I am lucky to be an analyst. Many might say, “Aren’t you a consultant?” And my reply is that “An analyst is trying to understand where the market is going, whereas a consultant has the answers.” I don’t have the answers, but I am actively studying the market to help business leaders figure out the questions they should ask to drive performance improvements.

For the past twenty-two years, I have had the luxury of watching supply chain stories unfold. Business leaders came and went as an analyst, technology shifted, and markets ebbed and flowed. I am unsure how many business teams I had the good fortune of working with, but a casual count nears 3,000 over 20 years with over 500 conference speaking opportunities. When Gartner bought AMR Research, I left to build a company, and in the process, I slowly built a Linkedin audience of over 330,000 followers. Over time, I used this group as a research panel to better understand the choices made by supply chain leaders and what made a difference in balance sheet performance. I give thanks for this experience. I also am very grateful for the following and the support of the global supply chain.

A Story

I am a Meyers Briggs INFP with a strong N and P. As a result, I tend to write about the possibilities of the future versus focusing on the positives of the here and now. When I see potential and imagine creative alternatives, my mind races. Recently, work has been slower than usual, and I have not been traveling, so I have been writing an article daily.

Forbes has a contest, and as a Forbes contributor, I have been competing to up my rankings (thanks for reading my articles). I aim to help business leaders not typically steeped in the day-to-day supply chain life understand how to lead supply chain teams better. When I posted an article yesterday on My Lessons Learned From The Supply Chains to Admire Work, a LinkedIn follower commented, “You write a lot about what does not work. What did work?” The comment stopped me in my tracks. He was right. This comment is the genesis of this article. Based on my research, I write about four strategies that drove value over the last decade.

The Journey

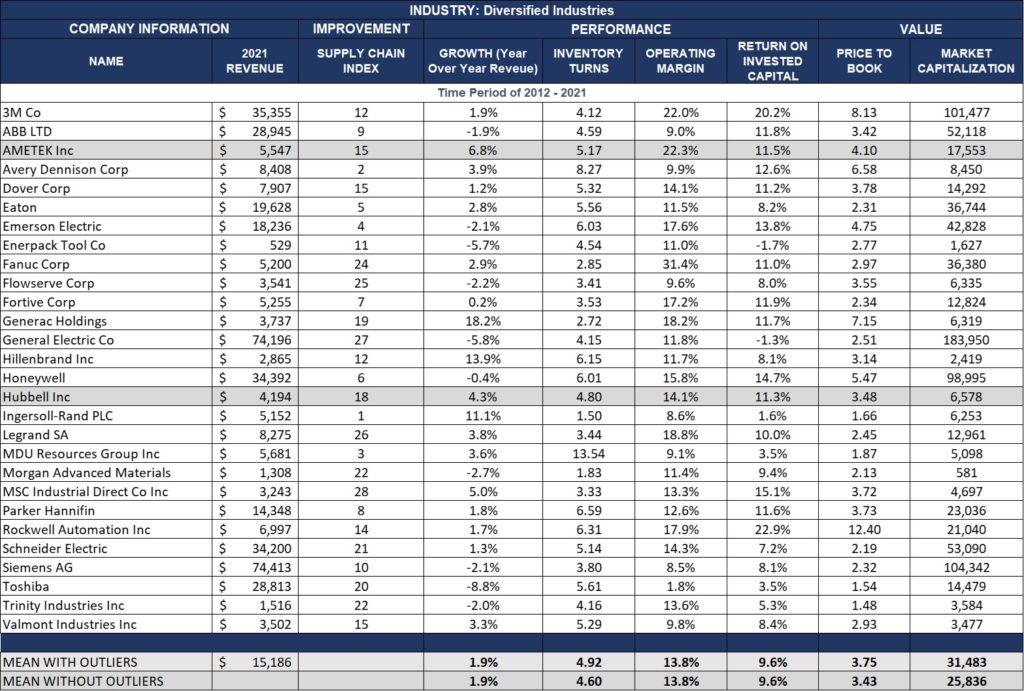

In this Forbes article, I write about my insights from the Supply Chains to Admire Work, an annual assessment of balance sheet performance, and a hard look at supply chain performance. This work started in 2014 when the Colgate team challenged me for giving so much admiration for the P&G team in my first book, Bricks Matter. Colgate outperformed P&G in Return on Invested Capital (ROIC), and P&G exceeded Colgate in inventory turns. The question was, “What mattered? Which strategy drove the most significant value??” So, I started work with Arizona State University to take balance sheet data from 2003-2007 to analyze which combination of metrics drove the highest market capitalization.

