strategy documents. Frequently I see the goal of “build a customer-centric strategy” or “define an end-to-end vision to deliver on the customer promise.” However, when I probe and ask companies to explain what this means, I get either a pregnant pause or a blank stare. Many will say “Isn’t it obvious?” I shake my head and answer, “No. It requires a careful execution of strategy and the connection of strategy to execution.” All too often supply chain leaders are good at high-level vision, but weak at connecting the vision to execution. It requires big wings and big feet. (Big wings represent the ideation and creation of the strategy, and the big feet represents the execution. The Customer-Centric Supply Chain Strategy needs both.)

About twice a month companies ask me to review their strategy documents. Frequently I see the goal of “build a customer-centric strategy” or “define an end-to-end vision to deliver on the customer promise.” However, when I probe and ask companies to explain what this means, I get either a pregnant pause or a blank stare. Many will say “Isn’t it obvious?” I shake my head and answer, “No. It requires a careful execution of strategy and the connection of strategy to execution.” All too often supply chain leaders are good at high-level vision, but weak at connecting the vision to execution. It requires big wings and big feet. (Big wings represent the ideation and creation of the strategy, and the big feet represents the execution. The Customer-Centric Supply Chain Strategy needs both.)

In my work with clients many companies have customer-centric goals, but there are few compelling case studies. During my webinar on August 17, I will co-present with Mark Hersh from Clorox. I am proud of Clorox. The Company was my client for many years at AMR Research, and when I look at Mark’s slides for the webinar I see many of the elements that we heatedly debated back in 2009-2010. In these sessions, when I pushed Mark and his colleague Dave Nagle to define the number of supply chains and the customer strategies for each, frustration abounded. We talked about it at great lengths for two years. It is not an easy answer. However, they accepted the challenge and defined customer strategies for each supply chain type. In the webinar, Mark will share his story

When I called Mark to tell him The Clorox Company outperformed for the period of 2009-2015 in the Household Products sector and won a 2016 Supply Chains to Admire Award, he said, “Lora, I am happy to help. Your advice was a large part of our journey.” (Mark will also be speaking at the Supply Chain Insights Global Summit on September 6-9, 2016.

Customer-Centric Strategies

Last week I visited a client. For four years the company supply chain team argued about the number of supply chains, the customer segmentation strategy, and how to tie customer policy to execution. The heated debates fueled energy, but little action. As I watch teams of consultants working with the client, I shake my head. So much discussion, yet so little action. For two years I have seen the teams argue on how many supply chains they have without a goal in mind.

So while building and sharing scorecards is a starting point, the companies that are the most customer-centric have ten characteristics:

1. Clarity of Purpose for the Buyer. Many times companies are not clear on who is their customer. For example, in the medical device supply chain is the customer the doctor, the hospital, or the patient? And, is the focus on efficient sickness, or health and wellness? This is a different supply chain response. Similarly, in Agrosciences is the customer the distributor of seed/additives, the farmer, or the downstream purchaser of food products? And are they selling products or crop yield? In the case of the consumer supply chain is the customer the retailer, the shopper, or the end user? And how do customer-centric supply chain strategies evolve based on promotion strategies and the digital path to purchase? Clarity is the first step.

1. Clarity of Purpose for the Buyer. Many times companies are not clear on who is their customer. For example, in the medical device supply chain is the customer the doctor, the hospital, or the patient? And, is the focus on efficient sickness, or health and wellness? This is a different supply chain response. Similarly, in Agrosciences is the customer the distributor of seed/additives, the farmer, or the downstream purchaser of food products? And are they selling products or crop yield? In the case of the consumer supply chain is the customer the retailer, the shopper, or the end user? And how do customer-centric supply chain strategies evolve based on promotion strategies and the digital path to purchase? Clarity is the first step.

2. Take Ownership of the Channel: Drive Reliability and Excitement. While driving reliability is the first step, bringing excitement through new products and services, and approaches to the market ignites the relationship. Use channel data and orchestrate supply chain policy to improve outcomes. For example, over the weekend a group of drug retailers were laughing about Procter & Gamble. The conversation focused on P&G’s slow response to adapt to smaller units and flexible shipping policies. The group of three retailers feel that the company is just now executing on a strategy—North American distribution mixing centers and reduction in case pack sizes.

