I remember the plane ride well. My career was in transition. I was moving from a position where I led a manufacturing operation to being a part of a team to design supply chain software to improve planning decisions. I was moving from the world of manufacturing to a new world of software.

I remember the plane ride well. My career was in transition. I was moving from a position where I led a manufacturing operation to being a part of a team to design supply chain software to improve planning decisions. I was moving from the world of manufacturing to a new world of software.

As I read the brochure of my new employer on the airplane, I felt so behind. The words and concepts were foreign. A feeling of hopeless despair swept my body. This lasted for weeks. When I went through the training to learn the new software, I struggled. The names of the technology providers, the process definitions, and the architecture descriptions were a new lexicon. For a business gal it was a new world.

Now I know that I was not behind. The tension I felt reading the brochure on the plane is what I believe every supply chain leader feels every day. The technology world moves at a quicker pace than the world of manufacturing and distribution. The language and the expectations are different. It is hard to sort through the marketing speak of software vendors to get to the true facts. That is one of my primary drivers at Supply Chain Insights. As a team we conduct quantitative research of supply chain leaders to help gain clarity of the answers. It is my goal to sort the wheat from the chaff and help the supply chain leader quickly get to what is valuable.

Why do we do this? We think that it matters. Growth is slowing and the complexity is escalating. The impact of complexity on inventory is not quick. It is a slow, continued impact that happens week-to-week as complexity increases. It is a lot like that five pounds gained each year that adds up to 20 before you know it.

To help, today I want to share some of the insights from our recent Inventory Optimization study.

The Business Problem

Inventory management is a hot issue. Tension abounds between corporate finance and the operations teams. Why? Companies invest in project after project, yet inventory levels remain the same. The analogy is weight loss. While we all want to lose weight, it is not the big program that improves weight loss. Instead, it is the discipline every day.

In business there are many drivers of inventory, and the management of inventory levels requires discipline and a cross-functional focus. The rise of the global multinational has greatly impacted inventory requirements. How so? In today’s global supply chain there is more in-transit inventory and complexity. The changes may seem slow, but they add up. Here are some examples: Item and process complexity increases inventory requirements for cycle and safety stocks; Slow steaming and larger ocean vessels affect inventory levels in transit; Intermodal slows transportation and increased inventory; The greater the number of nodes in the supply chain, the greater the inventory levels; The higher the demand volatility, the more inventory required.

Supply chain processes are now over 30-years old. While there is a generalized belief that maturity of supply chain processes has improved inventory turns, this is not true for nine out of ten companies. In fact, many are stuck in a bad way, like a car trying to get traction in a snow bank. Many teams just do not know where to start, and the swirl of inventory technologies confuses the teams much like how I felt reading my first brochure on supply chain planning 25 years ago.

Improvements in cash-to-cash have primarily been driven by lengthening payables. First it was 60 days, then it was 90 days, and for many now the discussion is 120 days. It cannot go further. I feel that the lengthening of payables is like a bad drug. It pushes waste and costs to the suppliers and gives the organizations a short-term high. The teams feel good because cash-to-cash metrics improve; but in many cases, in the joyous celebrations, companies do not realize that they have reduced capabilities with suppliers and not made improvements in inventory. In industries like beverage, pharmaceuticals, consumer packaged goods, and medical device, the industry averages have gone backwards (inventory turns have decreased, not increased) during the period of 2006-2014.

What Drives Inventory Effectiveness?

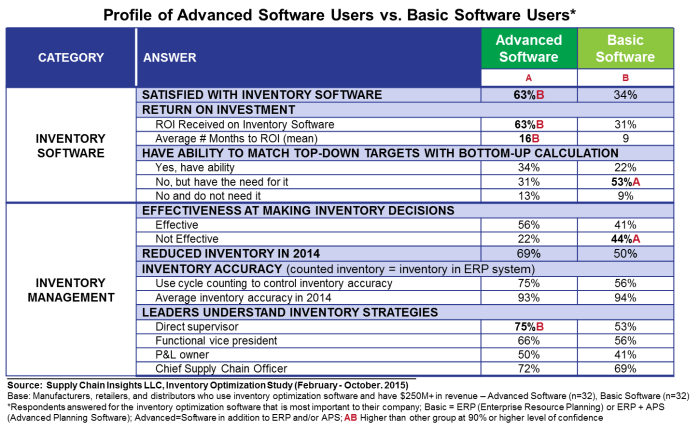

In the last year we completed a study on inventory optimization. In the study we compared company maturity on meeting inventory targets to choices on inventory technologies. We had 64 respondents: 32 used basic software (ERP or Advanced Planning) and 32 were using more advanced capabilities from Multi-Tier Inventory Optimization solutions (often termed Multi-Echelon Inventory Optimization, or MEIO). Technology vendors love acronyms. The names defy logic.

We also compared the sample to a self-assessment on inventory effectiveness. The companies using more advanced technologies rate themselves more satisfied. The test is significant at a 90% confidence level.

Figure 1. User Satisfaction with the Performance of Inventory Optimization Software

As shown in Table 1, companies that rate themselves as more effective meeting their inventory goals are more likely to be located in North America than Europe. They are also more distribution centric i.e. retail and consumer packaged goods. They have a higher satisfaction with the use of the software and were able to drive a return on investment. The adoption of more advanced capabilities takes time (16 months on average versus nine months). It is not something that happens overnight. As a result, companies rating themselves as effective in making inventory decisions have managers that better understand the use of these deeper solutions.

