I laugh when business leaders tell me that they are going to replace their current supply chain planning technologies with “AI.” Sounds good, but most do not have a clear definition of “AI” and the market is in transition.

In fact, the supply chain planning market is a bit of a mess. Each supply chain planning technology at the end of 2024, went through disruption–change in CEO, business model shift, layoffs, re-platforming and acquisitions. Sorting through this to make a decision on a new planning solution at this time is tough. Why do it?

My advice? I coach clients to wait and see. Let the market settle-out over the next year. Contrary to many thought leaders’ thinking, I do not think that supply chain planning will be made obsolete by AI techniques.

I believe we need to rethink supply chain processes to focus on value. Here I define value as improving market capitalization/employee for a public company.

Background

Most of the clients that I am working with are working on two large supply chain initiatives for 2025: Implementation of SAP RISE and Compliance with the EU Digital Product Passport initiative. Better supply chain planning is integral to success in both. With the supply chain planning market in turmoil, the question for many discussions is, “What to do?” I advise for clients to maximize the value of SAP as a system of record and start to build the concepts and flows for the next generation of planning as a system of insights. Two concepts that I would like to have considered are outside-in planning and self-service planning (redefining work and the planning function).

To build an outside-in model, and use new forms of analytics, we must start the discussion with the question of, “what drives value?” Traditional planning models optimize functional processes to improve cost and customer service. The problem is that the reduction of costs within one function does not necessarily drive value. For example, if I improve the cost structure in transportation, procurement, manufacturing and sales independently, what decision support framework decides the right trade-offs? You are right. In today’s architectures and functional metrics, value optimization does not exist.

In current systems where Distribution Requirements Planning (DRP) and Transportation Management (TMS) are different models, alignment is impossible. And, when procurement and tactical planning operate in isolation, there is no decision support framework to guide the trade-offs especially when the functions are tethered to different and conflicting metrics. Before you ask, yes, there are design and simulation technologies–even a digital twin or two–but these technologies are usually deployed as ad-hoc analysis deep within a function and not used holistically.

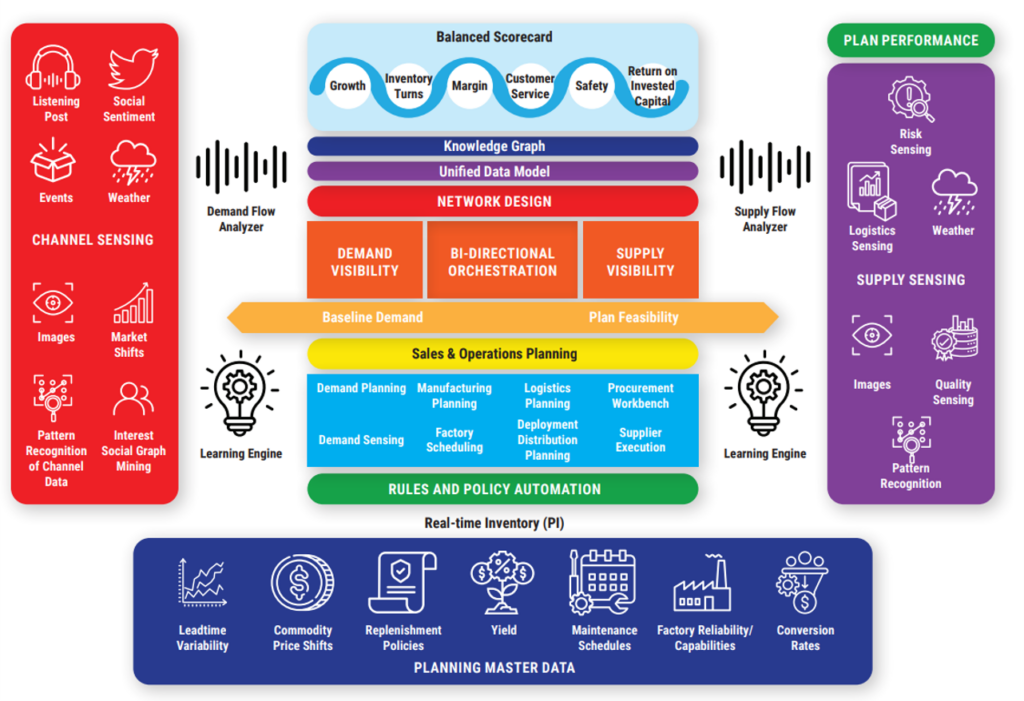

So, in my journey to industry challenge to shift from inside-out to outside-in planning processes, I built the model shared in Figure 1. At the top of the model is a balanced scorecard. The concept is that this new System of Insight would drive performance bi-directionally from both channel and supplier network signals while optimizing the trade-offs across functions. The goal is to use functional optimization to improve reliability while aligning all process and performance outcomes to a balanced scorecard.

