The average manufacturing company’s supply chain organization is 15 years old. Historically, the traditional supply chain focused on improving costs. Today more mature supply chain teams focus on delivering value. While companies want to improve supply chain performance and drive value, it is easier said than done. The first question to answer is, “What defines value?”

The average manufacturing company’s supply chain organization is 15 years old. Historically, the traditional supply chain focused on improving costs. Today more mature supply chain teams focus on delivering value. While companies want to improve supply chain performance and drive value, it is easier said than done. The first question to answer is, “What defines value?”

The journey for value requires a clear definition and analysis of what is possible. The first step on the journey is to analyze balance sheet results and understand industry trends. To help, in this post we provide you with some insights for the period of 2006-2015.

A Look at History

The supply chain is a complex system with finite, and nonlinear relationships between supply chain metrics that drive balance sheet results. The analysis needs to be measured through an evaluation of year-over-year improvements. It usually takes at least three years for a supply chain to make an impact on financial balance sheet results.

For many companies, improving results is elusive. In our analysis only one out of ten companies successfully improves operating margins and inventory turns at the same time. We find that companies can improve one, but not two of the metrics. Teams struggle to drive improvement in both metrics at the same time. This frustrates finance and increases friction between operations and financial teams.

Many attempt to drive improvement through new organizational structures. While 30% of companies have a supply chain center of excellence, only 50% of companies feel that their supply chain center of excellence is performing well. The reason? Typically, it is a lack of common definition on what defines supply chain excellence.

Organizational structure matters. In our recent analysis of supply chains that are “working well,” we find higher performance when companies have source, make and deliver reporting to the supply chain organization. When this happens we find that the organization is more aligned and performs better on the Supply Chain Metrics That Matter: growth, inventory turns, operating margin, and Return on Invested Capital (ROIC). (We term these the Supply Chain Metrics That Matter because they have a higher correlation to market capitalization.)

Figure 1. Supply Chain Organizations By The Numbers

Analysis of Performance and Improvement by Industry on the Supply Chain Metrics That Matter

Each year at Supply Chain Insights we study the progress of public companies in the manufacturing, retail and distribution sectors. We term this report The Supply Chains to Admire. The analysis takes us about six months to complete. Our target date for this year’s report is July 2016.

In the research, top performers for the report meet the following criteria:

- Analysis by Industry. The analysis is within peer groups as defined by NAICS codes. Top performing companies post results better than their peer group on the Supply Chain Metrics that Matter while driving improvement at a rate faster than their peers. Companies that do not rate above average on the metrics, or are not driving improvement faster than their peer group, do not make the list.

- Resiliency. The analysis is for two time periods: 2006-2015 and 2009-2015. The study evaluates enterprise resiliency. The period of 2007-2008 was the great recession. The superior supply chains sensed demand, and adapted to changing market conditions. We analyze the patterns for the two time periods.

- Value. The companies selected drive greater value than their peers: they are posting better results on Market to Intangible Book ratio.

Each month, as we complete the analysis by industry, we will publish a Supply Chain Metrics That Matter report. In April we will publish an analysis of the pharmaceutical industry. In subsequent months we will publish the analysis of 15 industries: apparel, automotive, automotive suppliers, B2B electronics, chemical, consumer products, consumer electronics, contract manufacturers, food and beverage, medical device, over-the-counter drugs, restaurant operators, retail, and semiconductor in the countdown to the launch of the final report. These reports will publish in our monthly newsletters and will be available on SlideShare and in the Beet Fusion Community.