Table 1. Profile and Comparison for Advanced Software Users of Inventory Optimization versus Basic Inventory Software Users

The Role of Technology in Driving Improvement

In driving inventory improvements, the technology choice is one part of the equation. The two most important factors which are not performing well are S&OP maturity, and the Adherence to S&OP targets. While organizations are not performing well on forecast accuracy, the proper design of flows and buffer strategies through the use of more advanced inventory software can overcome the issues with high demand error. Increasingly, in the research we see adherence to inventory targets based on software recommendations as a key to success. While this sounds easy, it is not. Organizations have difficulty accepting answers from a ‘black box’ optimizer and many finance groups mistakenly play with inventory levels to meet quarterly and yearly Wall Street commitments. In our research on the Supply Chains to Admire analysis, we see the use of more advanced technologies, the adherence to inventory targets from the technologies, and the maturation of Sales and Operations Planning as the keys to success to drive continued improvement of inventory levels while improving margins and driving growth.

The Role of Finance

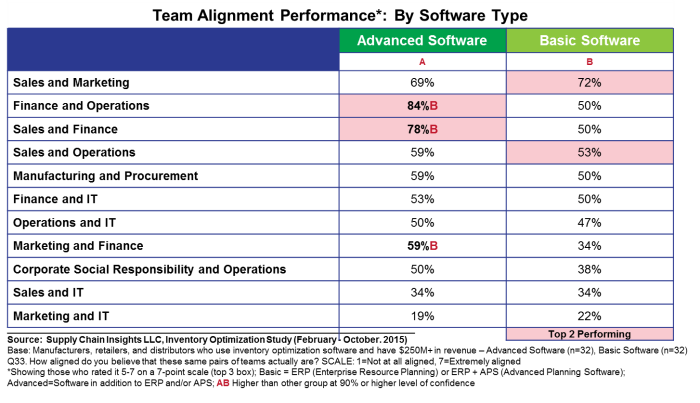

While the supply chain organization has the primary responsibility to reduce inventory in over 97% of companies surveyed, the effective use the technologies requires close coordination and alignment with corporate finance. This requires a carefully crafted change management program.

The lack of understanding of inventory by finance is a major barrier in the effective usage of technology. As a result, it should come as no surprise that companies that are more advanced in their use of inventory management software have closer alignment with finance and the operations group, and between the sales and finance groups. The difference in alignment is significant at a 90% confidence level.

Table 2. Organizational Horizontal Alignment by Type of Software Used to Guide Inventory Decision Making

In the study, we ask respondents to answer “open-ended questions” on inventory effectiveness and the use of the technologies. In Figure 2, we share some of the responses.

Figure 2. Open-Ended Responses

|

So, if you are seeking to improve inventory turns should you consider the use of a multi-tier inventory management system? My answer is yes. However, the name is misleading. Why? While the name signifies the use across multiple nodes, the greatest benefit today is the use of deeper optimization to managing inventory within the enterprise. Few companies have deployed the solution as a value chain solution.

When you implement the software, what is my advice? Go slow. Don’t try to rush the project. Focus on form and function of inventory as opposed to inventory levels, and train the finance team on the role of inventory in market-driven value networks. Most financial teams see inventory as waste and a cost to optimize. This is a major change management issue. Tackle it early. The teams lack the understanding of inventory as a way to buffer demand and supply variability. This comes over time.

In closing, we cannot complete surveys without the help of our readers. So, if you filled out the survey, I want to thank you for helping us with our study on inventory management. It was a hard survey to complete. There are few companies that have implemented advanced inventory management technologies. At Supply Chain Insights, we are completing our 60th survey this month. We will take the months of November and December to do cross-study analysis, mine the open ends, and correlate the data to financial data and our newsletters will be rich with these insights. In the October newsletter at the end of this month, we will share insights on both the Inventory and Sales and Operations study, and share insights on the evolution of supply chain performance in the automotive industry.

Figure 3. Progress on Research

With this collection of research, we felt that it was time to organize it into a community. We launched a new supply chain community, BeetFusion, this month. It is free for supply chain leaders. It is designed for supply chain teams, students, and technology providers seeking to understand supply chain excellence. There is no advertising. It is our vehicle to share Open Content research and engage the community in discussion. The design of the community is not about us. The design is for you.

We launched the Open Beta of Beet Fusion last week. Today we have 500 members in the community. We would love to see you there. Why should you join? We are launching monthly blogging on special topics in the community for the featured bloggers. This month’s topic is the Future Projection of Supply Chain 2020. It is also a good place to post resumes and job openings, listen to webinars and videos, and gain clarity on supply chain excellence. To help, we are sharing all the work we have done on maturity models and supply chain performance metrics.

We are just getting started. In December we will be rolling out rating and review capabilities for technology providers and consultants. It is a good way to raise your voice. Our goal is for the community to have the features of LinkedIn, Monster, Yelp, and Facebook for the Supply Chain Community. We want it to be the Superfood for the supply chain.

The community is currently in Open Beta. So when you join, try to stress test the community and let us know your suggestions and concerns. We also would love your feedback in the Beta Tester’s forum. A more polished version of the community, and a new online training website, are planned for January-March. It will be based on your input.

About the Author:

About the Author:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple, or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.