Figure 1. Conceptual Model of an Outside-in Planning Process

Driving Value

Which leads me to a discussion on what drives value?

Before we get started, let’s agree. The answer is not the Gartner Top 25. Compared to peer group performance for 2013-2023, 59% of the Gartner Top 25 score below their peer group on average revenue growth, 41% below inventory turns, and 41% below their sector on invested capital. The celebrated group is doing the best on the operating margin, where only 24% rank below their peer group.

I also laugh when newer software players speak to me about autonomous supply chains or no-touch planning. Or the use of AI to improve supply chain planning. The reason? I observe that organizations are unclear on outcomes and the definition of supply chain excellence.

What should we do? I think the rewiring starts with the education of the executive team, and that process should follow strategy. Never start with the process definition. Instead, implement a balanced scorecard, build a clear strategy, and align bonus incentives. What should be on the scorecard? This brings me to the unveiling of the outcomes of the two-year project with Georgia Tech.

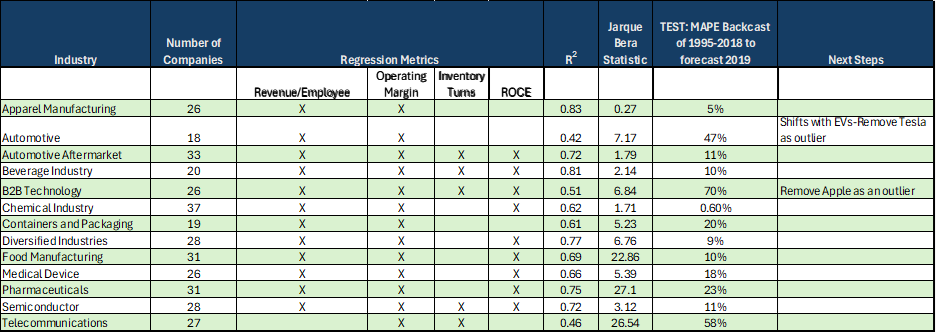

The history of this research effort with Georgia Tech ISYE uses Y-Chart data. Supply Chain Insights built a database of 117 metrics for twenty-six industry sectors (using the Supply Chains to Admire industry classifications) for 610 companies from 1980 to 2023.

The Y chart service harmonizes the data across different public markets, currencies, M&A, and restatements. This work was expensive. I thank Kinaxis for funding the graduate students working on this project.

The data outcome is open source and can be used to improve project outcomes. Because the academic literature lacks a definition of value in the supply chain, Georgia Tech is developing a series of journal articles. The goal is to give back and help business leaders drive value.

This is not a new project. My journey to understand supply chain value stretches over fourteen years.

What have I learned? Eleven of the thirteen industries studied are forecastable and stable over time. Four metrics can effectively model market capitalization/employee with the supply chain delivering more than 50% of value. These metrics are strongly affected by supply chain practices but are usually degraded by functional optimization.

When the Cost of Goods metric is substituted for Operating Margin, the correlation coefficient falls by 40-60%. (A focus on cost throws the supply chain out of balance. Cost reductions also do not always translate into operating margin improvements.)

Currently, no planning technology helps business leaders translate a balanced scorecard into actionable exceptions. This is an opportunity. Instead, traditional planning approaches optimize functional metrics like Safety Stock (versus the form and function of inventory), Operational Equipment Efficiency (OEE), Purchase Price Variance (POV), and Functional Costs. Functional improvements throw the supply chain out of balance, decreasing value.

How Do You Drive Value?

