On Sunday I spent the day at the Barnes Foundation with an old friend Karen. I love art museums, and connections with old friends are great for the soul. The Barnes Foundation is an incredible exposition of some of my favorite artists–Matisse, Modigliani, and Picasso. It was a good day.

On Sunday I spent the day at the Barnes Foundation with an old friend Karen. I love art museums, and connections with old friends are great for the soul. The Barnes Foundation is an incredible exposition of some of my favorite artists–Matisse, Modigliani, and Picasso. It was a good day.

As Karen and I set out on foot, my legs, tired from ballet classes, and my body weary from a tough week on the road, struggled. (The combination of weather and the Democratic convention in Philadelphia delayed all my flights for at least two hours on multiple days. It was a tough travel week. For three consecutive nights I crawled into bed at 2:30 a.m. for 8:00 a.m. strategy meetings with clients.) It turned out to be a very long week talking to clients about integrated planning.

With the tough travel, walking around the art exhibits listening to the moderator on my headset was a real treat. A welcome escape. As I turned the corner and entered a hallway, the narrator said, “Barnes, an eclectic chemist, believed four elements characterize art– line, space, color and light. He arranged artwork across periods based on these four criteria into ensembles.” I loved the simplicity of the statement.

Most Integrated Supply Chain Planning Projects Generate Rubbish

In this complex world simplicity is a good thing. In my travels last week I worked with three clients. At each location the team wrung their hands as they told me their stories of “Integrated Supply Chain Planning.” Their systems were not meeting their expectations. They told stories of garbage in and rubbish out.

In this complex world simplicity is a good thing. In my travels last week I worked with three clients. At each location the team wrung their hands as they told me their stories of “Integrated Supply Chain Planning.” Their systems were not meeting their expectations. They told stories of garbage in and rubbish out.

To use the Barnes example, in this blog post let’s focus on simplicity. Good planning requires a clear focus on inputs, data model ( a fit to the business requirements), and outcomes. Most companies ask the wrong questions. The journey should start with the goal in mind.

As planning organizations within companies grow up–a move from a regional, to multinational, to global– getting clear on the basics of planning becomes more and more important. Why? The impact, both good and bad, is greater. I can count the number of companies that are good at supply chain planning on one hand. My favorites are Cisco Systems, Frito Lay, Intel, General Mills, and SanDisk. I find most companies are good at pockets of planning–demand planning, supply planning, transportation planning, material planning or plant scheduling, but the flows are not connected. This includes companies like BASF, Clorox, Eastman Chemical, J&J, Kimberly-Clark, Mondelēz, Nestlé, P&G, and Unilever. Each are good at localized planning within a focused area of demand, supply, network design, transportation planning, material sourcing or finite scheduling. Many projects at companies like Amgen, Cargill, Coca-Cola, J&J, Hershey, Kellogg, Nike, NCR, and PepsiCo fail one, two, or even three times before they understand the basics. For most, the goal of a fully functional integrated planning project is inspirational, and remains elusive.

Let’s start with a definition, and then explore the possibilities. Integrated planning, what is it? I find five common definitions:

- Tight Integration of Transactional and Planning Data. A focus on movement of data into and out of the engines from Enterprise Resource Planning (ERP).

- Sales & Operations Planning/Integrated Business Planning (IBP). Process integration with finance to evaluate mix, cost, and volume to determine the most profitable plan. Companies with a deep focus on Sales and Operations Planning (S&OP) will often default to this definition.

- Synchronization Across Planning Horizons. Each planning horizon–strategic, tactical, operational, executional–consumed in the processing of the plan. Getting good at the handoffs in roles and governance is key. Many well-intended teams get tangled in the discussions without clarity on the goals and consumption logic within each planning area. While regional supply chain teams could focus on operational decisions–deployment, DRP/MRP logic, finite planning/scheduling within manufacturing, and transportation routing–global teams must get good at tactical planning globally to drive synergies.

- Process Integration Across Functions. The greatest value happens when companies can link across source, make and deliver. Few implementations of planning connect to procurement and transportation. With most global organizations this is the greatest benefit. The traditional advanced planning tool footprints did not give organizations a path to do this well.

- Regional Integration Across Businesses. The process flows across regions and planning teams, and the inherent governance of around who plans, makes decisions and provides inputs, are critical to success.

