90, then 80, followed by 76.

The highway rolls ahead of me. There are endless mile markers. It is a long day. Today, I am cruising major freeways traveling from Chicago to my new home in Pennsylvania. Against my friends’ advice, I decided to drive to speak to 120 business leaders at the GAINSystems event. The rain delays through the summer soured me on air travel.

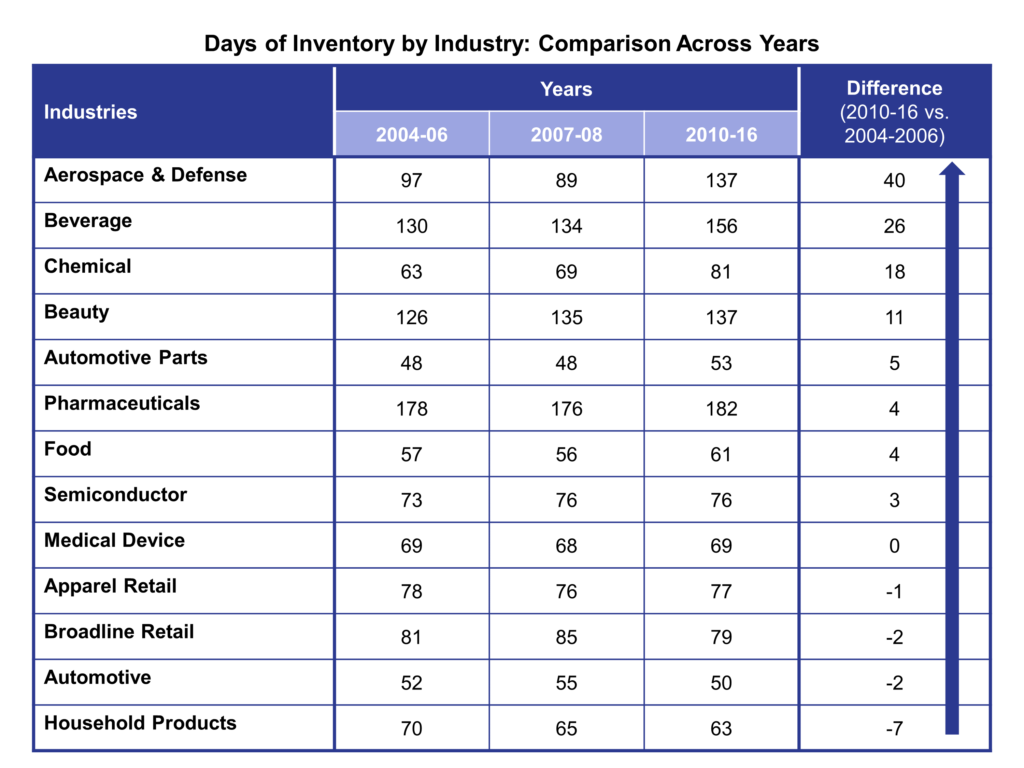

The sun is shining. The fall harvest—on either side of the road—bountiful. As I press the pedal to the floor at 80 miles-per-hour, I munch Cheetos puffs (one of my favorites) and think about the session I just finished. The cheese on the puffs stains my hands like I feel that mis-guided past practices have indelibly colored supply chain practices. At the session, we discussed why companies have not made more progress on inventory management. (The presentation is on slideshare.) Note in Figure 1, that eight industries have gone backwards and four moved forward. In most value networks, downstream partners have progressively pushed costs and waste backwards in the extended supply chain. In the case of Apparel and Automotive industries there are slight improvements, but they have shifted inventories to suppliers.

Figure 1. Days of Inventory Pre and Post-Recession

Why Have We Not Made More Progress?

When we ask business users open-end questions in quantitative surveys, shown in Figure 2 are the most common responses. It is not one issue. There are many.