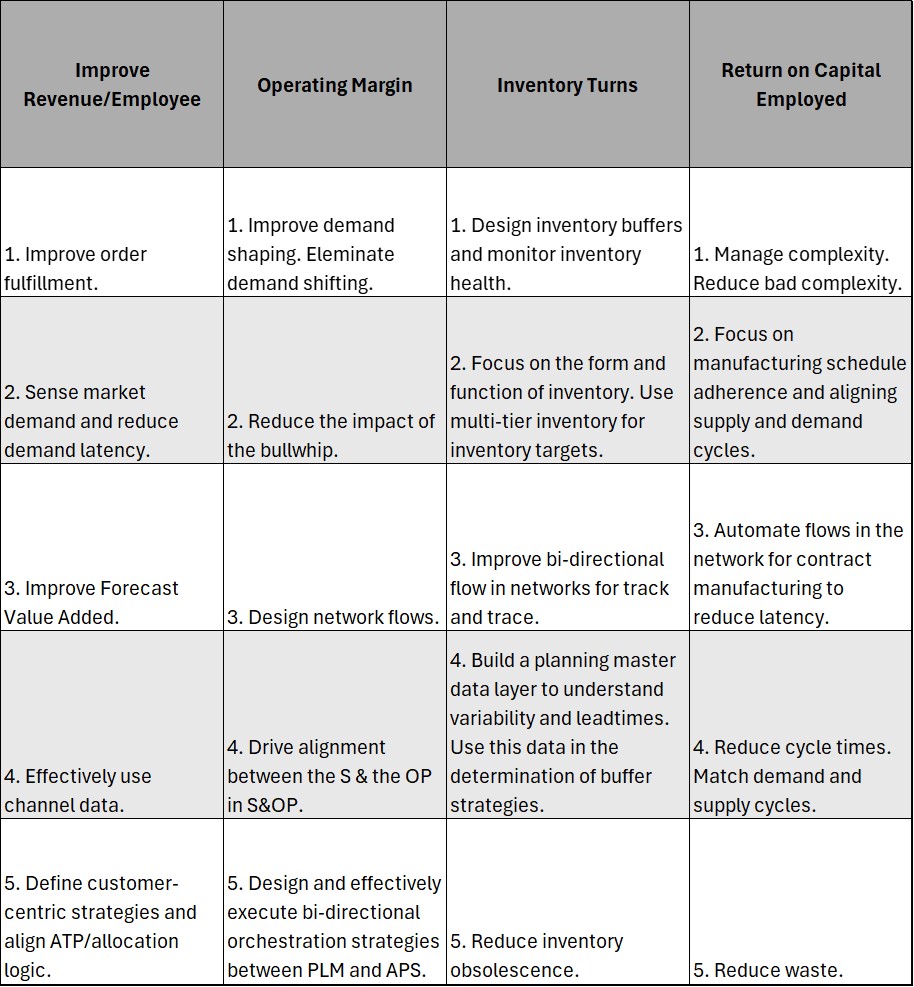

Your next step? Align the organization in 2025 to a balanced scorecard of growth, operating margin, inventory turns, ROCE, and order fulfillment. Align bonus incentives to this balanced scorecard. Align functional metrics to reliability to deliver value. As a business leader, drive organizational alignment from the customer back.

In Table 2, I share a chart of five actions for you to take to improve each of these metrics.

Supply chain excellence should be about driving value. When we run the models substituting cost of goods sold for operating margin, the correlation to market cap/employee degrades 40-60%. The reason? Cost reductions do not necessarily translate to value, and asset strategies are essential to consider in the definition of supply chain strategies.

The process of aligning functional metrics to improve the reliability of outcomes for the balanced scorecard. Hopefully, by now, you realize that anyone that advocates that supply chain excellence can be achieved by only focusing on the trade-offs of customer service, cash, and cost should be shown the door. This perspective is just too simplistic.

Building a Guiding Coalition

At the end of January, I will be teaching a virtual course on building outside-in planning for manufacturers, retailers, and distributors. The course is designed to facilitate networking and engage like-minded leaders in a “how-to class” on building outside-in planning processes. To drive engagement, the course is supported by a Large-Language Learning Model with multi-language support designed by WAEL ~ from utheral.ai using all of the test materials, survey results, blogs, YouTube content, and eBooks developed by Supply Chain Insights over the past five years. The class kick-off is in ten days. Each attendee will be assigned to a group and asked to do some research using the AI learning tool to get started.

Training on new concepts is a wonderful use case for a large language model. There are two classes–one for EMEA and one for the Americas–on different time zones. In each class, the participants will build outside-in models, contrast the value outside-in versus outside-in models, and refine supply chain outcomes based on outside-in flows. The class curriculum is posted here. If interested in participating, please send me a direct message at lora.cecere@supplychaininsights.com.

Here is the video of the Georgia Tech conference on metrics.