I take supply chain management seriously. My focus is writing research for the business leader that is an early adopter attempting to drive first-mover advantage. I am also known for telling it like it is. This blog post on my take of the Blue Yonder’s news. On March 29th, Blue Yonder announced a binding agreement to acquire One Network for approximately $839 Million. The goal is to create a multi-tier enterprise supply chain ecosystem. I am passionate about the goal, but feel that this acquisition is not the answer.

Let me give you some background. To date, I have read sixteen write-ups from press, thought leaders, and analysis on the acquisition. Some are a recap of the press release (which is of no value, in my opinion to the business leader trying to make a decision), while others are congratulatory. Here, I say not so fast. When clients ask my opinion, I comment, “If only there were there.” I am surprised by the size of the acquisition based on the level of maturity of the One Network solution. What does this mean to the market?

About Blue Yonder

Blue Yonder, historically a consolidator of planning applications, pieced together the applications of Arthur, E3, Manugistics, i2 Technologies, JDA, Red Prairie, and Yantriks over the last decade. In 2023, Blue Yonder purchased Flexis AG and Doddle. Each with a different platform focused on a different value proposition.

The Company is investing in building a new architecture. Spending started in 2023 with the intention of a $1B investment over the next two-to-three years. My take is that most of this investment is focused on improving the productivity of the planning organization through better engines using AI and ML modeling techniques with proactive alerting using a cloud-native architecture.

As background, in 2021 Panasonic acquired Blue Yonder, purchasing the remaining 80% of its shares after initially acquiring 20% in July 2020. The investment valued Blue Yonder at USD 8.5 billion. Saddled with debt before Panasonic’s infusion of capital in 2021, Blue Yonder focused on platform integration as the best it could with little capital. The Panasonic acquisition valued the Blue Yonder assets at the time of the investment at $8.5 B.

The past two decades were a rough ride. Employee churn was high with the company surviving primarily on maintenance revenues in the planning market prior to the Panasonic Invesment. The company largely missed the boon in the warehouse management market, ceding market share to Manhattan and new cloud-based applications. Over the last two decades, the gap in technological innovation—modeling, usability, and visualization- grew compared to competitors.

For Blue Yonder, this is a time of change. From 2022 to 2023, Blue Yonder underwent three CEO leadership changes. Duncan Angove, with prior experience at Infor, Oracle, and Retek is the current CEO. The Company employee churn and financial viability stabilized over the past three years making Blue Yonder a more viable player in the supply chain planning market.

About One Network

One Network, founded in 2002 by Greg Brady, started with purchasing Elogex to improve dock door scheduling. Over time, the company slowly built network applications but never achieved market leadership or network capabilities to fully serve any sector. The greatest depth is in grocery retail. The Company has been shopped at a much higher multiple over many years.

The Opportunity

Few supply chain leaders would disagree with the premise of the value of building effective value networks. The problem is that it is easier said than done. Here I share some thoughts.

- Who does this acquisition serve? The acquisition benefits the significant shareholders of One Network. The value for Blue Yonder is questionable. Potential buyers should be suspicious of the marketing spin.

- What will happen now? If this acquisition follows the patterns of others in the market, the major shareholders of One Network will reap the benefits staying for a pre-determined time and then leave. Expect layoffs as the two companies consolidate.

- Who benefits from the acquisition? I think the ensuing turmoil at Blue Yonder, along with the upcoming rationale of applications and people, will only serve its competitors well. The acquisition could slow innovation at a time when the market is seeking a differentiated platform. Look for Blue Yonder clients need to seek to understand the current platform developments and test the assumptions of the One Network acquisition.

- Has any company with enterprise planning successfully launched value network services? The answer is No. Infor bought GT Nexus with a decline in market awareness. Kinaxis purchased MPO, but little has changed in Kinaxis’s positioning. Conversely, E2open bought enterprise applications as an industry consolidator but never connected the applications to a network. The issue is that inside-out and outside-in planning solutions don’t fit together well. The reason? Enterprise applications are inside-out, while network solutions are outside-in: the flows are divergent. While I asked for details on planned process flows, I did not get them.

- Why was the announcement on a Friday before Easter? That’s a good question. My public relations training taught me to launch good news at the beginning of the week and obligatory, but not complimentary, announcements on the last day of the week before a holiday. There was no pre-briefing to thought leaders in the market. I think the issue is lack of experience by the Blue Yonder team not an attempt to sweep the acquisition under the rug in a holiday period.

Why Is Building A Network Solution So Hard?

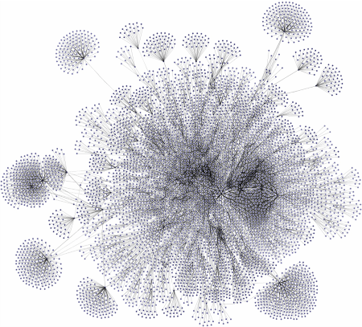

The issue is that the market is fragmented over 100 applications, each solving a slightly different business problem, with no interoperability and no natural buyer. Blue Yonder does not have a sales force to sell into this market and One Network has limited market share.

Here I share my two cents. I welcome your insights.

Footnote: This blog was shared with One Network and Blue Yonder before posting today. My goal was factual review. Much of the response was opinion. While our opinions on this planned acquisition differ, I have modified the original post to reflect factual feedback.