3. Build Segmented Customer Strategies: Tie Strategy to Policy/Execution. Price and shipping policies should go hand in hand. The company that is the easiest to do business with—trucks move smoothly at the dock, returns are low, and orders are hands-free– should get preference. Likewise, the most strategic customers need to have preference on allocation strategies, Available to Promise (ATP) and lead times. An order is not an order. Likewise, a customer is not a customer. Segment and tie order execution policies to segmentation to drive value.

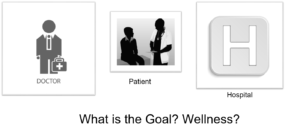

4. Cost-to-Serve with Data-Driven Discussions. Less than 10% of manufacturing companies are effectively using cost-to-serve analysis. Why? It is easier to start a program than to keep it running. The issues are numerous. Getting to data and managing the cross-functional interactions are difficult. An exception is L’Oreal.

Shown in Figure 1 is a cost-to-serve analysis. The example shows the relative distribution costs by retailer. Review of this by a cross-functional team helps to align to improve customer value.

Figure 1. Cost-To-Serve Analysis

5. The Supply Chain Has a Clear Focus on Outcomes. Reliability is the hallmark of great customer service. At one time, earlier in my career, I believed that scorecards could bridge the gap between buyers and suppliers, and that it would help supply chain teams forge new levels of value.

Today, after about a decade of use, we find that the most used scorecards—those for retail compliance–improved on-time shipping performance, but fell short in driving customer-centricity. The improvement on delivery is not trivial, but is the tip of the iceberg of what is possible.

Figure 2. Impact of Customer Scorecards on Supply Chain Performance

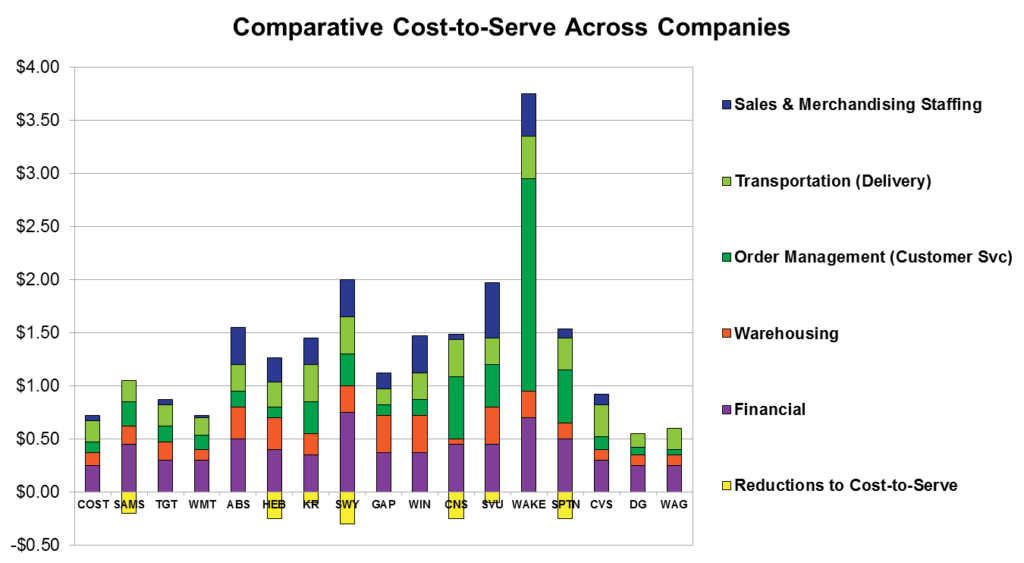

6. Alignment Between Operations and Commercial Teams. The greater the alignment issues between operations and commercial teams, the tougher it is to drive customer centricity. As shown in Figure 3, the largest issue is between sales and operational teams.

Figure 3. Supply Chain Alignment

7. Build Outside-In Processes. While the SCOR models and traditional supply chain practices are inside-out, i.e. processes starting with the order and focused on order execution, outside-in processes start with the channel, use the channel data to sense, and has flexible policies and systems to improve agility. Processes built on channel data reduce demand latency and improve the agility of the supply chain to work with item complexity.

