Another plane, another client; and yet another discussion. They are sounding a bit the same. I am trying to not sound like a broken record.

Regional supply chain companies are attempting to define global requirements. They are well versed in requirements for regional supply chain planning, but they are attempting to redefine their processes and be more global. It is very similar to the man in the picture: a company attempting to teeter between two similar, but very different worlds.

Regional supply chain companies are attempting to define global requirements. They are well versed in requirements for regional supply chain planning, but they are attempting to redefine their processes and be more global. It is very similar to the man in the picture: a company attempting to teeter between two similar, but very different worlds.

Initially companies believe regional planning systems easily adapt to become global, but they quickly learn otherwise and hit roadblocks. Instead, it requires some rethinking of processes. Here I expound on what I see at client sites.

Success in Supply Chain Planning Is a Flip of a Coin

Before we start the discussion, I want to ground the reader. Supply chain planning success is difficult to achieve. Today, as shown in Figure 1, only 50% of planners are satisfied with their planning solutions. However, when success happens the business results are immense with a Return on Investment (ROI) in three to five months. So you might think, sometimes, you’d have better luck than this in Vegas. You would be right.

Figure 1. Importance Versus Effectiveness of Demand and S&OP Planning Solutions

What Drives Dissatisfaction? How Can Companies Improve Outcomes?

Satisfaction starts in the selection process. Time after time I hear, “80% functionality is good enough.” What most people miss is the need for industry-specific modeling capabilities. Broad-brush approaches –an assumption that one-size-fits-all–just do not work. Given the choice between IT standardization and industry-specific functionality, the highest value comes from industry-specific modeling. The returns from planning systems are three to five months; but to maximize value, companies need to validate the outputs. (IT standardization returns are in years. Companies get entangled in Total Cost of Ownership discussions and miss the larger impact to improve business results through good planning systems.)

The second issue is treating supply chain planning as a technology project implementation. Putting in the technology is the easy part of the project. The more difficult aspect is cleaning the data, fine-tuning the model, and validating the outputs. This process helps to build planning capabilities. If a planning project short-circuits the conference room pilot stages, it will be difficult to ever maximize the value from the investment. When attempting to implement a global system, this often requires model testing and fine-tuning by each business unit or region of the world. It takes time, and a strong leader. However, if the focus is on implementing technology quickly, the teams never refine the models to improve outcomes and build planning capabilities.

The third issue is the lack of understanding that global processes–to maximize the economies of scale in transportation and material buying–need strong governance. This is not as important in a regional deployment of 10 to 100 planners, but becomes paramount in managing global planners with hundreds, and even thousands, of planners around the world. To avoid conflict companies need to clearly define the role of the region, the role of the business, and the role of the global planning process. There is no one right answer. It varies by company, but requires a conscious decision.

Supply chain planning is decision support. The use of engines and advanced math helps companies to find better alternatives, and make decisions faster. When it comes to governance, there is no one-size-fits-all, but in the absence of the definition of governance, nothing works very well.

In addition, a fourth area of conflict is process definition and discipline. After the governance decision, the business units need to use the same data frequency of planning within time horizons, and write the plans to a common system of record to enable the corporation to roll up data globally. While the systems of insight (individual planning engines) can vary by business, the businesses need to run the engines, fine-tune the model, and write back the plans on a regular and preset cadence. This allows shared services of procurement and transportation to function smoothly to achieve the economies of scale. Without this discipline, the global organization cannot actualize buying power in procurement or lower costs and improve costs/customer service in transportation. For example, SAP APO is the best system of record for the global supply chain leader, but it is a substandard system of insight. The APO engines, and the newer IBP engines, are not deep enough and powerful enough to model most supply chain processes. However, the SAP APO backbone with the CIF interface is ideal to provide a system of record for visibility. Companies with an SAP implementation attempting to become global should pick two or three different modeling technologies, and clearly define global process cadence and governance to enable the businesses to plan, and then write back the plans to the SAP APO backbone for use by the larger organization.

I am working with one organization that has over 20 different businesses. In the last three years the company has embarked on a path to improve Sales and Operations Planning (S&OP). The good news is it has driven business value. The bad news is there was no well-defined governance and cadence of the business process. As a result, the results of the S&OP processes cannot be written back to a common system of record.