There is no single, or right, answer. However, it is important to have a clear definition. Without agreement, the teams try to execute different visions; and move in cross-purposes.

Get Clear on the Definition. Get Started. Focus on the Basics.

Supply chain planning is decision support technology. The use of analytics in the planning solutions enables faster answers to tough problems. As companies become more global and complex, the problems become more gnarly. To avoid heated political debates, the planning team needs to constantly evaluate the fit of the plan and drive continuous improvement on planning outputs. This requires continued education. Without focus and alignment, teams will spin. Avoid discussions which focus on getting precise on a bad plan, or technology standardization. These discussions are counter productive.

As I listen to most client discussions, the quote from Superman circles in my brain: “Great power carries great responsibility.” Analytics within supply chain planning are powerful, but they only work well when used correctly. Most companies would be better off if they started slowly, learned how to build good plans, and then evolved. However, most IT organizations rush to jam in the technologies and consider their jobs done.

Supply chain leaders have largely been rewarded for responding well to the urgent. Supply chain planning is about managing the important. Good planning sets up the organization for success. To do this well requires a long-term focus by stable teams with enlightened leadership. In today’s world the focus is often short-term (people churn in the planning roles), the teams come and go, and there is a lack of understanding by leadership. As a result, many organizations get captivated by a nirvana dream painted by system integrators and technology provider who send them down the path of generating bad answers faster. (Remember, as you listen to the pitches in a conference room with pretty powerpoints, that each person pitching you the nirvana story is heavily incented to sell the service. For kicks and giggles ask them about their commission structures over a beer.)

When I ask clients what “Integrated Supply Chain Planning” means I get very different answers. Most are unclear on outcomes and what it takes to implement a planning project. There is no clear definition of integrated supply chain planning in the industry. Most have made a mistake of implementing a technology project without clear definitions of planning horizons, governance, and handoffs. While Integrated Planning sounds good, and teams can sit around the table and nod their heads with a false sense of security that the group reached agreement, buyer beware. The devil is in the details. Without a clear definition be careful what you ask for. There are seven traps:

- High Forecast Bias Improves Sales. The average company has 25-35% bias. The use of collaborative forecasting without Forecast Value Add (FVA) increase both bias and error in the forecasting process.

- One-Number Forecasting Is a Goal. Someone that recommends one-number forecasting does not understand forecasting. Forecasting is a hierarchical data model containing thousands of numbers. The goal? A common plan: not one number. Focus on the best inputs to the model and the best outputs into the other planning engines for supply/transportation. (Expect many connections.) In the flows, focus on the use of probability of demand, not one number.

- Tight Integration Creates Better Plans. The best plans require what-if analysis within a modeling environment. The most mature teams review and modify the plans based on testing. The plan should only be passed when reviewed by an experienced planner. Tight integration can pass data that has not been reviewed and finalized. This is especially true when there is high complexity and shifts in the item master or in organizations with high demand error.

- Buying From the Same Vendor Improves Integration. Large companies perpetuate this myth. It is to their benefit and tends to drive larger deals. It is just not true.

- Planning Implementations are Technology Implementations. While many companies attack the implementation of supply chain planning as a technology project, the greater obstacle is building a planning organization. Companies that focus on implementing supply chain planning as a technology project will fail.

- Consultants Are Planning Experts. Today there are few very good consultants in supply chain planning. Sadly, the understanding of supply chain planning by consultants decreased over the course of the last decade. There is deeper expertise in boutique consultancies than the larger consulting firms.