Analysis by Industry

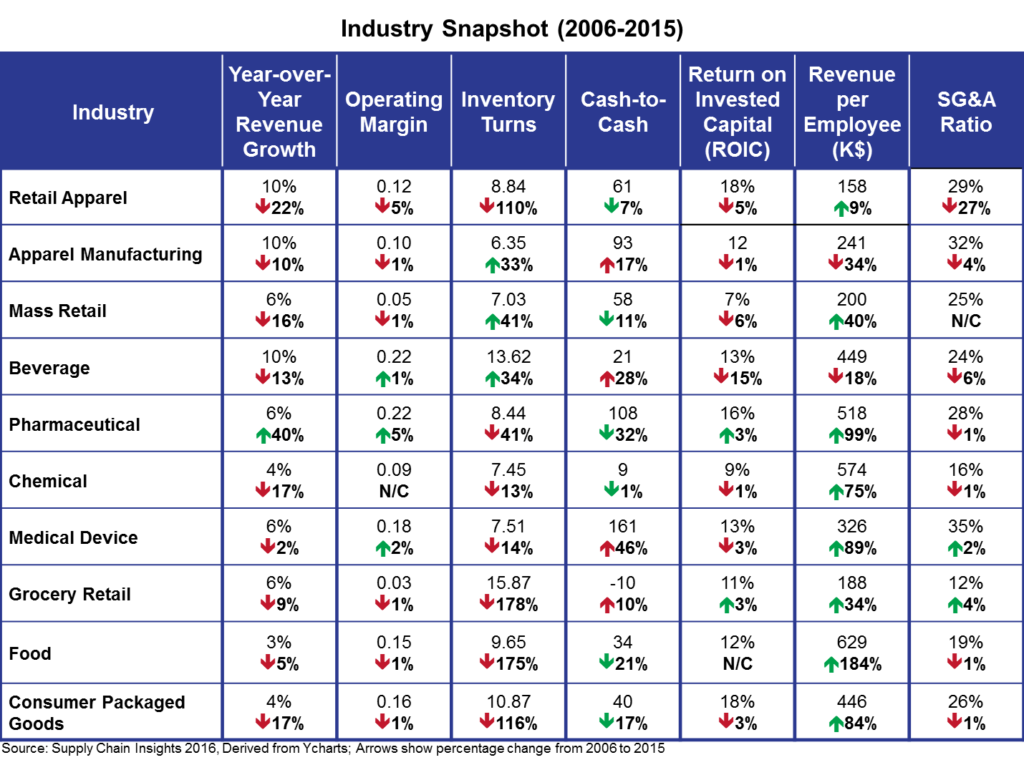

To whet your appetite for the full analysis, in this post we share the high-level industry results. In Figure 2 we share the average results by industry peer group for each metric and contrast the average value of 2006 to 2015. For example, the average operating margin for apparel companies for the period of 2006-2015 was 12%; but when 2015 is compared to 2006, the average operating margin has declined by 5%.

Rationale of this analysis? Simply put, we wanted to compare pre- and post-recession results. 2006 was the last full year before the recession, and 2015 is the most recent year reported.

What can we learn?

- Growth. Growth is slowing in all industries except pharmaceuticals. While companies want to grow, and most have growth intiatives,

- Operating Margin. Only beverage, pharmaceuticals, and medical device companies have increased margins.

- Inventory Turns. The bigger the inventory turns number the better. As shown in Figure 2, apparel, mass merchants and beverage companies improved inventory turns.

- Cash-to-Cash. Improvements in C2C outpaced inventory improvements. C2C is a compound metric of receivables plus inventory minus payables. The smaller the C2C number, the better balance sheet results. So how could companies not make progress on inventory, yet drive improvement on C2C? The answer is simple. As companies elongated payables to suppliers they made faster progress on C2C than inventory turns. C2C improved in the retail apparel, mass retail, pharmaceuticals, chemical, food and consumer packaged goods industries.

- Return on Invested Capital. Only pharmaceutical and grocery retail companies drove improvements in ROIC.

- Employee Productivity. Only two of the ten industries did not improve employee productivity. However, note that these improvements in employee productivity did not translate into operating margin results. Supply chain is not a labor arbitrage game. The days of chasing lower labor rates are largely over.

- SG&A Ratios. In the period of 2000-2005 many companies attempted to stimulate growth through increasing the size of commercial teams. Back office continuous-improvement programs often funded the growth of commercial teams. However, in the post recession period, SG&A ratios also declined.

These results show a clear pattern that the metrics of each industry form a unique pattern. Supply chain excellence can only be judged within an industry.

Why the decline in business results? Complexity is eroding supply chain performance, and the practices and processes within the global supply chain are evolving. The need for business performance improvements will transform the supply chain in the next decade. The opportunity lies between functions and in the definition of multi-tier flows between trading partners. The limited vision of the efficient, functional supply chain organization is giving way to an end-t0-end vision. In this evolution, the supply chain is becoming outside-in: sensing and shaping demand and translating the signals to a value network.

Figure 2. Results by Industry Peer Group

As you look at Figure 2 take a deep breath. Note how much ground we have lost in driving supply chain results across the industries. It is for this reason that I think we have traditional practices, not best practices. I also think that most companies plateaued in the delivery of results; and it is for this reason companies need to take the digital pivot, and focus on building outside-in processes which sense and respond, using new forms of analytics. The journey forward will be less and less about ERP and descriptive analytics and more and more about cloud-based analytics that test and learn.

What do you think? I would love to hear your thoughts.

Where Can You Find Out More?

We are currently putting the finishing touches on the Supply Chain Insights Global Summit. (Registration is open for the first 150 participants. We limit the number of technology providers to 25% of the audience.) The conference will be live streamed as we discuss five themes:

- Financial Results. A critical look at supply chain processes impacting supply chain financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models like Alibaba, Amazon, and Uber.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement and talent development for emerging markets.

- Outside-In Processes. Experience the difference between traditional inside-out and outside-in processes.

In addition, you can gain some short-term insights by attending our Network of Networks & Shaman’s Circle in Amelia Island on April 17, 2016 (invitation only), or by participating in our new research studies. With the completion of each study we share the research results. We always keep our survey respondents and their responses confidential, but share the results with business leaders in private roundtables to maximize networking.

Our philosophy is, “You give to us, we give to you.” We do this through Open Content research for supply chain leaders. Our current studies in the field are:

If you are a discrete manufacturer in supply chain, we would love your insights on this research study on direct material sourcing. The goal is to understand how companies manage sourcing in innovation, compare suppliers and collaborate on design. At the conclusion of the research share the results and network with leaders around the world.

If you are a discrete manufacturer in supply chain, we would love your insights on this research study on direct material sourcing. The goal is to understand how companies manage sourcing in innovation, compare suppliers and collaborate on design. At the conclusion of the research share the results and network with leaders around the world.

Agility and flexibility in supply chain operations is strongly dependent on the building of strong cross-functional and horizontal processes of Sales and Operations Planning, revenue management, new product launch and supplier development. In this study, we analyze the maturity of revenue management and Sales and Operations Planning and the value of cloud-based solutions to drive improvements. This study will close in May and the results will be shared with business leaders in a cross-industry round table.

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for supply chain excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for supply chain excellence.