As an analyst, when technology providers acquire and divest companies, I get invited to pre-announcement conferences. In these sessions the technology providers share their rationale for the investment and invite questions. Thursday morning it was the acquisition of GT Nexus by Infor. The transaction closes in 45 days.

As an analyst, when technology providers acquire and divest companies, I get invited to pre-announcement conferences. In these sessions the technology providers share their rationale for the investment and invite questions. Thursday morning it was the acquisition of GT Nexus by Infor. The transaction closes in 45 days.

Infor, a market consolidator of enterprise software, currently has revenues of $2.8 billion in sales and about $800 million in earnings before interest and taxes in the past 12 months. Despite numerous acquisitions and product development efforts, SAP and Oracle are much larger industry giants. In 2014, SAP posted revenues of $19.5 billion and Oracle with $38.3 billion.

Founded in 2002 under the name of Agilisys, Infor rebranded in 2004. In the period of 2002-present, the company acquired/aggregated many applications. The most significant for the supply chain market are assets from Baan, Formation Systems, Fygir, Intentia, Lawson, MAPICS, Mercia, and SSA Global.

The What

On August 13th, Infor announced the intent to purchase GT Nexus for $675 million. Based on reporting from the Wall Street Journal, the company hired Morgan Stanley to shop the company and package it for sale in 2014 with an expected evaluation of $800 million. At this size there were few possible suitors for the company. SAP and several other companies passed on the opportunity. Today, GT Nexus is privately held with 43% ownership by Warburg Pincus Equity Firm. The transaction is significant for both the market and for Infor. It’s Infor’s second largest acquisition. The largest was the purchase of Lawson in 2011 for $2 billion.

GT Nexus began operations in 1998 using the name Tradiant. The company branded as GT Nexus in 2001 and purchased Tradecard in 2013. With revenues estimated at 150M$, this transaction has a 4-5X multiple.

In the supply chain management technology market, historically, Infor is a market consolidator, buying and integrating disparate software assets and assembling them into industry solutions. The Infor ION architecture is a canonical enterprise model used to integrate disparate applications purchased by Infor over the past decade. Infor’s investment in the Hook and Loop team created Ming.Li, a redesigned user experience, to improve collaboration and ease of use.

The So What? If I Had a Magic Wand…

When I hung up the analyst call, I struggled with my emotions. The Infor team presented the acquisition as an opportunity to extend ERP to the value chain, to automate inter-enterprise order management and to sell more Infor solutions. I think that it could mean much, much more for the market.

Many of my Fortune 1000 global clients are struggling to automate value networks. They each have a chartered project that looks very similar. The goal is deeper analytics to sense and respond across make, source, and deliver. (Most of them have invested in both GT Nexus and other B2B solutions. There is seldom one technology used within a manufacturing company to connect B2B value networks.) The current market offers no solution.

In this post, I share what I would wish for to help my clients. If I only I had a magic wand…

I write this post in the form of an open letter to Charles Phillips, the CEO.

Charles-

I listened to your analyst call yesterday. Congratulations on Infor’s acquisition of GT Nexus. The GT Nexus platform is an important supply chain asset, connecting with over 25,000 trading partners globally. While the majority of supply chains are connecting to their value networks today through spreadsheets and email, clients of the GT Nexus platform have taken an important step to automate the flows of the network through a canonical infrastructure supported by a many-to-many network.

In the industry, the GT Nexus product is the platform of choice for ocean visibility. With the larger ocean carriers and port congestion, GT Nexus becomes more and more important to retail and manufacturing companies. It is clear. GT Nexus is one of the strongest providers of transportation visibility for the global ecosystem. There is little functionality overlap between GT Nexus and the other B2B network providers like E2open, Elemica, GHX, NeoGrid and SupplyOn. This is good news for you and defines the greater opportunity. Based on the research that we have done at Supply Chain Insights, I feel the greater opportunity is three-fold. If I had a magic wand, these are the areas I would like for you to attack:

1) Create a Network of Networks. By definition, ERP infrastructure is inside-out. The movement of data in ERP technologies is from the enterprise out. Value networks synchronize outside-in flows, using many-to-many architectures (supporting flows from many companies to many companies as opposed to point-to-point interaction)

ERP technologies are rigid and inflexible. Figuratively speaking, supply chain leaders feel that they have been ERP’d to death. Maintenance upgrades, high costs of customization, and the inability to get data are problematic. The work with GT Nexus with many-to-many data flows could help you create true outside-in process flows for the value chain. It could give you a vehicle to redefine the company to rise above the declining market valuation for ERP solutions.

