I am heads down writing my book, Bricks Matter. The book is scheduled to publish in August, 2012. It focuses on the evolution of the three bricks of supply chain management: asset strategies, forging strategies in global countries (BRIC countries) and having the right supply chain processes in place (supply chain bricks). I am co-authoring the book with Charlie Chase, author of the book Demand-driven Forecasting (see it on Amazon at http://www.amazon.com/Demand-Driven-Forecasting-Structured-Approach-Business/dp/0470415029/ref=sr_1_1?ie=UTF8&qid=1326038261&sr=8-1 )written under contract with SAS Business Series with Wiley. With the first chapter written, my first reaction is WHEW! My second thought is that writing a book is hard work. 98,000 words is a bigger task than it sounds.

In preparation for the book, we have talked to fifty supply chain leaders, collected data from balance sheets and rummaged through consortia data. It has been a great time for discovery. I share some snippets here, and I will give you more over the next couple of weeks. Let me know your thoughts and insights as I finish the rest of the chapters. <I look forward to your feedback. We want to make this a collaborative effort.>

2012 is the Thirtieth Anniversary of Supply Chain Management. 2012 is a big year. It is the thirtieth anniversary for supply chain management. The first published document using the term supply chain management (Oliver, R.K., Webber, M.D., 1982, “Supply-chain management: logistics catches up with strategy”, Outlook, Booz, Allen and Hamilton Inc. Reprinted 1992, in Logistics: The Strategic Issues, ed. M Christopher, Chapman Hall, London, pp. 63-75) published 30 years ago. The book will publish on the 30th anniversary of the discipline.

2012 is the Thirtieth Anniversary of Supply Chain Management. 2012 is a big year. It is the thirtieth anniversary for supply chain management. The first published document using the term supply chain management (Oliver, R.K., Webber, M.D., 1982, “Supply-chain management: logistics catches up with strategy”, Outlook, Booz, Allen and Hamilton Inc. Reprinted 1992, in Logistics: The Strategic Issues, ed. M Christopher, Chapman Hall, London, pp. 63-75) published 30 years ago. The book will publish on the 30th anniversary of the discipline.

Time to Celebrate the Pioneers. We are currently training the fourth generation of supply chain leaders. The first generation is passing the baton. They are leaving the workforce. This generation fought for a place at a table–any table– to talk about supply chain management. They will leave knowing that there is now a supply chain organization.

The second generation were the boots on the ground building global supply chains. This will be the first generation that will sit at the table as Chief Supply Chain Officers (CSCO). The third generation is currently plugging away at entry-level jobs. They are trying to apply what they have learned in school to the real world. The fourth generation is busy completing their courses at Universities. In the passing of the baton, there is a skill shortage in the second generation and a need to train and build talent in emerging markets. Current graduates are getting jobs before they graduate with higher salaries than prior years. It is a time to celebrate the early pioneers and reflect on the changes that have happened in the discipline.

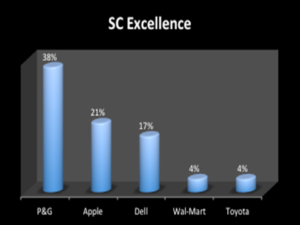

Procter & Gamble is Seen as the Leader. In the book, we are evaluating supply chain leadership in two ways: asking supply chain leaders who they think did it best and then evaluating twenty years of balance sheet data.

Procter & Gamble is Seen as the Leader. In the book, we are evaluating supply chain leadership in two ways: asking supply chain leaders who they think did it best and then evaluating twenty years of balance sheet data.

When asked the question, respondents struggle. There is no one company that comes to mind. Instead, companies are seen as doing pieces of the supply chain well. There are many examples. Toyota is known for lean. Dell is known for working capital management. Wal-Mart is known for Retail Link. However, 38% of the time, Procter and Gamble is cited as the supply chain leader. And, in the analysis of year-over-year balance sheet data, it looks like there is a compelling story.

