Holiday travel. Packed airports and the children screaming in unison. Today as I sit scrunched into a coach seat in 26C, working on this blog post and hoping to not spill my coffee on my neighbor, I dutifully type to complete my weekly post. Thanksgiving is one of my favorite holidays. I give thanks for our clients and the ability to do what we do. Here I share insights on the work we are doing on the Network of Networks, and Five Trends that Excite Me.

Holiday travel. Packed airports and the children screaming in unison. Today as I sit scrunched into a coach seat in 26C, working on this blog post and hoping to not spill my coffee on my neighbor, I dutifully type to complete my weekly post. Thanksgiving is one of my favorite holidays. I give thanks for our clients and the ability to do what we do. Here I share insights on the work we are doing on the Network of Networks, and Five Trends that Excite Me.

Building the Network of Networks

This week I will be at the Camelback Inn in Scottsdale, AZ. I am facilitating a workshop between supply chain business visionaries and technology innovators. At the session, together through education, sharing case studies, and reviewing research, we will explore the opportunities to build a Network of Networks to improve B2B supply chain connectivity. This group meets three times a year, and I always find the discussions stimulating.

This week I will be at the Camelback Inn in Scottsdale, AZ. I am facilitating a workshop between supply chain business visionaries and technology innovators. At the session, together through education, sharing case studies, and reviewing research, we will explore the opportunities to build a Network of Networks to improve B2B supply chain connectivity. This group meets three times a year, and I always find the discussions stimulating.

My goal is drive new thinking. Just as the Internet spurred connectivity, B2B processes, and new business models, I am trying to stimulate the discussions and business models to redefine B2B. Stuck today, companies struggle to drive improvement.

While many technology companies have co-opted the network of networks message, today there is no interoperability between network solutions. GTNexus (now Infor), E2Open, Elemica, and SupplyOn operate in islands. There are no plans for interoperability.

Buyers beware of the use of the name without meeting the definition. There are many examples in the market. In the design and building of B2B value networks, we have to face the facts. EDI is too cumbersome, and SAP Ariba’s focus, despite the marketing hype, is primarily on managing indirect spending. (My interest is in direct material spend. I find indirect spending interesting, but not germane to the discussion.) The SAP acquisition of Ariba slowed innovation and the purchase, and then the failed promise of investment in Crossgate was disappointing to SAP supply chain business users. Likewise, while Elementum has great marketing and some market adoption, when people ask me about the solution developed by Flextronics, I have to smile and say, “Friends do not let friends buy Elementum.” In the state of Texas they have an expression I think is fitting for the Elementum solution: It is, “Big hat, but no cattle.” The application, primarily a visibility solution, is too lightweight and not ready for the rough-and-ready world of B2B integration. Why do I take such a hard stance? I have interviewed fifteen companies that have implemented Elementum. Within the business community, there is usually a small pocket of positive buyers; but in contrast, the larger organization is struggling to bridge the security, scalability and onboarding concerns.