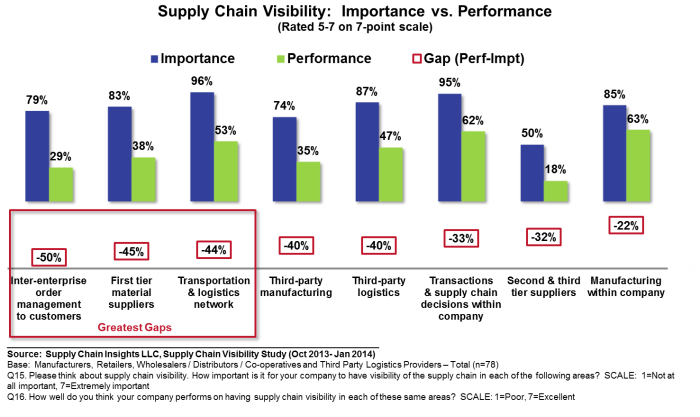

As shown in Figure 1, the gaps in inter-enterprise visibility are large. Companies have automated the enterprise, but the automation of the value chain offers great opportunities. This is the opportunity.

Figure 1. Current State of Network Visibility

In your spare time, examine the market opportunity more closely. There is a great market for a holistic solution on supply chain visibility. Historically, our approaches have been too limited in scope and definition.

While many will compare you to SAP, it is not a comparison. SAP purchased Ariba in 2012 for $4.2 billion, and the company has been slow to actualize the asset and drive incremental revenue. I am not surprised. The Ariba infrastructure is so heavily entrenched in indirect procurement processes that it is hard to adapt to the solution to manage direct materials in the supply chain. With the GT Nexus acquisition, you have a leg up with a fully functioning solution that is operating with direct material shipments. Now is your time to strike to build a network of networks.

What would this look like? Interoperability between GT Nexus and the other B2B networks is the goal. I would like for you to not look at these other players as a competitors. Why? We have a market of niche solutions. Most companies use multiple B2B networks because they have evolved to serve a part of a supply chain–source, make or deliver within an industry–versus a value chain solution that can connect industries. To capture the opportunity, if I waved my magic wand, I would like to see you drive the evolution of an integration standard to enable the GT Nexus platform to become the network infrastructure for all supply chain networks. The value chain needs a solution that enables a network of networks with seamless interoperability.

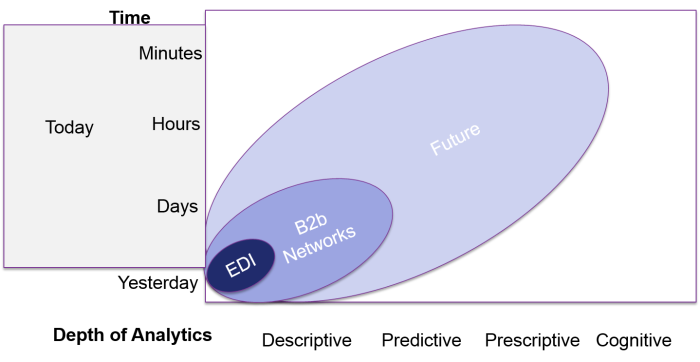

2) Advanced Analytics. Most of the analytics today in B2B networks are descriptive, and operate with a latency of days and hours. The traditional EDI approach inserts a day of latency to open and read documents. Value networks need data more quickly and with greater insights. The opportunity is to deepen both the analytics and the capability for GT Nexus to use real-time information and drive higher levels of decision support. Let’s first examine the opportunity to deepen analytics.

