This morning the Washington Post rang. The reporter wanted to discuss the implications of Hurricane Florence. The question was simple, “What will be the impact of Hurricane Florence on the supply chain?” The answer is not so easy. The implications are far-reaching. Quite simply no one knows.

This morning the Washington Post rang. The reporter wanted to discuss the implications of Hurricane Florence. The question was simple, “What will be the impact of Hurricane Florence on the supply chain?” The answer is not so easy. The implications are far-reaching. Quite simply no one knows.

North Carolina, South Carolina, Virginia and Georgia sit squarely in the storm’s path. Each state has a rich manufacturing economy. The supply chain impacts will ripple across the states as Florence moves west. The outcomes will be slightly different, but with consistent themes.

(There is also a string of potential hurricanes in the Atlantic sitting over 82 degree water. This may be a long hurricane season.)

Across the United States, triage teams are working to minimize the impact of Florence. This storm will test the system. Leadership teams need to plan for three outcomes:

Supplier disruption. Plot Your Supply Chain Risk. Expect surprise. The supplier that you take for granted now is likely to have an outage.

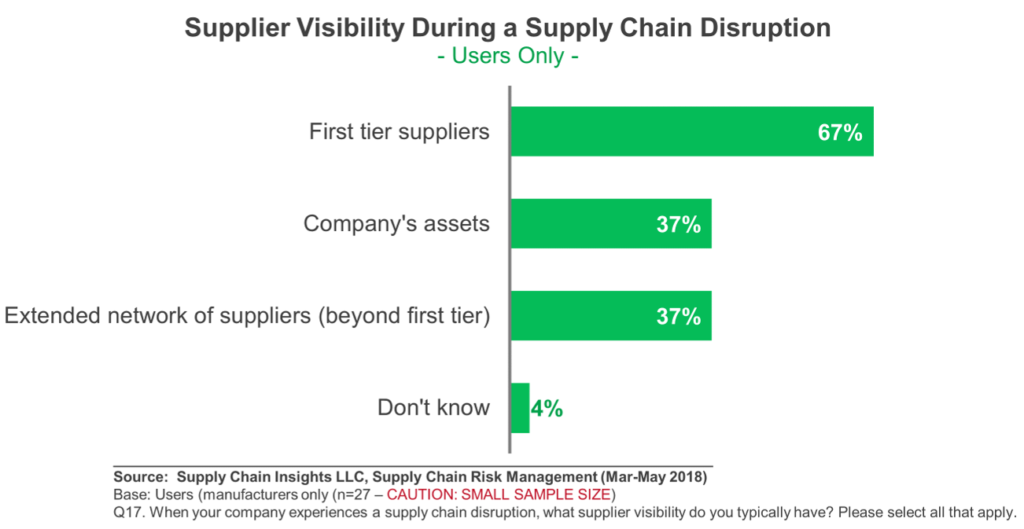

To prepare, stratify your suppliers into strategic, single source and high volume flows. Plot these categories against requirements. Understand what you need in the next thirty days and then be a sleuth. Research the location of second and third tier suppliers for your suppliers. (As shown in Figure 1, most companies know the geographical location for their first tier suppliers, but only 37% know the location of second and third tier providers. This data is from a recent study, but we fear that the visibility issues are greater than the research shows.) Plan now for potential outages. Be proactive. Attempt to find alternate sources from geographical areas that are not projected in the path of Florence.

Thirty percent of companies have supplier development groups. Supplier development teams work with suppliers to drive value. If you are fortunate, and have built this expertise, deploy your supplier development teams early and try to help your suppliers that find themselves in the path of Florence.

Expect the Unexpected. There are obvious impacts. The port of Wilmington, NC ranks 15th in throughput. It is now closed at the start of a busy shipping season as companies prepare for holiday inventory builds. It is a deep water port. While ships on the water are moving to other ports, this will put a strain on the US port system that is struggling with capacity issues. Expect longer and more variable unloading times.

There are also the non-obvious risks Inland rivers are swollen. Florence will add 5-20 inches of rain to water-soaked terrain from prior heavy rainfall in early September. As a result, Hurricane Florence will result in road closures, rock slides, and threaten the integrity of earthen dams. Transportation will become more variable; and even scarce. Work closely with transportation carriers. Capacity will be an issue. Demand will escalate and prices for over-the-road carriers will climb. (Last year transportation price increases were 2-5%.) Use your transportation optimization systems to minimize dead miles and give carriers early notices of loads. Work with the carriers to improve visibility of load requirements. Tight capacity is not isolated to only the path of Florence. Expect tight capacity across North America. For ideas check-out the podcast with Dale McClung with insights from last year’s hurricane’s season with Harvey, Irma and Maria.

