Inquiry is increasing. Company dissatisfaction with supply chain planning is growing. The goal is to improve insights while decreasing the number of planners. The growing dissatisfaction is on the inadequacies of today’s technologies.

Yesterday, I facilitated a group of business leaders attempting to drive innovation in supply chain practices. The last five years were tough for the group. With five serial years of Draconian cost-cutting efforts and downsizing, the team has been heads-down trying to survive. For many years, the focus was overcoming day-to-day hurdles. In addition, the company, for the first time in a decade, is struggling to grow. As a result, there has been little time for reflection. Conferences, external training, or educational forums took a back seat.

Five years is a long time in the technology space. The team is waking up to realize SAP APO for supply chain planning is being sunsetted. Worried by the risk of technology obsolescence, the team is looking for a replacement for SAP APO (SAP has given mixed messages on the life of SAP APO in the market). Their goal is to find a replacement. The recommended SAP IBP is not seen as a viable alternative. The group is searching for an answer, but they are out of touch with the market. Sadly, the consultants hired to help the group are out of touch as well. The supply chain market is in flux to a greater degree than in the past decade. What consultants have sold in the past is not the answer today.

Reflection

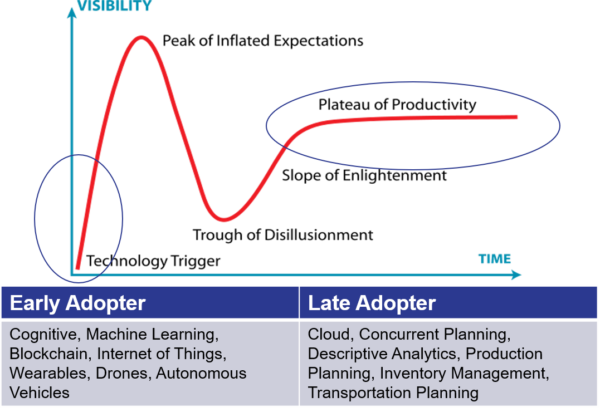

I have been an industry analyst for two decades now. I have never seen a time where there is as much innovation and confusion in the supply chain market. While the group wanted to drive innovation, the consulting practice recommended mature technologies on the plateau of productivity. I questioned the disconnect and found the consulting partner was not aware of many of the emerging technologies.

The software market is moving through the final rounds of consolidation of client-server technologies. A confluence of technologies is redefining decision-support technologies. This includes the Internet of Things, Cloud, Cognitive Computing, Blockchain, Additive Manufacturing, Robotics, and open source/big data analytics. As a result, the givens are no longer givens, and the possibilities are exponential. However, the DNA of the culture drives the rate of adoption.

Figure 1. Hype Cycle

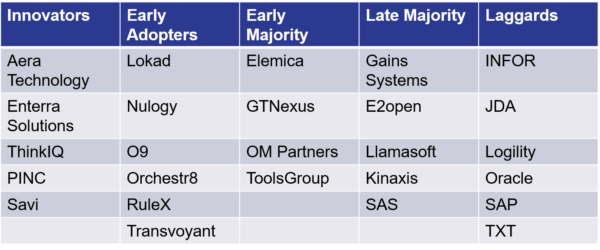

To better understand the market, my categorization of technology providers on this hype cycle is in Table 1. The solutions evolving for innovators are emerging, but the architectures are still in flux. For the innovator, the rewards are greater, but the solutions require greater co-development and partnering with the technology firm. Many of the innovators do not understand the requirements of enterprise-class architectures. Not all organizations are equal to this task.

The early adopters are testing solutions, and the late majority are finalizing the approaches while Late Majority and Laggard buyers want proven solutions with a well-defined Return on Investment (ROI). They are less willing to accept risk. The group was an Early Majority adopter. As a result, I recommended that the group consider using the engines from innovators to improve the outcomes of more mature decision support technologies. My recommendation is to break down the problem into requirements for inputs, engines, outputs, user interface, scenario planning, and data model fit.

Table 1. State of Supply Chain Planning Solutions

The Mirage of Outside-In Processes.

The group wants to drive a digital transformation. The goal is outside-in. They want a touchless system. However, the discussion in the room was very inside-out. Unfortunately, inside-out thinking is what they know. It is hard to learn from the past, to unlearn, to relearn. The “unlearning” is the toughest part.

The consultants believe it is possible to turn an inside-out process to be outside-in. This where we had a disconnect. I do not believe this is true. Instead, I believe that outside-in processes need to be defined with the goal in mind, and that an inside-out process focused on the organization and transactional flows is not suitable for an outside-in digital transformation. The reason? Simply put, an inside-out process is about the company. It is insular. An outside-in process starts with the channel and provides synchronization of data across flows from market-to-market. The inputs, outputs, and flows are different. It is about synchronization of data versus integration. The architectures are also very different. As a result, I believe the consultants in the room were painting a mirage for the group. What is a mirage? It’s an optical illusion. A frequent analogy is an appearance of a sheet of water in a desert or on a hot road, caused by the refraction of light from the sky by heated air, when there is no water present.

I know of no group that has been able to take an inside-out process and make it outside-in. I also cannot find a successful use of an ERP architecture to build an outside-in process. However, many of the decision-support tools listed in Table 1 can be outside-in. The key is in the definition of the implementation. The data models, flows, and inputs are different.

Table 2. Driving The Digital Outside-in Transformation