A lasso is what supply chain leaders would like to have. Why? To align S&OP. The processes are out of control.

A lasso is what supply chain leaders would like to have. Why? To align S&OP. The processes are out of control.

Let me explain. As companies transitioned from regional to multi-national organizations, Sales and Operations Planning (S&OP) processes proliferated. Today, the average company has seven S&OP processes, but a global chemical company averages over 30. In contrast, as a regional supply chain leader in the 1990’s, my company had one S&OP. The proliferation of S&OP is not a trivial topic. Today, each company is different, and most are struggling. In my work, I have not found a company that can easily roll up a global material balance or gain a common view of demand.

The proliferation of S&OP might sound like a good thing; and it could be, but only if the processes are built with the goal in mind. A frequent mistake is letting each business build their own systems without governance. To correct this, clearly define the role of the executive team, the global planning teams, the business teams and the regions. The definition is different by company. In some companies, the regions have strong control while in others the global teams drive the process. For example at J&J, the regional teams have the power while P&G is a very matrix’d organization.

A common mistake by business leaders is thinking that they know what good looks like. The research that I have done recently dramatically challenges my 1990’s paradigms. (When companies hire from outside, they will attract talent from many companies. Each defining S&OP differently. As a result, when they sit around the table to discuss the process without detail, they will spin. Each thinks they know what S&OP should look like, but the discussions need to be facilitated to drive alignment.)

Most companies that I work with are struggling with consultant talent. The challenge is greater than the knowledge level. Chose consultants carefully. A successful S&OP process is 60% change management/organizational design, 30% process and 10% technology. Most want to sell technology.

I frequently see groups of supply chain leaders arguing about the right for individual businesses to define their own systems/process. I get it. Businesses are different. However, to maximize the effectiveness of S&OP there is a need for a corporate view of data. Here I start the discussion of commonalities and differences.

What needs to be the same:

- Common Definition of Time Horizons. The roll-ups are only possible if the time horizon between tactical and operational planning is consistent across the organization.

- Cycle Frequency. The frequency of the plan needs to be common across the organization. If one business has a weekly planning system, and another has a monthly system, good luck!

- Metrics Definition. The organization needs to be clear on the Metrics That Matter and the alignment of vertical silos’ metrics to the balanced portfolio. There needs to be a common definition of supply chain excellence.

- Reporting Structure. The S&OP process needs to report to a P&L leader.

- Flow-Based Architectures. Many businesses do not operate in isolation. Diagram the flows and understand how businesses within the company interoperate. Build a system to enable these flows.

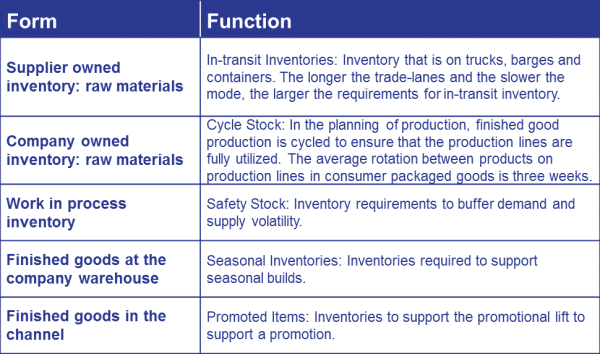

- Financial Reporting. Forecasting hierarchies need to roll up to define business requirements, and inventory needs to be reported by form and function. All need to be clear on the role of the budget. (The budget is very controversial. I believe that S&OP should inform the budget, but the budget should never constrain S&OP.)

- Business Strategy. The flows need to support a common business strategy. This needs to be common across all businesses.

Table 1. Form and Function of Inventory

What can be different?

- Technologies. The technologies used can vary by business unit. For example, one business unit can run SAP, one Oracle, one Logility, one Kinaxis, and one OM Partners; and it will be OK. (There are some trade-offs in training and labor, but having the right fit of a data model to build a feasible plan for supply can be well worth it.) In fact, often the requirements of the business for constraint-based planning will dictate the need for a different technology. There is a false belief that better S&OP processes use the same technologies. This myth is only perpetuated by a technology vendor trying to make his bonus, or a consultant attempting to drive a seven-figure deal.

- Data Models. The supply data models can vary by business, as long as the time horizons and granularity are the same across the organization.