Figure 4. Long Tail of the Supply Chain

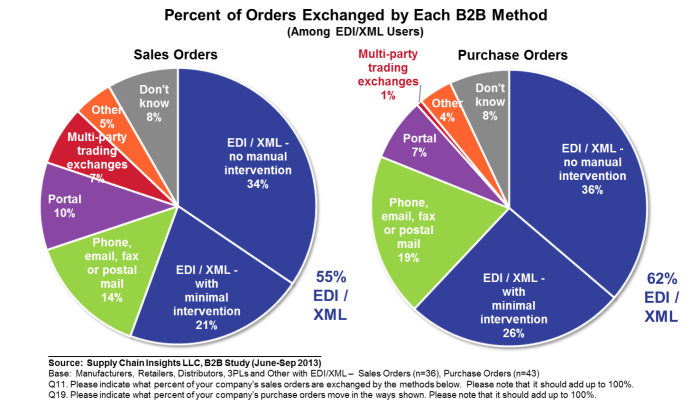

8. Hands-Free and Reliable Order Processes. While we are on the second generation of IT spending, as shown in Figure 5, the percentage of hands-free orders is low. To be reliable, focus on hands-free processes. Not only does it take a day out of the order cycle, but the lack of matching is usually the result of more systemic issues. Working the issues drives exponential gains.

Figure 5. Hands-Free Orders

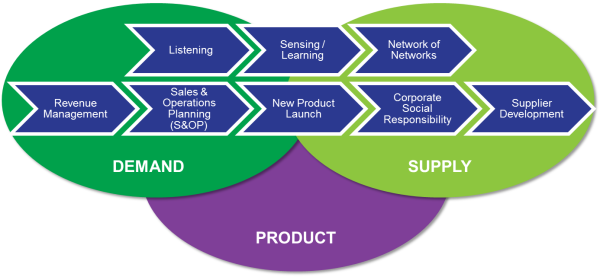

9. Cross-Functional Listening. I know five companies that are working on cross-functional listening. Use of unstructured text to listen is a next-generation supply chain horizontal process as shown in Figure 6. These cross-functional processes linked outside-in.

Figure 6. Next-Generation Supply Chain Horizontal Processes

10. Execute at the Moments of Truth. Each supply chain has a moment where there is an undeniable truth: The supply chain either met the goal or the team did not. Map and measure performance at these moments of truth. For e-commerce, and the execution of omnichannel in the food supply chain, the flows look like those in Figure 7. Map master data across the supply chain to be more agile and quicker to respond.

Figure 7. The Moments of Truth

How to Get Started. Here is advice for the buyer and seller in these relationships.

Advice for the Buyer

- Share Data Freely and Openly Through a Private Network. Today, sharing is through a portal – a web-based interface that enables businesses to manually enter data and create business documents, and integrate these forms with back-end systems such as accounts payable or warehouse management systems. Companies have portal fatigue. The most effective way to share data is through a private network, which provides a platform for collaborating and information sharing between business partners. Data shared through a portal lacks persistence: there is no common system of record, and this limits opportunities for collaboration.

- Focus on Clean Data. The supply chain needs an effective perpetual inventory signal in order to manage out-of-stocks and campaigns/promotions. To be a collaborative trading partner, build a good perpetual inventory signal. Focus on improving your forecast; measure the error of your forecast and drive greater accuracy for your supplier.

- Take Your Hand Out of the Supplier’s Pocket. For many buyers, deductions and penalties for performance have become a budget line-item – often a profit center. 84% of buyers charge for deductions, which have become a systemic way of making money for the buyer. In this relationship no one wins. Suppliers cannot get to the root cause to solve problems resulting in delayed revenue recognition. Instead of focusing on deductions, focus on clean transactions. Remember that carrots drive better performance than sticks.

Advice for the Supplier

- Use Buyer Data. Today’s data sharing practices are not perfect, but they are a start. Trust, but verify. Redesign your supply chain processes outside-in, and use data to better sense and shape demand. This enables you to improve the response of replenishment to buyers.

- Give Buyers a Reason to Share Clean Data. Use buyers’ data to identify new opportunities. Possibilities include collaborative logistics, inventory reductions, improved shelf assortment, and specialized offers. Use network design and inventory technologies to unearth new opportunities.

- Pay for Performance. Actively monitor deductions and ask for a detailed accounting for deduction types. Where possible, tie campaign/promotion performance to incentives to increase the focus on the carrot (not the stick).

I hope this helps! Let me know your thoughts. If you are interested in benchmarking your progress on building a customer-centric strategy and networking with others, participate in our research study. (We keep all responses confidential. )We hope to see you on the webinar on August 17, and I hope that your organization avoids the issues that plagued Delta this week. All the best!