Figure 2. Quantitative Open-End Responses

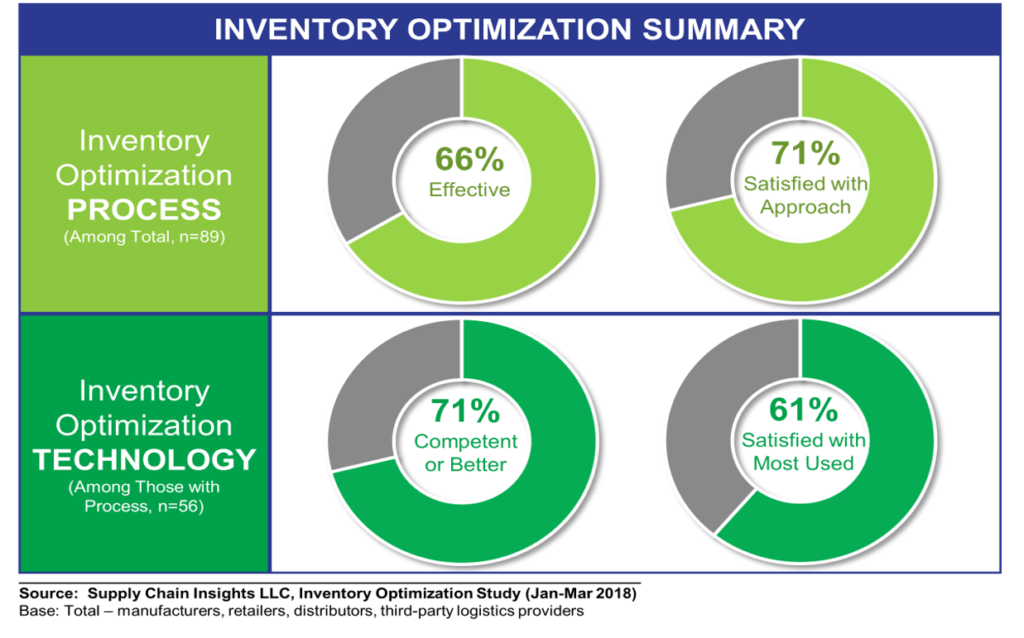

Business and IT teams lack alignment. The technology teams, focusing on implementation and go-live dates, believes that inventory technologies and processes are equal to the challenge. We share this data in Figure 3. The focus is on going live versus “does it work.” As a result, many technologies post implementation do not move the ball forward. I was speaking to a frustrated CFO last week that said, “If I had 1% of the money spent on technology to improve inventory management, I would be a rick man.” I smiled and bit my tongue. I wanted to say, “You let the consultants influence you to buy the wrong technologies based on IT standardization. Your teams did not know enough to understand the consequences of their decision on business results.”

Figure 3. IT View of the Current State of Inventory

Five Reasons

As I sorted through years of research on the topic, I came up with five reasons: holistic thinking, planning system satisfaction, over-dependence on spreadsheets, rise in complexity and organizational alignment. Here I share the key points from the discussion:

Holistic Thinking.