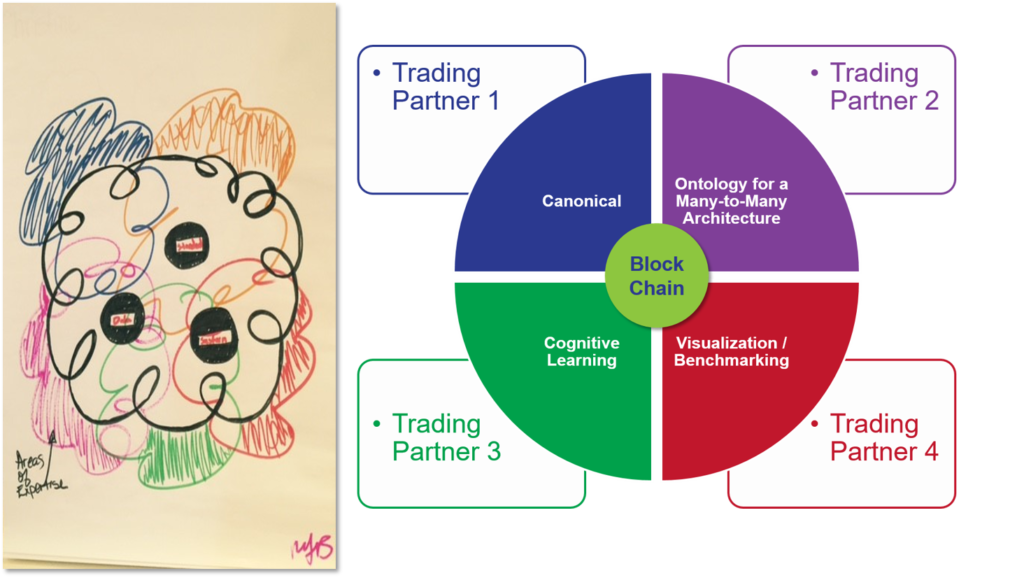

At the Network of Networks session we will discuss the possibility of B2B networks taking a hard left. Instead of tight control of B2B flows, what if they could be dispersed, yet connected, through cognitive learning and rules-based ontologies. At this small session we will explore these new trends:

- What is the role of blockchain in the future of building value networks? Could it help in track and trace? Suitable and instrumental for contract management and supply chain finance?

- Could we use Open Source Hadoop to process transactions across all networks with powerful in-memory processing?

- Instead of unique sign-ons for each value network, could there be a community registry across all networks?

- Master data management and standards are the bane of B2B connectivity. Could we map these flows and continually adapt process integrity using cognitive learning? Can artificial intelligence make standard discussions obsolete, and master data management roles no longer necessary?

- Data today does not move at the speed of business. Could we define business network flows through Apache Spark which can move real-time data like telematics, GPS, weather and temperature data, and sensor information at the speed of business to drive new forms of prescriptive analytics? Can these approaches be rolled up to design and implement a network of networks?

These are the discussion items for the group. We are looking for answers. It will take us awhile. The network of networks is a technology solution to provide interoperability between and amongst networks in one-to-many and many-to-many architectures. I look forward to sharing the insights. In Figure 1, we share a conceptual and definitional image.

Figure 1. Definitional Image

Five Technology Trends That Excite Me

When companies speak to me about the future of supply chain solutions being SAP HANA, I laugh. I think that the investment in ERP has been expensive and the CRM, APS, and SRM software extensions of ERP providers have not lived up to marketing promises. Companies want SAP IBP to work. There is hope. However, time after time, when I interview business users they share that SAP IBP provides visibility capabilities, but the integration of IBP into ERP and other APO capabilities is less than expected. Another source of disappointment is the lack of capabilities in the IBP modeling engines.

While the building of effective B2B networks will take years, requiring extensive testing and pilots, and SAP is expensive with gaps, companies ask what can they do? Here are several promising trends to consider. These excite me:

1) Supplier Collaboration. Traditional procurement functionality in SRM focused on improving transactional efficiency. There has been little progress in the management of direct materials and the collaboration with suppliers on innovation. This is especially true in discrete industries. The evolution of supplier collaboration applications in solutions like Directworks, Pools4Tools, and SupplyOn enable the sharing of design data and collaboration on design specifications. Long has this been a gap between Product Life Cycle Management (PLM) and Materials Requirements Planning (MRP). Figure 2 is from our recent research in this area. Note the gaps in existing technologies.

Figure 2. Supplier Collaboration Software

2) Cognitive Learning and Artificial Intelligence.

My recommendation is for companies to stabilize their ERP spending and divert the funds into cognitive learning and artificial intelligence pilots. I think these solutions will fill in the current gaps in master data management and will be the basis of the next generation of supply chain planning. The future is autonomous planning. Today there are three primary providers: Enterra Solutions, IBM, and RuleX, but look for more competitors in this space in the near future.