As a result of the research with ASU, I settled on the combination of growth, margin, inventory turns, and ROIC for the Supply Chains to Admire analysis. We started charting public performance on Orbit charts studying the relationships between metrics and having conversations with manufacturing and retail teams about their results. The orbit charts are a very different way of analyzing performance, so many meetings were like dogs watching TV and trying to critique their performance and choices.

In the process, I learned many valuable insights. Small companies outperformed smaller ones: global corporate politics is a killer. No company achieved improved economies of scale through M&A. Tight integration of decision support to ERP introduced nervousness into the complex system called a supply chain, decreasing resilience. The most impactful stories are never shared on a public stage: the most influential supply chain leaders are humble servants that excel at influence management and storytelling. Change happens over time through internal leadership. A large number of consultants focused on functional improvements is deadly. (I often laugh at the number of consultant signatures on the book at the entrance of most large companies. They are often great fodder for my future articles.)

This gets me to answer the question, “What did work?” I am currently working on an ebook of what I feel are the most impactful client case studies from my two decades as an analyst. I ponder this question and turn to these case studies as reference materials.

What Worked

Based on these collective experiences, here is what I believe worked to improve the value of the supply chain team over the past decade. I hope this helps:

- Organizational Alignment. Organizations that are better aligned outperformed. In the 2015 analysis of the data and the correlation to balance sheets, we found that companies that were more closely aligned with a focus on the & in S&OP (balance between the “s” and the “op” with a focus on planning (what-if analysis and network design) drove better results at the intersection of growth and inventory management. (We are currently re-working this analysis and would love to have you participate in the current study. If you participate, I will gladly share your organization’s results.)

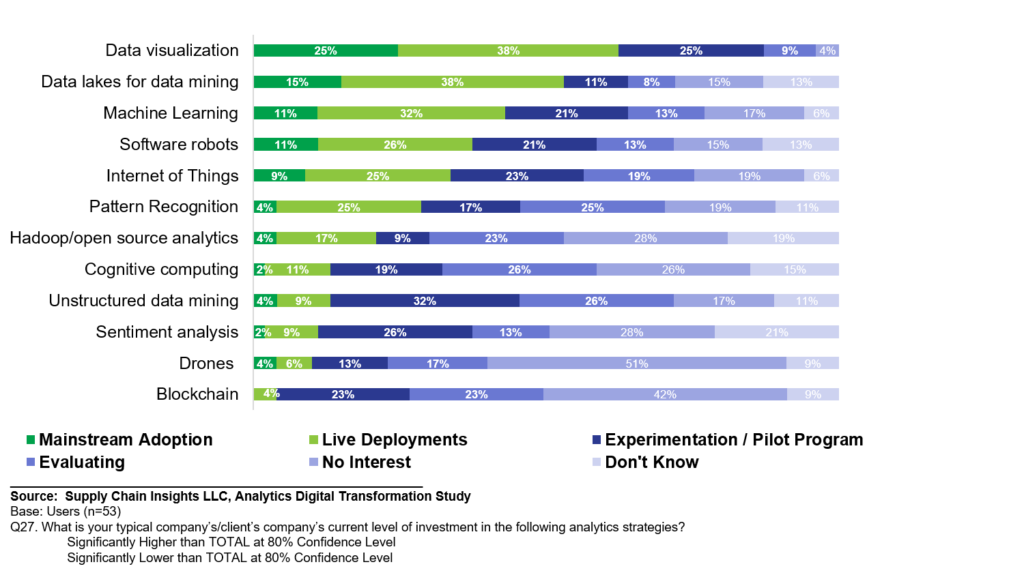

2. Investment in Descriptive Analytics. The most frequently cited valuable technology investment during the pandemic was descriptive analytics. Teams with solid investments in descriptive analytics were better at collaborating and aligning. These investments helped many companies’ shortfalls and deficiencies in supply chain planning deployment. (Tight integration with ERP was a killer. Only 1/3 of companies can perform what-if analysis or determine a feasible plan.)

As shown in Figure 1, when companies had a robust deployment of data visualization technologies, they self-rated their performance during the earlier part of the pandemic as more responsive at an 80% confidence level.