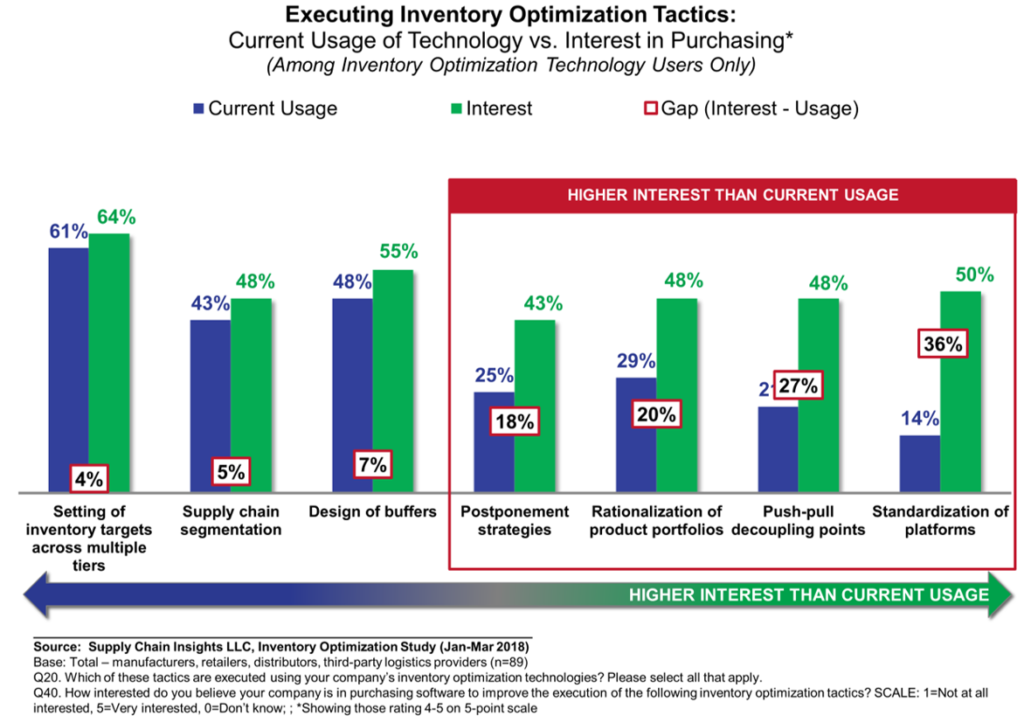

With the increase in demand volatility, inventory increases in importance as a shock absorber of variability. It is the most important buffer. While there is a lot of hype on material buffers and supply, the greatest opportunity lies in the management of demand data and treating demand not as a static set of numbers, but as a set of flows. To do this companies need to use channel data to decrease demand latency, and then use pattern recognition and advanced analytics to define buffer strategies. Current investments target safety stock while the opportunity is in the better management of cycle stock, platform rationalization, and the design of inventory strategies as shown in Figure 4.

Figure 4. Gaps in Inventory Strategies

Success in Selection of Advanced Planning Systems (APS).

I discussed the topic of technology selection for planning at great length in the Blog, Yowza, A Nine-Step Process for Selecting Supply Chain Planning Systems. Supply chain planning is all about better math and modeling. Today, since many do not test the solutions and often buy based on IT standardization, the probability of success is about the same as playing the tables in Las Vegas. As shown in Figure 5, only one-in-two business users are satisfied. The default? Most planning happens in Excel Spreadsheets.

Figure 5. Satisfaction with Supply Chain Planning

Dependency on Spreadsheets.

This topic was the most contentious at the session in Chicago. Hands quickly went up to defend the use of Excel Spreadsheets. While I firmly believe that today’s complex non-linear system cannot be modeled in an Excel Spreadsheet, most business users are so unhappy with their systems that they believe that it is a necessity.

At the event, the attendees cited dirty data, depth of modeling and user training. I understand the issues, but the reliance on Excel is a barrier. I encouraged all the attendees to get to the “Why?” Learn why are users dependent on Excel? After this understanding, the goal is to tackle and resolve the problems. I firmly believe that Excel spreadsheets lead to Excel ghettos of isolated, disconnected planning.

Figure 6. Use of Excel Spreadsheets.

Increase in Complexity.

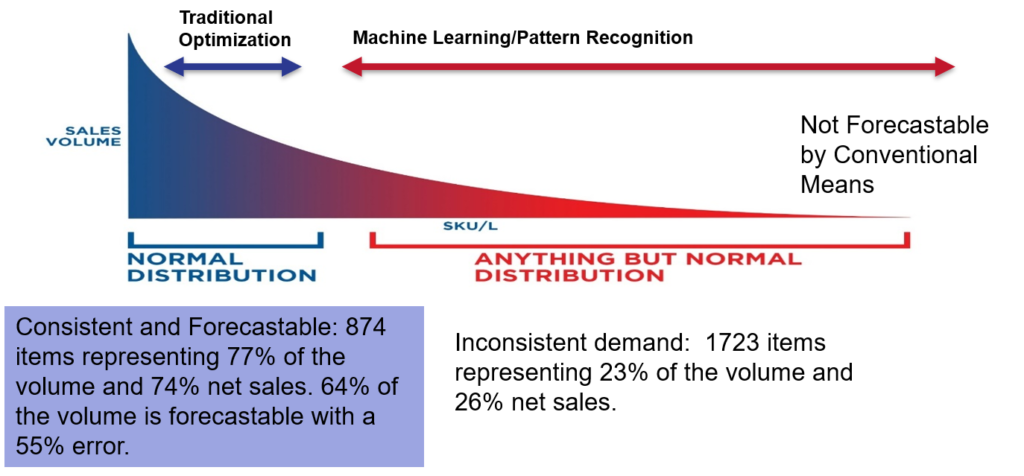

This is a major issue. Unfortunately, too few companies are taking action. The addition of items, platforms and new business models often results in the elongation of the supply chain tail.

