It was an early morning. I cradled my cup of tea in my hand. It had been a long night. However, I had little time to be tired.

It was an early morning. I cradled my cup of tea in my hand. It had been a long night. However, I had little time to be tired.

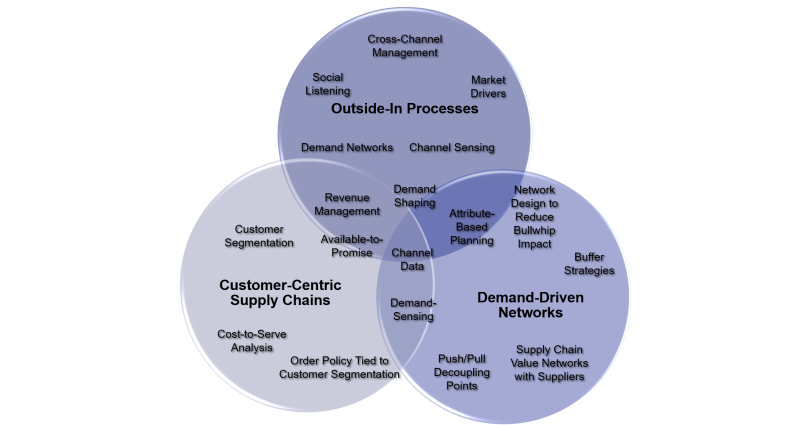

The client leaned across the table and asked, “Is a customer-centric supply chain strategy the same as a demand-driven supply chain strategy?” I smiled. As we talked the adrenaline started to pump. I asked for a black marker to draw on the board in the room and replied, “If only it was that easy!” I then turned and went to the whiteboard to draw this diagram. I started with two overlapping circles.

My answer was simple. I began, “It is and it is not. The concepts are close cousins. The relationship is best represented by a Venn diagram. There are overlaps.” I drew the picture shown in Figure 1.

Figure 1. Drawing from the Whiteboard: Building Customer-Centric Supply Chain Strategies

As we discussed this drawing the dialogue flowed in the conference room. Most of the concepts were new to the team; and while the group had discussed many of the ideas at a high level, they had not been able to take the conceptual ideas into implementation. As a result, there were arguments. Many were religious: wafting into principle-based inflexible positions.

I asked the group to think of demand-driven concepts as the enabler of customer-centric strategies. They are not the same, and the delivery of a demand-driven strategy does not mean the company will enable a customer-centric supply chain, or build/implement outside-in processes. These are three different, but complementary, concepts. It requires awareness and conscious choice.

Starting With Definitions

As we discussed the progression to outside-in, this raised the question of, “What is an outside-in process?” So I erased the board and started again. I drew a new diagram shown in Figure 2. We then began the discussion on outside-in processes. To help, I wrote a few definitions on the board:

- Demand-Driven Processes. A Demand-Driven Value Network as defined by AMR Research in 2007: A network that senses demand with minimal latency to drive a near real-time response to shape and translate demand.

- Market-Driven Processes. In 2012 I built on these concepts to define the market-driven value network. The definition: an adaptive network focused on a well-defined value-based outcomes. The network senses, translates, and orchestrates market changes (buy- and sell-side markets) bidirectionally with near real-time data to align sell, deliver, make and sourcing organizations outside-in.

- Customer-Centric Supply Chain Processes. A value network governed and defined by customer segmentation and a clear understanding of what drives value for the customer.

- Inside-Out Supply Chain Processes. Supply chain processes driven and governed by the inside-out signals of demand: orders; marketing and sales input; and financial budgets.

- Outside-In Supply Chain Processes. A supply chain process driven and governed by market signals with minimal latency.

Building Outside-In Processes

In principle, there is greater value when the processes use independent channel signals, as opposed to dependent demand (orders and shipments), and build value networks to connect/orchestrate across buy- and sell-side relationships. The most value is at the center of this diagram.

Figure 2. Definition of Outside-In Processes

The Building Blocks

Let’s start with a clear definition of the terms:

- Demand Networks. A demand network translates demand across multiple parties. The focus is on channel data: price; inventory positions; and policies. The use of advanced analytics enables the sensing of out-of-stocks. As markets shift, a demand network enables a clear understanding of market positions with minimal latency. It is about much, much more than Vendor Managed Inventory (VMI) or Collaborative Forecasting and Replenishment. An example of a global demand network is IBM iBAT. I know of ten demand networks using this definition. They are the most prevalent in the consumer electronics industry.

- Social Listening. The use of unstructured text mining, and sentiment analysis, to understand and listen to customer responses to products and services in near real-time. Advanced companies are building cross-functional teams to use unstructured data to analyze warranty, quality and service failures. An example of social listening is the Lenovo Case Study presented at the 2015 Supply Chain Insights Global Summit. I only know of five case studies of cross-functional listening.

- Market Drivers. To become outside-in, the primary signal for demand becomes a market signal. The value network is triggering off of market signals which represent independent demand. In contrast, the traditional supply chain forecasts using historical orders and adjusts based on sales forecasting. This introduces demand latency into the supply chain. (The order translation from the channel based on replenishment points is order latency. For most companies it is weeks and months, but can be multiple quarters.)

- Channel Sensing. Channel sensing enables the use of channel consumption, and the modeling of inventory across channels, to understand global and regional trends to maximize opportunity and mitigate risk. Channel sensing combines VMI, CPFR, and the use of channel signals into a holistic demand signal.