Figure 1. Analytics Deployment

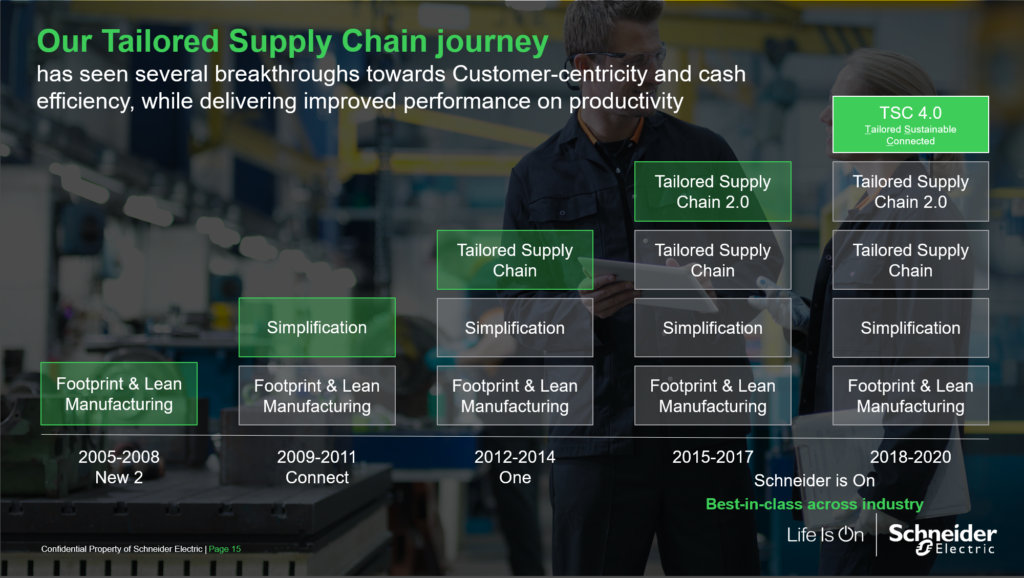

3. A Clear Strategy. The best example of a clear strategy I experienced was Annette Clayton’s transformation of Schneider Electric in 2004. Over time, based on the deployment of the strategy, Schneider’s performance improved. While never exceeding its peer group, the company demonstrated progressive and apparent progress. What I love in this strategy is the focus on simplification. What I loved in my experience with the Schneider team was the focus on building teams and internal training.

Figure 2. Schneider Electric Strategy

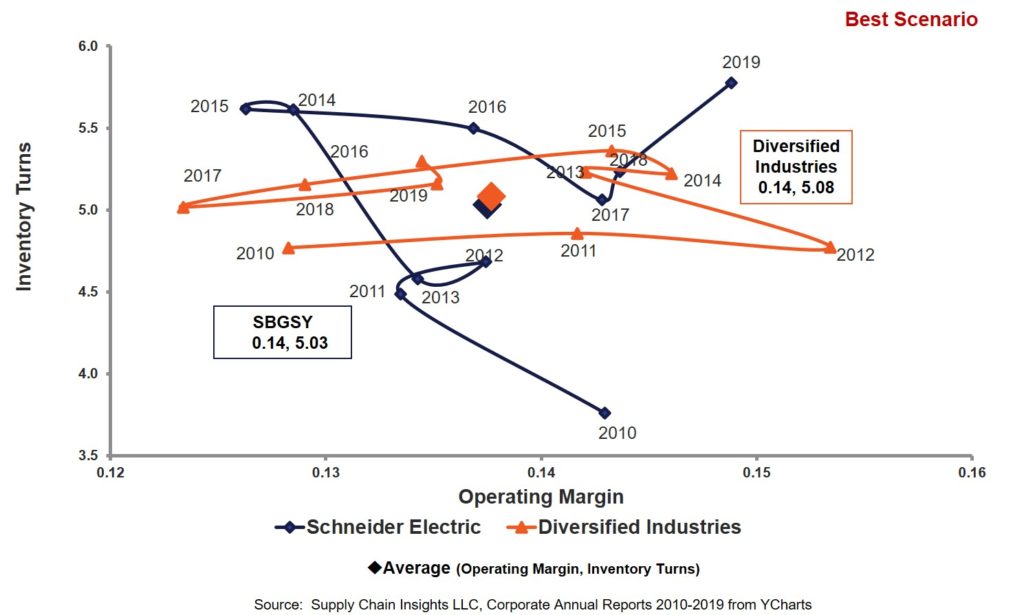

In Figure 3, I share the Schneider Electric Orbit Chart at the intersection of margin and inventory for the ten years ending in 2019 (at the start of the pandemic).

I deliberately show the pre-pandemic orbit chart. During the pandemic, there were some resilience issues, as reflected in the current analysis, with Schneider falling in the Supply Chain Improvement ranking to 21 out of their peer group of 28. (The larger the number, the slower the rate of improvement.)

4. Supplier Development. Companies with strong supplier development teams rate their performance higher on supply chain visibility and knowledge of second and third-tier relationships. A focus on supplier development is a team that genuinely works with the supply base to be a better trading partner. My favorite supplier development story is an A&D manufacturer that staffed a 1-800 line with seasoned engineers to help suppliers better translate the quality of design to improvement in quality of conformance. The research supports that only 32% of companies have a supplier development team.

Conclusion

I hope this helps. Happy holidays to you and your family.