Figure 7. Long Tail Definition.

Items in the tail require the definition of inventory strategies to buffer demand variability and drive consistency. This chart is from a recent client engagement. I find that most companies have a similar pattern.

Items in the tail require the definition of inventory strategies to buffer demand variability and drive consistency. This chart is from a recent client engagement. I find that most companies have a similar pattern.

Alignment.

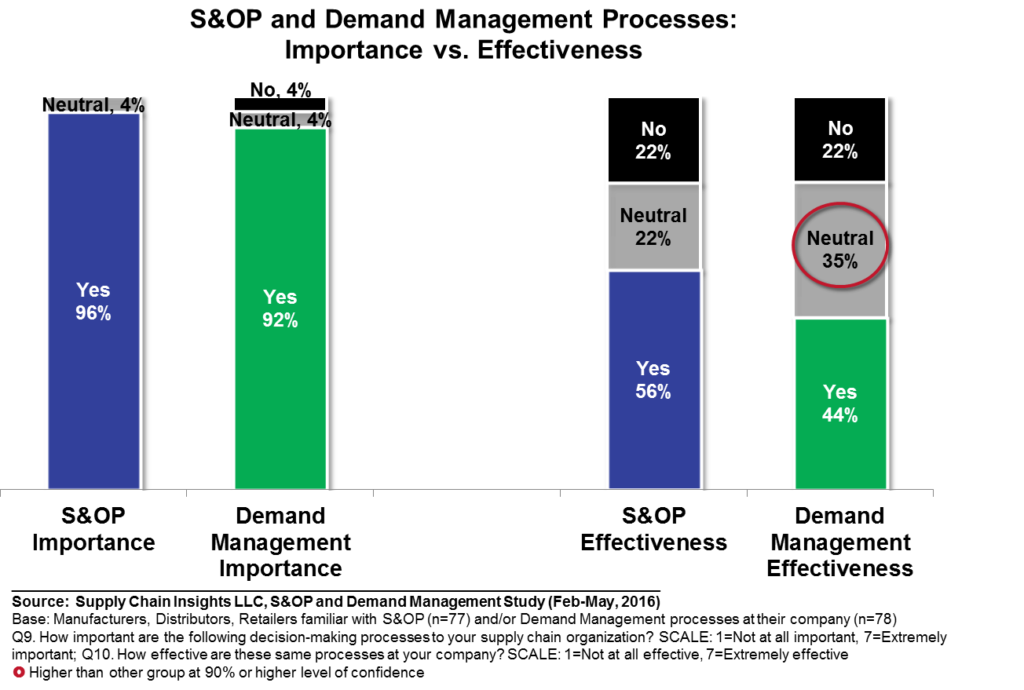

In most organizations, inventory is misunderstood. Commercial teams mistakenly think that high levels of inventory will drive sales and minimize customer service issues. The problem is that high levels of inventory often result in customer service issues. When companies drown in inventory, they often have the wrong stuff. And, without discipline, they cannot get to the right inventory when they need it. In parallel, the financial team often sees inventory as a pocket-book to manage at the end of the quarter. There is an endless cycle of cutting inventory at the end of the quarter, followed by customer service issues.

To combat this barrier, education is essential.

Figure 8. Elements of Business Pain

As I drove home, I thought about the audience’s response. The most pain centered on discussion of spreadsheets. Excel is so embedded in supply chain processes that companies struggle to give them up. The other area of heated discussion was on data cleanliness. Planning master data–lead times, cycles, yields–are often inaccurate. Paying attention to planning master data is an opportunity for most.

I am proud of GAINSystems for their work on master data management and machine learning. I started covering GAINS in 2001 as an analyst at Gartner. Today, the small company is innovating faster than larger competitors. Focused and caring, the company is making progress. While there are more sophisticated architectures and larger, more global organizations, GAINS is a great value for companies seeking to test new concepts at a reasonable price.

These are my thoughts. I welcome yours.

Here is some reading material on some relevant research:

Inventory Optimization in a Market-Driven World

Why is S&OP so Hard?