- Cross-Channel Management. The corporate ability to understand the customer across channels. An example is the understanding of the shopper across the moments of truth in omnichannel strategies.

- Customer Segmentation. Rationalization of customers and the translation into priorities for orders, Available-to-Promise (ATP), production scheduling, and inventory allocation.

- Order Policy. The use of customer segmentation strategies to define order policies for lead times, discounts, allocation, and shipping priorities.

- Cost-to-Serve. Analysis of the relative costs to serve customers and a data-driven process to reduce and manage costs at specific customers.

- Customer-Driven Available-to-Promise. The use of customer segmentation to determine priority in matching inventory with orders during the order cycle.

- Use of Channel Data. The harmonization and synchronization of channel data to be used in forecasting, replenishment, and inventory planning.

- Demand Sensing. The use of pattern recognition and advanced analytics to analyze order patterns to translate tactical demand planning (forecast) into a short-term, and more accurate demand signal for replenishment.

- Demand Shaping. The use of price, promotion, sales/distributor incentives, new product launch, marketing campaigns, or positioning to elevate and improve baseline demand.

- Demand Translation. The translation of independent demand into cycle stock reduction in production planning and material buying in demand-driven MRP.

- Attribute-Based Planning. Modeling based on attributes (abstraction from item/location logic termed SKUs) to better see patterns in demand and supply planning.

- Push/Pull Decoupling Points. Choices on when to push, and when to pull, with translation into inventory policy and decoupling points. This requires modeling and continued refinement. An example of the use of customer segmentation into push/pull decoupling points was the Sandisk case study from the 2015 Supply Chain Insights Global Summit.

- Supply Chain Visibility and Supplier Connectivity. The sharing forecasts in supplier relationships is of little value. Instead, companies link suppliers to multiple signals: manufacturing production plans; distribution requirements; and current inventory positions, to help suppliers better plan for supply. These Supply Chain Operating Network Strategies enable multi-tier many-to-many enablement of first and second/third tiers of suppliers of services, materials and transportation.

- Buffer Design. The design of buffer strategies–capacity, inventory, and supplier relationships–to absorb demand and supply variability.

- Network Design to Reduce the Bullwhip Effect. The design of the network to reduce nodes and improve B2B connectivity to align the network and maximize agility.

So while many companies bandy these concepts around in discussions on supply chain strategies, I think it is important to be grounded in definitions. These are three complementary concepts–each valuable by itself–but more powerful when used together. We will be discussing the concepts of Customer-Centric Supply Chains on our webinar on August 17th. Clorox will be presenting their insights on building a customer-centric strategy. I think the Clorox story is a great case study.

I hope that this helps!

I would love to hear from you. What do you think?

Customer-Centric Benchmarking

Interested in benchmarking your supply chain on customer-centric strategies? We would love to have you participate in our new research study. In return for taking the survey, you will be able to participate in a virtual roundtable discussion and network with others. This allows you to use the research as a backdrop for a great conversation with others on how to develop and implement customer-centric strategies. (We keep all company and respondent names confidential and report data in aggregate. Results to be shared in our October newsletter. )

Interested in benchmarking your supply chain on customer-centric strategies? We would love to have you participate in our new research study. In return for taking the survey, you will be able to participate in a virtual roundtable discussion and network with others. This allows you to use the research as a backdrop for a great conversation with others on how to develop and implement customer-centric strategies. (We keep all company and respondent names confidential and report data in aggregate. Results to be shared in our October newsletter. )

Take Us With You on Your Last Summer Holiday

![]() Sadly the summer is coming to a close. If you are taking a last-minute vacation, take us with you. Listen to our podcasts using our apps for iOS and Android. Download the Straight Talk with Supply Chain Insights apps and listen to the testimonials of this year’s Supply Chain to Admire winners as you travel. We are now on our 190th podcast. During the next two weeks we will be sharing the interviews of 2016 Supply Chains to Admire winners and speakers for the Supply Chain Insights Global Summit.

Sadly the summer is coming to a close. If you are taking a last-minute vacation, take us with you. Listen to our podcasts using our apps for iOS and Android. Download the Straight Talk with Supply Chain Insights apps and listen to the testimonials of this year’s Supply Chain to Admire winners as you travel. We are now on our 190th podcast. During the next two weeks we will be sharing the interviews of 2016 Supply Chains to Admire winners and speakers for the Supply Chain Insights Global Summit.

Like the Shaman blog? Check out the new Shaman’s Journal. Each year we organize the best-read posts in a more readable format and publish a softcopy book. Order your copy today through Amazon to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your summer vacation.

Continue the Discussion at the Supply Chain Insights Global Summit

We will continue this discussion at the Supply Chain Insights Global Summit. (Registration is open for the first 125 participants. We limit the number of technology providers to 25% of the audience.) At the conference we will be challenging supply chain leaders to focus on Supply Chain 2030 through a programmatic focus on five themes:

- Supply Chains to Admire. Financial Results. A critical look at supply chain processes impacting financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models.

- Supply Chain 2030. Building Outside-In Processes. Experience the difference between traditional inside-out and new outside-in processes through the use of new forms of analytics and the network of networks.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement, and talent development for emerging markets.

We hope to see you there!

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn or push for supply chain excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn or push for supply chain excellence.