François-Régis Le Tourneau leads the efforts at L’Oreal for Standards & Prospective Process Improvement. At the Supply Chain Global Summit 2018, Francois discussed the impact of digitalization, Industry 4.0, and L’Oréal’s approach to business that has allowed the company to continuously rank as a Supply Chains to Admire winner for four consecutive years. The award, based on beating the industry peer group on rate of improvement on the key metrics of growth, operating margin, inventory turns, and Return on Invested Capital (ROIC) while outperforming their peer group, is tough to achieve. We complete the analysis each year. In Figure 1, we detail the methodology calculation. (Read more to understand the details on the Supply Chain Index.)

François-Régis Le Tourneau leads the efforts at L’Oreal for Standards & Prospective Process Improvement. At the Supply Chain Global Summit 2018, Francois discussed the impact of digitalization, Industry 4.0, and L’Oréal’s approach to business that has allowed the company to continuously rank as a Supply Chains to Admire winner for four consecutive years. The award, based on beating the industry peer group on rate of improvement on the key metrics of growth, operating margin, inventory turns, and Return on Invested Capital (ROIC) while outperforming their peer group, is tough to achieve. We complete the analysis each year. In Figure 1, we detail the methodology calculation. (Read more to understand the details on the Supply Chain Index.)

Figure 1. Supply Chains to Admire Methodology

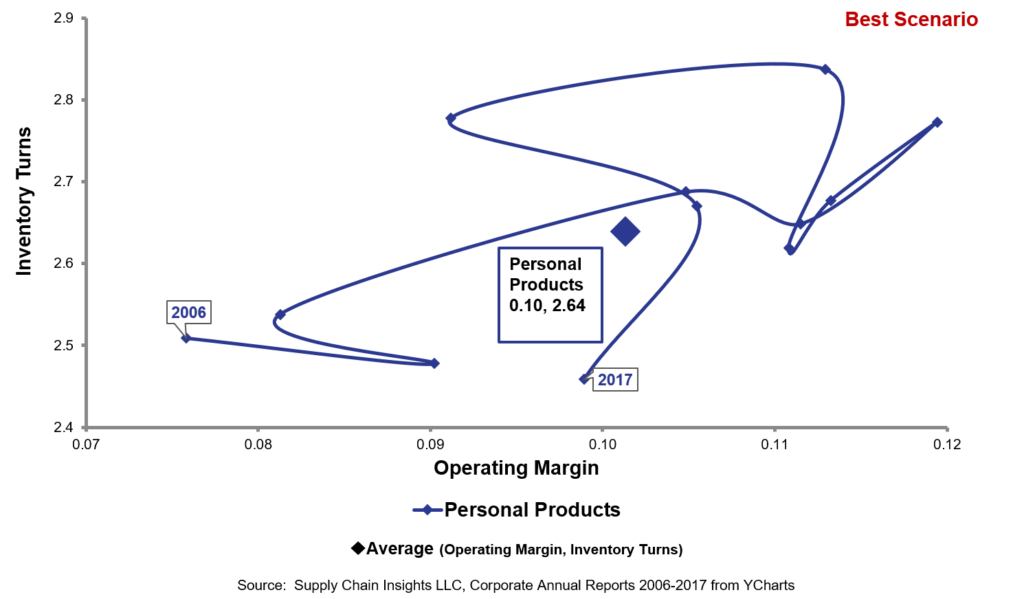

A Multi-Year Unbeatable Champion

Based in Paris, L’Oréal is a global personal care manufacturing company. It is the world’s largest cosmetics company with annual sales estimated at over €26B. The Company has outperformed their peer group for the last decade making L’Oréal a multi-year Supply Chains to Admire award winner for the past four years. To perform the analysis, we grouped L’Oreal into the Personal Products industry, which includes beauty, hair care, vitamins, etc. The orbit chart below illustrates L’Oréal’s performance at the intersection of two metrics. Note that in the industry aggregate, in Figure 3 that the peer group actually went backwards.

Figure 2. Orbit Chart for L’Oréal at the Intersection of Inventory Turns and Operating Margin

