Within a supply chain organization there is turmoil. The enlightened leader knows that the efficient silos do not create the most effective supply chains; however, it is hard to deviate from the traditional path that focused inside-out. Most are on a fixed march for process standardization to build efficient vertical silos. These traditional processes are batch, often using latent data, and the focus is inside-out. The building of outside-in processes, using value network thinking, is a break in traditional thinking and IT architectures. One of the basic tenets of building outside-in processes is the effective use of channel data. Here we share some updates on the use of channel data by consumer products companies.

Figure 1. Definition of Outside-In Processes

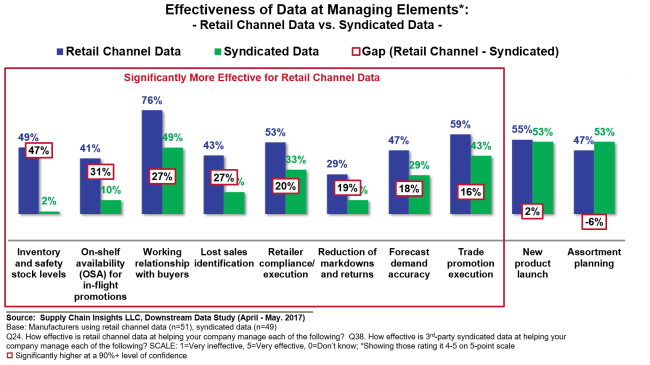

Point-of-sale data is not new. The first tests of point-of-sale data started in 1988. The possibility of using point-of-sale data is now in its third decade. Ironically, most consumer products companies spend millions of dollars on syndicated data, but are reluctant to invest in the synchronization and harmonization of channel data. This is despite the fact that the use of retail channel data is a significantly better demand signal for inventory management, on-shelf reliability, and forecast/demand planning accuracy. The biggest barrier for companies to invest in the building of systems to use point-of-sale data to improve replenishment is the lack of proven ROI. When I hear this, I laugh. Sometimes leaders just have to use their intuition and fight to test new approaches. For me the data is so clear. If companies want to improve replenishment and store availability, they need to use channel data and build effective outside-in processes. The reliance on orders is not sufficient.

Figure 2. Effectiveness of Retail Channel Data versus Syndicated Data in Consumer Products

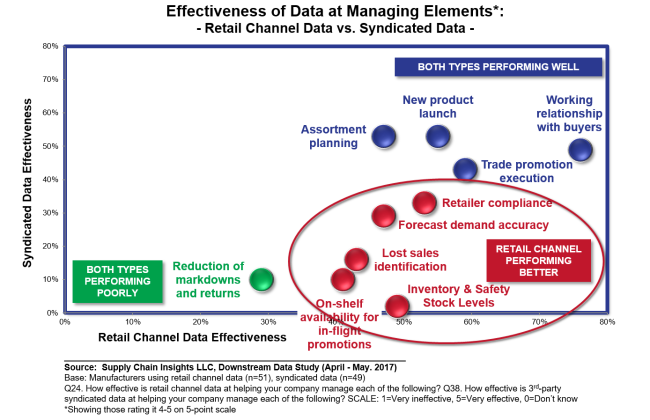

A decade ago I initiated research on the use of downstream data repositories and new forms of analytics to harmonize and synchronize channel data across retailers. While the use of synchronized data from providers like Nielsen and IRI is easier, the data has greater latency and error. Building a downstream data repository is not easy, but the rewards are high as shown in Figure 3.

Figure 3. Effectiveness of Different Approaches to Manage the Channel

Today, when I speak to clients, the original business promise of a Downstream Data Repository (DSR) is forgotten. Many companies are investing in data lakes to mine demand insight data to define and drive new approaches to the market. I think that both approaches are important. The supply chain response will never be as effective with order data, and data from Synchronized Data Providers. To make this point, I am conducting a face-to-face networking session at the Microsoft office in Chicago on August 1, 2017. It is designed for consumer packaged goods and food/beverage leaders interested in building outside-in processes. At the session we will share recent research and case studies in a roundtable format. If interested, shoot me an email at lora.cecere@supplychaininsights.com, and I will save you a seat. I hope to see you there!

Beyond Rabbit Ears on a Black & White TV

When I was a young girl, we received one television channel. Rabbit ears on top of the TV helped us get more channels. We loved