Figure 3. Future of Analytics in the Building of Supply Chain 2030

3. Streaming Data and the Use of Sensor Data.

Sensors surround us. One of the greatest opportunities to use sensor data is in the building of digital manufacturing strategies. The goal is to use shop-floor data to redefine maintenance. Today companies manage maintenance based on historic patterns of meantime failure. In the building of digital manufacturing capabilities, the goal is to use this sensor data (Programmable Logic Controllers or “PLCs”, motor and pump sensors, and temperature gauges) to schedule maintenance and automate plant floor scheduling based on actual inputs from the plant floor. In addition, the use of telematics, i.e. GPS and RFID, in logistics enables the building of accurate Estimated Time for Arrival (ETA) and the continued automation of logistics. Another use case is RFID sensor capture in cold chains and the calculation of temperature exposure and the recalculation of shelf life. Look for solutions from SAS Institute and SAVI Technology to drive these improvements.

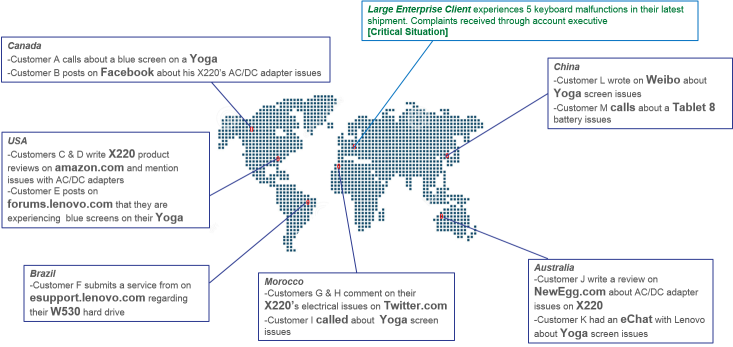

4) Text Mining and Listening.

Social data and unstructured data abound. It includes warranty, quality, and return data. All is valuable for the supply chain, but is not used today. The use of unstructured text mining enables sensing capabilities. Today the supply chain cannot sense. It only responds. The building of listening posts is a great opportunity for most supply chain leaders.

Figure 4. An Example of a Listening Post from Lenovo

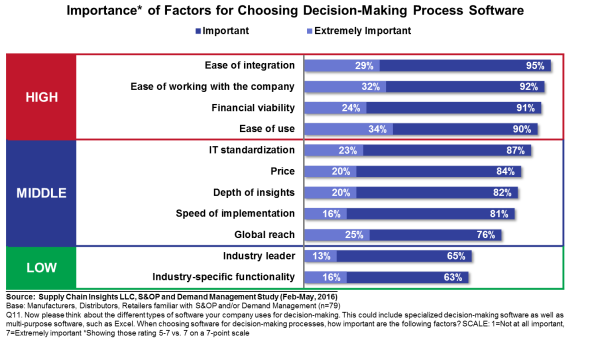

5. Packaged Analytics to Refine Current Planning Data Models.

The use of modeling capabilities from AIMMS, LLamasoft, OM Partners, and Opalytics enables the refinement and tuning of existing planning engines. The goal of these solutions is to maximize current planning investments through augmentation. The gap? Most companies failed to select capabilities based on industry-specific capabilities, and there is a struggle to deliver on the promises made in the areas of plant scheduling and inventory. The largest opportunity is in the management of cycle stock. One opportunity is to set the targets and constraints in network design tools and write the set points into the planning engines. The second is to build optimization engines to compensate for the lack of functionality in existing planning solutions. The concept is plan by design, and augment existing technologies. These new solutions help.

Figure 5. Factors Used to Select Supply Chain Planning Applications

We continue to push forward to help business visionaries seize innovation in supply chain. Join us for the Next-Generation Supply Chain Training Webinar on December 6, 2016. And we look forward to hosting you at the upcoming Supply Chain Insights Global Summit on September 5-8, 2017.