It was a stuffy, hot day, and I found myself sitting by Bridget. The supply chain team was attempting to explain their demand-driven project. They were asking for funding; and Bridget, the treasurer, was not buying the message. On my way back to the train, I struggled with what had just happened. I had worked hard to teach the team—presenting how to talk the language of demand —but it was not understood at the boardroom level.

Bridget crossed her arms and asked why the project they had just implemented on improving demand planning was not sufficient. Lee, across the table, chimed in to say that the new processes of Integrated Business Planning (IBP) would do the trick. I asked myself, “How ironic is it that the technologies and processes of the past are always presented as the answer.” This morning, I was speaking to Rick Davis, of Kellogg, and Rick’s quote, “When we are talking, we are not listening” made me think. I smiled and thought of the interaction with Bridget on that awful, hot day.

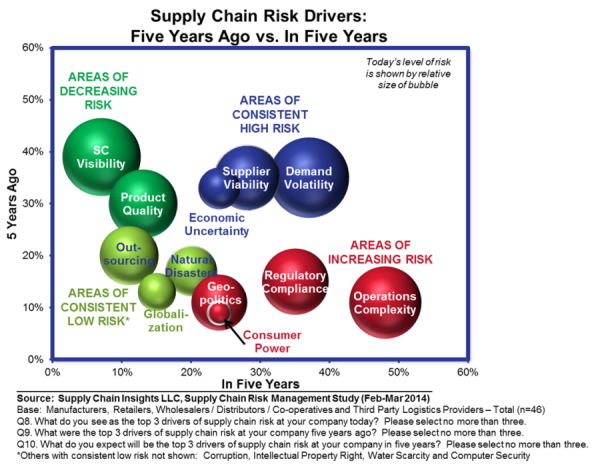

Most people see the problem and think that they have the answer. As shown in Figure 1, demand volatility has increased, the pain is increasing, and the impact on the costs in the supply chain are real. At this point, most leaders wring their hands and say, “If only the forecasting team could do a better job of forecasting.” If this is you, stop! Improving forecasting is not the answer. My blog post is written for you to understand what needs to happen…

While companies need to be good at forecasting—and redefining forecasting to be outside-in is needed—it is not sufficient. This doesn’t also mean you should abandon forecasting processes. Tactical forecasting helps us to think through the questions of long-term asset strategies and sort through network design optimization alternatives. Recognize that these are tactical processes. Companies need to redefine demand processes to sense and translate from the channel back. Where to start?

1) Actively Build a Demand Organization. I can count the number of companies with a demand organization on one hand. Most have a supply organization that has a subgroup which is chartered with forecasting demand for use by supply. In contrast, the demand organization that I am advocating is an analytics group that crosses over sales and marketing into supply. The group is cross-functional and serves the business by mining demand insights, sensing market patterns based on channel data, and recommends demand shaping programs based on the analysis of revenue management. They are sensing and shaping channel behavior.

2) Invest in New Forms of Analytics. The traditional tools and approaches are not up to the task. Invest in technologies like demand signal repositories, demand sensing analytics, and cognitive learning. Treat demand latency as the evil empire. It is MUDA. Go on a mission to translate demand with as little latency as the data allows. Educate all business leaders on the causality between demand latency and cost/waste.

3) Listen. Don’t Believe That You Know the Answers. Push for New Solutions. Let’s face it. Our conventional paradigms had us do some crazy things. There are still consultants running around pontificating about the need for one-number forecasting and consensus planning. My advice is to stop and rethink the processes.

3) Listen. Don’t Believe That You Know the Answers. Push for New Solutions. Let’s face it. Our conventional paradigms had us do some crazy things. There are still consultants running around pontificating about the need for one-number forecasting and consensus planning. My advice is to stop and rethink the processes.

Understand that the one-number approach is too simplistic, and that the goal should be a common plan (the demand hierarchy is composed of a myriad of numbers). The relationships between the data elements to manage tops-down and bottoms-up forecasting is important. Respect it.

Secondly, consensus forecasting may sound like a good approach, but in most organizations, it has not helped. The opinions, if not grounded in a disciplined approach of forecast-value add analysis, can introduce bias and error. Instead, invest in learning the new processes that are evolving to use channel data and to sense demand. Demand sensing is the translation of market data in the short-term duration (days-to-weeks) to improve the supply chain response. Demand sensing typically improves inventory turns by 11% and reduces obsolescence. The greater the demand latency (time to translate purchase in the channel to receiving an order), the greater the value of demand sensing to reduce demand latency.

If you want to read more on this topic and understand the impact on the value chain’s results, consider picking up my new book, Supply Chain Metrics That Matter, to read over the holidays. I give thanks this holiday season for the opportunity to engage with some amazing readers. Let’s make 2015 a great year!

Let’s help Bridget by giving her new answers. We can do this together.

Digital Transformation: Where Was the Beef?

Where is the Beef? is now a colloquialism. The phrase started as a line in an advertisement in 1984 for Wendy’s hamburgers. I remember sitting