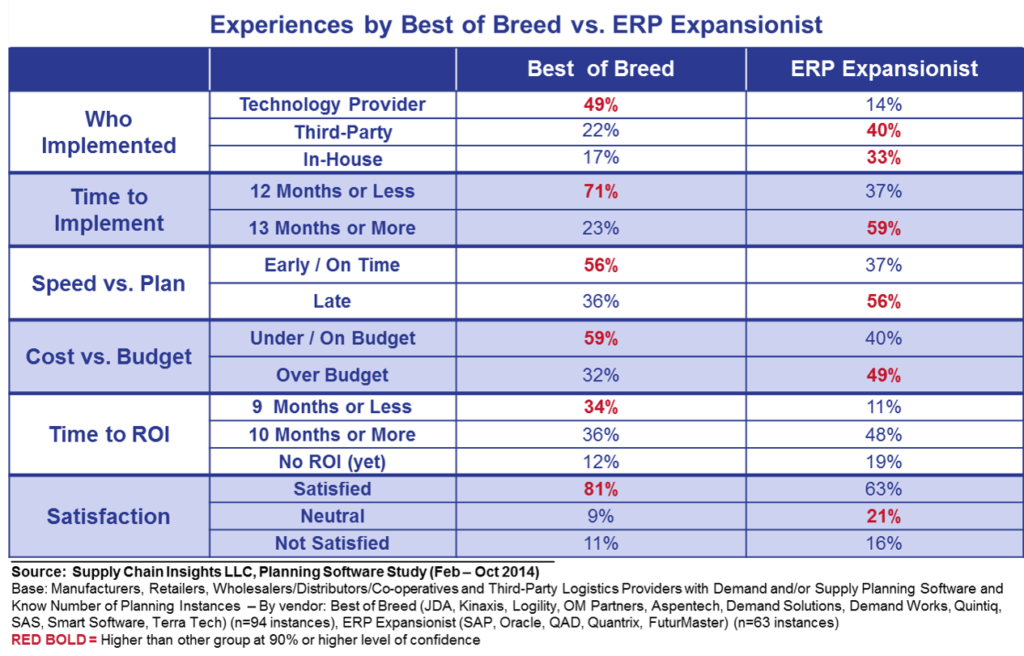

- You Don’t Need Technology. Or Don’t Act Now. Wait for the Next Generation of Technology. The average projects yield a Return on Investment (ROI) of 6-9 months. The best projects pay for themselves in 1-2 months. We are also on the cusp of a technology evolution with cognitive computing and open source platforms. Early adopters are experimenting and these will become mainstream within 3-5 years. You should act now. Move slowly and learn. Set the expectation that you will get a ROI within a year and that the technology needs an upgrade in 3-5 years. (For more on Why Is Supply Chain Planning So Hard? check out our recent report.) Here is some data from our research on relative ROI:

So as you sit in your chair, at the table, listening to the discussions about planning with your team, think about your systems for planning. As you facilitate the discussion, focus on inputs, data models and outputs. At the end of all meeting ask your planning teams five questions:

- What is our goal? How does the output of the model tie to a business outcome?

- How do we know the model fits our business? How do we measure that we have a good plan?

- Is our data clean enough to drive a good outcome? How do we detect and remove anomalies?

- How do we maximize the use of our technologies? Do we have the right people? Training? Skill development?

- Where are we on clear handoffs, roles and responsibilities to support regional, business and global planning? Are we clear on governance? What should it be?

At the end of this discussion, ask yourself, “Am I driving towards improving the goals of the corporation? Is there alignment and clear outcomes?” “Or am I producing rubbish?” Based on my travels I think most teams, if they are honest, will say that they are making more rubbish than they would like.

Let me hear from you. Share your thoughts.

Take Us With You for Your Summer Holiday

In June we published our new Shaman’s Journal. The Shaman blog is now read by 15,000 readers globally. The Shaman’s Journal book is a collection of best read posts organized in more readable format. Order your copy today through Amazon to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your summer vacation.

In June we published our new Shaman’s Journal. The Shaman blog is now read by 15,000 readers globally. The Shaman’s Journal book is a collection of best read posts organized in more readable format. Order your copy today through Amazon to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your summer vacation.

Also, listen to our podcasts. Download the Straight Talk with Supply Chain Insights app on your iPhone or Android to listen to the testimonials of this year’s Supply Chain to Admire winners as you travel.

Continue the Discussion at the Supply Chain Insights Global Summit

We will continue this discussion at the Supply Chain Insights Global Summit. (Registration is open for the first 125 participants. We limit the number of technology providers to 25% of the audience.) Move quickly! The hotel room block is almost sold out. At the conference we will be challenging supply chain leaders to focus on Supply Chain 2030 through a programmatic focus on five themes:

- Supply Chains to Admire. Financial Results. A critical look at supply chain processes impacting financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models.

- Supply Chain 2030. Building Outside-In Processes. Experience the difference between traditional inside-out and new outside-in processes through the use of new forms of analytics and the network of networks.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement, and talent development for emerging markets.

We hope to see you there!

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn or push for supply chain excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn or push for supply chain excellence.