Figure 3. Industry Aggregate Comparison

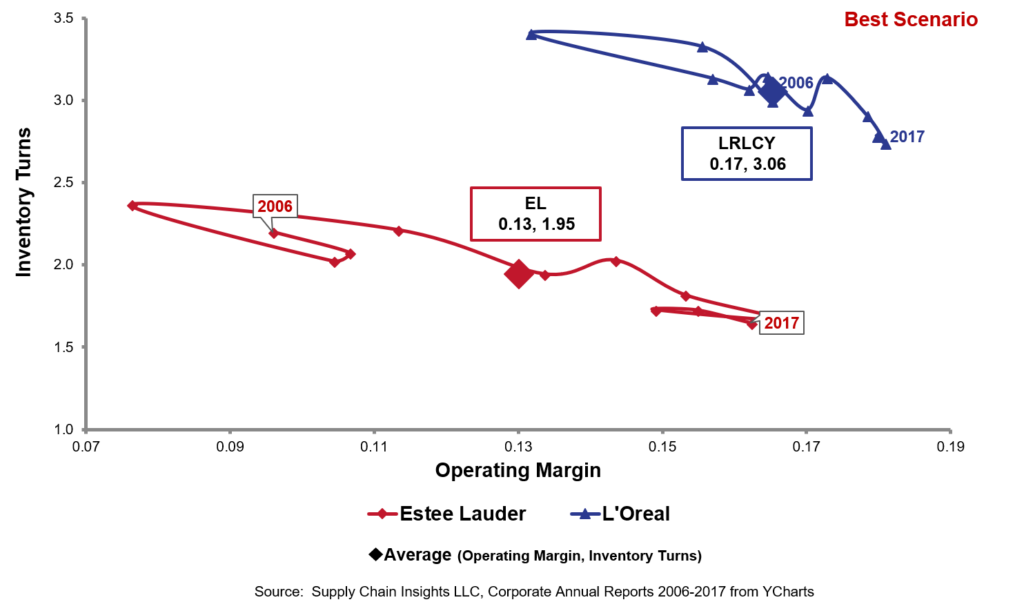

Compare the performance of L’Oreal to its largest competitor, Estee Lauder. On average for the period of 2006-2016, L’Oreal had a 17% operating margin as compared to Estee Lauder’s operating margin of 13%. Additionally, L’Oreal’s inventory turns were slightly over 3.06 outpacing Estee’s inventory turn value of 1.95 . In this analysis, patterns matter. While both companies are driving improvement, L’Oreal is driving both improvement while outperforming the peer group. In contrast Estee is driving improvement, but not outperforming the peer group.

Figure 3. Orbit Chart Comparison of L’Oreal and Estee Lauder

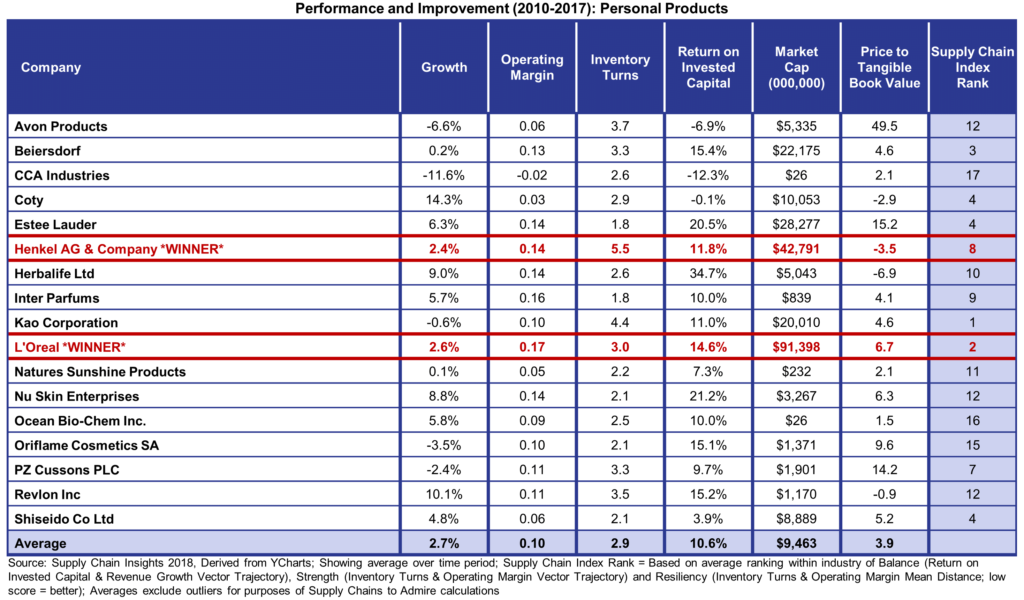

To understand the extent of the achievement, note the comparison to their industry peer group in Table 1. Note that the company is at the industry average on growth, but outperforming the average on operating margin, inventory turns, return on invested capital, market cap, price to tangible book. Overall, L’Oreal is number two in the peer group in terms of driving improvement as defined by the Supply Chain Index.

Table 1. L’Oréal’s Performance Compared to the Peer Group.

This is an example of managing a balanced portfolio and of driving a supply chain revolution.

Driving Change: Adopting and Thriving

L’Oréal’s global strategy embraces globalization with a keen focus on the customer. This case study is the best example we have seen of a customer-centric supply chain. The Company’s strategy is to acquire brands developed on a local or regional scale and then bring them to a global scale in a short period of time. The focus is first on the customer with a global roll-out using an agile supply chain strategy to continually adapt to customer needs. (We define agility as the ability to deliver the same cost, quality and customer service given the level of demand and supply volatility.

Anticipating the shifts in demand, the company’s focus is increasingly digital. In China, for example, more than 40% of the company’s business through eCommerce. The company experienced a 34% growth in global e-commerce in 2017 and is expecting the trend to continue. This is transforming the ways L’Oréal addresses the business. More than 38% of L’Oreal’s advertising budget is now being spent on digital. This is how the company activates the markets and to ensure alignment, the supply chain team works closely with the digital marketing teams.