- Visualization. When it comes to analytics, users have strong business preferences. As long as the data flows for roll-up on inventory, forecasting and planned orders, each business can build and run their own visualization layer as long as it can roll up for an executive view. The planning level must be able to model the feasible supply plan. A common mistake that many companies make is not defining the analytics requirements for these four layers. The executive layer needs to be common, but the business leader workbench can vary by business. The good news is that this is easier today with the proliferation of descriptive analytic techniques.

Figure 1. Analytic Layers of a Global S&OP

So, if you find yourself talking in circles about the differences in business requirements for S&OP, start by making a list of what needs to be common and what can be different. Take the emotion out of the room and make it actionable.

And if you have any to add to my list, please put them in the comments. I look forward to getting your input and making this a dialogue.

On a side note, don’t forget to register for the Supply Chain Insights Global Summit. We are putting the finishing touches on the agenda, and promise that the experience on September 5-8, 2017 will be a great opportunity for digital transformation leaders to ideate and imagine the supply chain of the future.

On a side note, don’t forget to register for the Supply Chain Insights Global Summit. We are putting the finishing touches on the agenda, and promise that the experience on September 5-8, 2017 will be a great opportunity for digital transformation leaders to ideate and imagine the supply chain of the future.

The event’s focus is on next-generation supply chain thinking. It is attended by 100-125 supply chain leaders and is designed to enable learning on new technologies, ideation on process innovation, and networking with other business leaders on the future of supply chain management. Each company can send up to three supply chain leaders. We limit technology software providers to 25% of attendees.

The conference is designed to generate new ideas on next-generation supply chain thinking. During the program, together we will explore:

- Digital Supply Chain. We will answer the question of how the confluence of technologies—wearables, robotics, cognitive computing, 3D printing, real-time data and the Internet of Things (IOT), blockchain, and bitcoin—will change the future of supply chain processes and drive opportunities for a digital supply chain transformation. Don’t miss out on Unilever’s presentation on the use of cognitive computing to drive new insights on decision support; Jabil’s presentation on designing/driving digital innovation; Carter’s work on managing complexity or Fast Radius’ launch of process innovation through additive manufacturing. You will also gain insights on the Network of Networks group’s work on blockchain along with insights on wearable/IOT to redefine digital manufacturing.

- Forge New Directions for Supply Chain 2030. In dialogue with our keynote speakers–Robert J Gordon, of Northwestern University, speaking on American productivity from past industrial revolutions, and Gita Gopinath, from Harvard, sharing insights on the rise of China and India as the global economy shifts through cycles of Nationalism and Globalization—we will forge a clearer vision of Supply Chain 2030.

- What Drives Supply Chain Excellence? As a group, we will examine the impact of supply chain strategies on balance sheet and income statements for the period of 2010-2016 and celebrate success. This work is the culmination of a six-month project that Supply Chain Insights and Cloudera are partnering together to mine new insights using Big Data Analytics techniques (using five years of quantitative research and market data).

- Hands-On Experience with New Technologies. Explore the impact of new technologies through one-one-ones with technology providers through dialogue with 32 innovators in the digital showcase.

- Understand the Value of Outside-In Processes. Experience the value proposition of outside-in processes through a hands-on discrete simulation game. Gain new insights on how the design of outside-in processes improves case fill rates by 50-60%.

The event starts with a unique business leader networking event on September 5, 2017 (named the Shaman’s Circle). On Wednesday, you will have the opportunity to network with peers through golf or hiking. The main event kicks off on September 6, 2017 at noon. In this opening session, we share insights of the Supply Chains to Admire through a series of case studies and gain insights from Gita Gopinath, a Harvard Economist. In this session, we will look forward to global trade in 2030 as we explore the tensions between nationalism and globalization and the role of China/India in Supply Chain 2030. On Thursday September 7, 2017 , we will be focused on digital innovation case studies and ideating together on the future of Supply Chain Processes. This will conclude with the digital showcase where 32 technologists will share their next-generation solutions. On Friday September 8, we wrap up the conference, giving attendees the opportunity to participate in Supply Chain Insights’ new discrete simulation game SCI IMPACT! on the power of outside-in processes.

Good luck with your S&OP process design. Contact Regina (regina.denman@supplychaininsights.com) or I to register for the Summit. We look forward to seeing you there!