We are also facing a variety of potential danger issues. For example, there are about 79,000 dams in the United States, 85 percent of them are earthen. Many lie in the path of Hurricane Florence. In addition, Florence will cross nuclear plants, major financial districts and large pig/chicken farming operations. The implications are power issues, financial disruption, and water contamination. Some of these potential impacts have the potential for long-term outages. Stay tuned to the news and respond quickly with your triage teams.

Demand Volatility. Shelves will be Empty. This is a seasonal event. Evacuation changes markets. Volume will rise and then fall. Many items–rain gear, food products, and building materials– will become waste quickly. Companies that are market-driven using consumption data and demand sensing will have a competitive advantage. In contrast, companies that use historic demand and assume that history is a good predictor of demand will miss market opportunities. As a consumer, expect disruption. Shelves will be empty and variety less. As a manufacturer, stay close to market signals. Build flexibility in operations. While most think of risk management as a set of supply side impacts, the issues of sensing and translating demand are even greater as risk for most companies.

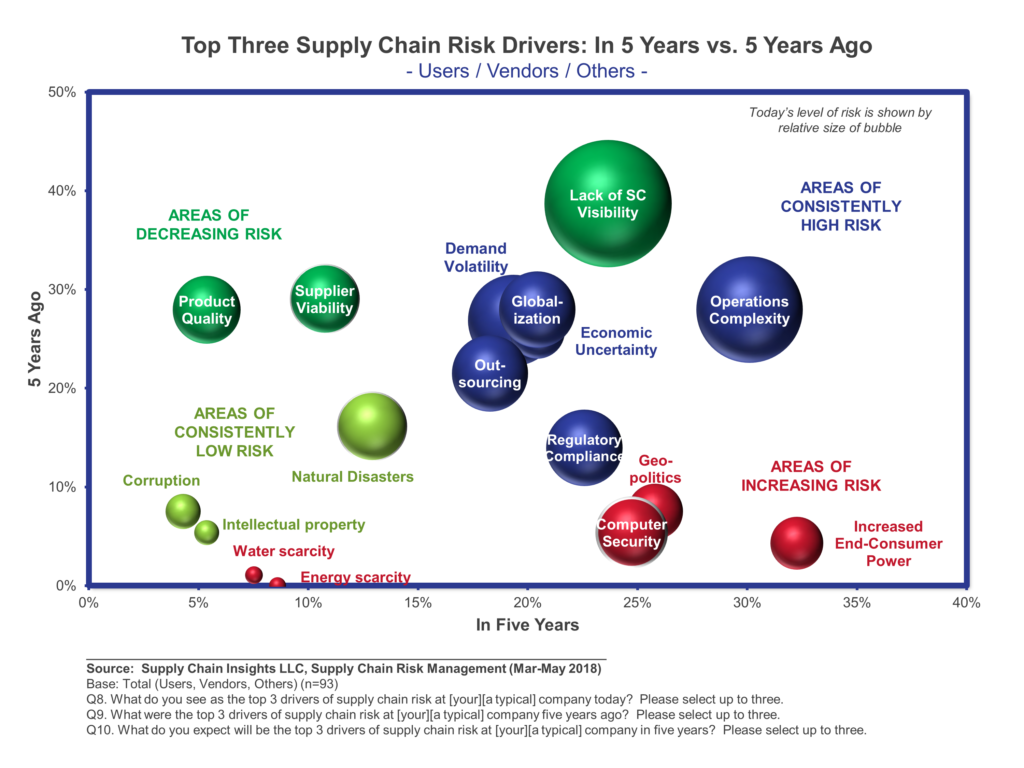

Figure 2. Risk  Management Issues

Management Issues

Good luck to all. Let me know how I can help.

If you have some tips and tricks on hurricane triage, please share in the comments on the blog. I look forward to getting your feedback.

Native-AI Supply Chain Planning: A Blueprint for Success

Sharing of a blueprint to adopt Native-AI Platforms in the redefinition of supply chain planning.