Do you find it ironic that despite years of investment that companies can still not agree on the definition of supply chain excellence? There is no clear definition from the Council of Supply Chain Management Professionals (CSCMP) or APICs, and I have always struggled with the AMR Research Top 25 methodology for two reasons. I just don’t think that you can put companies from all industries into a spreadsheet and shake them up and come up with a leader. I also do not think that you can evaluate supply chain excellence in one year snap shots.

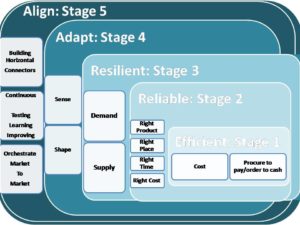

Earn your way to Become Demand Driven. I have written for the past seven years on demand-driven concepts. I am a strong believer that the reduction of demand latency and the improvement in sensing capabilities is key to supply chain leadership. However, I was reminded in the interviews, that we have to earn the right to build these higher level capabilities by building the basics. As a result, I built this five stage model of supply chain capability. Let me know what you think.

In the early stages of supply chain team development, companies are focused on transactional efficiency. The focus is on basic blocking and tackling. The goal is improving the accuracy of the order-to-cash and procure-to-pay processes and getting the basics right in the areas of inventory management, logistics/delivery, and customer service. At this stage, the supply chain does not have the credibility to discuss anything other than improving reliability of operations and reducing costs.

The next stage of maturity focuses on improving the reliability of operations. In this stage, teams work on delivering the right product at the right place at the right time at the right cost. This is the beginning of cross-functional discussions that become foundational in driving how value chain trade-offs can be made.

At the next stage of the supply chain (resiliency), processes start to become horizontal and outside in (market sensing). The focus is on risk mitigation, demand sensing and the translation of market signals. At this stage, the organization slowly earns the right to improve the value in customer relationships. In our interviews of supply chain leaders, 80% of companies are working in stages 1 and 2 of the supply chain maturity model and 15% are operating at stage 3.

As the supply chain matures, supply chain leaders partner with the commercial teams to design outside-in processes that can better sense and shape demand and use these insights to drive a more profitable response. In our interviews for this report, 5% of companies were at this stage of maturity.

In the most mature phase, the company aligns the supply chain market to market to become market driven. In this stage the supply chain senses buy and sell-side market shifts and orchestrates trade-offs horizontally in a bi-directional coordinated response. This represents less than 1% of companies interviewed.

Each stage requires progressive levels of outside-in thinking and design of horizontal processes. However, each level of maturity opens up new opportunities to add value – including driving innovation, new business models, and executing channel strategies– with the greater organization.

Today’s supply chain responds. Its response based on internal data with very little sensing. The response is based on little insight of market data. If markets are stable, this is not a problem. But if conditions are volatile – increases in competition, changing commodity prices or significant changes in consumer confidence/economic cycles– this is problematic. In 2011, 85% of companies experienced a major supply chain disruption. To drive resiliency and improve supply chain reliability, companies must improve demand and supply sensing to drive dynamic decision making.

In steps 1-2 of the capability model outlined above, the processes were designed outside-in: from the enterprise to the network. In this traditional design, the supply chain is insular. The supply chain is blind to what is happening in the market. The only data is internal. Trading partner relationships are transactional. The parties share order-to-cash and procure-to- pay information, but little else. The focus is on transactional efficiency and cost mitigation. Processes are governed by inflexible rules. The organization responds, but it does not sense.

In stages 3-5 of the model, the processes become progressively outside-in (from the market into the enterprise). The focus shifts to focus on the use of external data. To maximize value, companies focus on capturing market data with minimal latency, the lowest level of granularity and the highest level of frequency. The volume of data, the disparate data types and the difference in data formats have given rise to data repositories for supply and demand market data. These repositories cleanse, harmonize and synchronize data for enterprise usage. This shift to outside-in processes, the redesign of enterprise processes to sense before responding, is a major change management issue. It can also be painful. Why? In the evolution, companies find that many of the processes and technologies built over the last thirty years are obsolete.

We would love your thoughts. You will find me heads down writing this weekend. We have 72,000 more words to complete.

Native-AI Supply Chain Planning: A Blueprint for Success

Sharing of a blueprint to adopt Native-AI Platforms in the redefinition of supply chain planning.