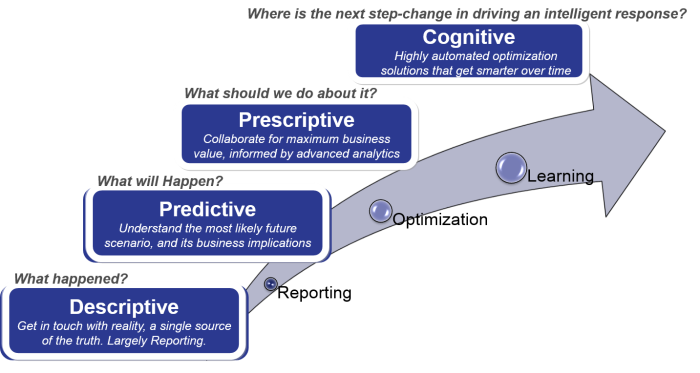

As shown in Figure 2, the continuum of analytics runs from descriptive to cognitive. Google and many iPhone applications today offer prescriptive analytics for traffic routing and driving for the consumer market, but there are few examples in the supply chain technology industry for the use of prescriptive and cognitive computing. Instead, most of the analytics are descriptive, enabling visualization with no contextual insights. Predictive analytics using optimization helps companies to see better alternatives, but companies need prescriptive analytics to drive insights and recommendations. And, to take it a step further, cognitive computing–learning systems to test and learn and adapt over time–would drive even greater insights.

To accomplish the goal, technology companies need to embrace the variety of data types. While ERP and current enterprise systems are transactional systems based on a rational database structure, capturing the market opportunity requires a focus on deeper math and rules-based engines, based on structured and unstructured data together. Unstructured data types like geospatial maps, weather patterns, digital images, warranty information, call-center logs, quality reports and contract document information are not used today. It is the opportunity. Build new systems for supply chain visibility, using structured and unstructured data, to drive learning systems that can allow the network to test, adapt, and learn.

Figure 2. Evolution of Analytics

EDI and early forms of B2B networks define the current state depicted in Figure 3. You have the opportunity to redefine the solution and accelerate a new era of application.

Figure 3. Current State

3) Benchmark Data and Early Alerting.

There is also an opportunity for the automated benchmarking and the use of a B2B network as a syndicated data feed. Companies need a real-time data source on performance. With a sensing layer placed on the network, you can sense and share important performance data

So, Charles, in conclusion, I think a great opportunity lies before you. My advice? Don’t stop with the automation of orders, or the extension of ERP. Your customers have limited options today. Functionally defined definitions from the past decade dictate architecture design. It is not what the customer needs. The functional applications of Customer Relationship Management and Supplier Relationship Management are not the right adapters, or connectors, of the enterprise to the larger value network.

It is an opportunity to define value-chain architectures which can work. As a result, I would love to see you use this acquisition to capture a larger technology market opportunity. While you can enrich the functionality by adding prediction and interoperability, you will destroy the value of GT Nexus if you try to make it the platform to extend INFOR. Good luck in your journey. Let me know how I can help.

Congratulations!

The Shaman

______________________________

Companies are seeking B2B solutions that offer interoperability and depth of analytics. They need a new and deeper capability for supply chain visibility. The race is on to enable the network of networks. Infor, with the acquisition of GT Nexus, has a powerful asset to deliver against the promise.

These are my thoughts. I would love to hear from readers. Do you agree? What are your insights? I look forward to seeing your comments.

_____________

Life is busy at Supply Chain Insights. We are working on the completion of our new game—SCI Impact!—for the Supply Chain Insights Global Summit in September. We would love to see you there! Our goal is to help supply chain visionaries around the world break the mold and drive higher levels of financial improvement.

Life is busy at Supply Chain Insights. We are working on the completion of our new game—SCI Impact!—for the Supply Chain Insights Global Summit in September. We would love to see you there! Our goal is to help supply chain visionaries around the world break the mold and drive higher levels of financial improvement.

About the Author:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.