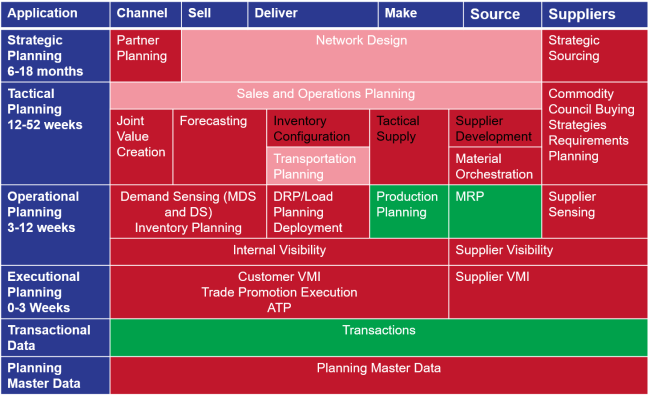

The fifth opportunity is in operational design. Planners need time to plan. Whenever jobs combine the urgent and the important, only the urgent will happen. As a result, tactical and operational planning roles should never be combined; and manufacturing schedulers should never also do demand planning. Each company needs a well-defined process map like the one in Figure 2.

I share Figure 2 only for illustration. Defined on the left are the time horizons. The color schemes indicate the maturity. (Green represents strong capabilities, pink maturing capabilities, and red immature planning capabilities.) This company has just finished a global ERP implementation and is strong in transactional processing, but weak in planning.

In the building of the organizational processes, each of the job descriptions should follow the time horizons. The strategic planners are a job classification, the demand planners and supply planners are a job classification, and the operational planners in manufacturing and transportation are job classifications. In the ideal design, the company builds a planning career path which allows planners to move from job to job within the planning organization to build a cross-functional understanding, but the job design should never confuse the urgent with the important. Planners need time to plan, and training to learn a new job. Getting good at planning takes time. It requires strong analytical skills and business understanding.

Figure 2. Planning Time Horizons and System Overview at a Client

Five Lessons in Building Global Planning Organizations

So with this in mind, in the design of the global planning organization keep these five principles in the front of your mind:

1) Carefully Define Global Governance. Get clear on roles. Build a planning governance model based on a format like shown in Figure 2. For each of the time horizons, clearly communicate the role of the business, the role of the region, and the role of the global team. In the global business, decide where to make the pivot between regional and global processes to gain economy of scale. This is typically within the procurement and transportation/logistics teams/shared services organizations within the corporation.

2) Build a Planning Career Path. Use this model to define career paths. Ensure that within the jobs there is no confusion on focus between the urgent and the important. Enable planners to gain mastery in each position and move across planning positions. Focus on building T-shaped leaders. (A T-shaped leader has strong experience within a function and learns the trade-offs of business planning and horizontal processes through experience in planning.)

3) Tactical Planning Strength Enables the Pivot. It is almost impossible to build a global planning organization without a strong tactical planning process, technology and team. Focus on building strong capabilities to enable tactical planning along with the hand-offs for the operational horizon(s). (The mistake that many global manufacturers make is a belief that regional manufacturing planning processes can substitute for strong tactical planning. The problem is that this does not allow enough trade-off of source, make and deliver processes across the globe.)

4) Plan By Design. Plan continuously using strategic design tools like Llamasoft, JDA Strategist, and Opalytics to build process flows (postponement, push/pull decoupling points, and set inventory targets for the form and function of inventory). Use this design as the foundation for tactical supply chain planning.

5) Build with the Plan in Mind. Use a Supply Chain Center of Excellence to guide the building of strong global planning. Make it a pull, not a push to the business. The more that the Global Center of Excellence serves the business with core processes for network design, inventory planning, education, and technology refinement, the faster the organization can drive value. The devil is in the details; but when done well, a successful Center of Excellence builds value.

Do not force tight integration of planning engines. Allow planners time to plan and only move planning data when the planners are satisfied with the plans. This takes time and plan refinement.

In Figure 3, we share some of the research on what drives value in the supply chain.

Figure 3. Factors that Improve Price to Tangible Book Value

These are my thoughts. I welcome yours.

As a company, Supply Chain Insights is dedicated to bringing open content to supply chain leaders. We pride ourselves that our writing is independent and research-based. Our goal is to help supply chain leaders everywhere. For more insights on these topics based on our research, consider these reports:

Why Is Supply Chain Planning So Hard?

Maximizing the ROI in Supply Chain Planning

What Drives Inventory Effectiveness in a Market-Driven World?

Putting Together the Pieces: The Role of Analytics

Putting Together the Pieces: Solutions for S&OP

Driving Supply Chain Excellence (Insights on a Center of Excellence)