With a keen focus on the customer, L’Oréal senses and uses customer sentiment. The Company;s senses consumer preferences to change and align their portfolio to deliver personalized products for purchase anytime and anywhere. This has pushed the company to hyper-connectivity with the final consumer. And, to meet the expectations of eco-friendly customers, the company has developed a method of assessing the environmental impact and the social contribution of each product they launch. If a conceptualized product does not exceed the results of an already launched similar product, it won’t be launched. This approach has fundamentally shifted L’Oréal’s response to the market.

Growing Pains

With eight distribution channels, L’Oréal believes they operate a complex global supply chain within the peer group of fast-moving consumer goods (FMCG). In their benchmarking, they believe that the closest company as measured by complexity is Nestlé. In just a few years the company went from a limited range of brands and SKUs to a highly complex business model. The Company currently produces 7 billion products across 55 brands.

Operations complexity that came with growth and globalization is intense. Some manufacturing sites are more focused on regional markets and on mass-market consumer products, others – mostly small branches in the US, France, and Japan – act on global scale for luxury segment. The company is continuously performing a balancing act in terms of luxury craft, complexity, and agility to produce a large number of SKUs made of over 1500 types of raw materials. We show their defined priorities in Figure 4.

Figure 4. Key Priorities in L’Oréal’s Operations’ Strategy

To respond to consumer shifts in preference, L’Oréal continually redesigns physical distribution and network optimization. This is active and ongoing. With smaller order sizes due to the focus on e-Commerce picking in detail is becoming more frequent. During the last decades detail-picking orders mostly applied to luxury products in the hair salon channel. Now, picking the “each” is being extended to the entire catalog across the eight distribution channels.

To respond to consumer shifts in preference, L’Oréal continually redesigns physical distribution and network optimization. This is active and ongoing. With smaller order sizes due to the focus on e-Commerce picking in detail is becoming more frequent. During the last decades detail-picking orders mostly applied to luxury products in the hair salon channel. Now, picking the “each” is being extended to the entire catalog across the eight distribution channels.

Defining the Strategy of Operations 4.0

François-Régis’s focus is defining agility in operations through their Operations 4.0 strategy. This is a code word for operating model change in terms of manufacturing, supply chain, and global operation based on how fast and in what direction the business is changing and how the consumers are moving.

To define this strategy, the company started with consumer needs and then adopted manufacturing technologies through augmentation using virtual reality, simulation machine learning, 3D printing, etc. As the company transitioned from data scarcity to data abundance coupled with cheap data storage, the focus shifted from the ways to obtain data to the use of data to drive insights.

For L’Oreal 3D printing improves flexibility. The Company revolutionized product prototyping. The use of 3D-printing enables smaller batches, lower manufacturing costs, and shorter lead times compared to traditional machining. The focus is on time-to-market to fuel growth strategies.

Figure 5. 3D-printing Revolutionizes L’Oréal’s Prototyping

Consumers want fashion in their cosmetics. 3D printing has enabled the company to produce products that they were unable to produce before. For example, product packaging seen below would not have been possible without 3D. These are shown in Figure 6.

Consumers want fashion in their cosmetics. 3D printing has enabled the company to produce products that they were unable to produce before. For example, product packaging seen below would not have been possible without 3D. These are shown in Figure 6.

Figure 6. Use of 3D Printing To Improve Time-to-Market

The company is also able to test virtual products before moving to production decisions. This has led to accelerated development and has significantly cut costs. 3D-printing enabled a reduction in cycle time: the transition from 60-day development cycle of first mock-ups with considerably high costs to 15-day cycle at a fifth of the cost.

Testing for compatibility of the formula and the packaging before launching a new product is of out most importance in the company’s industry. For example, chemical interaction between aerosol cans and their product formula can lead to dangerous leakages. L’Oréal partnered with IBM to develop technical capabilities for identifying possible interaction based exclusively on artificial intelligence and machine learning. Since compatibility tests last up to 6 months, this technology has greatly reduced our time-to-market.

Our Take: The Success Formula

In our study of supply chain, L’Oréal has the most effective global-regional-local governance model we have ever seen. The company empowers an entrepreneurial culture within regions. They ask each region to know their customers, and empower the supply chain teams to collaborate with their commercial and digital marketing teams. It is one of the most effective regional/global governance models studied.

Might culture have anything to do with success? François-Régis certainly thinks so. “Our success is a question of proximity to our consumers,” – he insists. “We operate our global business with our long-term strategic vision, but the day-to-day operations are kept local. Our supply chain and operations teams are customer-oriented entrepreneurs. We really focus on driving local supply chain initiatives. We empower employees to propose and to innovate.” We think so as well. Everyone in the organization is very aware of consumers’ high expectations. In the end, it’s a drive for innovation to serve the customer.

For additional reading, check out the relevant reports:

Supply Chains to Admire 2018

Supply Chain Index

Driving the Customer-Centric Supply Chain